The COVID-19 pandemic has caused irreparable pain and devastating loss to many families and businesses. The impact has been broad-based, and in response, seniors housing and care operators have been creative, passionate and remarkably effective, given the highly vulnerable nature of their residents, the shortages of critical testing and PPE supplies, and the realities of staffing shortages and financial pressure. Their perspectives on the crisis so far, as well as their insights on what the future holds, were the focus of the latest installment of NIC’s “Leadership Huddle” webinar series, held Thursday, June 18.

Both known for thinking outside the box, operators Kelly Cook Andress, President, Sage Senior Living, and Dwayne Clark, Founder, Aegis Living shared what they’ve learned in a discussion moderated by NIC chief economist, Beth Mace.

Both known for thinking outside the box, operators Kelly Cook Andress, President, Sage Senior Living, and Dwayne Clark, Founder, Aegis Living shared what they’ve learned in a discussion moderated by NIC chief economist, Beth Mace.

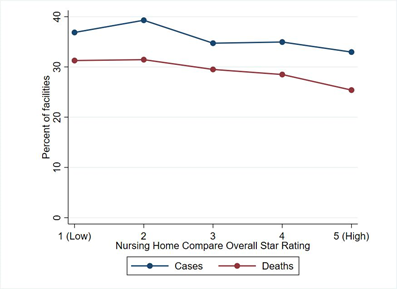

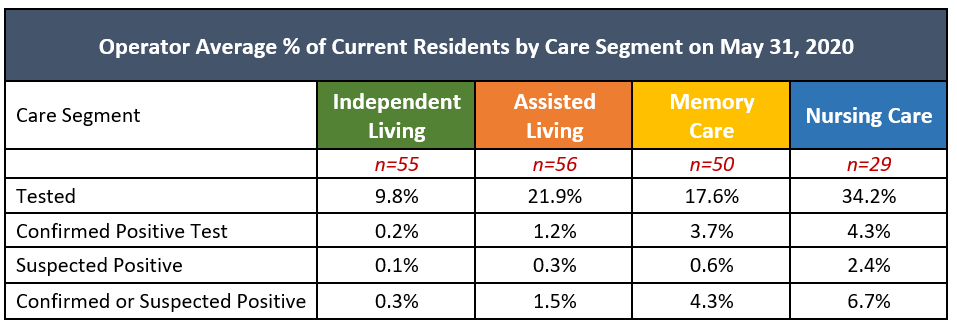

In her opening remarks, Mace highlighted the need for data, and transparency: “In continuation of our mission at NIC, we continue to encourage transparency in our understanding of the virus. As the COVID-19 pandemic has developed it has become increasingly clear that the availability of data on seniors housing and skilled nursing communities is vitally important.” She pointed to the many NIC initiatives to collect, analyze, and distribute COVID-19-relevant data, and expressed gratitude to the many operators who continue to contribute their data for the effort. Data contributors, she said, “are improving transparency in the sector, which leads to credibility, and ultimately trust, by educating not just investors and other operators but also policymakers and the general public.”

Perhaps surprising to some, both operators reported in their self-introductions that projects in development continue to move forward. Philadelphia-based Sage Senior Living, which Andress said is now called Sage Life, has 650 residents spread over Maryland and Pennsylvania. The company will be opening two new communities this summer. Clark’s Aegis Living operates 32 communities primarily in Washington state and California, and has 10 more in construction development, which, he said, “is an interesting discussion in and of itself right now, during these times.”

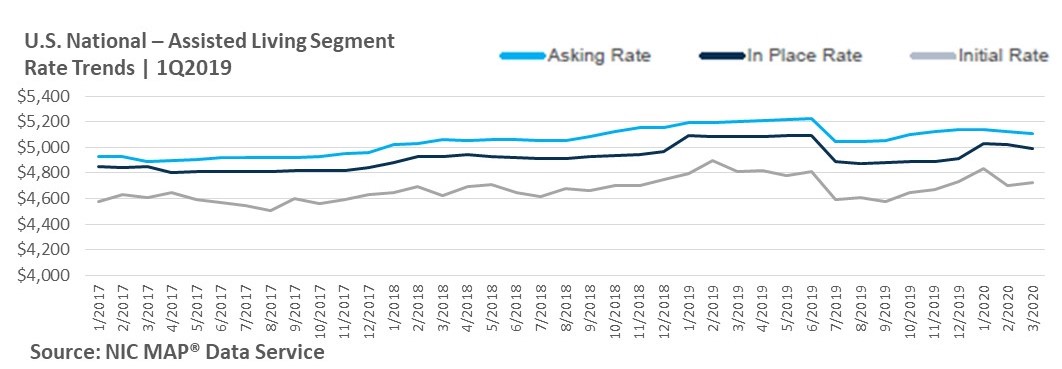

Both leaders, responding to a question on the impact of COVID-19 on their businesses, reported lower occupancy rates. “Our occupancy has slid,” Andress said, “What we are projecting is about a 2% per month decrease in occupancy.” On the expense side, she said, “We have found that our expenses have stayed about the same, but they have been re-jiggered as our operation has changed.”

