As the seniors housing and care industry’s leading data provider, NIC tracks occupancy, asking rents, demand, supply, and construction data for independent living, assisted living, memory care, skilled nursing properties—and both for-profit and nonprofit continuing care retirement communities (CCRCs, also known as life plan communities). The following narrative describes CCRC occupancy as of the third quarter 2019, supply and demand, asking rent growth, and construction trends in the combined primary and secondary markets, which represent the aggregate of the data collected from 99 of the nation’s largest core-based statistical areas (CBSAs) and breaks out the data further by payment type.

Key Takeaways

- CCRC occupancy has remained steady around 91% since the end of 2014.

- Rental occupancy is at an all-time low while entrance fee occupancy is at a recent high (89.1% vs. 92.6%).

- The occupancy gap between entrance fee and rental CCRCs is near the widest since NIC began collecting the data but has narrowed slightly from 3.4% in the prior quarter to 3.2%, currently.

- Overall, CCRC construction activity is down from a time series peak reached in 1Q 2018 (3.1% of existing inventory to 2.6%) primarily due to moderating construction of rental community units.

- Five markets represent more than one-third (36%) of the CCRC units currently under construction: Dallas, San Diego, Charlotte, Phoenix and Washington, DC.

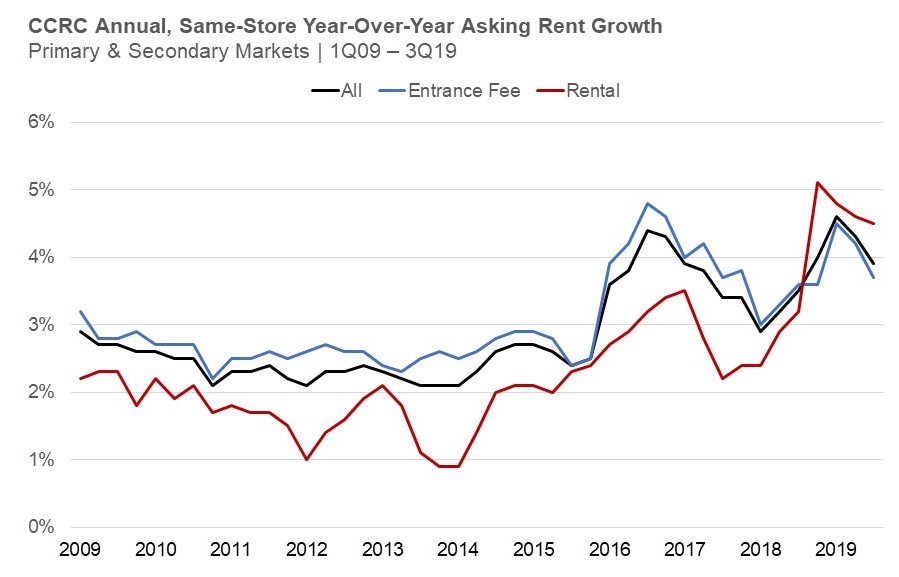

- CCRC year-over-year, same store asking rent growth in the third quarter of 2019 was 3.9%, down from the time series high of 4.6% reached in the first quarter of 2019.

