Marking the sixth consecutive year, NIC once again partnered with National Real Estate Investor (NREI) on an annual investor sentiment survey in late summer 2020. Conducted from August 5 to August 11, 167 surveys were completed answering questions on topics ranging from attitudes on seniors housing market fundamentals to investment attitudes. The points below highlight some of the key survey findings.

Additionally, NREI hosted a webinar with NIC on September 17 which presented further commentary and analysis on the results of the 2020 survey, as well as a broader discussion on the opportunities and challenges facing seniors housing,

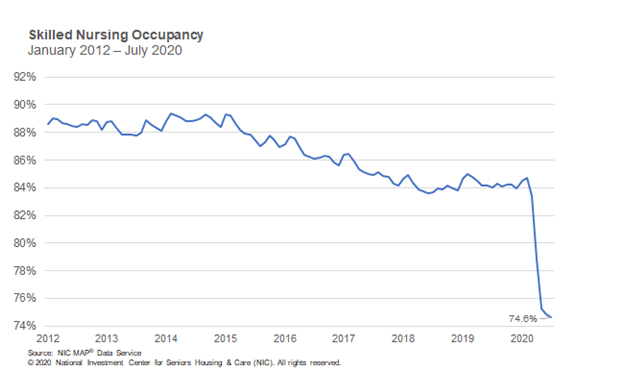

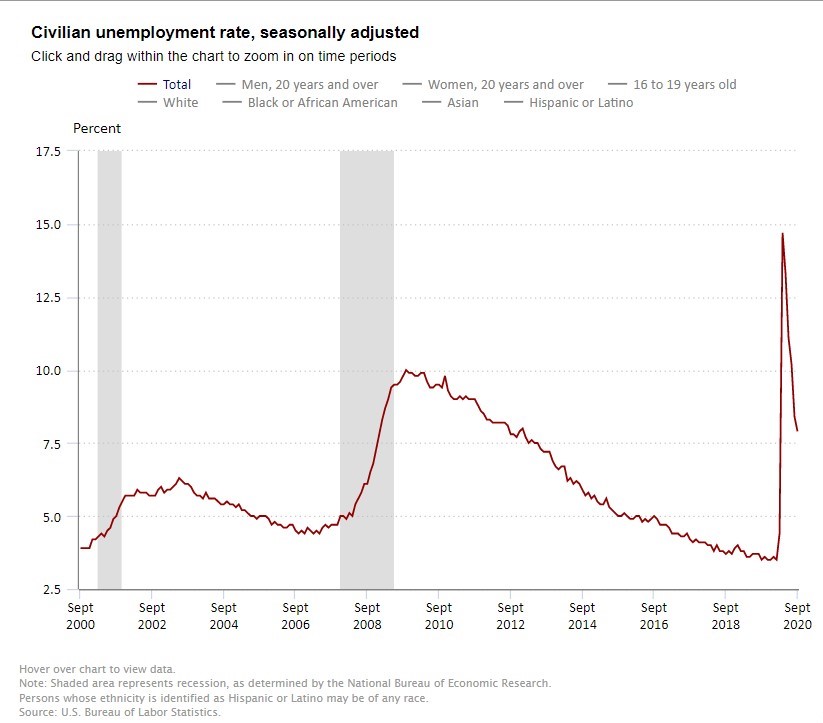

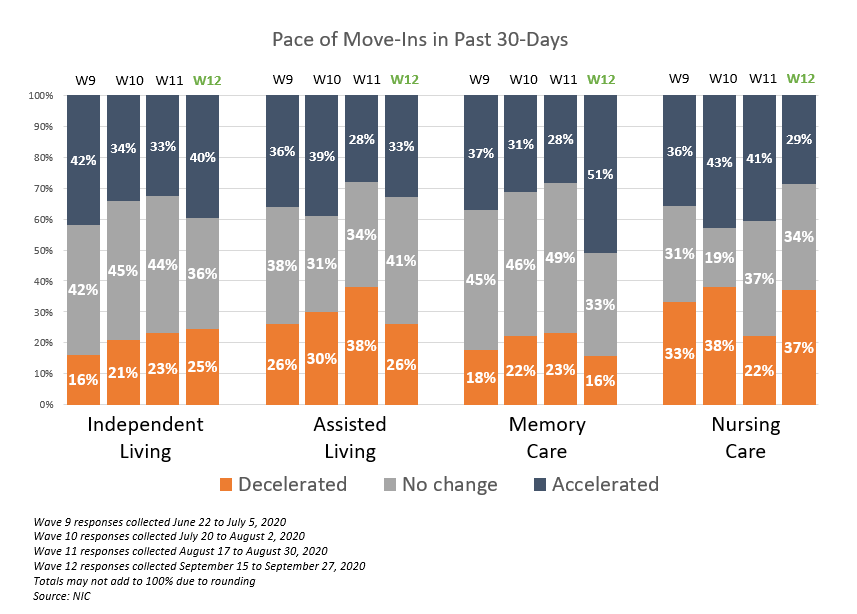

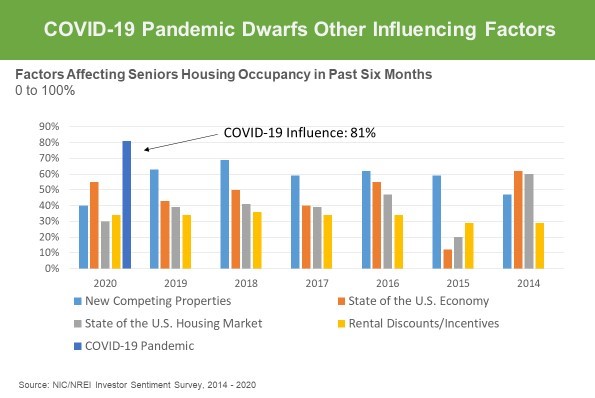

- Most survey respondents indicated that the COVID-19 virus was the biggest factor impacting occupancy rates at seniors housing properties over the past six months. Roughly four of every five respondents said the pandemic has had a very significant impact, while a little more than half of the respondents also reported that the state of the economy is having a significant impact. The state of the economy had not been as large an influencing factor since 2016. Further, more than half of the respondents believe that seniors housing sector itself is in recession or at a trough.

