The skilled nursing industry is currently facing numerous challenges, but many operators do see long-term opportunities as the growth of the senior population accelerates and skilled nursing properties will be the only option for many higher acuity patients given the current long-term care infrastructure in the country.

Doubtless, the industry faces headwinds including Medicare reimbursement cuts, low occupancy rates, chronic underfunding of Medicaid reimbursement in many states, a staffing crisis, and ongoing elevated inflation including wage rate growth. In addition, Medicare Advantage continues to grow as enrollment in these insurance programs expands for seniors throughout the country and value-based care continues to progress, which requires the industry to continue to adapt at a time when revenues are relatively low, and expenses are growing at a rapid pace.

The government provided relief during the pandemic such as the Provider Relief Fund and the 3-Day Rule waiver, which was implemented by the Centers for Medicare and Medicaid Services (CMS) to eliminate the need to transfer positive COVID-19 patients back to the hospital to qualify for a Medicare paid skilled nursing stay, hence increasing the Medicare census at properties and therefore higher reimbursement.

No Easy Answers

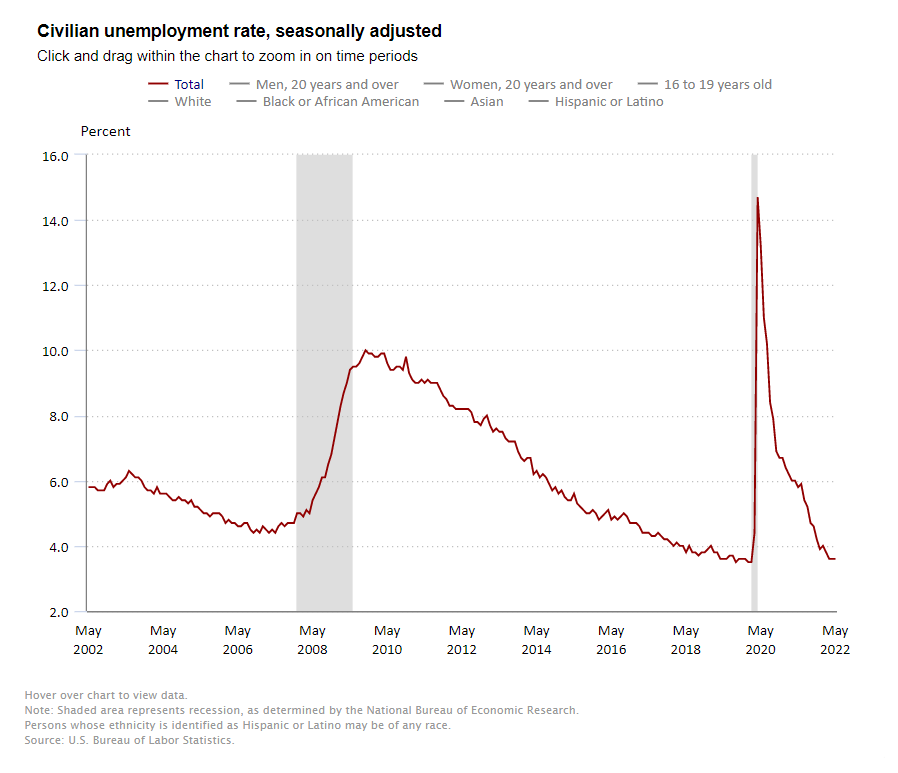

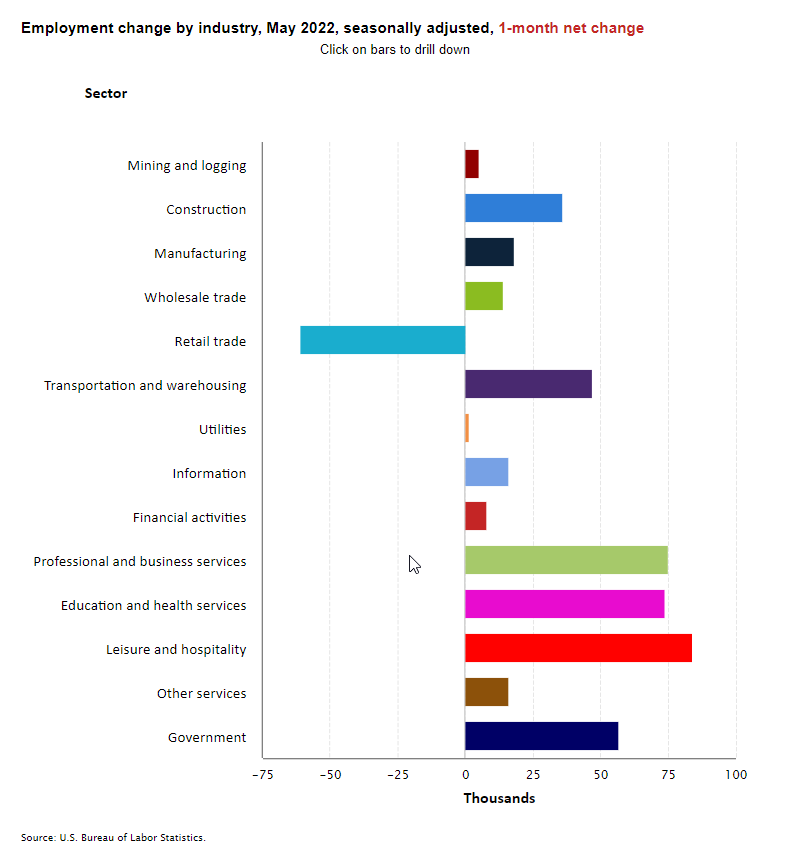

However, going forward there are no easy answers, especially to resolving the escalating, enduring staffing crisis and inflationary pressures that operators are facing. Some potential solutions the industry has discussed to help manage the staffing crisis include increased pay, better reimbursement, creating flexible schedules for current staff, hiring workers from overseas, and reining in staffing agency costs.

Regarding reimbursement, one of the current main concerns is the proposal to claw-back Medicare reimbursement as it relates to the Patient Driven Payment Model (PDPM), which became effective on October 1, 2019. This PDPM recalibration is a surprise to many given the current state of the industry as operations and financial performance have been unclear due to COVID-19. Isolating the impact of PDPM on skilled nursing government spending is difficult and pointing to the reimbursement change as the sole driver of spending growth when COVID-19 was impacting the industry is a difficult analysis. However, CMS is proposing to incorporate a 4.6% rate cut to skilled nursing rates. CMS’s analysis suggests that spending on skilled nursing rose approximately 5% in fiscal year 2020 after the implementation of PDPM. Since the PDPM rule was supposed to be “budget-neutral,” the agency is looking to adjust payments to bring spending back to parity.

