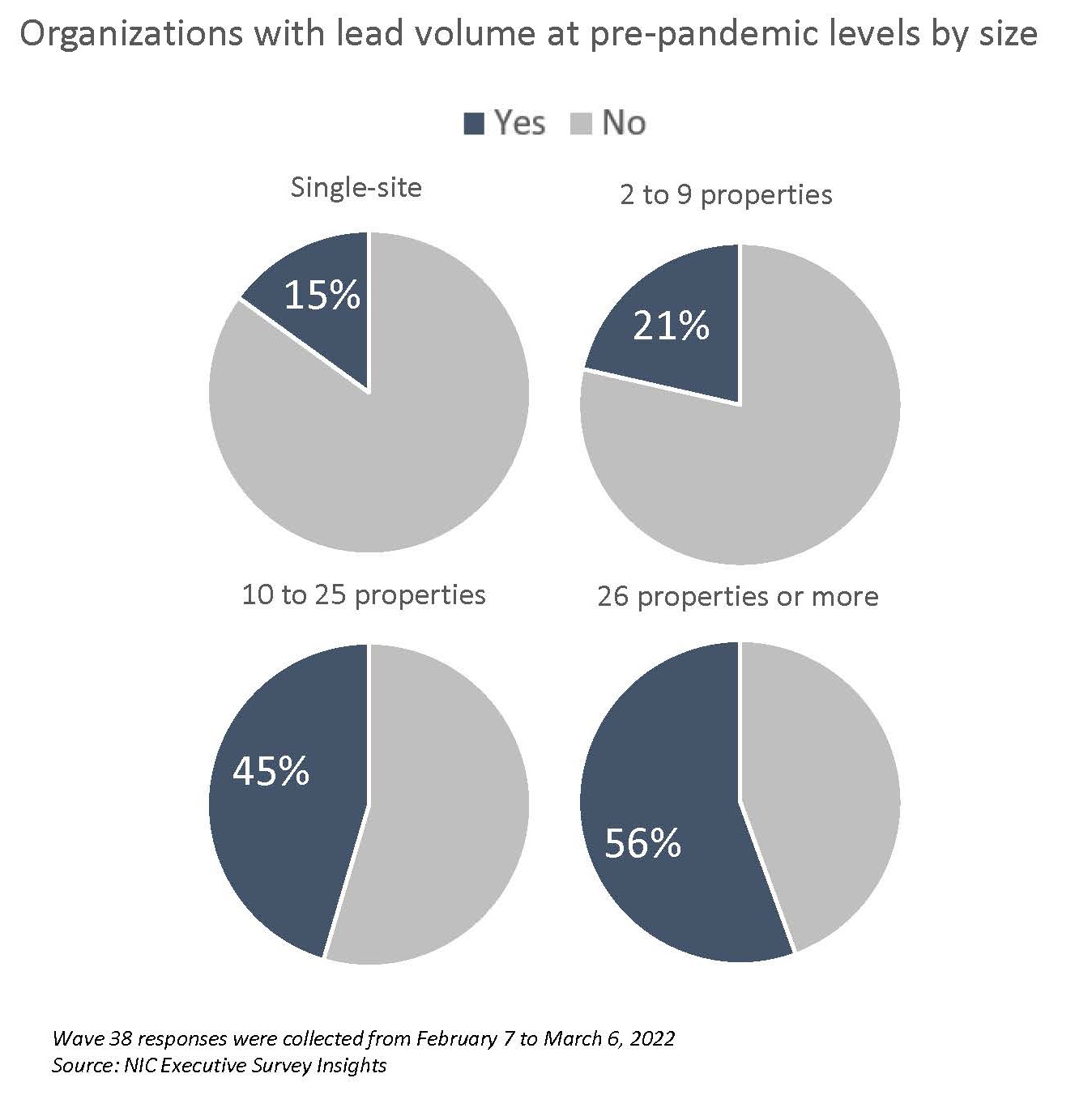

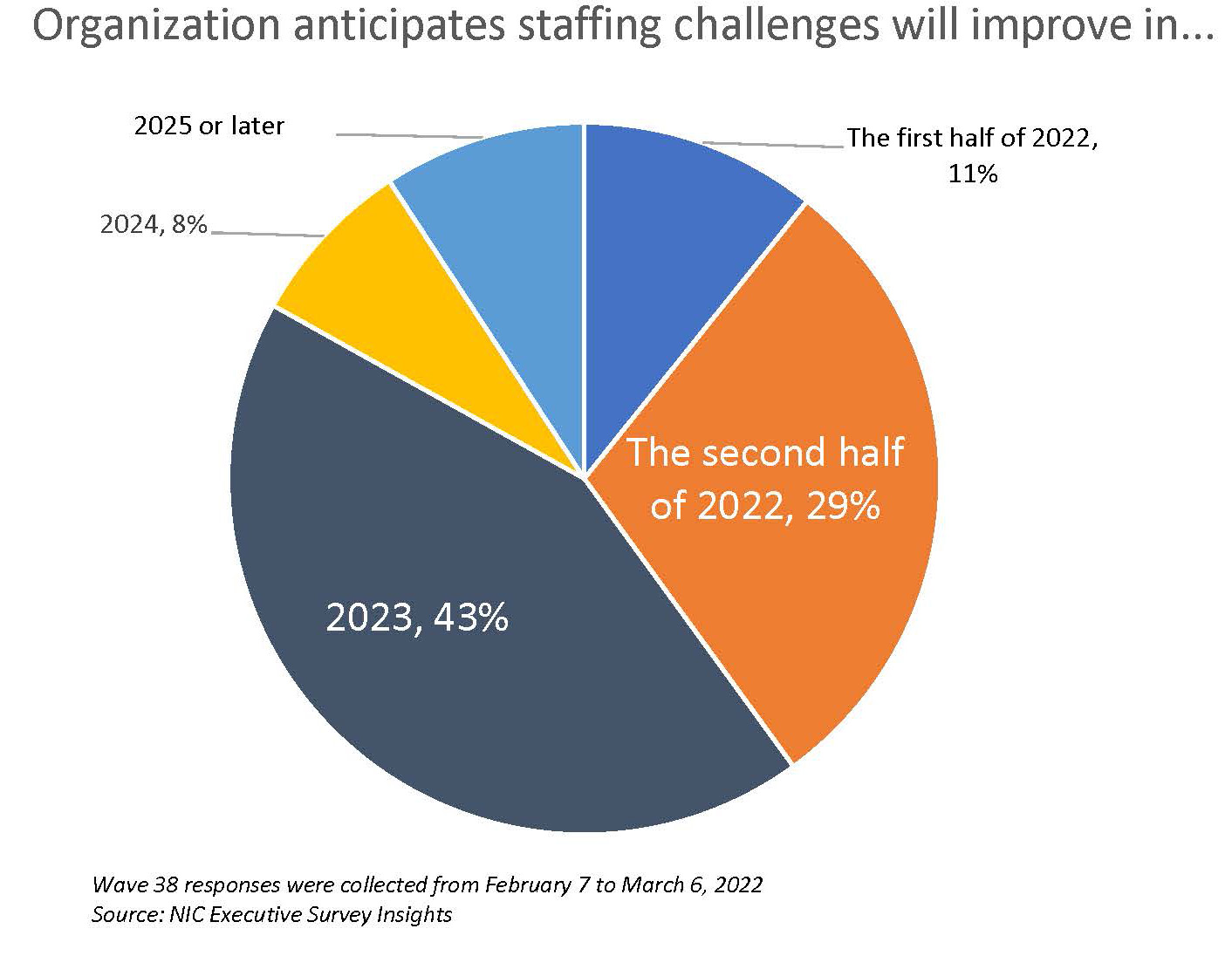

As the pandemic eases and occupancy recovery in senior housing progresses, rising operating expenses may limit the degree to which operating margins will grow in the next six months. In the Wave 38 survey, three-quarters of respondents expect margins to increase; the majority anticipate the increase will be between 1% and 5%. Nearly three-quarters of respondents are optimistic that labor and staffing challenges will begin to ease in the second half of 2022 or 2023. Currently, all respondents are paying staff overtime hours and four out of five rely on agency or temp staff to fill in the gaps. About one-half do not expect their reliance on agency or temp staff to change in 2022; however, 40% anticipate it will decrease. (Note that nine out of ten respondents to the Wave 38 survey lend their support for a federal investigation of anticompetitive practices by nursing and other direct care staffing agencies.) The pace of move-ins remained strong for assisted living and improved in the nursing care segment but slowed for independent living and memory care. Reasons cited by respondents that observed a deceleration in the pace of move-ins included “normal movements,” “Omicron,” “lack of available staff,” and the “slowdown of hospital admissions.” Smaller operators are less likely to have achieved pre-pandemic lead volumes than larger organizations. In Wave 38, more than half of the survey’s largest organizations have reached pre-pandemic lead levels compared to only 15% of single-site operators.

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of senior housing and skilled nursing operators was implemented in March 2020 to deliver real-time insights into the impact of the pandemic and the pace of recovery. In its third year, the “ESI” is transitioning away from the COVID-19 crisis to focus on other challenges facing the industry. While some standard questions will remain for tracking purposes, in each new survey “wave,” new questions will be added. Let us hear your suggestions!

This Wave 38 survey includes responses from February 7 to March 6, 2022, from owners and executives of 67 small, medium, and large senior housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

