The following analysis examines broader occupancy trends, year-over-year changes in inventory, and same-store asking rent growth – by care segment – within 571 entrance fee CCRCs and 488 rental CCRCs in the 99 NIC MAP Primary and Secondary Markets.

Entrance Fee CCRCs Lead in Occupancy Rates

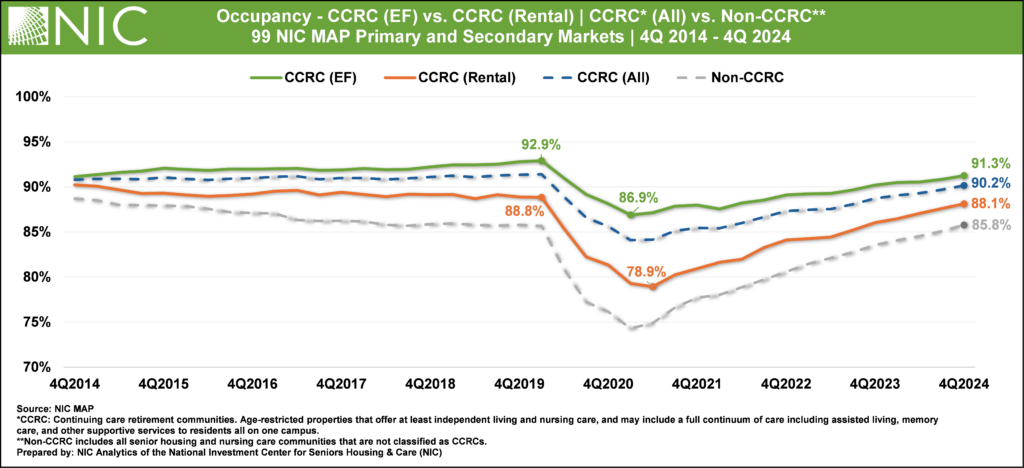

Entrance Fee CCRCs Maintained a Higher Occupancy Rate than Rental CCRCs in the Fourth Quarter of 2024. In the 99 NIC MAP Primary and Secondary markets, the occupancy rate for entrance fee CCRCs increased to 91.3%, 3.2 percentage points (pps) higher than rental CCRCs (88.1%) and 5.5pps higher than non-CCRCs (85.8%). In the fourth quarter of 2023, the occupancy rate surpassed 90% and has continued to grow quarter over quarter since.

Rental CCRCs Reported Higher Year-over-year Occupancy Growth than Entrance Fee CCRCs in the Fourth Quarter of 2024. Compared to year-earlier levels, rental CCRC occupancy has increased by 2.1pps while entrance fee CCRCs saw a growth in occupancy rate of 1.1pps.

The occupancy rate of rental CCRCs reached 78.9% in the second quarter of 2021 and has increased for 14 consecutive quarters since, with a cumulative growth of 9.2pps. This increase is more than double the 4.1pps growth seen in entrance fee CCRCs over the same period.

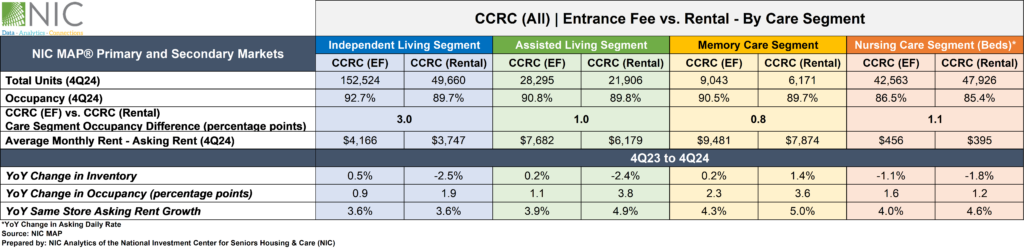

4Q 2024 Market Fundamentals by Care Segment – Entrance Fee CCRCs vs. Rental CCRCs

The exhibit below compares the market performance of entrance fee CCRCs and rental CCRCs by care segment for the fourth quarter of 2024, highlighting year-over-year changes in occupancy, inventory, and asking rent growth.

Occupancy. Entrance fee CCRCs continued to outpace rental CCRCs in occupancy rate across all care segments. The difference in the fourth quarter of 2024 occupancy rates between entrance fee CCRCs and rental CCRCs was largest in the independent living segment (3.0pps), followed by the nursing care segment (1.1pps), and the assisted living segment (1.0pps), with the smallest gap in the memory care segment (0.8pps).

The highest occupancy in entrance fee CCRCs was seen in the independent living care segment (92.7%), while the memory care segment (89.8%) has the highest occupancy rate in rental CCRCs.

Asking Rent. The monthly average asking rent for entrance fee CCRCs across all care segments remained higher than rental CCRCs. Rental CCRCs showed higher year-over-year rent growth in assisted living (4.9% to $6,179), memory care (5.0% to $7,874), and nursing care (4.6% to $395) segments.

Note, these figures are for asking rates and do not consider any discount that may occur.

Inventory. Compared to year-earlier levels, independent living inventory experienced the largest decline in rental CCRCs (2.5%) and the largest growth in entrance fee CCRCs (0.5%). For rental CCRCs, the memory care segment saw the largest year-over-year inventory growth at 1.4%. This is the only positive year-over-year inventory growth among all care segments.

Negative inventory growth can occur when units/beds are temporarily or permanently taken offline or converted to another care segment, outweighing added inventory.

Look for future articles from NIC to delve into the performance of CCRCs.