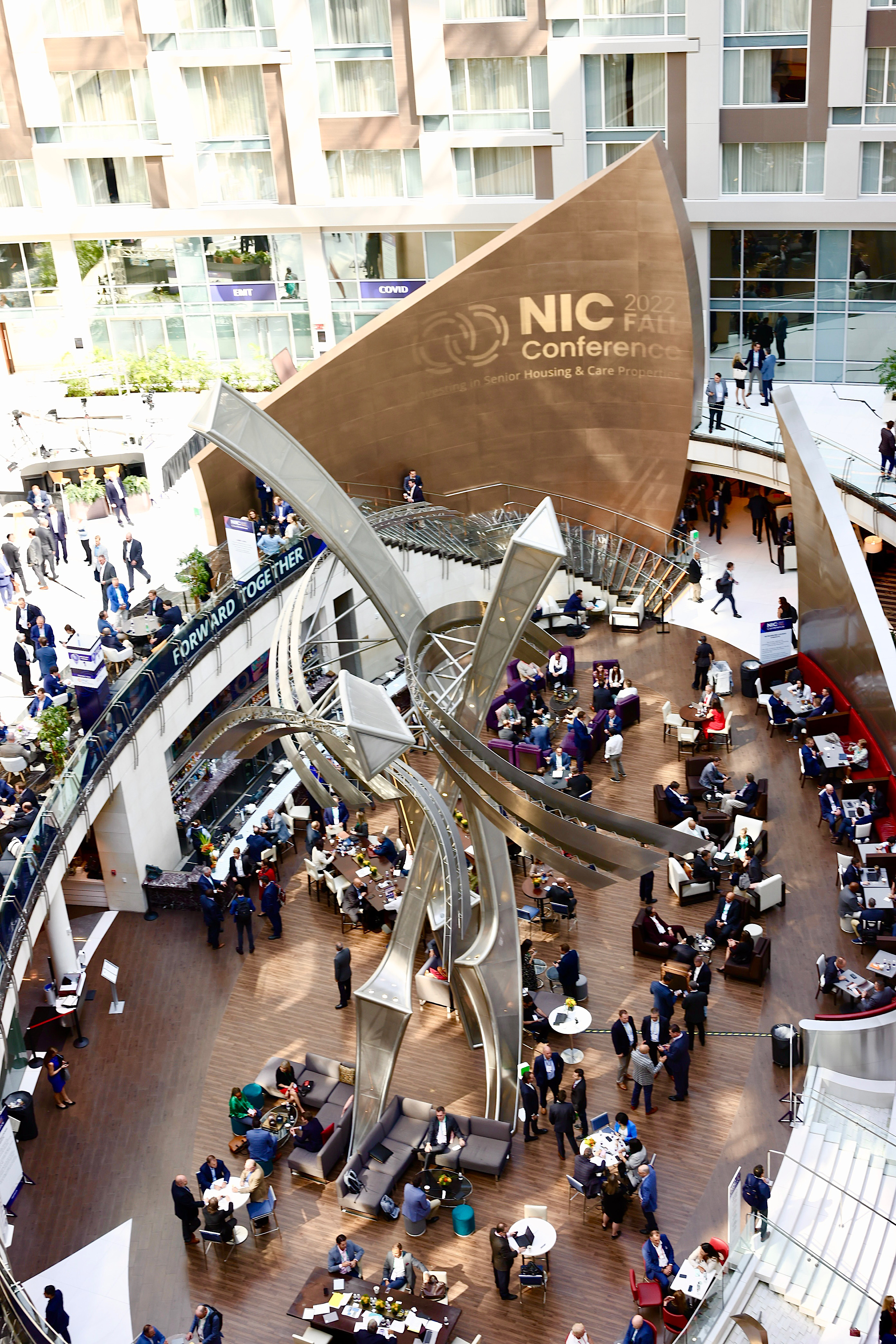

Senior housing and care’s premier event delivered on three days of connections, learning, and engagement.

Bringing together more than 2,800 industry participants, the 2022 NIC Fall Conference surpassed turnout expectations as attendees explored the near-term challenges of the senior housing and care sector, and the long-term opportunities as a demographic wave of older adults begins to arrive. The Conference was held September 14-16 at the Marriott Marquis in Washington, D.C. Highlights included:

Bringing together more than 2,800 industry participants, the 2022 NIC Fall Conference surpassed turnout expectations as attendees explored the near-term challenges of the senior housing and care sector, and the long-term opportunities as a demographic wave of older adults begins to arrive. The Conference was held September 14-16 at the Marriott Marquis in Washington, D.C. Highlights included:

-

- A detailed economic and industry specific outlook.

