After the historical occupancy rebound in 2021, current senior housing sales metrics largely reflect pre-pandemic conditions. But as markets return to normal seasonality patterns, sales and marketing strategies should be adjusted based on data-driven insights and away from pandemic occupancy recovery tactics.

Today, more leads originate from digital sources than ever, making individual attention and personalized nurturing of prospects even more critical. If this is the “new normal,” operators must adjust to managing and engaging growing volumes of inquiries to sustain the occupancy recovery.

As the pandemic’s significant disruption of the business cycle appears in the rear-view mirror, this article looks back at market conditions leading up to the pandemic compared to present conditions to illustrate the current state of the market and suggest opportunities for operators to boost sales.

Key takeaways:

- Year-over-year occupancy growth shows signs of a moderate deceleration, suggesting that an adjustment in sales approaches may be appropriate in some situations.

- Sales strategies that rely on “quick wins” may not maximize results.

- Leasing counselors will continue to work with growing volumes of digital leads.

- Personal engagement with prospects is associated with higher conversions.

- Teams must become more resourceful in nurturing prospects from digital sources to increase conversions.

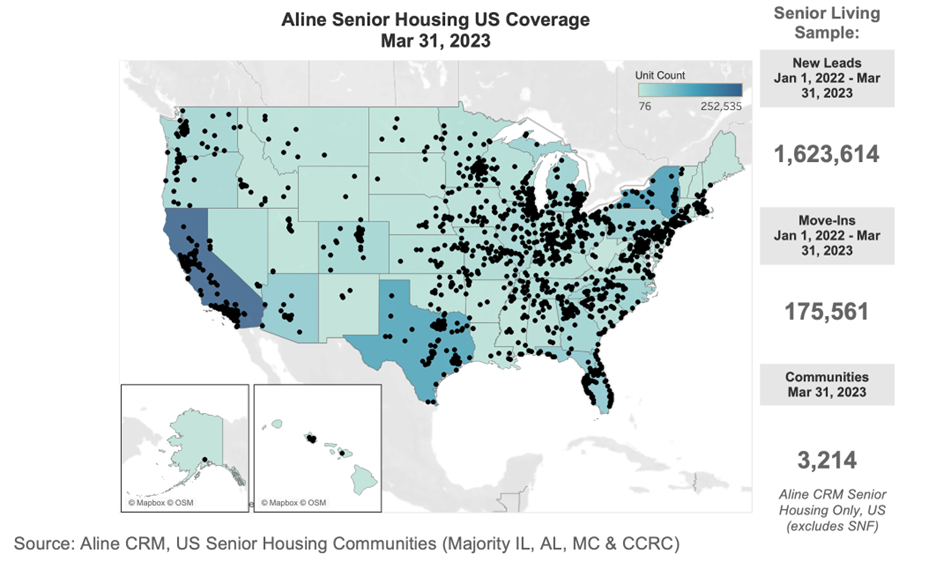

The data used for this analysis include U.S. senior housing data – independent living, assisted living, memory care, and CCRCs (Continuing Care Retirement Communities) – from the Aline Marketing and Sales CRM. This analysis comprises 1,623,614 new leads and 175,561 move-ins.

While still positive, the momentum of senior housing occupancy growth has slowed to some degree since 2022 depending on the property type and geographic location. Some potential reasons for the moderation include downward pressure due to rising rents, increased competition from other senior living options and in-home care, a downturn in housing markets due to interest rate hikes to combat inflation, and deferred capex spending to keep aging properties up to date. Higher acuity options—memory care and assisted living—have experienced the most improvement in occupancy rate growth since emerging from the pandemic.