- About 45% of respondents expect occupancy rates to increase, the fewest since the survey began in 2014 and down from 72% in 2019. On the flip side, 42% expect occupancy rates to decline, the most of any survey ever conducted.

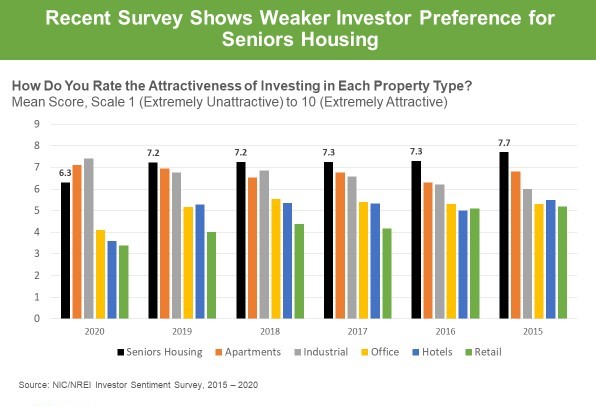

- Partly because of the pandemic and the effect it has had on the seniors housing sector, survey respondents had a less favorable view of seniors housing as an investment property than in any of the past seven surveys. Indeed, for the five-year period from 2015-2019, respondents had ranked seniors housing as the most attractive property type for investment out of six property types (apartments, industrial, office, hotel, and retail). When asked to rate the attractiveness of different property types for investment on a scale of 1 to 10, industrial and apartments rated the highest at 7.4 and 7.1, respectively. All other property types showed a decline in sentiment compared to results from the past five years with seniors housing dropping to 6.3 from 7.2 in 2019 and 2018.

