Investor sentiment in the seniors housing sector that appeared to be firmly on the road to recovery a year ago has taken a modest step back in 2022. Exclusive results from the ninth annual WMRE / NIC Seniors Housing Survey show that high costs and broader economic concerns are creating challenges for operators and weighing on near-term investment strategies.

There is a dichotomy at play. While operators and investors have confidence in improving fundamentals within the sector, the factors of high inflation, rising interest rates and staffing issues have produced formidable headwinds.

Survey results show pessimism creeping back into plans to invest in the near term. On the positive side, three-fourths of respondents said they plan to invest the same, if not more, in the near term. But of concern is that one in four are likely to invest less—nearly double the 13.3 percent who said they planned to invest less a year ago.

“What I’m starting to hear is that a lot of the investors and capital providers are beginning to understand that this is a challenging time and that there might be compromised margins as a result for the next few years,” says Beth Burnham Mace, NIC’s chief economist and director of outreach. Concerns are less impactful on longer-term strategies. A majority (85.5 percent) plan either no change or an increase in seniors housing investing, while only 14.5 percent said they are likely to invest less.

Rising costs and staffing issues are clearly top of mind for operators and investors. Not surprisingly, nearly all respondents (96.4 percent) reported an increase in their expenses from March 2020 through June 2022. And for many, costs have increased significantly. Just less than two-thirds (65.0 percent) report that the increase in expenses has been 10 percent or more, with 16.0 percent saying costs have climbed 20 percent or higher from pre-COVID levels. The typical respondent reported an estimated mean increase of 12.0 percent as compared to 9.1 percent in the 2021 survey. “That is very significant, because that’s going to have an impact on the overall ability to maintain margins, and they’re largely not going to be able to offset the expense growth that they’re seeing by any kind of rent increase,” says Mace.

Growing cost burden

More respondents now expect increases in expenses due to COVID-19 to be permanent at 78.3 percent as compared to 57.2 percent in the 2020 survey and 48.6 percent in the 2021 survey. A number of respondents voiced frustrations with reduced NOI due to higher costs that can’t be passed on to residents with equivalent increases in rents. “The increase of operating expenses has made the operations in the last three years extremely difficult,” wrote one respondent.

Although rising costs have been a factor on expenses across the board from utilities to food, labor challenges are especially concerning as staffing typically accounts for about 60 percent of the overall expense load, according to NIC. Difficulty in filling vacant positions forces some operators to rely on more expensive temporary or agency help. Costs are further exacerbated by high turnover.

Respondents said that the positions that were most difficult to staff are frontline workers with 69.2 percent indicating it is “very” or “extremely” challenging to find workers, followed by LPNs at 63.2 percent and managerial staff at 46.4 percent. The turnover rate also is highest among frontline care workers with 80.0 percent reporting turnover for those positions within the first 12 months. LPN positions also had a high turnover rate of 62.6 percent within one year, while managerial was lower at 33.4 percent.

“We have felt the effects of these challenges like everyone across the industry, but I think we have come up with pretty creative solutions internally to combat rising costs,” says Camilo Padron, senior vice president of senior living investments at Lloyd Jones LLC. For example, Lloyd Jones relies on its own local recruiting in a market to staff properties versus using agency staffing.

“Necessity is the mother of invention. So, we’re seeing our operators get more and more creative and involved in the hiring process,” adds S. Scott Stewart, founder and managing partner of Capitol Senior Housing, a private equity-backed real estate acquisition, development and investment management firm based in Washington, D.C. Some of the company’s regional operator partners are forming more extensive HR departments with a mission to step-up recruiting, while others are bringing in people and giving them the training they need to move up the ranks, he adds.

Owners and operators also are paying more attention to creating a culture at facilities that helps retain and attract both workers and residents, which includes diversity, equity and inclusion (DEI) initiatives. Most respondents (59.5 percent) report their firms currently have some type of diversity, equity and inclusion initiatives in place. The most common is DEI awareness/sensitivity training for all staff among 39.0 percent of respondents.

Occupancies continue to rebound

Seniors housing occupancy levels have shown steady improvement over the past year, increasing to 80.6 percent in the first quarter of 2022, a 2.6 percentage point increase from a pandemic-related low of 78.0 percent in the second quarter of 2021, according to new NIC MAP data, powered by NIC MAP Vision.

Confidence in fundamentals has been buoyed by rising vaccination levels along with the long-anticipated “Silver Tsunami” of aging baby boomers now on the doorstep for seniors housing facilities. More than four-in-five respondents (83.3 percent) believe occupancy rates will increase over the next 12 months, which is a slight uptick from the 80.1 percent who held that view in the 2021 survey.

