Though rising inflation and a new COVID variant may cloud the recovery, the right borrowers have a variety of financing options. Traditional lenders are cautiously making loans. Government sponsored lenders are dialing back restrictions. And new debt sources are filling the capital gap, which should help boost deal-making activity going forward.

“There will be more transactions next year,” predicted Kelly Sheehy, principal and managing director, healthcare, at Artemis Real Estate Partners. “Debt will be available.”

Sheehy and other lenders discussed debt market trends during a panel discussion at the recent 2021 NIC Fall Conference in Houston. The panel acknowledged the ongoing uncertainty around COVID-19 and its impact on the industry, along with the prospect of rising interest rates. But they were mostly upbeat that lenders and borrowers will continue to work their way through the issues with a better understanding of how to adapt to a variety of changing circumstances.

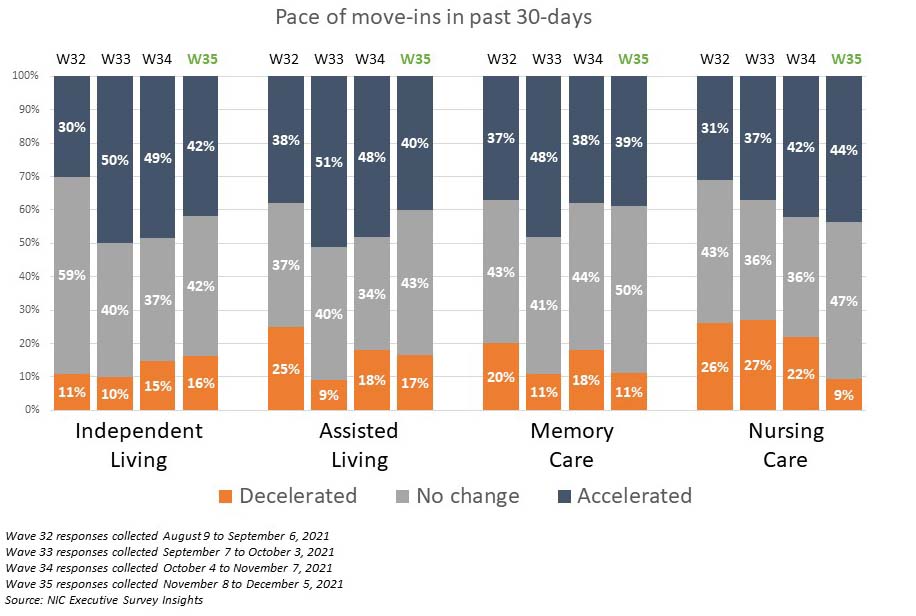

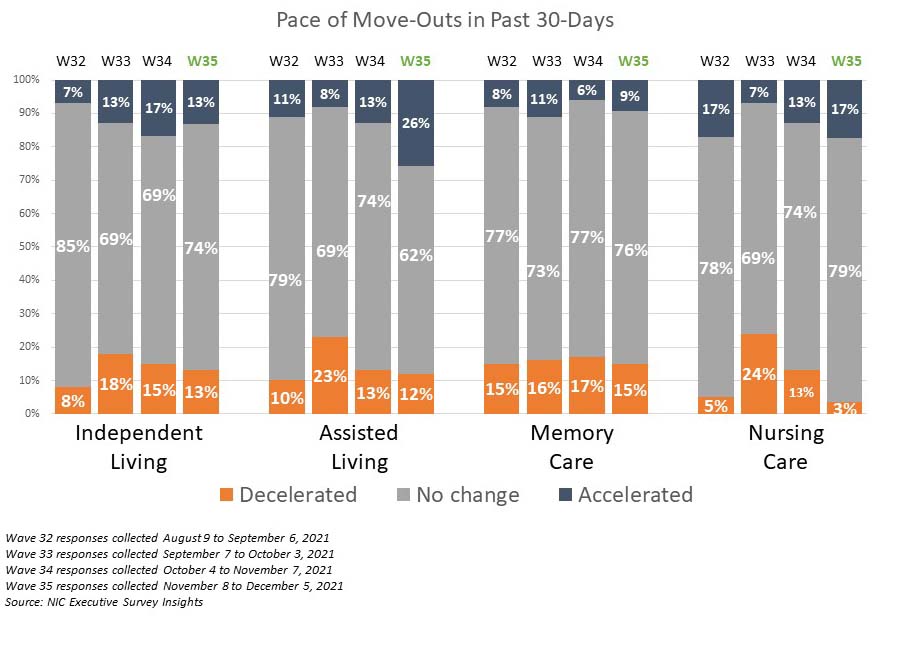

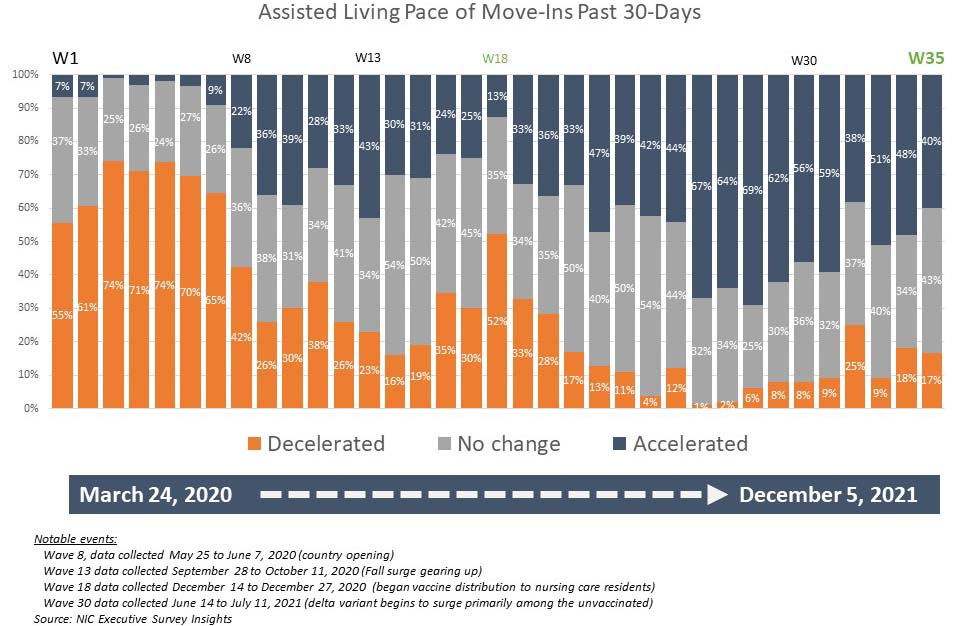

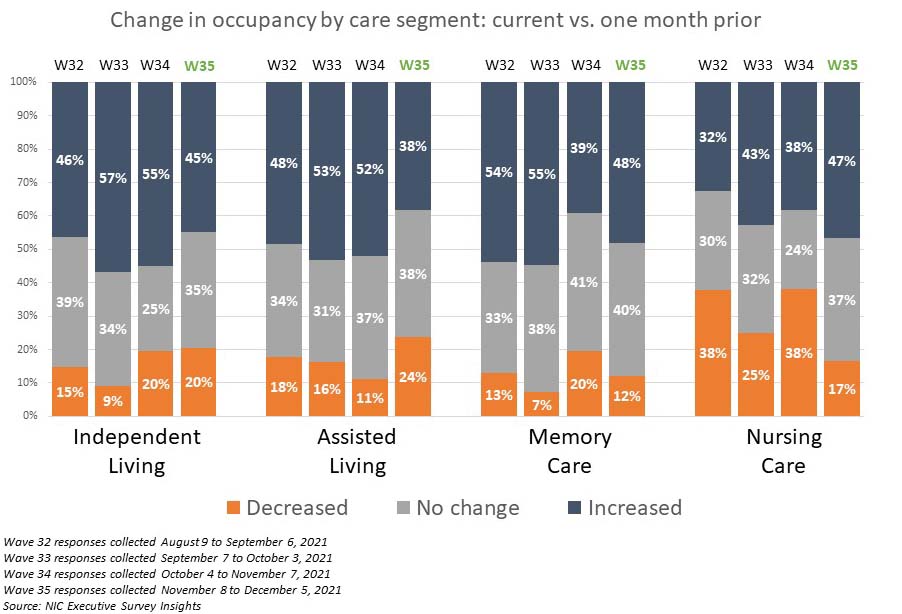

Lenders are monitoring occupancies carefully. Continuing care retirement communities and independent living properties are performing relatively well because they weren’t subjected to move-in restrictions. The assisted living and memory care segments, which had a fair amount of new inventory, are still catching up.

Nobody planned for the Delta variant which caused an occupancy slowdown. However, regions of the country with relatively high vaccination rates are experiencing higher occupancy rates in the lenders’ portfolios than those with low vaccination rates. The impact of the Omicron variant is still unclear.

Permanent financing from Fannie Mae, Freddie Mac and HUD is available for the right borrowers. HUD lending totaled $3.9 billion for fiscal year 2021, only down slightly from 2020 volume. Current activity is being driven by refinancings, according to Lee Delaveris, vice president, KeyBank Real Estate Capital. He expects 2021 volume at agency lenders—Fannie Mae and Freddie Mac—to be well off 2020 numbers when year-end figures are reported in December. Though the agencies are funding some loans, Delaveris noted growing competition for the best deals from life insurance companies and community banks. “There is not a lack of capital for stabilized properties,” he said.