- The inaugural Women’s Networking Meetup.

- Insightful educational sessions.

- A NIC white paper defining the emerging active adult segment.

- New research underscoring the integration of healthcare and housing.

- Multiple daily, formal and informal, networking opportunities.

More than 70% of all those at the event were executives at the C-suite or managing director levels. Attendees also represented a good balance of both senior living operators and capital providers. Notably, the Conference drew 637 first-time attendees.

In opening remarks, NIC Board Chair Kurt Read, managing director at RSF Partners, noted that NIC is much more than a conference. Rather, he said, “NIC is the collective expression of the passionate commitment to create better environments now and in the future for our nation’s elders and those who serve them.”

The Fall Conference theme— “Forward Together”—highlighted the resilience and perseverance of the industry and the importance of building effective partnerships among operators, healthcare providers, investors, and other capital sources.

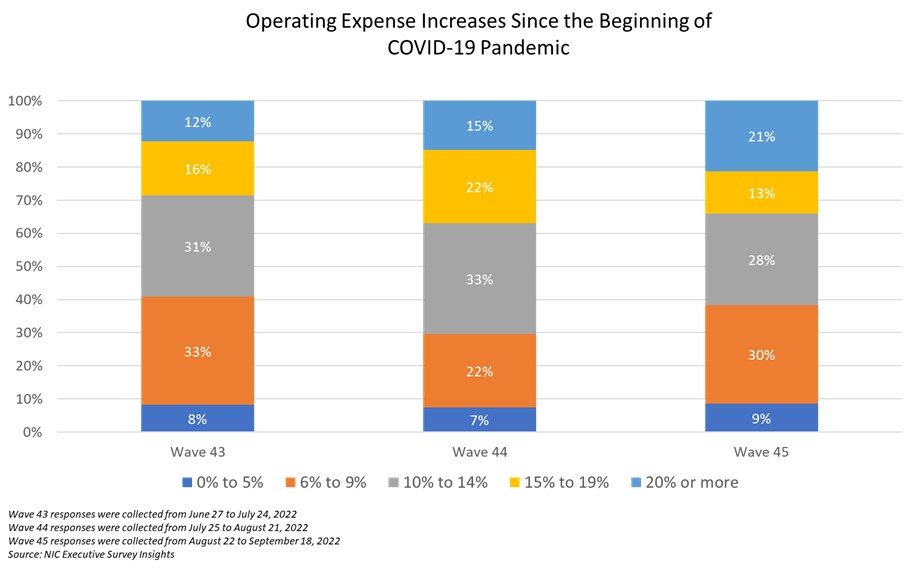

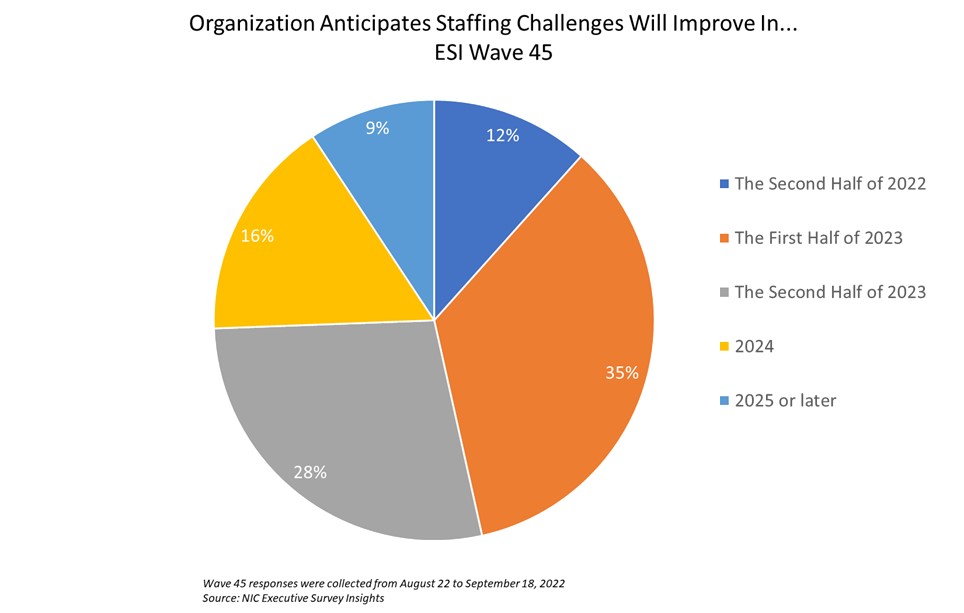

“The pace of change is frantic,” said NIC President and CEO Brian Jurutka, who listed the big industry challenges of rising expenses, a workforce shortage, ongoing pandemic-related issues, and the needs of a growing elderly population. “NIC is a platform and resource to help the industry move forward together,” he said.