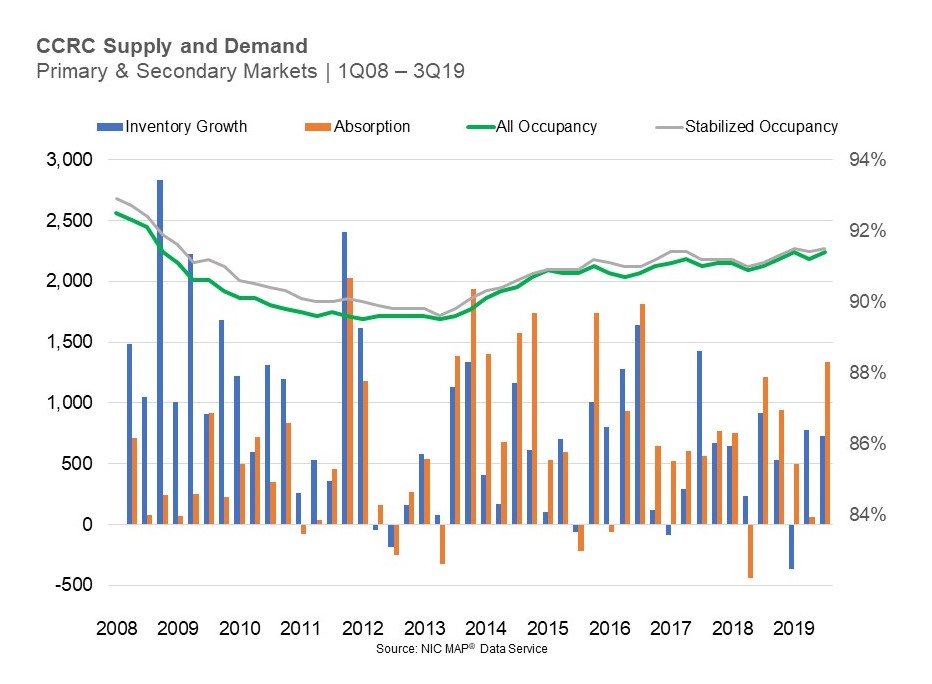

Supply and Demand Fundamentals

A review of the third quarter 2019 CCRC data for the combined 99 Primary and Secondary metropolitan markets tracked by NIC MAP® shows that both “all” and “stabilized” occupancy rates were essentially flat year-over year, fluctuating only as much as 20 basis points during the four quarters (4Q 2018 to 3Q 2019). Current “all” occupancy is equal to the recent high of 91.4% reached in 1Q 2019, which registered the highest rate achieved since 4Q 2008. Current “stabilized” occupancy (defined by NIC as properties that have been open for at least two years or, if open for less than two years, have already reached a 95% occupancy level) is 10 basis points higher (91.5%). For context, the seniors housing all occupancy rate for the 99 Primary and Secondary metropolitan markets also fluctuated 20 basis points over the same period and averaged 87.8% in the third quarter of 2019.

Over the past four quarters, CCRC net absorption outpaced net inventory growth by nearly 1,200 units. This quarter reported the most units absorbed in a single quarter since 3Q 2016 (1,333 units).

