Curious about what happened with asking rates and actual rate discounting in 2021 or how move-in patterns differed by care segment? Then read on for key takeaways from the recently released 4Q2021 NIC MAP® Seniors Housing Actual Rates Report, available to NIC MAP® subscribers.

In the recently released report, national monthly data through December 2021 of actual rates and leasing velocity is presented, including data on rate discounting and move-in/move-out trends. NIC MAP subscribers have access to the full report, which includes national data and additional key takeaways as well as data for the Atlanta, Philadelphia, and Phoenix metropolitan markets.

Select takeaways from the 4Q2021 NIC MAP® Seniors Housing Actual Rates Report are listed below. These key takeaways are pulled from the Segment Type report. Care segments refer to the levels of care and services provided to a resident living in an assisted living, memory care, or independent living unit.

Key Takeaways

- All three senior housing segment types—independent living, assisted living, and memory care—experienced the highest growth in year-over-year asking rates in the fourth quarter of 2021 since NIC MAP began reporting the data in 2017. Assisted living (6.6%) had the highest increase of the three levels of care, followed by independent living (6.0%), then memory care (3.5%). These gains continue the trend of growth in asking rates that started earlier in 2021 following the immense pandemic-related pressures of 2020.

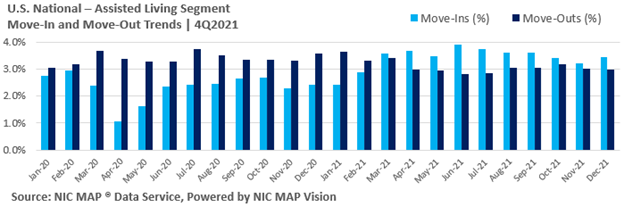

- For the third quarter in a row, move-ins outpaced move-outs for all three care segments (independent living, assisted living, memory care) in fourth quarter 2021. This marks ten consecutive months of move-ins outpacing move-outs from March 2021 through December 2021. Move-ins for assisted living segments were at 3.4% in October and December of 2021, down from the recorded high of 3.9% in June 2021.

- Average initial rates for residents moving in were discounted below asking rates for all three care segments. Initial rate discounts were slightly greater in the fourth quarter of 2021 than in the third quarter for independent living segments and memory care segments. Of the three segments, memory care had the largest initial rate discounting of 10.2% ($719) in December 2021. On an annualized basis, this discount is equivalent to 1.2 months. This discounting is comparable to the discounting one year earlier in December 2020 of 10.3% ($702 or 1.2 months.) The least discounting in the year 2021 for memory care segments was still high at 7.9% ($547) in August.

- Of the three metropolitan markets that are currently reported, the largest discounting in initial rates from asking rates for residents moving into senior housing was Atlanta’s assisted living segment (December 2021) and Phoenix’s independent living segment (November 2021) which were both at 17.1% (or 2.1 months on an annualized basis).

NIC MAP Vision CEO Explains the Importance of Actual Rates Data Initiative

Arick Morton, CEO of NIC MAP Vision, discusses the importance of the actual rates data initiative for the company and the senior housing industry at large. Operators can learn more about actual rates by visiting the NIC MAP Vision actual rates page.

Our Software Partners Support this Initiative

At the 2021 NIC Fall Conference in Houston, Texas, Glennis Solutions and Eldermark were proudly announced as certified Actual Rates Software Partners. Glennis Solutions and Eldermark now offer their senior housing operator customers the ability to share their data more efficiently in the official NIC Actual Rates format. To receive certification, a software provider works with the NIC MAP Vision team to develop reports that meet the NIC Actual Rates standard format. They are then required to provide six months of actual rates data for two or more operators using those reports.

NIC and NIC MAP Vision appreciate the time, effort, and commitment from our software partners and thank them for their partnerships .

The Actual Rates Data Initiative is driven by the need to continually increase transparency in the senior housing sector and achieve greater parity to data that is available in other real estate asset types. Now, more than ever, having access to accurate data on the actual monthly rates that a senior housing resident pays as compared to property level asking rates helps the sector achieve this goal.

About the Report

The NIC MAP® Seniors Housing Actual Rates Report provides aggregate national data from approximately 300,000 units within more than 2,600 properties across the U.S. operated by 25 to 30 senior housing providers. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as we currently require participating operators to manage 5 or more properties. Note that this monthly time series is comprised of end-of-month data for each respective month.

While these trends are certainly interesting aggregated across the states, actual rates data are even more useful at the metro level. NIC MAP Vision is continuing to work towards reporting more markets.

Interested in Participating?

The Actual Rates Data Initiative is an effort to expand senior housing data and we are looking for operators who have five or more properties to participate. We have expertise in extracting data from industry leading software systems, such as Yardi, PointClickCare, Alis, MatrixCare, Glennis Solutions, and Eldermark and can facilitate the process for you.

Operators contributing data to the NIC MAP® Actual Rates report receive a complimentary report which allows them to compare their own data against national, and metropolitan market benchmarks.

In addition to receiving a complimentary report, your organization benefits through:

- More informed benchmarking, strategic planning, and day-to-day business operations,

- Increased transparency, aligning with other commercial real estate assets in terms of data availability,

- Saved time, Actual Rates data is collected electronically directly from operators’ corporate offices, removing the need for telephone calls to individual properties, and

- Enhanced investment and efficiency across the sector.