Panel moderator Aaron Becker, senior managing director at Lument, asked how underwriting has changed.

“The challenge is to figure out whether the properties were performing prior to COVID to determine a new stabilization rate,” said Imran Javaid, managing director at BMO Harris Bank. “We cannot underwrite to current occupancy,” he said, explaining that a new stabilization rate is determined in collaboration with the borrower. “It’s not a hard and fast number,” he added.

In fairness to borrowers, Kelly noted that more than 1,000 new properties were delivered from 2017-2020. “Not every building got to where it needed to be pre-pandemic,” he said. That’s where debt funds have stepped in with capital.

Lenders generally require recourse loans or assurances that the borrower has access to fresh equity as a backstop. “The details are important,” said Javaid.

Experience Counts

Debt for new construction is available for borrowers with industry experience, a good track record and a reliable equity source. A big challenge, though, is the rising cost of construction. “Fewer projects are penciling out,” said Javaid.

Lenders prefer projects in barrier-to-entry markets with good demand. In most of those cases, the developer has already done the hard work of securing new project entitlements to keep the construction timeline on track.

HUD offers funding for new construction but with tighter underwriting standards. “These loans are for the experienced borrower,” said Delaveris.

Bridge loans and mezzanine financing are available, but again for the right borrower. The route to permanent financing depends on performance, noted Delaveris. The prospect of rising interest rates should spur borrowers to seek permanent financing.

New capital flow into senior housing bode well for borrowers. Hedge funds, private equity and pension funds are offering debt, currently at rates of about 3.5-4.5%. That compares to pre-COVID rates of 5-6%, according to Kelly. “There’s been some real compression in the cost of debt for higher leveraged paper,” he said.

Moderator Becker asked how the lenders helped their borrowers during COVID.

“Nobody’s plans worked out,” said Javaid. “Who planned for this?” He explained that every loan needed covenant modifications or extensions beyond the original maturity date. Projections have been recast as needed, for example, when the Delta variant emerged and caused an occupancy slowdown. “We have an ongoing process with borrowers,” said Javaid. “We want them to succeed.” He added that it comes back to the quality of the borrower. Lenders want smart operators that are in the business for the long haul.”

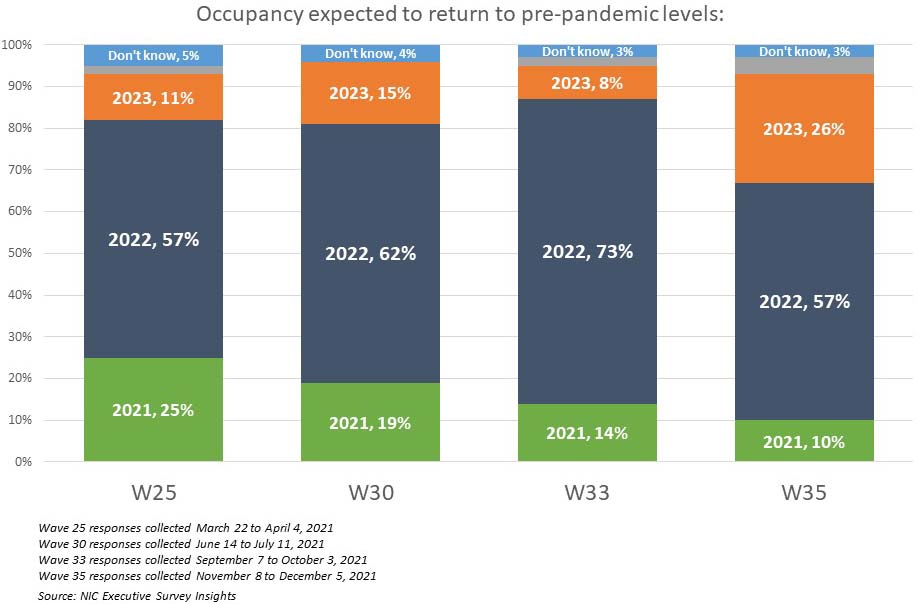

Looking ahead, Kelly expects more investors to jump into the senior housing debt market because it offers good yields compared to the other commercial property sectors. He did, however, warn about the emergence of COVID variants that could hurt the industry. Delevaris said that property performance is likely to dictate financing activity. “Permanent capital is available for deals that work,” he said. Javaid doesn’t expect absorption numbers to return to more normal levels until 2023. But, he added, “We will be doing better in 2022.”

