Workforce recruiting and retention efforts in the seniors housing and care sector are particularly challenging today. During a panel discussion at the 2019 NIC Fall Conference, representatives from leading operating companies shared their strategies for attracting and retaining top talent.

Moderating the discussion, Jacquelyn Kung, CEO, Activated Insights, noted that “Better workplaces lead to better performance.” She opened with examples of companies in other industries that have succeeded financially by focusing on workplace culture, including Southwest Airlines and Hilton Hotels. Hilton tops the Forbes 100 best companies list currently—a list compiled by the Great Place to Work® Institute—and has seen tremendous growth in stock price over the past five years.

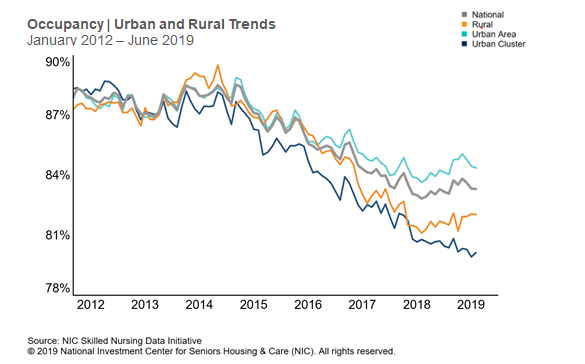

Great Place to Work began an initiative in the senior care industry two years ago, and this year surveyed almost a quarter million employees at more than 3,000 locations. Kung highlighted survey findings showing lower employee turnover in companies with higher trust index scores. She noted the data showed higher occupancy rates and higher charge rates in those companies as well.

The panelists shared moments of inspiration from their careers and how those experiences impact their work with their own employees. Common among the stories was the timing; all had experienced moments of inspiration very early in their careers. Kung noted that almost half of workers in senior care are very young adults and the importance of creating moments of impact to inspire the young workers to remain in the industry.

Audience members then submitted questions around staffing challenges for insights from the three panelists: Tom Grape, founder, chairman & CEO at Benchmark Senior Living, Manny Ocasio, chief human resources and compliance officer at Asbury Communities, and Ahkira McPherson, RN, staff development manager at Vi Lakeside Village.

When asked whether the industry’s biggest issue is recruiting, retention, or engagement, panelists all agreed that the three are equally important and intertwined. From Ocasio’s perspective, engagement allows you to attract more staff, “If you focus on engaging, you’ll get results on both retention and recruitment.”

Next, the panelists shared ideas on how to show return on investment (ROI) for workforce strategies. Tom Grape from Benchmark noted that culture can be an amorphous concept, and the ongoing pressure on wages and benefits in today’s hiring environment is tricky. But, data like that collected by Great Place to Work offer a compelling place to start. Ocasio added that some initiatives at Asbury have demonstrated measurable reductions in turnover, and that can directly affect the bottom line: “It costs about 1.1 times the salary per year of every nurse that you turn over.”

The discussion then turned to staff training. McPherson shared that Vi places a priority on management and staff development programs, and support from the top down. “From our corporate office, we have ongoing support down to our managers. And then we filter that down to the other stakeholders within the company and to the other employees.” The three panelists shared that training in their companies is primarily handled internally, with managers coaching staff directly. “Every manager has been trained in both being receptive to feedback and in being able to provide feedback that’s meaningful,” noted Ocasio.

When asked about hiring practices, Grape shared Benchmark’s success in reducing staff turnover through use of a predictive analytics tool, Arena, during the application process. He also noted the enthusiasm generated by the 3-day onboarding orientation program in Benchmark headquarters for new department heads and above. Ocasio talked about the use of behavioral interviewing in Asbury’s hiring process and the in-house culture program that helps tie behaviors to the organization’s values. McPherson noted that Vi recruits students and veterans, and offers apprenticeship and mentorship programs, “We are adamant about developing our own employees and promoting from within through leadership programs.”

Having advanced through the leadership programs at Vi herself, McPherson understands the importance of communication and connecting with staff at all levels, “Every day I’m encouraging someone.” Ocasio noted Asbury’s results in developing an app to improve communications with staff, and the nearly doubled message open rates versus email, “It’s really changed the way we communicate.”

Kung then asked the panelists about what she called “the elephant in the room:” workforce pay. Ocasio described Asbury’s living wage strategy, “Nobody makes less than what in their particular jurisdiction would be a living wage.” Grape noted Benchmark’s competitive market studies, recognizing that they are competing for workers with not just other senior living providers but with other local employers. Kung highlighted the importance of drilling down market studies to the local level, “The metro area is really important.”

“I would say you can pay better wages and have lower costs of labor,” said Ocasio, noting that higher wages reduce turnover.

An audio recording of the entire panel discussion is available to conference attendees on the conference recap page on NIC.org.