Key Takeaways:

Data from the recently released 1Q 2024 NIC MAP Vision Actual Rates Report show that:

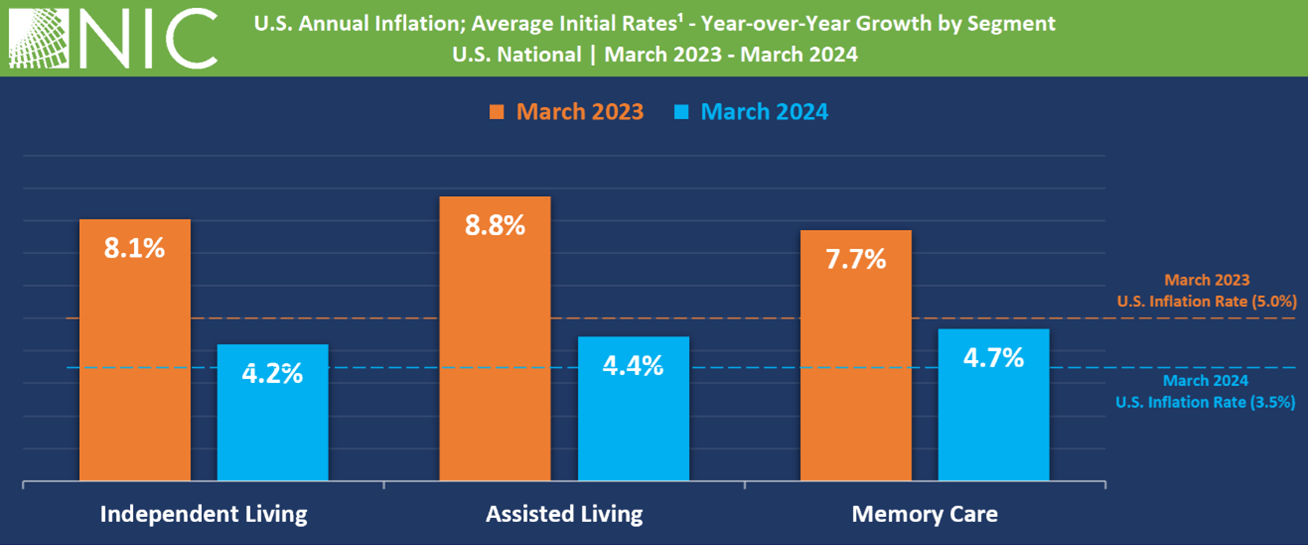

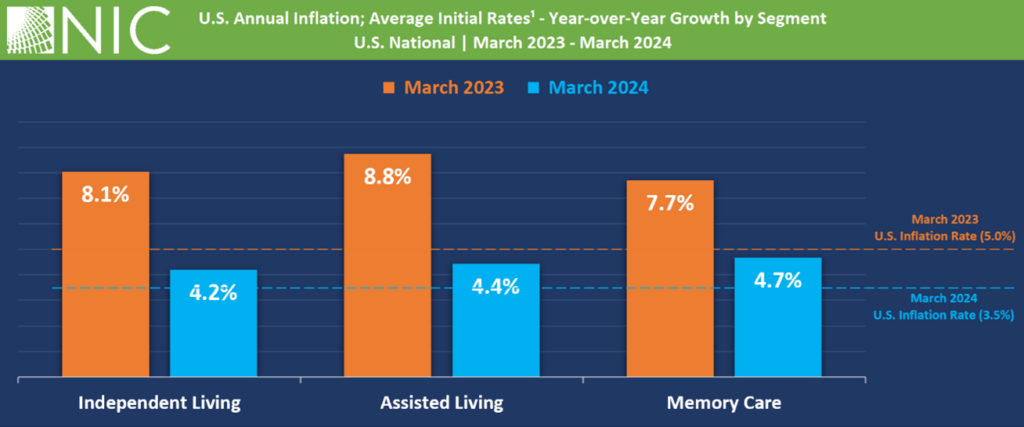

- The pace of growth in initial rates for all care segments (independent living, assisted living, and memory care) decelerated, indicating a trend towards alignment with inflation.

- Discounts remained highest in the independent living segment, followed by memory care and assisted living.

- The pace of move-ins remained strong and further improved compared to the previous quarter for independent living, assisted living, and memory care.

The pace of growth in initial rates for all care segments decelerated in the first quarter of 2024.

- For initial rates (move-in rates), the pace of growth slowed across all care segments in the first quarter of 2024. By March 2024, year-over-year increases were at 4.2% for independent living, 4.4% for assisted living, and 4.7% for memory care, down from 8.1%, 8.8%, and 7.7% in March 2023, respectively. The memory care segment showed the largest year-over-year increase for initial rates among the three care segments in March 2024.

Discounts in the first quarter of 2024 remained highest in the independent living segment, followed by memory care and assisted living.

- In the independent living segment, discounts between asking rates and initial rates remained in the double digits, averaging about 12.7% in the first quarter 2024. The March discount was $507, equivalent to 1.4 months on an annualized basis, and has stayed above $400 since June 2023. In-place rates had a 0.6 month annualized equivalent discount compared with asking rates.

- Discounts in the assisted living segment were lower, averaging 8.8% in the first quarter of 2024, equivalent to 1.1 months on an annualized basis for initial rates compared with asking rates. The March discount was $506, equivalent to 0.9 month on an annualized basis.

- In the memory care segment, the average discount for asking rates compared with initial rates was 8.9% in the first quarter 2024. The dollar discount ($778) in March 2024 was the equivalent of 1.1 months.

The pace of move-ins remained strong and further improved compared to the previous quarter for independent living, assisted living, and memory care.

- In the independent living segment, the pace of move-ins averaged around 2.2% of inventory in the first quarter 2024, compared to an average of 2.1% in the fourth quarter 2023. The pace of move-outs averaged around 2.1% in the first quarter 2024.

- For the assisted living segment, move-ins averaged 3.2% of inventory in the first quarter 2024 compared to 3.0% in the fourth quarter of 2023.

- Move-ins for the memory care segment averaged 3.7% of inventory in the first quarter 2024 compared to 3.4% in the fourth quarter of 2023.

Additional key takeaways are available to NIC MAP Vision subscribers in the full report.

About the Report

The NIC MAP Vision Seniors Housing Actual Rates Report provides aggregate national data from approximately 300,000 units within more than 2,700 properties across the U.S. operated by 35 to 40 senior housing providers. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as a requirement for participation is restricted to operators who manage 5 or more properties. Visit NIC MAP Vision’s website for more information.