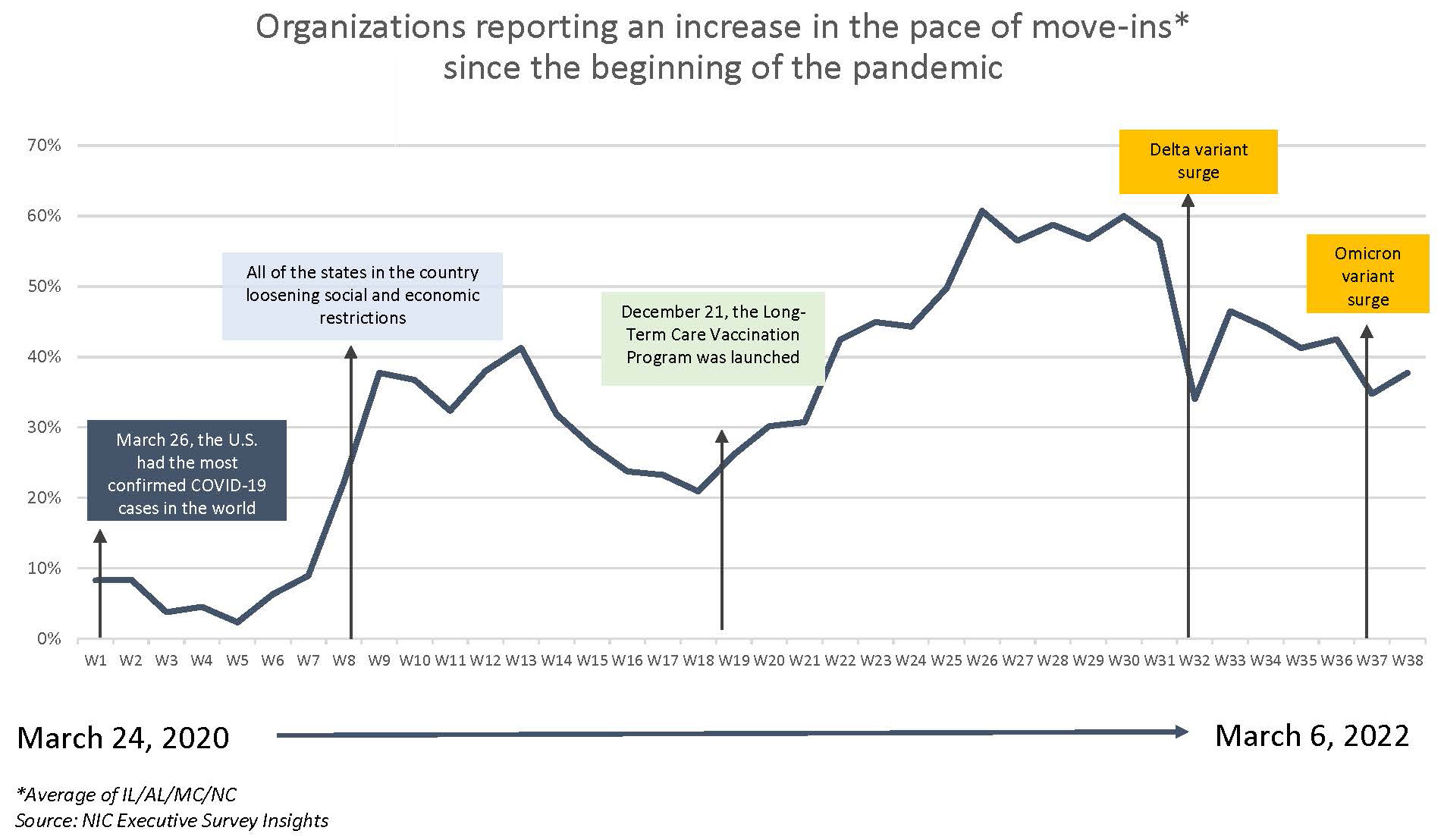

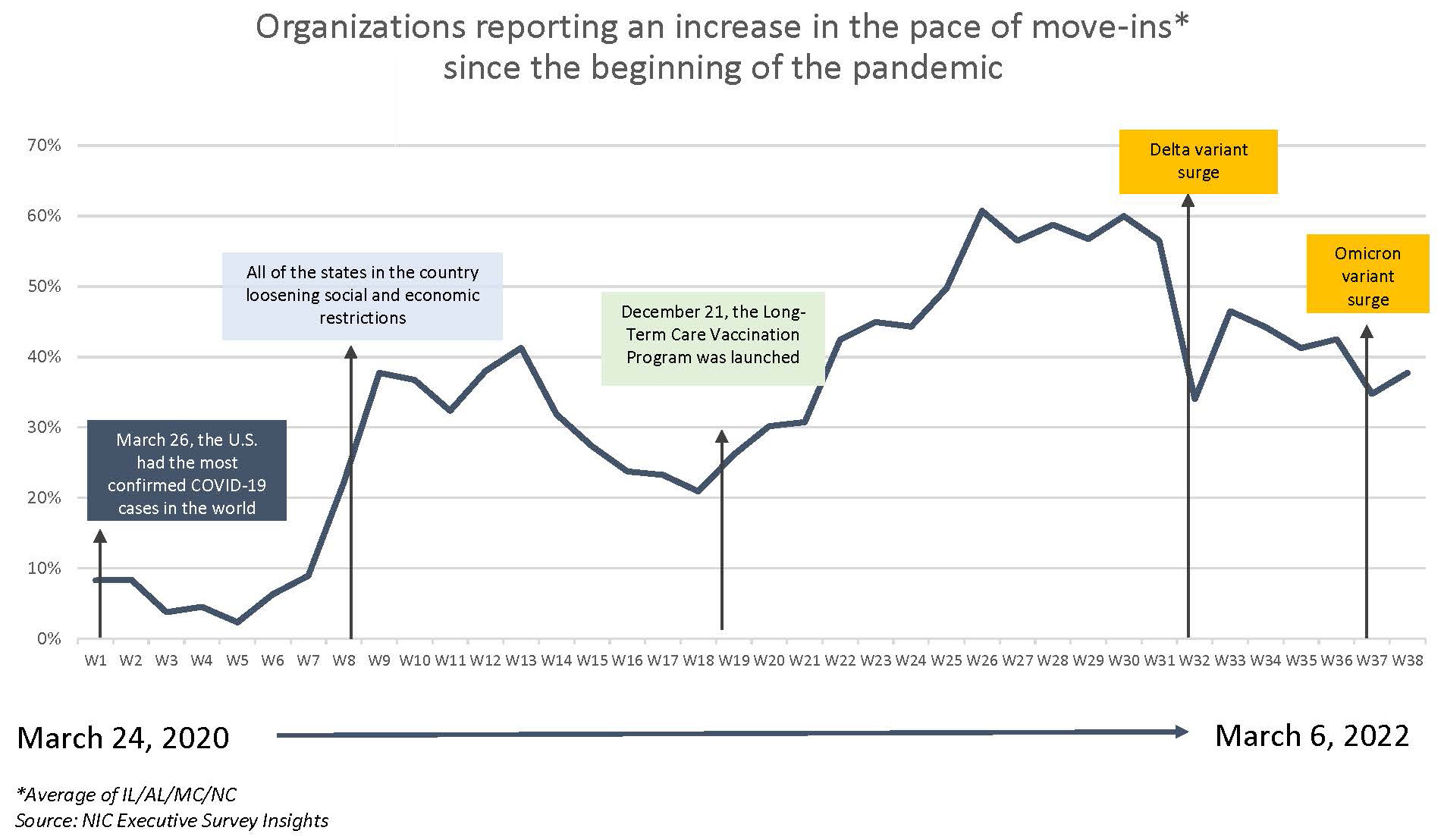

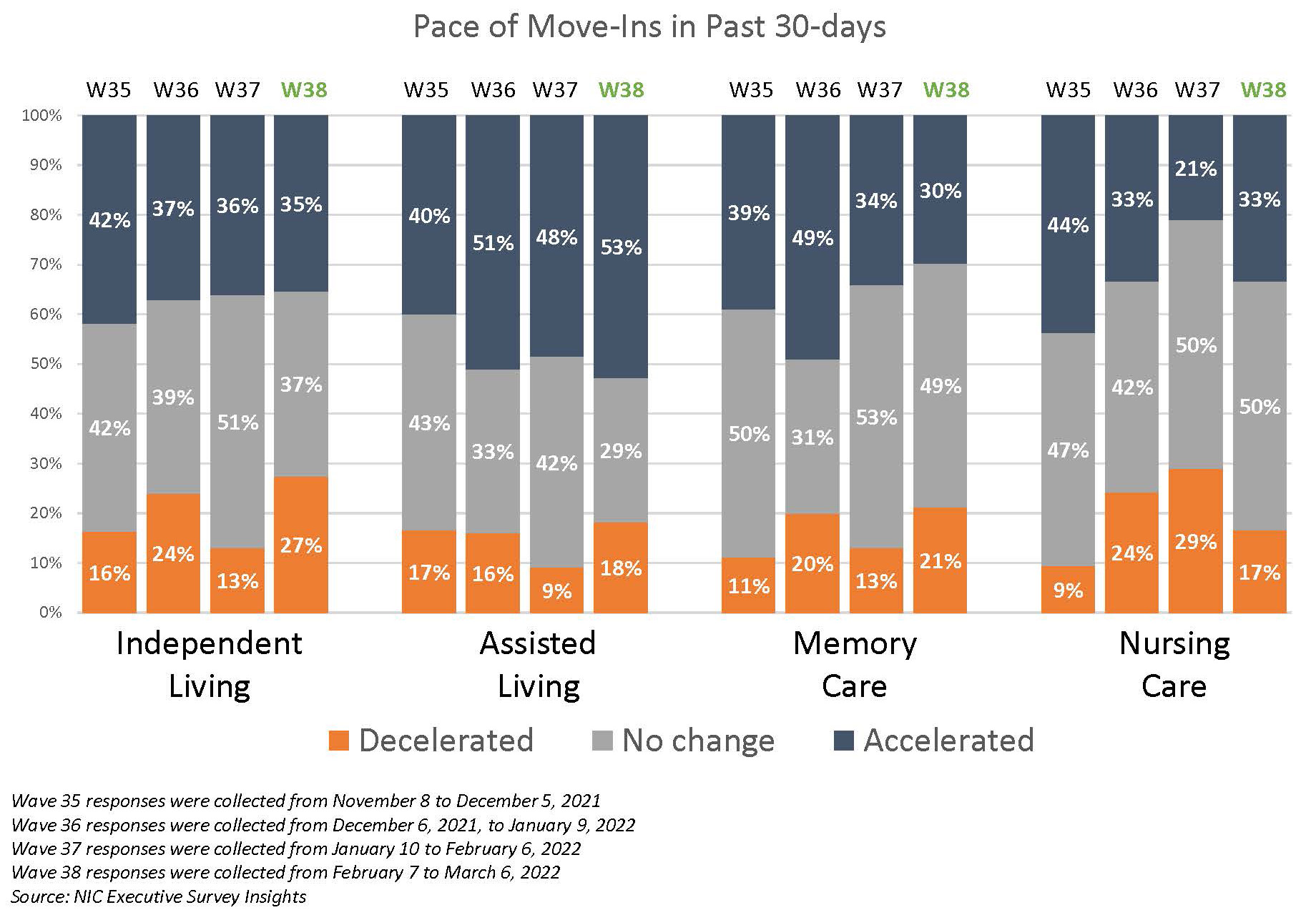

Across 38 Waves of the ESI, the pace of move-ins has closely corresponded with the broad incidence of COVID-19 infection cases in the United States. This is demonstrated in the timeline below that shows the share of organizations reporting an increase in the pace of move-ins during the prior 30-days. Data from the Wave 38 survey, which was conducted during the month of February, reflects an increase in the share of operators reporting acceleration in the pace of move-ins as the Omicron variant peaked and cases began to decline in the U.S. in the middle of January.

