Telehealth, telemedicine, virtual care, eConsult, store-and-forward…what does this all mean? More importantly, how do you better serve your resident populations — in a global pandemic and onward? Telehealth is a broad term that seems to get caught in a tangled web of policy, compliance, and reimbursement. However, telehealth brings incredible promise to our highest risk populations in this pandemic, and has transformational implications for the way healthcare will be delivered even once the pandemic is behind us.

Imagine an 87-year-old woman living in a senior living community. She falls on her way to the bathroom, hurting her hip and hitting her head. She is able to call for help and the night staff comes to her room. The young man on duty helps her back in bed, but knows she needs medical attention. He types her name into the iPad on the wall and is immediately connected with an ER doctor. The physician introduces herself, asks a few basic questions, and directs the night staff employee through a physical examination. She then directs the night staff employee to take a photo of the resident’s eyes to include in a neurology consult. The physician reassures the woman that everything is fine for now, but that she will need to get an x-ray in the coming days. The physician also explains that she will deliver the news from the neurologist in the morning, but there is nothing to worry about now. The woman is able to fall asleep and wakes up to a message from her ER doctor and a neurologist providing her detailed instructions around her care plan and the next steps — reassuring her she will be alright. She shares the videos with her senior living facility staff, children, and grandchildren.

How was this possible? First, the senior living community had synchronous primary and urgent care telehealth services. The operator of the property had already gathered key health data, emergency contacts, and consent, all of which was integrated into their in-room tablet and HIPAA compliant telehealth portal. The telehealth ER doctor was able to immediately access the key information and pair it with the incident requiring medical attention. Second, the operator and telehealth provider had asynchronous telehealth services for specialty care and video communication. This enabled the ER doctor to access specialists and receive care plan guidance within hours while also communicating key information to the resident in a shareable, repeatable, and personalized video message. This solution is what enabled the woman to have a neurology consult without leaving her room and receive a summary of her experience and next steps to re-watch, show her staff nurses, and share with concerned family.

Effective use of telehealth can result in reductions in ER visits, readmissions, and unnecessary COVID-19 exposures, while empowering front-line staff and improving the resident and family experience altogether. Telehealth has the potential to drive immense value for residents and providers alike within seniors housing. It may feel like this vision is a long way off, but the solutions are ready and available — operators need only understand what their options are and thus what best fits with their priorities.

A Brief History

The history of telehealth goes back several decades. Telehealth was first authorized in Medicare in 1997. Shortly thereafter, the internet boom democratized access to information, accelerating innovation across industries and instigating the rise of consumer choice (“consumerism”). The Affordable Care Act initiated a healthcare course correction toward value-based care, all while consumers were starting to expect the same kind of options, service, and convenience with their healthcare that they were experiencing when buying groceries, booking a plane ticket, or customizing a pair of shoes.

By the beginning of 2020, the majority of healthcare providers and hospital systems had started offering telehealth or at least had it on their strategic roadmap for the coming years, as it demonstrated the potential to not only please healthcare consumers, but also address rising healthcare costs and quality care access inequities. As such, telehealth has been on an upward trajectory for decades, albeit a slow one, until now.

When COVID-19 hit the U.S., cities, counties, and numerous states went under shelter in place policies. For millions of Americans, and thousands of healthcare providers, the need for telehealth options became urgent. CMS used emergency rulemaking to provide Medicare telehealth flexibilities for the duration of the pandemic. This expanded telehealth-eligible services, provided tech mode flexibilities, and expanded the types of practitioners eligible to provide telehealth services. Adoption skyrocketed, both by physicians and their patients, primarily older adults.

COVID-19 has significantly accelerated the proliferation of telehealth as a key element in care delivery. Now, telehealth is in the toolkit of nearly all providers and is an option for nearly all patients, including millions of seniors housing and care residents. According to a study done by McKinsey & Co, by May 2020, 76% of consumers said they are now interested in using telehealth going forward. User adoption coupled with telehealth’s impact potential on triage, coordination, productivity and convenience will ensure its continued presence in healthcare — and seniors housing — as we know it.

Telehealth Today

Telehealth can simply be defined as care delivered via virtual communication between patients and healthcare providers or providers to other providers.

There are many vendors offering a variety of telehealth solutions in today’s market. it is important to understand the defining variables that sit behind the vast array of options.

- Modality: Telehealth can be delivered through a variety of media — audio, video, or text. It is critical to consider the richness of the media. Video and other virtual media are the closest to in-person, while text may feel impersonal or automated.