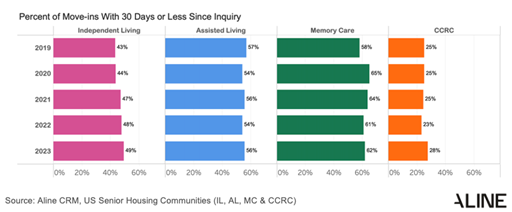

Operators relying on a sales strategy of “quick wins,” with prospects moving in within 30 days of contact, are missing opportunities to increase margins. Contrary to conventional wisdom, the volume of prospects by care level with an “urgent need” to move in (less than 30 days) has changed little since before the pandemic. (It is important to note that “urgent need” does not necessarily equate with prospect acuity.) The percentage of residents that moved in within 30 days of inquiry compared between 2019 and 2023 ranged from 43% to 49% for independent living communities, 57% to 56% for assisted living, 58% to 62% for memory care communities, and from 25% to 28% for CCRCs. Consequently, approximately one-half to just over one-third of independent living, assisted living, or memory care prospects and nearly three-quarters of CCRC leads require more than minimal time and effort from sales teams to exceed baseline expectations.

Due to increasing growth in age 75+ households and the growing adoption of digital marketing tools and referral sources to produce inquiries, senior housing lead generation and conversions have increased. Yet conversions have not kept pace to the same degree. In the first quarter of 2023, the average 100-unit building generated 44 leads per month compared to 32 just four years prior—representing an increase of 38%. However, the average 100-unit building generated an average of 4.5 monthly move-ins—a 27% increase since March 2019. On an annual basis, the rate of lead growth in the first quarter of 2023 was 8.6%—an improvement over 2019 (3.0%). Conversely, the annual growth of move-ins in the first quarter of 2023 was 6.3%–notably lower than in 2019 (14.9%).

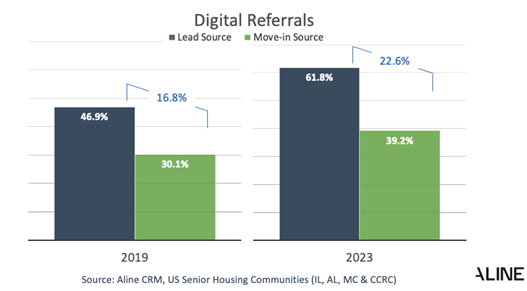

Although considerably more leads originate from internet sources than before the pandemic, the increase in conversions from digital marketing, direct website, and paid referral sources has increased but to a lesser degree than the volume of leads produced from these sources. Nearly two-thirds of leads are now generated by digital sources—up from about one-half before the pandemic. However, only about 40% of conversions are derived from these sources (up from 30% before the pandemic).

Given the pandemic’s lingering strain on operating budgets and compressed margins, sales and marketing teams are challenged with finding ways to allocate valuable time and resources in the most fruitful ways. According to Aline’s statistical analysis of the productivity of specific sales activities, being responsive instead of reactive and focusing on high-value tasks such as building relationships with prospects results in a higher probability of converting prospects.

Some typical sales activities are correlated with a higher likelihood of producing move-ins—such as tours, home visits, and planning sessions, while others are less so. Many operators place paramount importance on call-out quotas—but call-outs do not produce move-ins alone! Others bank on time and resource-intensive sales events, but could those efforts be better expended with a personalized plan for the next interaction with a prospect? Activities should be considered based on a prospect’s unique needs and the sales team’s time and resources. Consider professionalizing sales teams and investing in tools that amplify efficiencies and bolster return on investment.

Demographics will continue to drive inquiries, and more will originate from digital sources. As leasing counselors are challenged to become more resourceful in managing greater volumes of digital leads, high-impact, personalized activities such as voice-to-voice and face-to-face interactions, planning, and creative follow-up are crucial in advancing a prospect. How will sales teams keep up and convert more prospects into sales? Senior housing operators must work smarter, not harder.

For more information and to schedule a demo, please visit www.alineops.com.

About Aline

Aline has the industry’s most extensive and robust set of real-time data for identifying and understanding broad trends in the nation’s senior housing sales and marketing metrics. Providing a senior living operating system created to meet the industry’s most complex challenges – in a single software platform, the company serves sales, operations, and clinical teams in more than 5,700 communities across the senior living, post-acute, and home care sectors. The Aline senior living operating system increases efficiency, delivers performance gains, and connects residents, staff, and family members with industry-leading CRM, marketing automation, financial, reporting and care solutions.