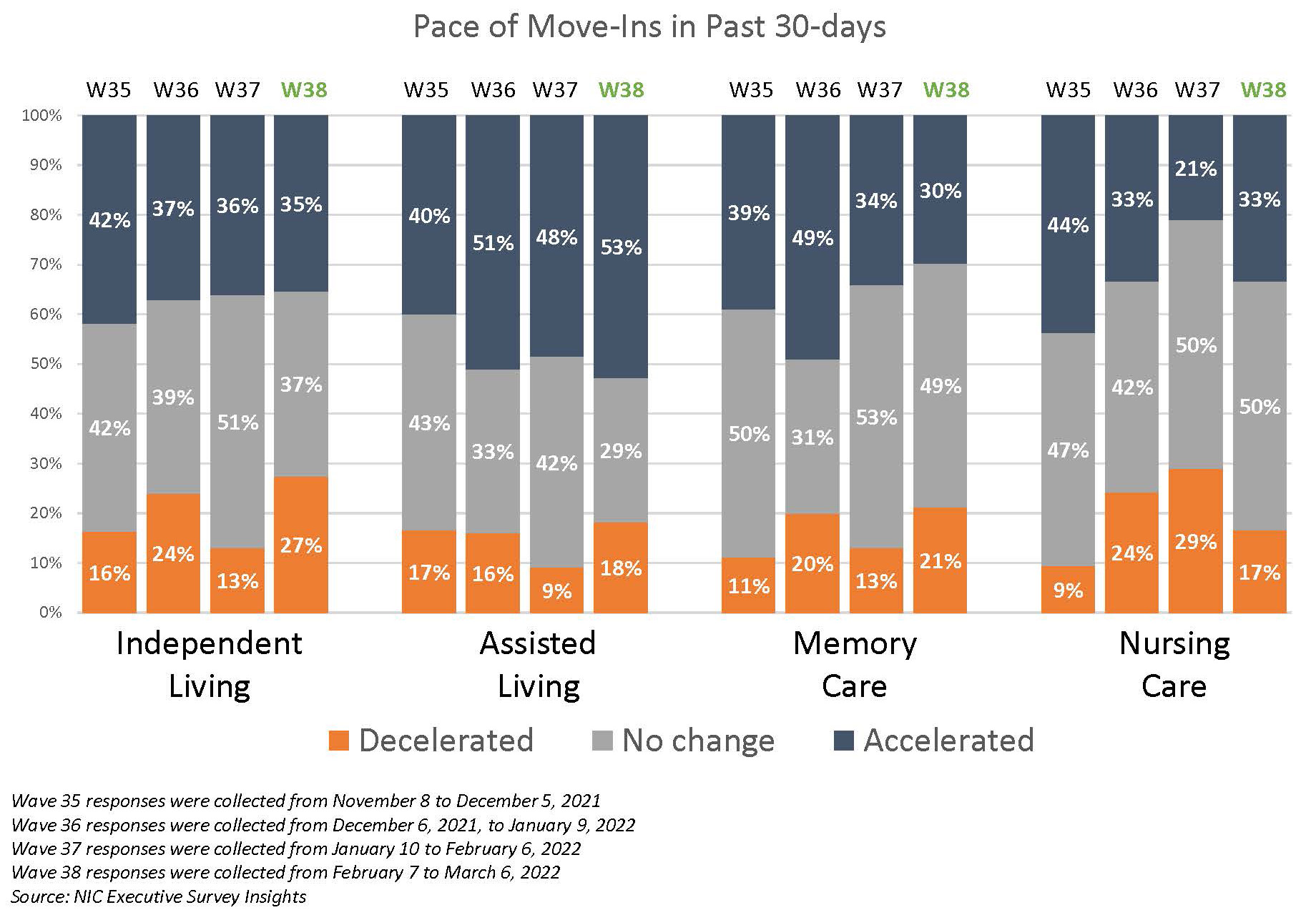

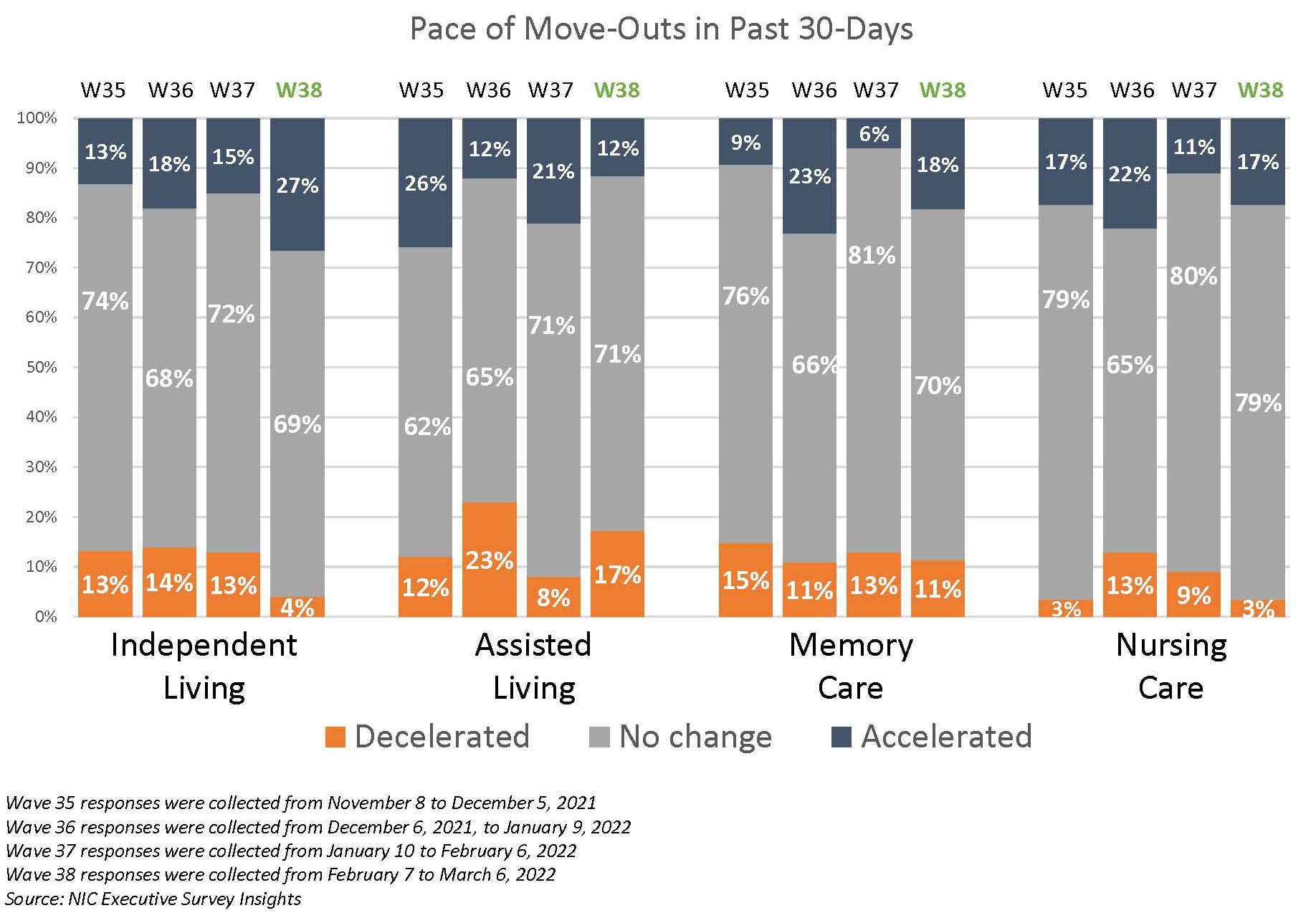

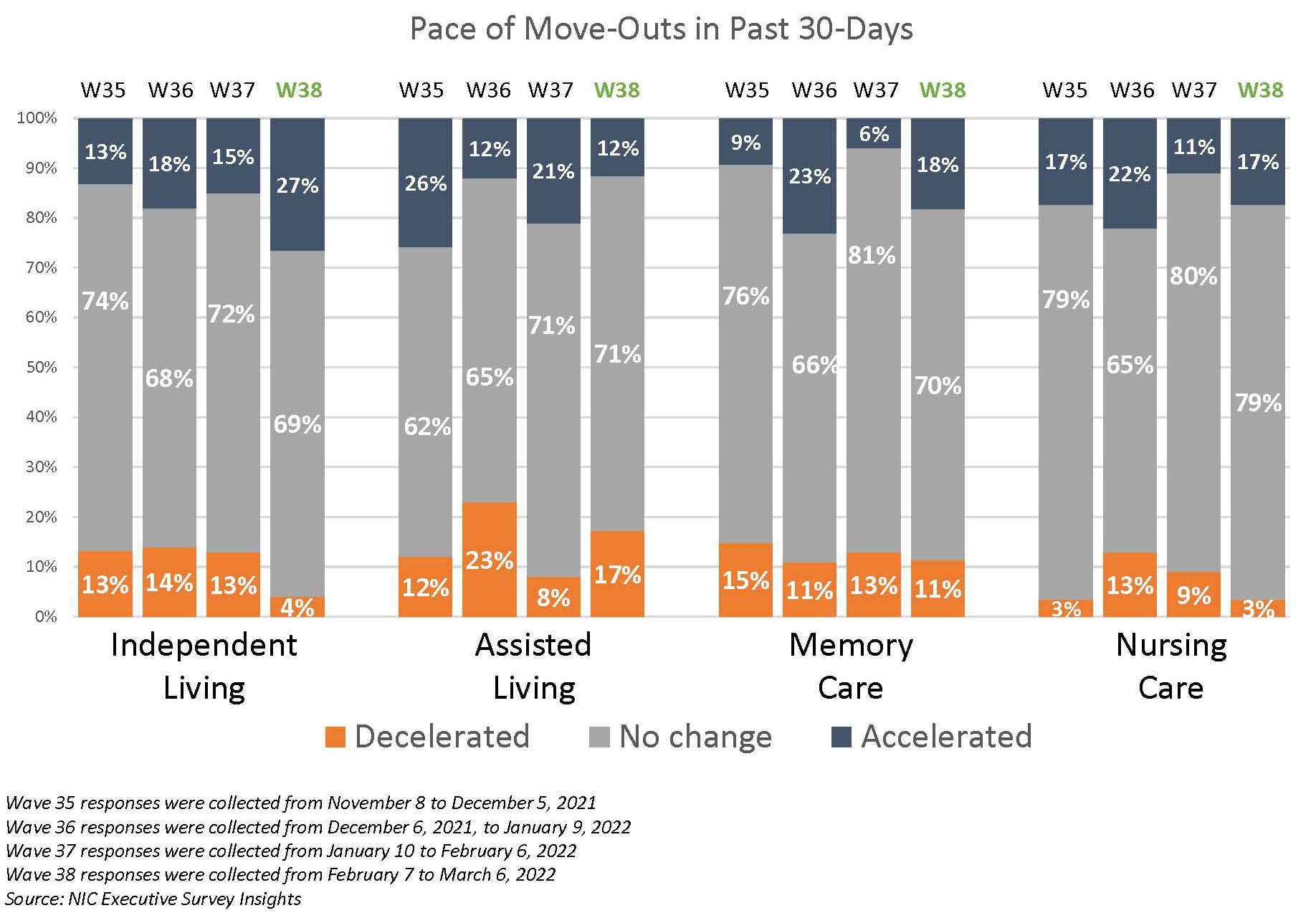

Since the Wave 36 survey (reflecting operator experiences in November), one-half of organizations with assisted living units reported acceleration in the pace of move-ins. By contrast, the pace of independent living and memory care move-ins slowed. Likely, in part due to seasonality, Omicron, and residents moving to higher levels of care, one-quarter (27%) of organizations with independent living units reported a deceleration in the pace of move-ins since the previous survey (27% vs. 13%), and roughly equal shares of organizations with independent living units reported acceleration in the pace of move-outs since the prior survey (27% vs. 15%). The pace of move-ins in the nursing care segment reversed its slowdown trend in Wave 38. However, notably fewer organizations with memory care units reported an increase in the pace of move-ins since the Wave 36 survey. Reasons cited by respondents that observed deceleration in the pace of move-ins included “normal movements,” “Omicron,” “lack of available staff,” and the “slowdown of hospital admissions.” Regarding reasons for acceleration in the pace of move-outs, one-half (53%) of organizations cited residents moving to higher levels of care.