- Timing: Telehealth can be delivered both synchronously and asynchronously. Synchronous refers to live communication such as a phone call. Asynchronous refers to communication that is delivered and then stored until the recipient reviews it — think of a voicemail (this is also referred to as store and forward). The value of synchronous telehealth is that it most closely resembles an in-person appointment. Asynchronous telehealth can also provide significant value to both patients and providers, as it eliminates the need for scheduling and can be referred back to, shared, or re-consumed.

- Participants: The most common use for telehealth is between patient and healthcare provider. Telehealth also empowers senior living care workers to take an active role in their residents’ care journeys, through three-way visits. The ability to include family or caregivers in the care process leads to better communication and decision-making for the resident. Telehealth also extends to virtual communication for care delivery purposes between two healthcare providers — think of a second opinion, or a consult. This mode of telehealth can collapse the care cycle by empowering frontline providers with specialist expertise — reducing wait times, coordinating care, and reducing medical costs.

- Provider integration: Many telehealth companies offer hardware or software to facilitate care. Others offer integration with provider networks, and occasionally operate as their own health system. Doctor On Demand, for example, has a network of board-certified primary care physicians, psychiatrists, therapists, and physician-led care teams. Similarly, Sitka is supported by a vast network of specialty providers such as dermatologists, cardiologists, neurologists, etc.

There are a myriad of options, and there is a lot to consider, but this should help set structure around the landscape of offerings.

Telehealth and Senior Care

Senior housing and care providers are uniquely positioned to reap value from telehealth for residents, families, staff, and the senior living communities themselves. Seniors housing has a captive user base around the clock and immediate economies of scale upon adopting a new solution. These communities largely have the power to control access and devices, while the expertise needed for physical examinations is usually available on site, oftentimes eliminating the need for in-person visits to your community. By employing telehealth solutions, operators can significantly decrease the need for in-person trips to the doctor’s office, or the emergency department, which families and residents now prefer to avoid.

The seniors housing population itself has greater need and greater reward for telehealth. The senior population accounts for the highest proportion of medical costs in the US, driven by ER visits and inpatient stays. Many times, conditions are worsened by travel and unnecessary exposures — avoidable with telehealth. Also, the senior population is eligible for value-based care (e.g., capitated Medicare Advantage Plans), which eliminates the incentive for excessive doctor visits or procedures and instead encourages timely and preventive care.

Seniors housing and care communities are home to over three million older adults, most of whom have multiple chronic conditions. The pandemic has brought with it heightened fear by these seniors and their adult children of traditional healthcare delivery settings, such as the hospital, the emergency department, and even the waiting room of the doctor’s office. Seniors increasingly both want and need to have healthcare services brought to their residential communities.

A clear opportunity exists for every type of senior living property, but telehealth is not one size fits all. Each senior living type, brand, and property should be assessed to identify how telehealth can be implemented to solve its most pressing needs.

First, structural elements must be assessed: skilled nursing availability, staff coverage, resident health plan membership mix, technological infrastructure (e.g., wifi, device access). Each of these factors will be key considerations as you balance budgetary constraints and feasibility of the different telehealth offerings.

It’s also important to factor in the intangibles: brand, culture, family involvement, resident investment in community decisions, staff / management relationship. Think about the goals of your proposed telehealth solutions and how they fit into your organization’s identity. While telehealth poses significant value, does the solution you are considering align with your organizational strategy and mission? Consider making small adjustments to better fit with competing priorities.

As you set off on this journey, it will be important to remember the fundamental rule of change management: key stakeholders must be included in the conversation and bought-in at each step. Such stakeholders may change depending on the operator or property type, but consider leadership, staff, residents, and families. Inclusion may entail conducting a pilot with specific residents and staff that have high likelihood to champion the chance, or hosting a marketing event with families early on to communicate the goal for the new telehealth solution. Buy-in will be critical to early stage implementation and to long-term success of telehealth in your organization.

Telehealth is Here to Stay

Change management may be daunting, but telehealth is here to stay. The sooner your telehealth solution is up and running, the better your communities and your residents will be in the long run. Telehealth is a powerful way to offer your residents safe and timely care, and will only become more essential in the future.