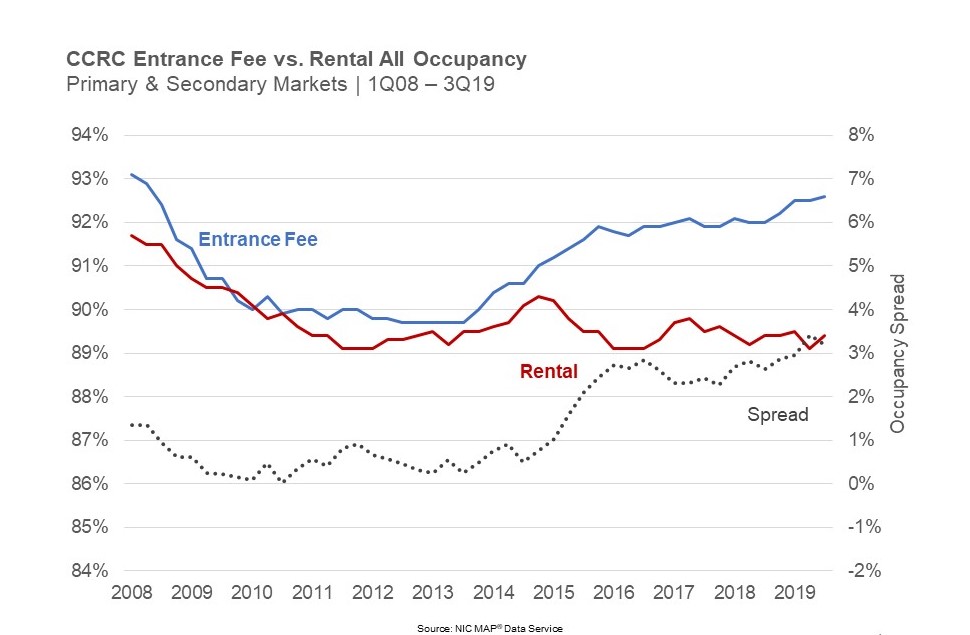

Entrance Fee vs. Rental CCRCs

Rental occupancy is at an all-time low while entrance fee occupancy is at a recent high

While rental occupancy is 89.4%—up 30 basis points over the prior quarter when it matched the lowest rate in the time series (89.1%), entrance fee occupancy peaked at 92.6%—a level not reached since mid-2008.

Entrance fee occupancy has been on an upward trajectory, growing approximately three percentage points since the middle of 2012. Rental occupancy, on the other hand, has been trending lower since its recent peak reached in late 2014, declining about one percentage point.

The spread between entrance fee and rental occupancy in the combined Primary and Secondary markets is near the time series high reached in the second quarter of 2019 (3.4%). The occupancy gap is currently 3.2%, down 20 basis points from the prior quarter.

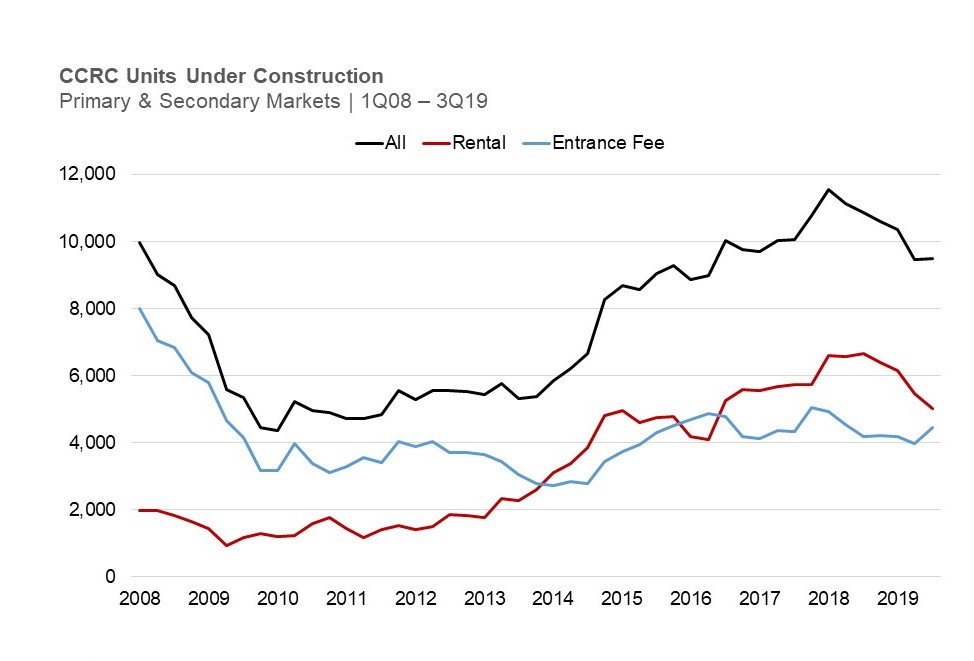

Construction Activity

Overall, CCRC construction activity is down from the time series peak of 11,544 units reached in 1Q 2018 (3.1% of existing inventory). Currently, 9,480 units are under construction (2.6% of existing inventory). As of 3Q 2019, rental CCRC construction is 3.6% of existing inventory compared to 1.9% for entrance CCRCs. Seniors housing construction as a share of inventory across the Primary and Secondary markets was considerably higher at 6.3%.