Although Clark also reported a “severe decline in occupancy” since the virus first hit his properties in February, he is now seeing an uptick. “We were up about 14 residents the last three weeks, which is not a bunch, but a positive’s a positive.” He said Aegis is currently down approximately 3% from their February occupancy rate of 93.1%, but, “I think the customer base is getting adjusted to a new normal and I think people are getting fatigued from being who have mom and dad living at home.”

On whether their properties’ infection rates “tracked” with the local and regional spread of the virus, Andress described a regional correlation. Her properties in Philadelphia and Baltimore saw higher infection rates about a month after New York, which was a major hot spot. “You could almost see it come down the east coast to us. I really think this is a regional situation more than a national situation at this point,” she concluded.

Mace asked what seniors housing operators are doing in terms of safety protocols, and whether these communities are actually the safest places to be for many residents. In Clarke’s view:: “I think that depends on the operator, and the investments you make, and the training you have and everything else.” He described being hit (by the coronavirus) very early, in February, and locking down buildings before policymakers required lockdowns. “It depends on your diligence…it can be the safest place on the planet. We’re not seeing a correlation between the upticks because of the safety measures that we take, not only with the people at work, but the safety measures we take when they’re at home.” He said his company provides telemedicine and food both for staff and their families at home, to help keep them away from the infection within their communities. “That’s the greatest risk,” he said, “we can keep people in a bubble and keep them safe, but it is when people go out into the greater community that it’s a problem.

Both leaders discussed how culture plays a key role in their ability to fight this pandemic. Clarke, an outspoken advocate for developing a strong culture, believes his investment in his staff has paid off with their loyalty and dedication, even during a time of crisis. Asked how he develops a strong culture, he pointed to his company’s focus on understanding staff needs even as the pandemic struck. “On March 8, 9, 10, we were meeting with staff, saying ‘what are your immediate concerns? Is it childcare? Yes, it’s childcare, so we got groups together to discuss their childcare issues. We talked to them about bringing food home for their entire family. We talked about telemedicine. We’re doing a series right now on the psychological impact of COVID…its being an advocate for your staff, being sympathetic, you know, and transparency. You tell them the good news first, but you also tell them the bad news.”

“You earn your culture before you need it,” said Andress, “Our staff has to know that we’re there for them. One of the leadership promises that we make to our team members is that they will have the supplies they need. Going to them early and saying ‘we’ve made the investment in PPE so that you will be safe here.” She pointed out that “no matter how many satisfaction surveys we do, the relationship between the resident and the staff is always very high up if not the number one source of satisfaction,” and highlighted the importance of keeping staff and residents well informed on what’s occurring in their residences, both good and bad. She also pointed out that this commitment to culture began long before COVID hit, “troubled times are a very difficult time to create culture, because that trust isn’t there.”

As millions of workers enter the labor market, some labor shortages are easing for operators. But not for every position. “Have we seen an abundance of care managers wanting to come to assisted living? The answer would be categorically, no,” said Clarke. “Have we seen an abundance of GM (general managers), (of) hotels that we would have loved to have had twelve months ago? More in the last 35 days than we’ve seen in the last three years.”

On finance and development, both operators are seeing the impact of COVID. Out of 22 banks recently surveyed by Aegis, only 2 are currently lending. “The equity requirements have totally changed, the floors have changed, the spreads have changed, everything has changed. I don’t think this is any different than what we had in the middle of the (2008/2009) recession…we saw the exact same thing. We saw spreads change 100, 125 basis points over night.” While he believes lending will resume, he pointed out that anyone new to the seniors housing and care sector will have a very hard time, “if you are new and you don’t have an established relationship with a banker, you are in an awful position…if you think you’re going to start an assisted living company today, I hope you have a couple billion dollars lying around because you’re not going to go to a bank,” he said.

Andress also sees the value in long-term relationships. “Our lenders have been very good to us, they have worked with us, but we and our partners have had long-term relationships with these folks. They know that we’re there in the short, the medium, and the long-term, along with our partners.” Looking to Fannie Mae and Freddie Mac, however, is presenting challenges. “We have heard that Fannie Mae will not close or lock on a deal that has a single COVID case. Who is going to go through an underwriting situation and not know if you have one COVID case come up between now and then? So, there are different levels of conservatism at different levels of the capital stack on the lender side.”