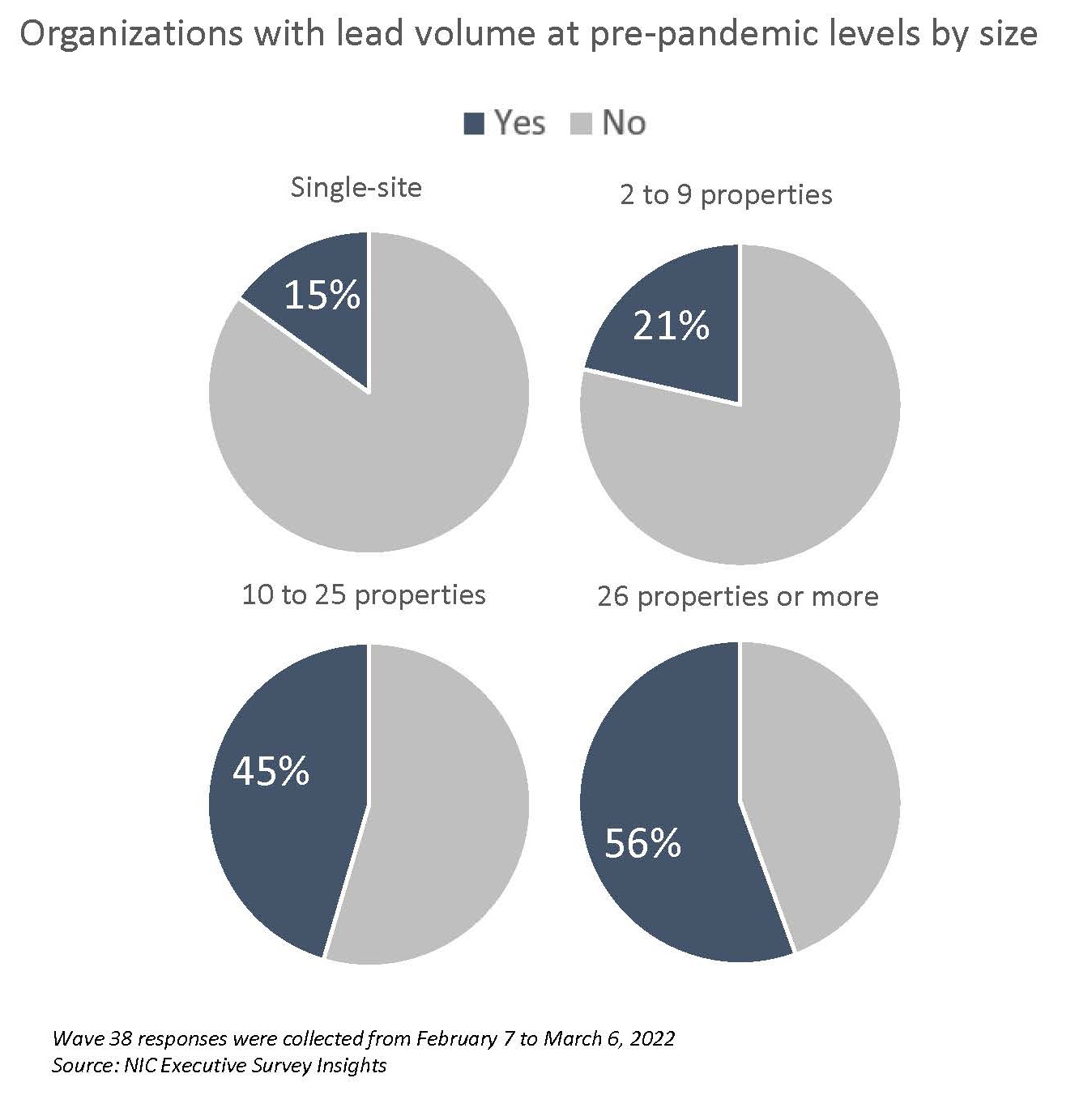

Smaller operators are less likely to have achieved pre-pandemic lead volumes than larger organizations in Wave 38. Given pent-up demand coming out of the pandemic and questions about the sustainability of historic and near-historic absorption rates during the third and fourth quarters of 2021 per NIC MAP Vision data, this measure in the ESI may be a leading indicator to watch with regards to occupancy recovery. As shown below, more than one-half (56%) of the survey’s largest organizations have reached pre-pandemic lead levels compared to only 15% of single-site operators. Potential reasons for this wide disparity in favor of larger organizations may include sizable sales teams and marketing budgets, sophisticated online and digital marketing capabilities, and geographic, demographic, and economic market diversity—all of which comes with scale.