The Need Remains

There is, however, some positive news as occupancy has increased since the lows of the pandemic and operational beds continue to decline, which bodes well for the long-term supply/demand dynamic. Many operators have stated that current occupancy challenges are more of a staffing problem rather than a demand problem. Hence, the need to resolve the staffing crisis as noted above. Freestanding skilled nursing occupancy has climbed 380 basis points from its pandemic low (73.5% in 1Q 2021) to 77.6% in 1Q 2022 within the 31 NIC MAP® Primary Markets. Although still low, occupancy has now increased four quarters in a row.

As home health and home care are growing their businesses within post-acute care, the need for skilled nursing is expected to continue as well. The growing need to care for the very frail older adult population that has multiple illnesses, and needs 24-hour care, is where skilled nursing properties must be a solution for years to come. The question is, will the country ensure this need is met with improved staffing, innovation, and operational infrastructure.

For further information and insights on skilled nursing occupancy improvement, please see these recent NIC Notes blogs:

Fitzgerald explained that Carlyle’s Active Adult communities are well-positioned to meet the needs of the aging Baby Boomer generation. “These communities are here to target residents in their late 60s to mid 70s, which is on the front edge of demand from the Baby Boomer generation,” Fitzgerald said. “This provides steady demand for at least the next decade.” Speaking about risk and opportunity in the segment, Fitzgerald explained lease-up cycles can be longer in Active Adult communities, but average length-of-stays of six years make these communities nearly “recession proof.”

Fitzgerald explained that Carlyle’s Active Adult communities are well-positioned to meet the needs of the aging Baby Boomer generation. “These communities are here to target residents in their late 60s to mid 70s, which is on the front edge of demand from the Baby Boomer generation,” Fitzgerald said. “This provides steady demand for at least the next decade.” Speaking about risk and opportunity in the segment, Fitzgerald explained lease-up cycles can be longer in Active Adult communities, but average length-of-stays of six years make these communities nearly “recession proof.”