Responding to a question on the impact on development, Clark stated that his equity investors see the pandemic as a short-term problem and want to get back into the game. “Debt is the problem. We have about five projects teed up for construction lending and I don’t know that we’ll get all those funded…it’s the classic chicken or egg situation. All these great sites that we were salivating for six months ago are now coming available because people can’t fund them, or the hotel’s not going to be developed or the apartment complex is not going to be developed…we see all these great sites, but you can’t get traditional funding.” He said he’s looking at other funding options, potentially with high-net worth investors.

Andress agreed, “I think some equity and debt sources aresitting on the sidelines saying ‘let’s see what happens in the Fall.’ The Fall is very important because that will have taken us through six, seven, eight months of this (pandemic). Seeing how quickly the resident base rebounds, and then seeing what the Fall situation is and if there is a second wave will be important,.” She also suggested she would seek out alternative financing sources if necessary. “Capital is fluid, capital tries to be put out to be productive and there are some interesting sources emerging that just need to be vetted and figured out.”

Clarke added that he sees promise in the industry, “We have some great market indicators that we don’t always pay attention to…Brookdale in the last 30 days had a 46% rise from low to high…someone’s believing in our industry and let’s not forget that we’re approaching the hockey stick years in 2026when we see the first baby boomer hit 80 years old. Every investor, economist and banker is looking at that and saying ‘that’s fertile ground.” However, he believes the crisis is not yet over, and is preparing for a second wave. “I think we’re going to be in a COVID crisis for 18 months…it’s another 18 months of pain.”

Both operators are closely watching developments in the understanding of the COVID-19 virus, as well as potential improvements in testing and PPE as the science and production of resources improves. They are also looking at other approaches to adapt their properties to better handle a pandemic. “Cleaning, vital oxide (disinfectant), UV (ultraviolet light), hepa filters, all of those things are definitely going to be, if not retrofitted, built in to new communities.” She also pointed to the importance of housekeeping and digital communications, including digital communications that are used for marketing as major advances that will remain in the future.

On technology, Clarke is cautious, “The sex appeal may outweigh the practicality of it.” He’s looking at UV lighting, digital communications, disinfecting technologies, and other potential advances, but he’s also looking at “practical solutions” such as outdoor living rooms, which can be used as visiting stations, and how to enable physical touch with families. He also said he thinks telemedicine “is going to boom,” as it keeps residents from visiting the hospital, a major risk of infection.

Clark also suggested the need for the industry to engage more with science and healthcare sectors. “We’re hiring a new chief medical officer…we want to be more science-based in our approach to healthcare.” Andress is looking to healthcare solutions, too, seeing telehealth as a “gamechanger.” She pointed out that doctors are more comfortable with the technology, which keeps residents out of the hospital while enabling access to quality healthcare.

Before taking questions from attendees, both panelists wrapped up with a few observations and comments on the impact of COVID. Clark suggested that not every operator would survive, “I’m not sure everyone’s going to make it through this. I think if you’re a company that has a weak culture, if you have a weak credit rating, if you have a weak leadership, I don’t think everyone’s going to make it.” Although asserting that the industry would survive, he went on to argue that change is inevitable: “Whether we like it or not, whether we think it’s going to change or not, it’s going to change. So, you’ve got to get ahead of the curve as opposed to being behind it.” He said his organization is rethinking health and wellness, “We want to be not only safe, we want to introduce things that are going to actually make people better in our buildings than when they came in.”

Andress sees another opportunity in the coming changes. “As an industry, we fell in love with the highest income residents. Let’s face it, during this time those highest income residents had more options in staying at home…I think we’ve seen a new appreciation for those folks who aren’t moving from the 4,000 square foot house and can bring in 24-hour care to shelter in place with.” Another change will reflect adjustments in vetting of assisted living residents’ health: “I think what we’ll end up with, six to nine months from now, will be less frail assisted living residents, and I think all of these things we’re implementing now will also keep influenza down, and other things that used to put our residents in the hospital.”

Answering attendee questions on demand, both leaders said they expect to see significant increases in move-ins, as pent-up demand comes to fruition. Clark explained the reason for his optimism: “We’re talking to the families and they’re saying ‘when this thing calms down,’ and we’re tracking that, how many people are saying that. It’s an abundance. I mean it’s in the hundreds…we think if there was a drug tomorrow, which there won’t be, you know a vaccine’s going to take 18-24 months for a variety of reasons, we’re going to see a real uptick.”

{{cta(‘05843e86-7aea-4b9a-9eb8-25a86f116f95’)}}

Both known for thinking outside the box, operators Kelly Cook Andress, President, Sage Senior Living, and Dwayne Clark, Founder, Aegis Living shared what they’ve learned in a discussion moderated by NIC chief economist, Beth Mace.

Both known for thinking outside the box, operators Kelly Cook Andress, President, Sage Senior Living, and Dwayne Clark, Founder, Aegis Living shared what they’ve learned in a discussion moderated by NIC chief economist, Beth Mace.