In his recent “NIC Talk,” given at the 2020 NIC Fall Conference, Dr. Tim Ferris, CEO of the Mass General Physicians Organization, said that when it comes to the utilization of telehealth to bring services to seniors with chronic conditions, “We are not going back.” Indeed, telehealth offers senior housing providers opportunity for onsite triage and proactive management of residents’ chronic conditions, allowing this high-risk population to stay at home. Pandemic necessitated telehealth will hopefully diminish soon, but continued investment and change management will ensure improved healthcare services, outcomes, and comfort for seniors in years to come.

Sources: McKinsey report — Telehealth: A quarter-trillion-dollar post-COVID-19 reality?

This article was originally posted on Medium by Sitka, Inc.

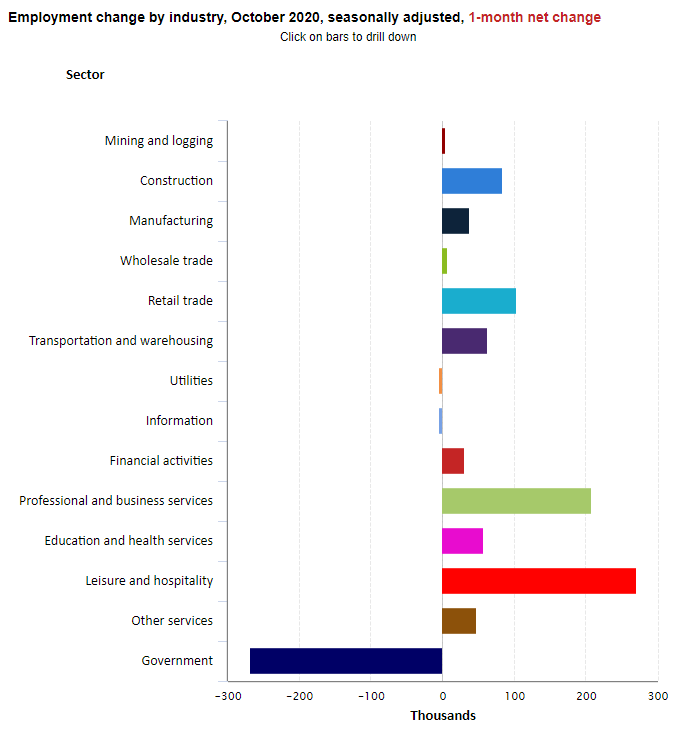

Health care added 58,000 jobs in October, with the largest gains occurring in hospitals, offices of physicians and dentists and outpatient care centers. These increases were partially offset by a decline of 9,000 workers in nursing and residential care facilities.

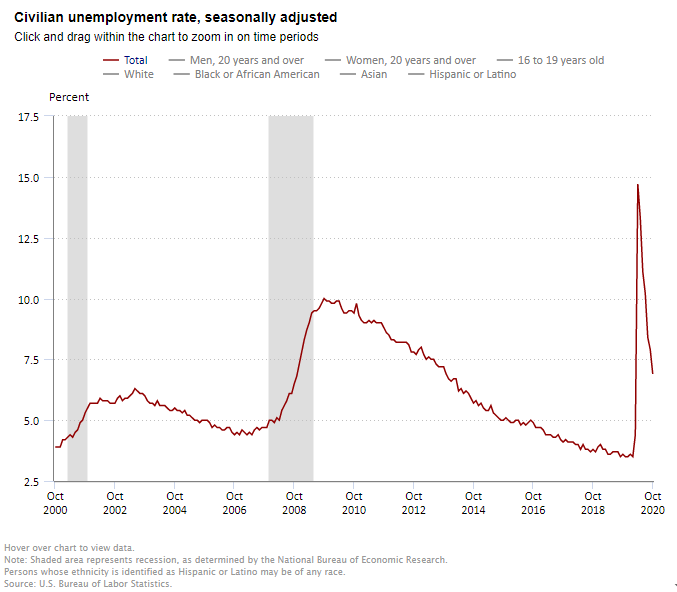

Health care added 58,000 jobs in October, with the largest gains occurring in hospitals, offices of physicians and dentists and outpatient care centers. These increases were partially offset by a decline of 9,000 workers in nursing and residential care facilities.  The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work increased by 0.3 percentage point in October to 61.7% and is 1.7 percentage points lower than in February. The employment-population ratio increased by 0.8 percentage point to 57.4% in October but is 3.7 percentage points lower than in February.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work increased by 0.3 percentage point in October to 61.7% and is 1.7 percentage points lower than in February. The employment-population ratio increased by 0.8 percentage point to 57.4% in October but is 3.7 percentage points lower than in February.