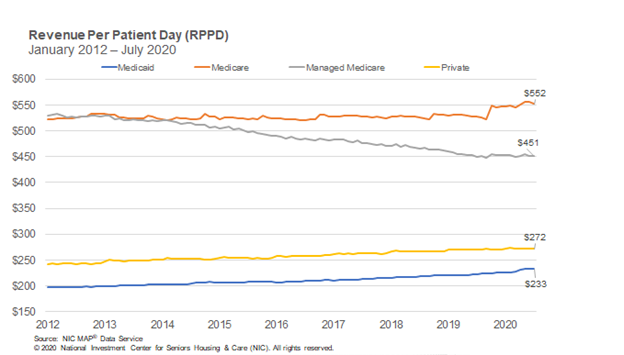

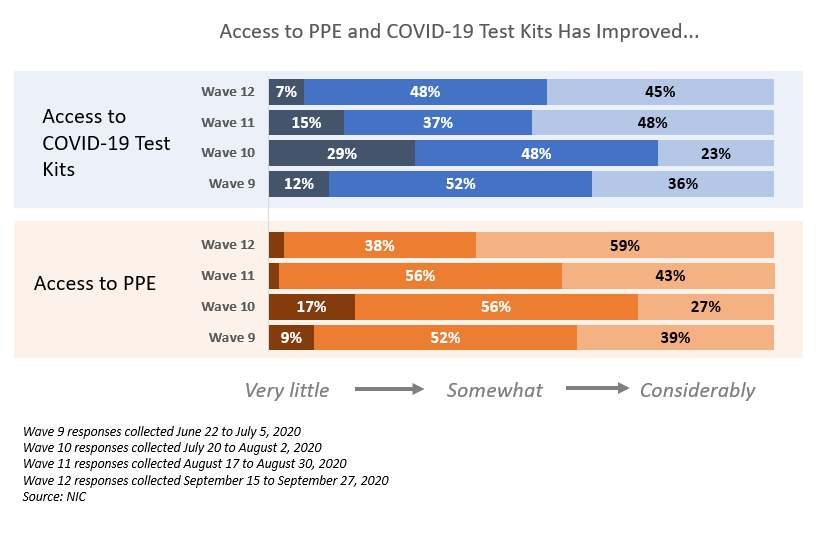

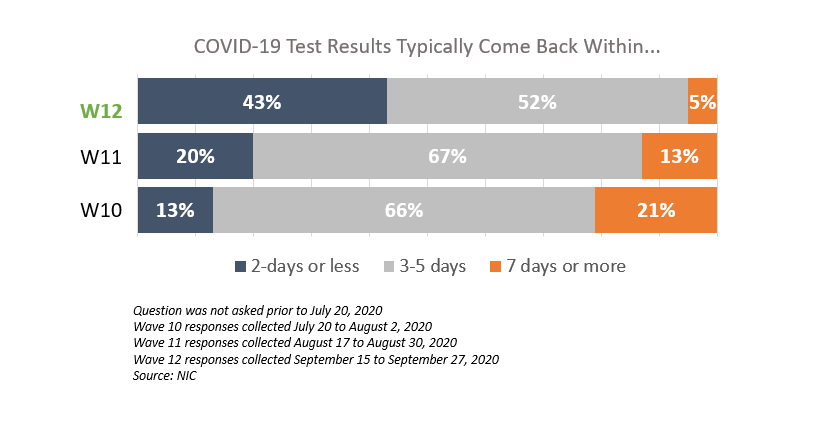

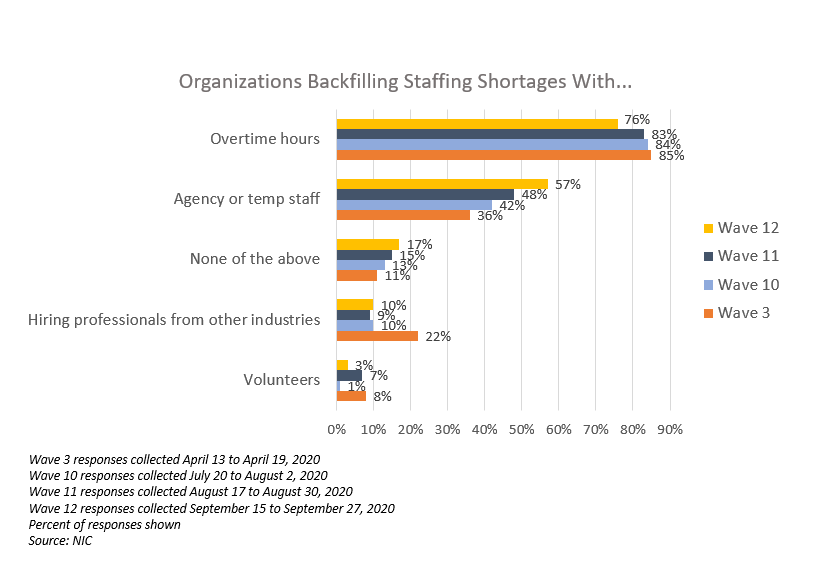

- The coronavirus is taking a toll on net operating incomes. The vast majority of respondents (90%) believe there has been at least some increase in expenses due to the virus between March 1 and August 1, with an estimated mean increase of 9.2%. Operators have seen costs rise for bonuses paid to staff, testing for staff and residents, increases related to PPE and additional cleaning. While not asked in the survey, it’s likely that operators could see additional upward pressure on expenses due to potentially higher property taxes and higher insurance costs.

- Although uncertainty related to the path of the virus is affecting near-term investment decisions, investors seem to be more positive on their long-term plans to increase investment in the sector. Nearly half of respondents expect no change in seniors housing investment in either the near (47%) or long term (52%). However, views are split on whether investment will increase or decrease in the near term versus long term. Roughly 36% of investors said they plan to invest less in the near term compared to 18% who plan to invest more. Those percentages flip when asked about long-term strategies with 34% who expect to invest more in the long-term and 15% who think they will invest less.

- A large number of respondents believe both equity and debt will be more difficult to get over the next 12 months and more than half anticipate that it will take longer to close a transaction. Roughly 80% of respondents expect underwriting standards to become tighter.

- Nearly two of three respondents think seniors housing construction starts will decrease over the next 12 months, while one in five percent believe they will remain the same. That is a notable shift compared to survey results over the past five years where nearly half, if not more, respondents consistently anticipated an increase in starts in what had been a robust construction cycle.

All in all, the 2020 Investor Sentiment Survey results paint a picture of a more cautious view on the sector. This makes perfect sense given the current state of the economy and the capital markets as we all collectively continue to make our way through the crisis of the COVID-19 global pandemic.