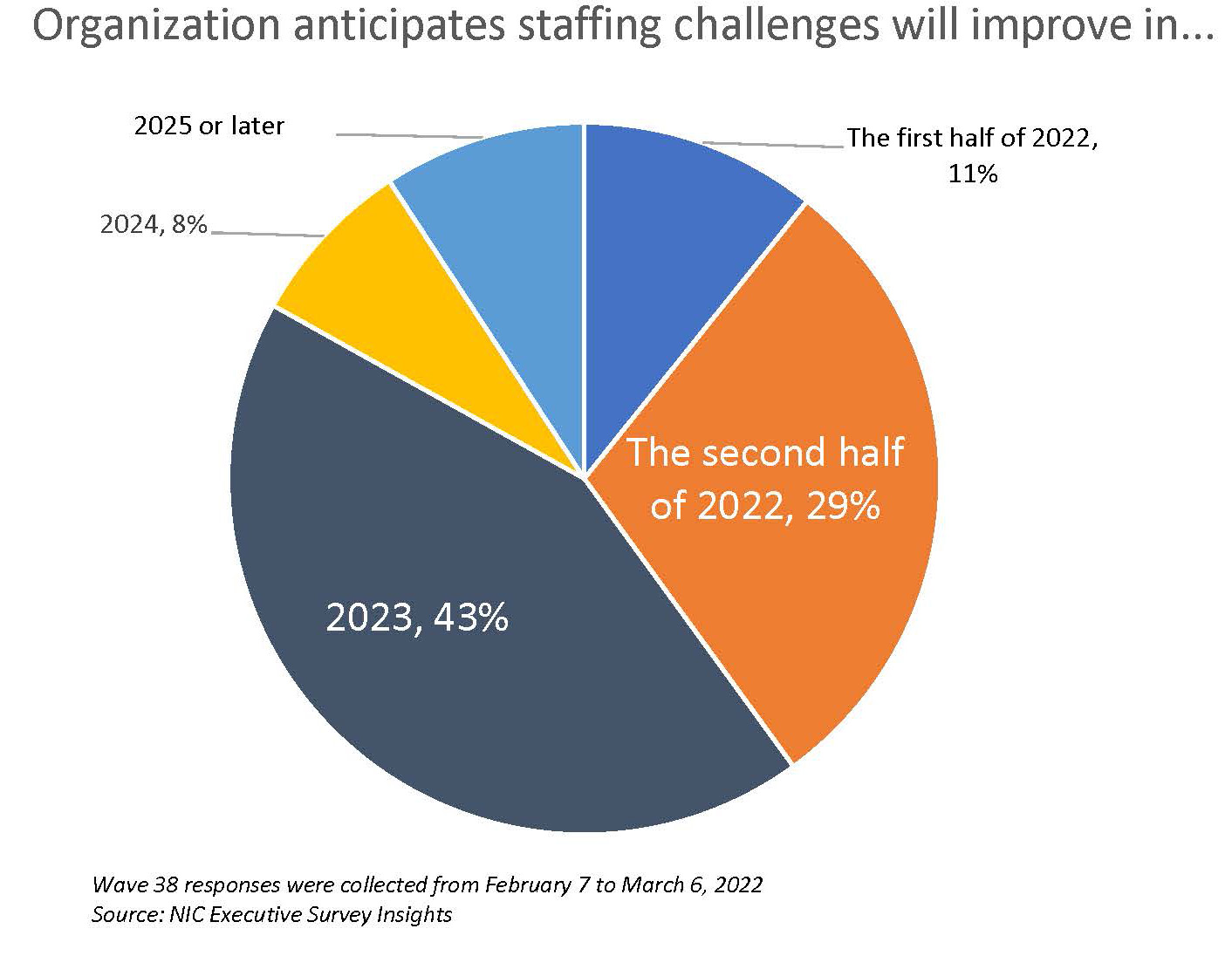

Staffing continues to be operators’ most significant challenge, but nearly three-quarters of respondents are optimistic that improvements are on the horizon. Since last July, nearly all operators (97% – 100%) responding to NIC’s Executive Survey Insights have reported staff shortages. Attracting community/caregiving staff and employee turnover remain the most significant challenges for survey respondents (86% and 60%, respectively). When asked about backfilling staff shortages, all respondents (100%) reported paying overtime hours in Wave 38, and four out of five respondents are currently tapping agency or temp staff (81%). Of those organizations, about one-half (49%) do not expect their reliance on agency or temp staff to change in 2022; however, 40% anticipate it will decrease. As shown below, just under one-third (29%) expect staffing challenges to improve in the second half of this year, while 43% believe labor markets will ease sometime next year.

Nine out of ten respondents to the Wave 38 survey (90%) lend their support for a federal investigation of anticompetitive practices by nursing and other direct care staffing agencies. At the end of January, the American Health Care Association and National Center for Assisted Living (AHCA/NCAL) with the American Hospital Association (AHA), sent a joint letter to the White House’s COVID-19 Response Team Coordinator, requesting assistance due to reports of anticompetitive practices by nursing and other direct care staffing agencies. AHCA/NCAL asked that the White House “urgently devote” the federal government’s attention to these practices. (Both organizations are still waiting on a response from the Federal Trade Commission after writing to the agency to investigate the matter last October.)

Rising operating expenses may limit the degree to which margins will grow in the next six months. As occupancy recovery progresses as the pandemic eases, operators’ margins may improve. In the Wave 38 survey, only 5% of respondents anticipate their margins will decrease over the next six months, while 75% expect margins to increase. The majority (55%) anticipate the increase will be between 1% and 5%.

Wave 38 Survey Demographics

- Responses were collected between February 7 and March 6, 2022, from owners and executives of 67 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise roughly one-half (54%) of the sample. Operators with 11 to 25 and 26 properties or more make up the other half of the sample (18% and 28%, respectively).

- Just over one-half of respondents are exclusively for-profit providers (54%), about one-third operate not-for-profit seniors housing and care organizations (31%), and 15% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 72% of the organizations operate seniors housing properties (IL, AL, MC), 25% operate nursing care properties, and 35% operate CCRCs (aka life plan communities).

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please get in touch with Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic. This is your survey! Please take the Wave 39 survey and suggest new questions for Wave 40.