In a sector with a wide range of stakeholders—at times with differing agendas—a bright spot of the pandemic is how the industry has come together to find common solutions and advocate for help.

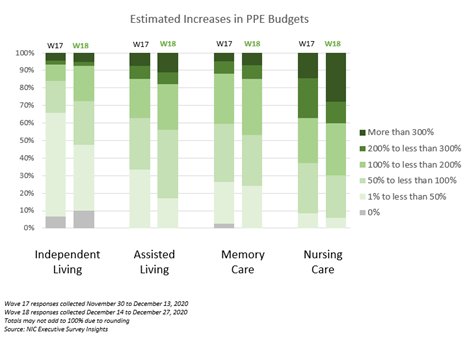

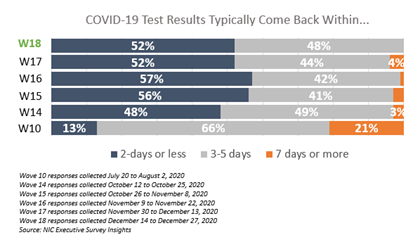

The industry’s cooperation and unified messaging has proved beneficial throughout the crisis. Organized efforts early on helped to increase the availability of personal protective equipment (PPE) and testing. A concerted industry approach has also helped to provide additional government assistance to operators and heighten awareness of the role of seniors housing and care in the healthcare continuum.

“The crisis caused the industry to focus and clarify that we’re working toward common goals,” said Brian Jurutka, president and CEO at NIC. He led a discussion with top executives at NIC’s Fall Conference during a session titled, “Working Together to Support Older American: A Conversation with Industry Leaders.”

Jurutka was joined on the panel by James Balda, president and CEO, Argentum; David Schless, president, American Seniors Housing Association; Katie Sloan, president and CEO, LeadingAge; and Scott Tittle, executive director, NCAL.

“We’ve seen an unprecedented level of cooperation among industry groups,” said Jurutka. He added that the industry has continued through the winter to work together to guide government policy, secure additional financial support, and prioritize vaccinations for the staff and residents of seniors housing and care communities.

“It’s more important than ever that the industry has a united message,” said Argentum’s Balda. “Collaboration has moved the needle on several fronts.”

When the pandemic hit, NIC’s Jurutka pulled industry leaders together for a weekly call. They addressed the sector’s priorities to present a unified message and share best practices on how to mitigate the spread of the virus.

Early industry goals not only focused on securing adequate supplies of PPE and testing, but also on financial help.

After several months of industry effort, licensed senior living settings qualified for access to funds from the CARES Act Provider Relief Fund. “It was a significant step for the industry,” said ASHA’s Schless.

Ongoing Efforts

In late December, Congress passed legislation adding another $3 billion to the Provider Relief Fund. Industry leaders agree that it helps, but the amount won’t be enough to cover rising expenses and occupancy challenges.

Also, many providers are still waiting for the government to distribute previously promised relief funds. Argentum’s Balda said in a follow-up email that all payments should be distributed as quickly as possible, and future funding should apply to third and fourth quarter losses.

Separately, the Department of Health and Human Services announced in January that providers who received more than $10,000 in Provider Relief Fund payments will now have a longer grace period to report to the federal government how the aid was used.

Left unaddressed by the December legislation was the question of reasonable liability protections, which continues to be an industry focus. “We are not asking to not be responsible,” said NCAL’s Tittle during the panel discussion. “But where there is a good faith effort, we need time-limited liability protection.”

Tittle added that the insurance market was already in a difficult place prior to the pandemic. Now carriers, the ones still even offering policies, have raised rates 60%-100% and exclude claims for COVID-19. “The challenge will be significant,” he said.

About half of the states have taken steps to provide liability protections, though a federal approach is preferred by industry leaders.

Consumer outreach and reputation repair is a priority. “We have work to do,” said Katie Smith Sloan, president and CEO at LeadingAge, the association of nonprofit providers.

That work started last spring. Stories and videos of how senior living communities and their residents have adapted to the pandemic are posted on Facebook and ASHA’s consumer website, Where You Live Matters.

More testimonials are being rolled out during the second phase of the campaign. “Consumer sentiment has improved,” said Schless. The other leaders agreed that more consumer education is needed to restore trust in the sector.

Throughout the crisis, NIC has provided data to put the crisis in context. For example, NIC’s Skilled Nursing COVID-19 Tracker shows the week-over-week change rate for new resident cases of COVID-19 within skilled nursing facilities on a per-facility basis, by geography.

The data is displayed in an easy-to-use interactive dashboard that can be sorted down to the county level. NIC is also working on a study of the impact of the pandemic on older Americans by care setting.

The panel discussion wrapped up with a lightning round of predictions. The leaders agreed that the fundamentals of the sector are still strong, but challenges remain.

The industry is focused on securing more federal relief from the Biden Administration; educating consumers and lawmakers about the sector; and adapting to new realities including the prospect of more government regulation. “There is no more important time to be involved in a trade association,” said Tittle. “We encourage everyone to reach out.”