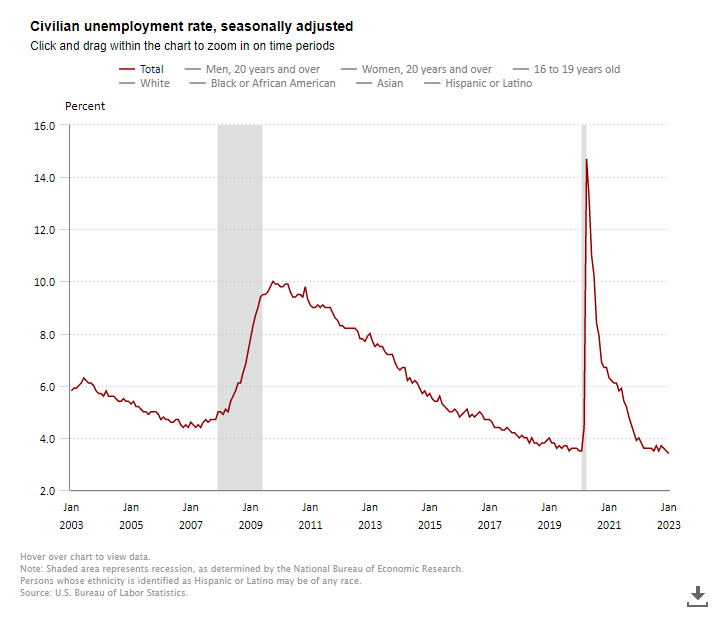

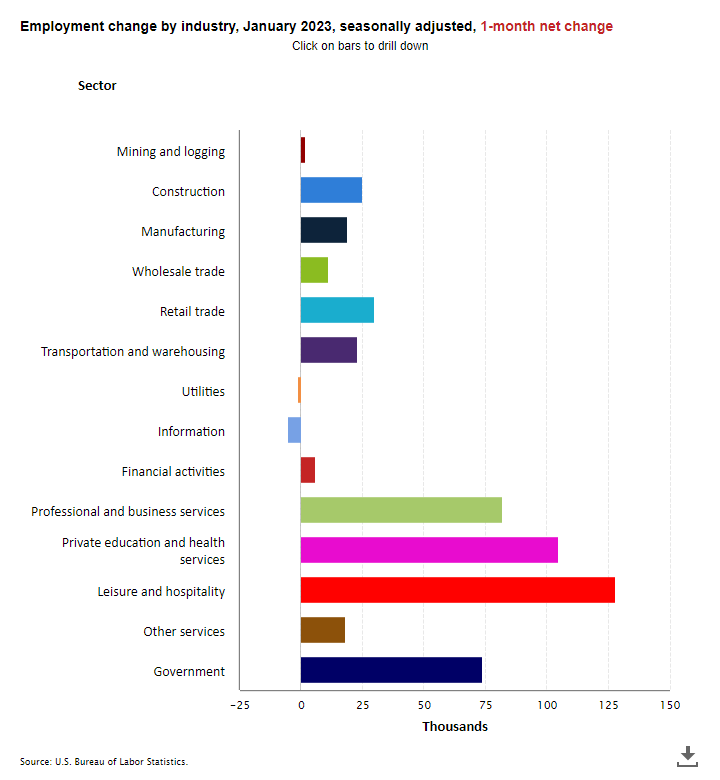

The unemployment rate fell to 3.4% in January, its lowest level since 1969 and below December’s already low rate of 3.5%. Separately, the U.S. Bureau of Labor Statistics also reported that nonfarm payrolls rose by a very large 517,000 in January 2023, nearly twice as much as in December (260,000) and more than the monthly average of 401,000 in 2022. Market expectations had called for a gain of less than 200,000 jobs. Revisions added 71,000 positions to total payrolls in the previous two months. The monthly gain and revisions paint an image of a still strong labor market.

Today’s labor report will add further impetus to the Fed’s policy conviction of nudging interest rates higher after already increasing rates aggressively last year and one month into 2023. Indeed, at the FOMC meeting this past week, the Fed announced a 25-basis point increase in the Fed Funds rate to a range of 4.50% to 4.75%. While this was a smaller increase than those in 2022, it nevertheless brought rates to their highest level since 2007. Further, in its official statement, the Fed indicated that “ongoing increases” in rates would still be required. Further, Federal Reserve Chair Jay Powell said he thought it would take “a couple of more rate hikes to get to that level we think is appropriately restrictive.” The Fed is hyper-focused on the rate of inflation and wants to be confident that inflation can be sustained at a 2% target range. At this point, the Fed is not convinced that this is the case despite evidence that inflation is decelerating. While goods inflation does indeed appear to be slowing, service inflation, largely driven by wages, continues to be worrisome.

Indeed, average hourly earnings for all employees on private nonfarm payrolls rose by $0.10 in January to $33.03. This was a gain of 4.4% from year-earlier levels, but lower than in recent months.

Employment in health care rose by 58,000 in January and after averaging 47,000 jobs per month in 2022. Employment in nursing care facilities grew by 4,500 jobs from last month and 35,600 from year-earlier levels and stood at 1,380,100 positions. Jobs increased by 8,400 positions in CCRC and assisted living facilities and were up by 60,700 from year earlier levels to 930,700 jobs.

In the household survey conducted by the BLS, the jobless rate fell from 3.5% in December and stood at 3.4% in January. Both months’ unemployment rates were well below the 14.7% peak seen in April 2020.

The labor force participation rate stood at 62.4% in January, up from 62.3% in December but was below the February 2020 level of 63.3%.

Among the major worker groups, the January unemployment rates were 3.1% for adult women, adult men (3.2%), teenagers (10.3%), Whites (3.1%), Hispanics (4.5%), Blacks (5.4%), and Asians (2.8%).

Learn from your peers about how value-based care models and at-home primary care can benefit both residents’ health and operators’ business models in the “Benefits of Integrating Primary Care into Senior Housing” Innovation Lab. Speaking of care delivery, Dr. Sachin Jain, CEO of SCAN Group & Health Plan, will give a keynote address called “Trends and Opportunities in Medicare” to explain senior living’s opportunity to serve Medicare enrollees as care delivery and payment models evolve and generate untapped efficiencies for senior living providers.

Learn from your peers about how value-based care models and at-home primary care can benefit both residents’ health and operators’ business models in the “Benefits of Integrating Primary Care into Senior Housing” Innovation Lab. Speaking of care delivery, Dr. Sachin Jain, CEO of SCAN Group & Health Plan, will give a keynote address called “Trends and Opportunities in Medicare” to explain senior living’s opportunity to serve Medicare enrollees as care delivery and payment models evolve and generate untapped efficiencies for senior living providers. Finally, how can operators harness value-based care opportunities to create a sustainable future of quality healthcare in senior living? Dr. Nirav Shah, Senior Scholar at Stanford University’s Clinical Excellence Research Center, will lead a keynote session called “The Future of Health and Healthcare: How Will Senior Living Operators Differentiate Themselves?” about the significant advances in health technology that are altering the landscape of opportunities for operators and investors in senior housing and how they can help senior living residents live healthier lives.

Finally, how can operators harness value-based care opportunities to create a sustainable future of quality healthcare in senior living? Dr. Nirav Shah, Senior Scholar at Stanford University’s Clinical Excellence Research Center, will lead a keynote session called “The Future of Health and Healthcare: How Will Senior Living Operators Differentiate Themselves?” about the significant advances in health technology that are altering the landscape of opportunities for operators and investors in senior housing and how they can help senior living residents live healthier lives.