The NIC MAP® Data Service recently released national monthly data through September 2019 for actual rates and leasing velocity. The NIC Actual Rates initiative is driven by the need to continually increase transparency in the seniors housing sector and achieve greater parity to data that is available in other real estate asset types. Having access to accurate data on the monthly rates that a seniors housing resident pays as compared to asking rates helps NIC achieve this goal.

Key takeaways from the 3Q2019 Seniors Housing Actual Rates Report by Property Type include:

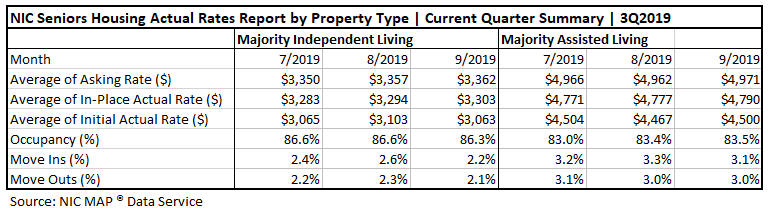

- Average initial rates for residents moving in were below average asking rates for both majority independent living and majority assisted living properties, with monthly spreads generally larger for majority assisted living properties dating back to April 2015.

- As of September 2019, initial rates for majority assisted living properties averaged 9.5% below their average asking rate, which equates to an average initial rate discount of 1.1 months on an annualized basis, close to the discount that has existed since July and close to the year-earlier discount.

- Similarly, the average discount for initial rates for majority independent living properties was equivalent to 1.1 months in September. This was as high as it has been since NIC began reporting the data in April 2015 and was also notable because until January 2019, the discount had generally been smaller for majority independent living than majority assisted living for nearly the entire time series. In January of this year and extending for several months, the annualized discount for initial rates was larger for majority independent living. More recently, the annualized discount for initial rates was larger for majority assisted living until September when they were the same.

- Average asking rates for majority independent living properties have exceeded in-place rates since May 2018 and the monthly gap between these rates was 1.8% or $59 in September 2019. For majority assisted living properties, average asking rates have consistently exceeded average in-place rates. The monthly gap between these rates was 3.6% or $181 in September 2019.

- In September 2019, the average majority independent living asking rate was 1.1% above its year-earlier level, the smallest annual increase since February 2018. The annual pace of growth for majority independent living in-place rates was nearly the same at 1.2%. Initial rates fell 1.3% from year-earlier levels, the third decline in the past four months.

- The rate of move-ins has exceeded or equaled the rate of move-outs for seven of the past twelve months for majority assisted living and eight of the past twelve months for majority independent living.

This Seniors Housing Actual Rates Report provides aggregate national data from approximately 300,000 units within more than 2,500 properties across the U.S. operated by 25 to 30 seniors housing providers. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as we currently require participating operators to manage 5 or more properties. Note that this monthly time series is comprised of end-of-month data for each respective month.

This quarter, NIC is also providing clients access to the Seniors Housing Actual Rates Report by care segment. Care segment type refers to each part or section of a property that provides a specific level of service, i.e., independent living, assisted living or memory care. In addition, care segment actual rates data is also available for the Atlanta metropolitan market.

Additional Data Available in 4Q 2019

Beginning in 4Q 2019, NIC is now providing clients access to the Seniors Housing Actual Rates Report by care segment. Care segment type refers to each part or section of a property that provides a specific level of service, i.e., independent living, assisted living or memory care. In addition, care segment actual rates data is also now available for the Atlanta metropolitan market.

NIC is prioritizing the roll-out of the reported metropolitan markets for the Actual Rates data based on the participation rates of local seniors housing operators, with the Atlanta metropolitan market the first available market.

Additional metropolitan areas will be added in the future as NIC collects additional data and grows the sample size to be large enough to release data at the metropolitan area level. Toward that end, NIC is now partnering with leading software providers including Yardi, PointClickCare and MatrixCare to facilitate data contribution to the Actual Rates initiative for operators. NIC appreciates our partnerships with these software providers and our data contributors and their work in achieving standardized data reporting.

If you are an operator or a software provider interested in how you can contribute to the Actual Rates initiative, please contact Brian Connolly at bconnolly@nic.org.