Are you ready to elevate your knowledge, connections, and influence in the senior housing and care industry? The NIC Spring Conference is the industry’s premier event, offering unparalleled opportunities to grow professionally and strategically. Registration is now open!

Whether you’re a senior housing operator, an investor, or a service provider, the conference provides a rich blend of networking, education, and actionable insights designed to help you navigate today’s challenges and seize tomorrow’s opportunities.

Top Reasons to Attend:

- Unparalleled Networking Opportunities:

- Build relationships with peers, decision-makers, and thought leaders in the senior housing and care industry. Whether it’s connecting over coffee or during structured sessions, these interactions can lead to meaningful collaborations and partnerships.

- Expert-Led Sessions:

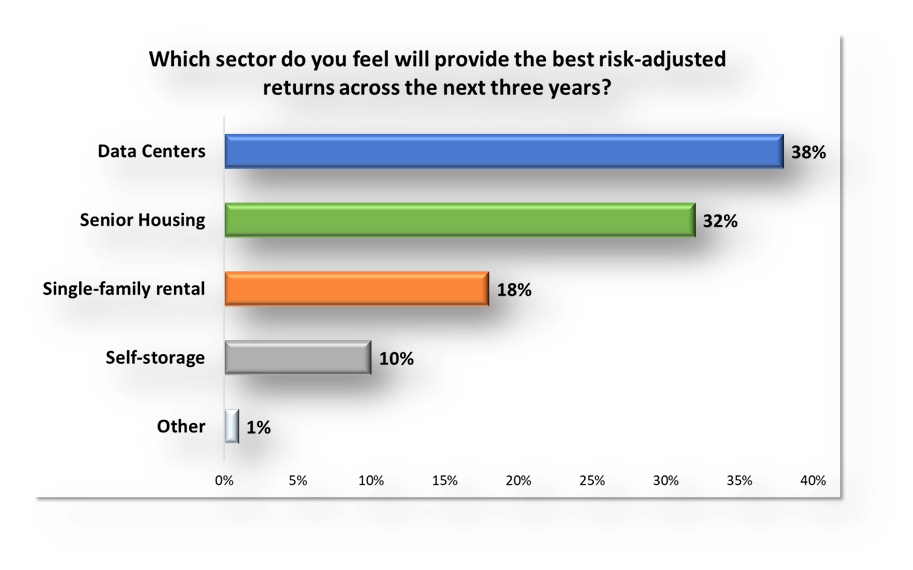

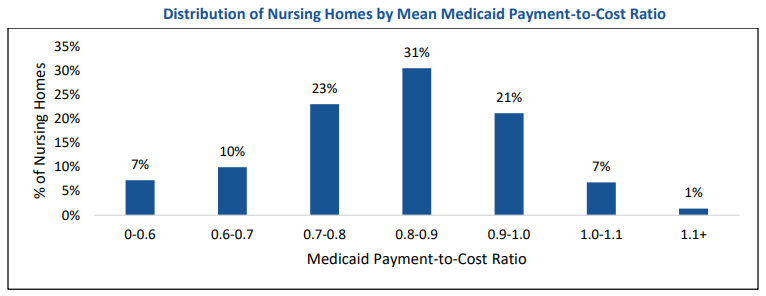

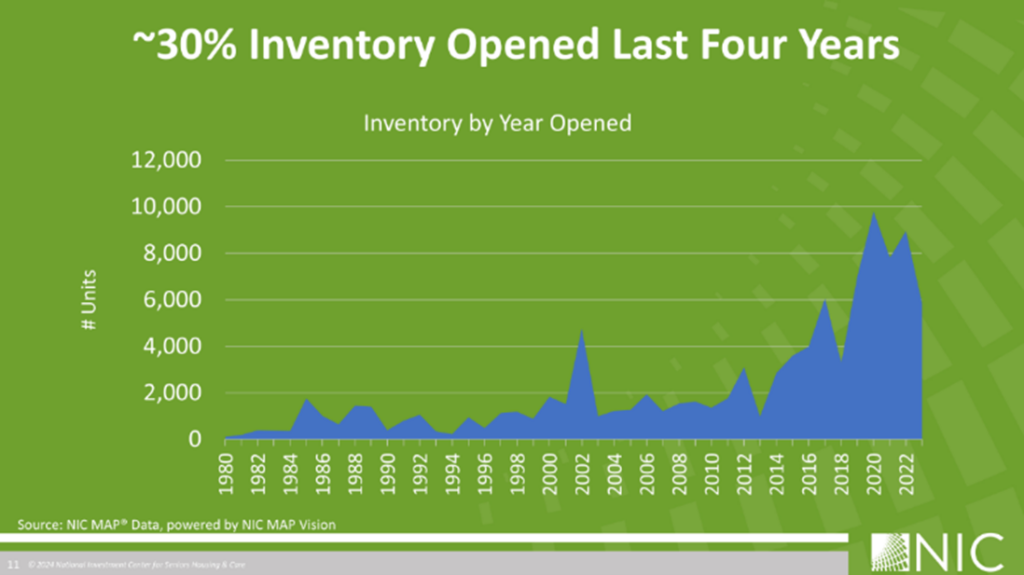

- Hear from top-tier speakers sharing cutting-edge strategies on topics such as capital and investment, innovative operational models, and senior housing trends shaping the future.

- Actionable Takeaways:

- Equip yourself with strategies and tools to address industry challenges and implement solutions that advance your organization’s goals.

- Innovation Lab:

- Witness cutting-edge technologies and innovative solutions designed to transform senior care operations.

- Stay Ahead of Trends:

- Gain exclusive insights into market dynamics and future trends that will keep you ahead in this competitive landscape.

Don’t Miss Out: Register by January 10th to take advantage of Early Bird rates and secure your spot at this transformative event. Join us and become part of the conversation shaping the future of senior housing and care. Register now and take the next step in driving meaningful change!