Overall, the average expectation is an increase of 250 basis points.

Respondents rated the South/Southeast/Southwest region most positively with regard to market fundamentals for the seniors housing sector. On a scale of 1 to 10 with 10 being the highest, the Southern region rated a mean score of 7.4, followed by West/Mountain/Pacific at 6.9, East at 6.5 and Midwest/East North Central/West North Central at 6.2.

Predictably, the COVID-19 pandemic has had the biggest impact on occupancy rates at seniors housing facilities over the past six months. On a scale of 1 to 5, COVID-19 rated the highest at 3.9 percent. That is not surprising giving the surge of the Omicron variant. However, the impact from COVID is lessening as compared to a mean score of 4.3 in 2020 and 4.0 in 2021. Other factors having a significant impact on occupancies are the economy at 3.7 and housing market at 3.5. Concerns about the state of the economy are the highest in the nine-year history of the survey, and concerns about the state of the housing market are the highest level since 2014.

“That is important to note, because people often use proceeds from the sale of their house to go into seniors housing. So that is another headwind,” says Mace.

Another concerning result of the 2022 survey is that 40.5 percent of respondents said that labor shortages have caused a reduction in the number of operating units/beds in their portfolios, which further squeezes NOI. “The occupancy rate overall is improving from its COVID low, but it still has a significant way to go. If staffing shortages are going to impact occupancies, that is worrisome. So, staffing is top-of-mind from an investor’s point of view,” says Mace.

Views on transaction outlook are mixed

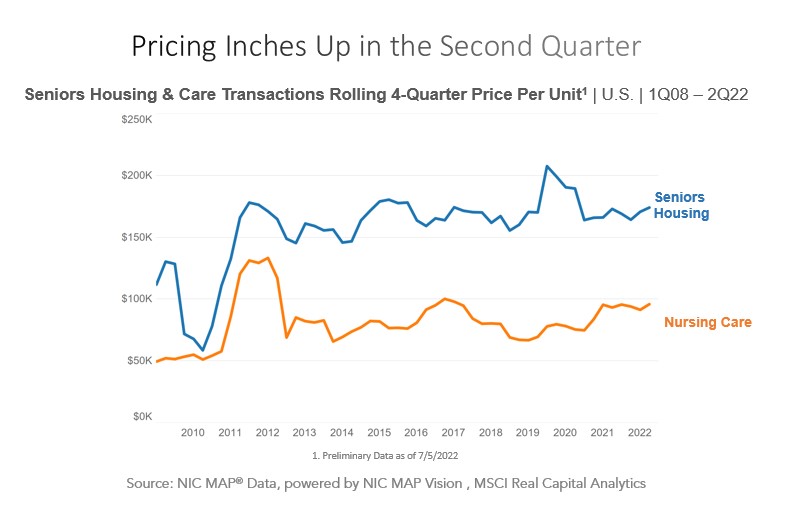

The seniors housing investment market is coming off a robust year of property sales in 2021. According to MSCI Real Assets, $20.0 billion in seniors housing properties traded compared to $18.4 billion in 2019. Although survey respondents are divided on their expectations for transaction volume in the coming 12 months, a majority 70 percent anticipate that sales volume will be the same if not higher. The 30 percent that anticipate a decrease is high based on historical survey results and second only to 2020 in bearish sentiment. According to MSCI Real Assets, 2022 sales activity is on a slower pace with $2.4 billion in closed transactions in the first quarter.

Anecdotally, many industry participants see plenty of capital and avid interest focused on the seniors housing sector. “As seniors housing fundamentals continue to recover from the impact of the pandemic, this year is shaping up to be a much improved year, with many sellers looking to take advantage of strong interest in the sector,” says John Sweeny, senior vice president, Capital Markets at CBRE. “We anticipate strong investment over the intermediate and long-term as investors look to sell into fundamental strength and end of fund life timelines,” he says.

For example, Lloyd Jones acquired the 113-unit Hamilton Heights senior living community in West Hartford, Conn. in June. The property marks the firm’s fourth senior housing acquisition this year. “Our CEO, Chris Finlay, sees major opportunities in the market right now from an acquisitions standpoint,” says Padron. Lloyd Jones is pursuing 55+, IL, AL and memory care communities. In addition, the company has an ambitious goal to grow its portfolio from roughly 1,500 today to between 9,000 and 10,000 units within the next five years.