Units under construction in rental CCRCs exceeded units under construction in entrance fee CCRCs in all but three quarters over the past 6 years. Although the difference in units under construction has moderated recently, since the end of 2016, rental units under construction exceeded entrance fee units on a quarterly basis by an average of 1,500 units. Rental units currently comprise 37.3% of total CCRC inventory.

Source: NIC MAP® Data Service

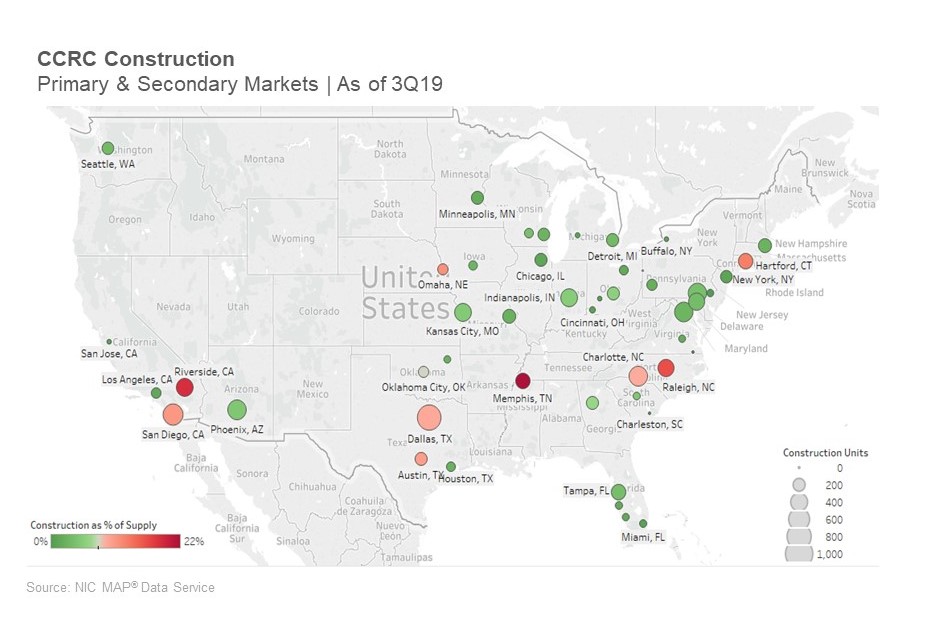

CCRC units under construction are concentrated in a few markets

The map below illustrates where CCRC construction has been strongest as indicated by the size of the circles. In addition to absolute growth in units, the color of each circle represents the percentage of units under construction in relation to total supply.

As of 3Q 2019, the highest number of CCRC units under construction was in Dallas (722), San Diego (510), Charlotte (446), Phoenix (446) and Washington, D.C. (437). The highest percentage of units under construction as a share of inventory was reported for Memphis (22%), Riverside (18%), Raleigh, (16%), Hartford (13%), Omaha, and San Diego (11% each). Half of the Primary and Secondary markets (51 out of 99) had no CCRC units under construction.

Annual, same-store year-over-year asking rent growth rates trending lower from recent highs

CCRC year-over-year, same store asking rent growth in the third quarter of 2019 was 3.9%, down from the time series high of 4.6% reached in the first quarter of 2019. While rental CCRC rent growth was 4.5%, down from the time series high of 5.1% in 4Q 2018, entrance fee CCRC rent growth was 3.7%, down from a recent high of 4.5% in 1Q 2019.

Source: NIC MAP® Data Service

In a future edition of NIC Notes, we’ll offer a new analysis considering the market fundamentals of care segments within CCRCs compared to non-CCRC segments in freestanding/combined communities. Also referred to as life plan communities, CCRCs offer multiple care segments (including, at a minimum, independent living and nursing care) typically by a single provider on one campus, and our future analysis will separate the segments from the CCRC community type that NIC includes under the main category of Seniors Housing.