Valuable Connections

As the premiere industry event, the 2022 NIC Fall Conference engaged attendees in three days of results-oriented networking, information sharing, and timely educational sessions. Industry leaders shared their perspectives and insights on a wide range of topics including the emerging active adult segment, the new consumer, capital market trends, and how to successfully scale operations, among other issues.

NIC Chief Economist Beth Mace was the featured speaker at the inaugural Women’s Networking Meetup, where nearly two hundred women executives exchanged ideas and made connections. Mace offered her insights and advice on the changing role of women in the industry. One tip: Be open to change.

Actionable Content

The Conference offered 10 stand-alone educational sessions. (High quality videos of all educational sessions are available to attendees in the Conference mobile app.)

Attendees packed the Marriott Marquis ballroom for the keynote session, “Economic and Financial Market Outlook.” Financial forecaster Jason Schenker delivered a lively, data-rich analysis of the economy’s bright spots and current risks.

“More people are working than ever before,” said Schenker, president of Prestige Economics and chairman of The Futurist Institute. But wages are rising, and inflation is up 8.3% annually, the highest rate since 1981.

Demographics are a big plus for senior living. “We will have a steady stream of residents,” he said. The healthcare needs of an aging population will greatly impact the workforce. In fact, he noted that 5 of the top 10 areas for job growth are in health-related occupations.

“The next 2-3 years will be tough,” predicted Schenker, citing expense pressures, rising interest rates, and worker shortages. But he was generally optimistic about conditions 24-36 months from now. His advice to attendees: “Plan for long-term upside opportunities.”

Several sessions addressed the new consumer and the growing active adult segment. NIC presented a white paper defining the property type. Key components include age-eligibility, majority market rate, rental, and lifestyle focused.

A panel of experts discussed the investment case for active adult in the aptly titled session: “Rational Exuberance.” Investors like the demographic profile of residents and their extended length of stay.

The panelists parsed the differences between active adult, senior housing, and multifamily properties. The operation of active adult properties is more like that of multifamily projects. But the sales cycle is more akin to that of senior living. “We’re very bullish on the sector,” said panelist Joseph Fox, co-founder and co-CEO, Livingston Street Capital.

Separately, a panel of industry leaders analyzed the new customer—a group much different from the population the industry has been serving. Baby boomers are harder to please than their predecessors. The panelists agreed that baby boomers are seeking an experience, not just a place to live.

“We are too wrapped up in the real estate,” said William Swearingen, senior vice president, marketing and sales, Spectrum Retirement Communities. It’s important to showcase the active lifestyle and the cultural reference points that baby boomers understand, he advised, “Take a chance.”

A CEO roundtable provided a big picture perspective on operations, the new customer, and workforce issues. In a separate panel discussion on repositioning, Tana Gall, president, Merrill Gardens, detailed how the company refashioned a portfolio for the middle market, now named Truewood by Merrill. Other speakers shared strategies on unit mix, tapping untapped workers, and how to reconfigure floor plans to boost staff efficiency.

The session, “Stay Focused and Keep Working: Effectively Scaling Your Operations,” mapped out successful approaches. Experts explored the pluses and minuses of acquisitions, new developments, and management assignments. “You need a plan to scale and grow,” noted panel moderator Bryan Starnes, CFO, ALG Senior.

New research, funded by NIC, was introduced at the Conference. It shows that senior housing residents average more than a dozen chronic conditions. The research was conducted by NORC at the University of Chicago. The study also highlights the opportunities to integrate healthcare and housing to improve health and cut costs.

A number of speakers at the Conference emphasized that the pandemic has secured a place for senior living in the healthcare continuum. Partnerships, in various forms, are growing quickly between senior living providers and healthcare systems.

The investment-focused sessions were well-attended. A panel discussion on environmental, social, and governance (ESG) strategies highlighted its growing role among institutional investors. Speakers also discussed the push for diversity, equity, and inclusion (DEI) initiatives.

Other popular sessions detailed the state of the capital markets and deal-making as operators rebuild occupancy. The consensus was that capital is available for the right product in the right place. Echoing much of the buzz at the Conference, speaker Julie Ferguson, executive vice president at Ryan Co. said, “We believe in the long-term value of senior living.”