Chicago-based Blueprint Healthcare Real Estate Advisors is one brokerage firm that continues to see robust investment sales activity. The firm is on pace for a record year with nearly $1 billion in brokered transactions as of the end of June. The depth of bidder pools varies on the location and asset. For example, Blueprint showcased a substantial package of skilled nursing facilities earlier this year that attracted 21 bids—the most the firm has ever seen in its history. “The ones that are attractive and check the boxes, we’ve got more demand than we’ve ever had,” says Blueprint CEO and Co-founder Ben Firestone.

Cap rates likely to rise

Rising interest rates and pressure on NOI are contributing to expectations for higher cap rates ahead. A majority of respondents (70.8 percent) think seniors housing cap rates will increase over the next 12 months, while 10.9 percent anticipate no change and 18.2 percent believe cap rates could decrease. Expectations for rising cap rates have moved slightly higher compared to 65.5 percent who held that view in the 2021 survey. However, the overall change is likely to be modest with an average increase of 51 basis points, less than the expected rise in interest rates by economists.

In addition, some market participants argue that cap rates as applied to in-place income have been a more difficult market barometer with many properties that are battling near-term NOI challenges due to high inflation and lingering effects of COVID on occupancies. Instead, investors are focusing on other factors, such as per bed and per unit pricing, drivers of value, and top-line revenue, notes Firestone. “Investors are stretching out their investment period and looking to other metrics than where cash flows are today at a static cap rate,” he says.

Pricing trends vary widely depending on the asset. For example, Blueprint recently closed on a single private-pay seniors housing asset with 60 percent occupancy for a cap rate of approximately 5.95 percent on projected year-two EBITDAR (earnings before interest, taxes, depreciation, amortization, and rent.) At the time of sale, the in-place EBITDAR was only marginal. However, prices continue to soar for those types of assets in good growth markets, which is driven in part by higher replacement costs, notes Firestone. “The investors that are the most aggressive in bidding are the ones that are willing to be patient and have a multi-year strategy,” he says.

Lloyd Jones is targeting acquisitions with cap rates ranging between 6.5 and 9.0 percent. “We’re also seeing a lot of negative cash flow deals. So, it’s hard to put a cap rate on some of those deals,” notes Padron. In particular, Lloyd Jones is looking to buy value-add assets at $70,000 to $80,000 per door. There were a number of operators that were hit hard by COVID and have yet to come out of it, he says. “That’s where we think we can come in at value and take properties over and turn things around,” he adds.

Rent growth also could help shore up cap rates. Annual rental rates rose across NIC MAP’s Primary Markets by 3.3 percent in first quarter, and an overwhelming majority (93.3 percent) expect rents to increase further over the next 12 months. Overall, the average expectation is an increase of 304 basis points. Sentiment is more positive than in the 2021 survey where 86.5 percent of respondents thought rents would rise by an average of 261 basis points.

“While operational challenges are a factor, investors are accounting for those challenges accordingly. Spreads/yields continue to be attractive and the intermediate to longer-term outlooks look robust,” says Sweeney. “Given seniors housing has performed well during previous recessionary cycles, capital continues to be interested in putting dollars to work in the sector in the right locations.”

Access to capital may tighten

Investors are concerned that access to both debt and equity could be more limited in the coming year. Nearly half of investors (53.2 percent) believe debt will be more difficult to access over the next 12 months. Fears are not as great as in 2020 when 57.2 percent thought access to debt would tighten, but it is significant that those views on more limited debt are at the second-highest level in the history of the survey. Opinions on access to equity also are more pessimistic. Roughly one-third of respondents (32.0 percent) said access to equity could be tighter over the next 12 months. Similar to debt, 2020, views on less availability of equity ahead are the second-highest level in the history of the survey.

That being said, a majority of respondents do think equity will remain the same (44.8 percent) or improve (23.1 percent.) “There is an abundance of capital that has been raised that these institutional groups need to put to work,” says Cary Tremper, managing director and head of Senior Housing Capital Markets at Greystone. “I wouldn’t say that everyone has the same access to capital across the board, but typically for the ones that have the ability to execute and have the track record, capital is there on the equity side,” he says.

Consistent with the prior survey, institutional lenders and REITs have edged out national banks as the most significant sources of debt capital for the seniors housing sector. On a scale of 1 to 10 with 10 representing a very significant source of capital, institutions had a mean score of 6.6 and REITs 6.4 followed by national banks at 6.3.

Over the ups and downs over the past three years, availability of both debt and equity for seniors housing has been relatively consistent, notes Tremper. Greystone’s Senior Housing Capital Markets team is currently working on sourcing capital on about 50 different engagements from permanent financing to bridge and construction financing. “Some lenders are taking more of a cautious approach, but in order to lend in this space and build a reputation, it is very difficult to time markets in terms of getting in and getting out,” says Tremper.