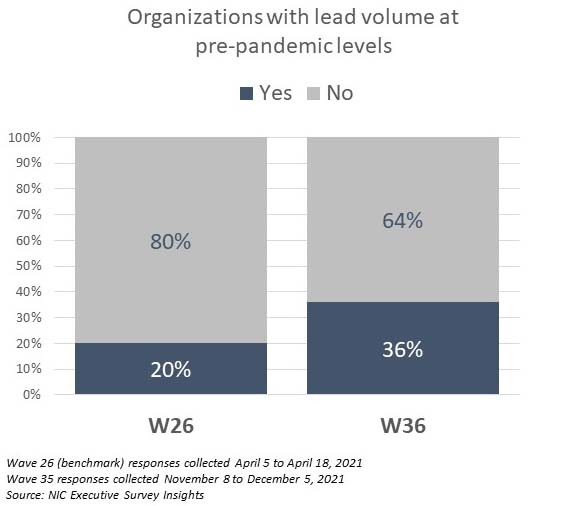

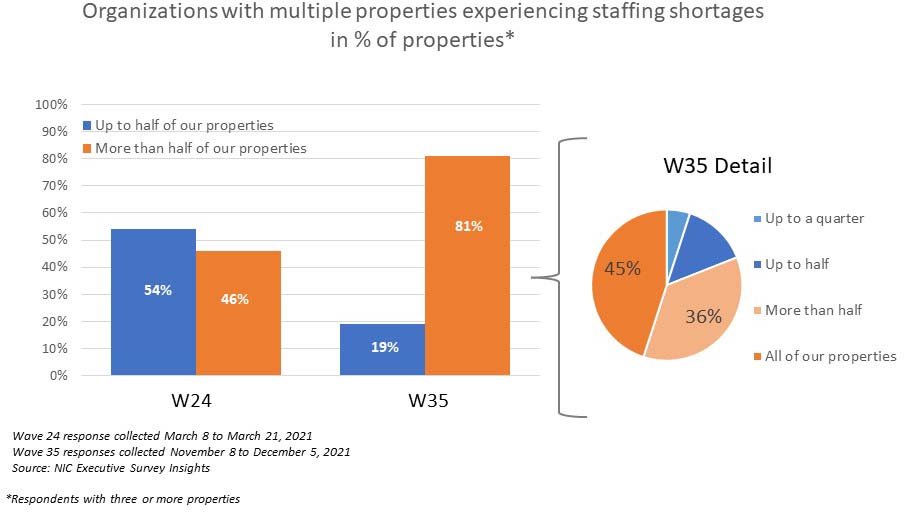

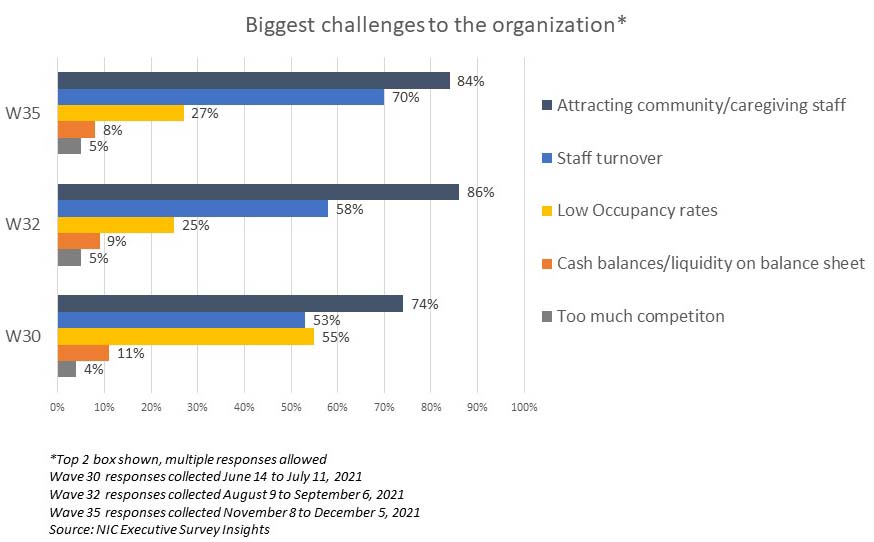

data?

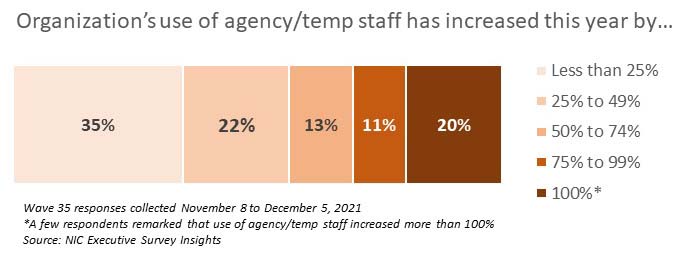

data?