Respondents are bracing for bigger changes ahead in financing over the next 12 months. In all, 83 percent are anticipating interest rates to move higher, while 64.4 percent think risk premiums will rise. More respondents (68.8 percent) now expect underwriting standards to tighten in the coming year compared to 32.2 percent who held that view in the 2021 survey.

According to Tremper, leverage levels have ticked down 5 to 10 percent as compared to six to 12 months ago, but there are still viable options out in the marketplace with a diverse group of lenders that are still committed to the space. “I also think that people going to the market today are realistic with their financing objectives,” he says. For example, some deals might require more structuring to get done, such as building in operating deficits or earn-outs, because there is recognition that it might take longer to execute on a business plan. About half of investors believe the time to close a transaction will remain the same, while 35 percent said the time required to close a seniors housing property transaction could be slower in the coming year.

Higher costs slow new supply

Higher costs slow new supply

The seniors housing development pipeline is still feeling the effects of COVID-19. Projects that were delayed or halted during 2020 is showing up in current construction numbers. Inventory growth during first quarter slowed to 5.3 percent, which is the weakest level since 2013. In addition, the roughly 36,000 seniors housing units under construction during first quarter is the lowest volume since 2015, according to NIC.

Construction starts are going to linger at moderate levels as rising construction costs, labor shortages and higher interest rates collectively weigh on plans for new development, notes Mace. Three in four respondents (75 percent) report canceling or delaying projects as a result of supply chain restrictions and/or inflation, while 9 percent said they have sped up timelines and 17 percent said supply chain and inflation have had no impact.

Respondents are divided on their outlook for seniors housing construction starts over the next 12 months. Overall, 38.9 percent said starts are likely to increase; 32.1 percent think they will decrease, and 29.1 percent do not anticipate any meaningful change. Expectations for increased construction activity has pulled back significantly from a year ago when 55.5 percent predicted that construction starts would increase.

However, some builders remain optimistic on the outlook for growing demand. “We’re very bullish on the sector,” says Stewart. “Even in light of the fact that we’re probably in a recession right now and there are supply chain issues, inflationary issues, workforce issues, we’re taking the long view and developing in good markets,” says Stewart. Capitol Senior Housing has four projects under development and 15 more that are in pre-development. “The slowdown is going to be exacerbated by construction lending drying up, and we think that is going to benefit us in the long run, because we won’t have to worry about as many competitors,” he says.

One of the key reasons that Capitol Senior Housing likes the sector is the demographics and fundamental demand drivers. “It’s impossible to argue the demographics,” notes Stewart. Roughly 10,000 Americans are turning 65 every day until 2030. At that time, seniors 65 and older will be 20 percent of the population. Stewart estimates that the demand for 55+active adult units annually will be an additional 230,000 units for the next several years. “We’re doing our best to meet the demand, but we still think there’s going to be a significant imbalance of demand outstripping supply for years to come,” he says.

Despite near-term challenges, seniors housing consistently ranks favorably compared to other property types. When respondents were asked to rate the attractiveness of investing in various property types on a scale of 1 to 10, seniors housing scored a mean 7.0, which was second only to apartments at 7.5. Although the current mean score is an improvement over the historical low of 6.3 in the 2020 survey, it is only slightly below its pre-pandemic score of 7.2.

Over the nine-year history of the survey, seniors housing has consistently ranked as the top one or two favored property sector. Many of the reasons the sector has traditionally been attractive to investors are still in place. It offers a good value proposition, and there is good demand across the spectrum of different property types and price points, notes Mace. “What we’ve seen in the last few years is greater segmentation and differentiation in seniors housing, much like you’ve seen in hotels,” she says. Increasingly, operators are picking which segment of the market they want to focus on, such as traditional, high-end or ultra-high-end, as well as the level of care that communities offer. “The sector is maturing and growing, and as that happens, there are going to be more options for aging adults, which also is going to help support greater usage of this product,” adds Mace.

Acces the full survey.

Survey methodology: The WMRE / NIC research report on the seniors housing sector was conducted via an online survey distributed to WMRE readers in June. The 2022 survey results are based on responses from 208 participants. The majority of respondents hold top positions at their firms with 43 percent who said they were either an owner or C-suite executive. Respondents also represent a cross-section of different roles in the seniors housing sector, including investors, lenders, developers, brokers and owner/operators.

The pandemic has had a major impact on the senior living industry. Beyond lower occupancies and added expenses, the crisis has changed the way the industry is perceived and operates.

The pandemic has had a major impact on the senior living industry. Beyond lower occupancies and added expenses, the crisis has changed the way the industry is perceived and operates.