The Labor Department reported that there were a significant number of jobs added in January–304,000 and well above the consensus expectation of 172,000. This was the 100th consecutive month of job growth. December was revised down to 222,000 from 312,000 and November was revised up to 196,000 from 176,000.

The 800,000 Federal workers going unpaid during the partial federal government shutdown were still counted as employed and as a result federal government payroll estimates were largely unchanged in January. In contrast, the uptick in the unemployment rate may have been influenced by the furloughed employees due to definitional differences in the household survey which is used to estimate the unemployment rate.

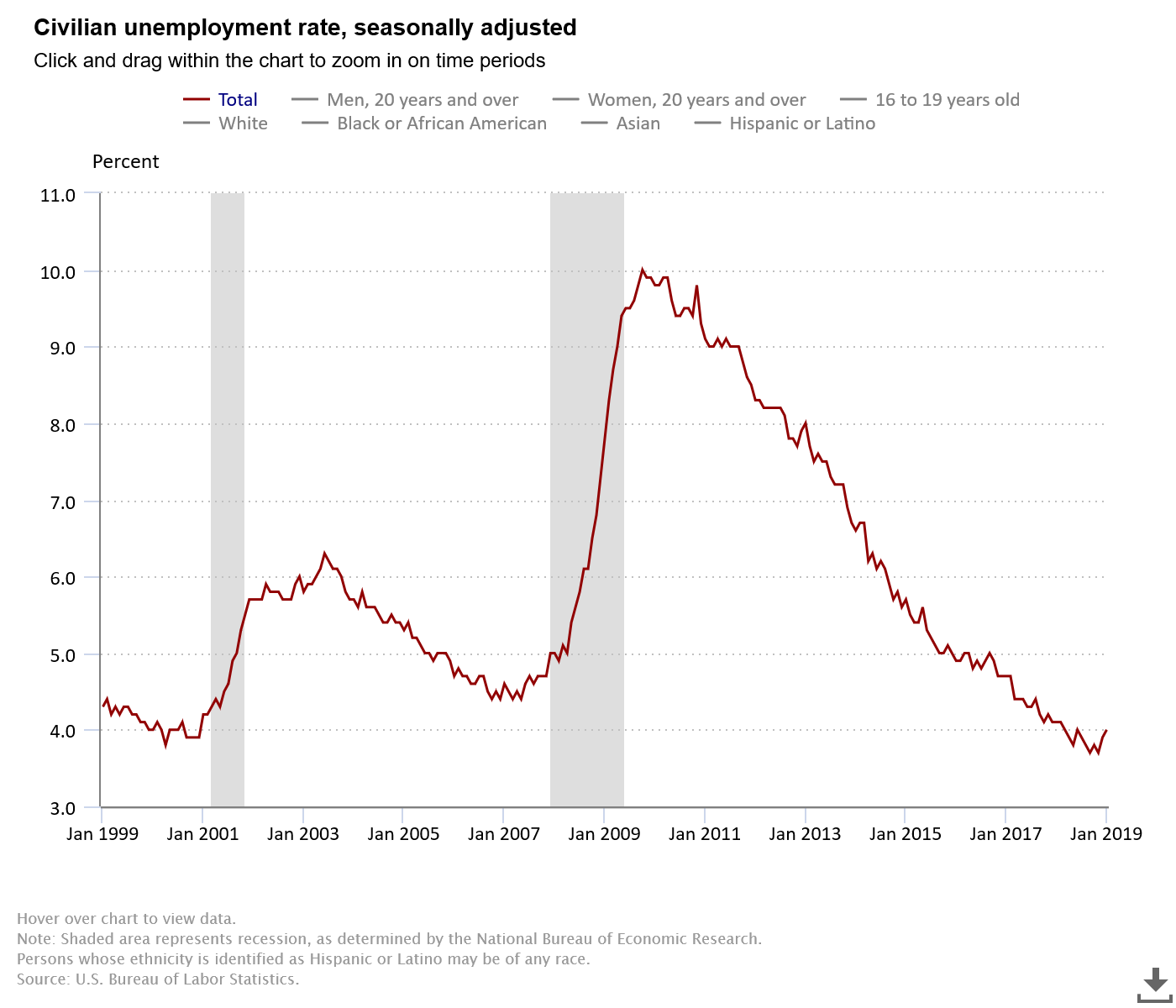

Indeed, the unemployment rate increased 0.1 percentage points from 3.9% in December and from a near-50 year low of 3.7% in November to 4.0% in January. Nevertheless, the jobless rate remains well below the rate of what is generally believed to be the “natural rate of unemployment” of 4.5%, which suggests that upward pressure on wage rates will continue. Further indications that this is in fact starting to occur were released in the report. Average hourly earnings for all employees on private nonfarm payrolls rose in January by three cents to $27.56. Over the past 12 months, average hourly earnings have increased by 85 cents, or 3.2%.

A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—rose to 8.1% in January from 7.6% in December.

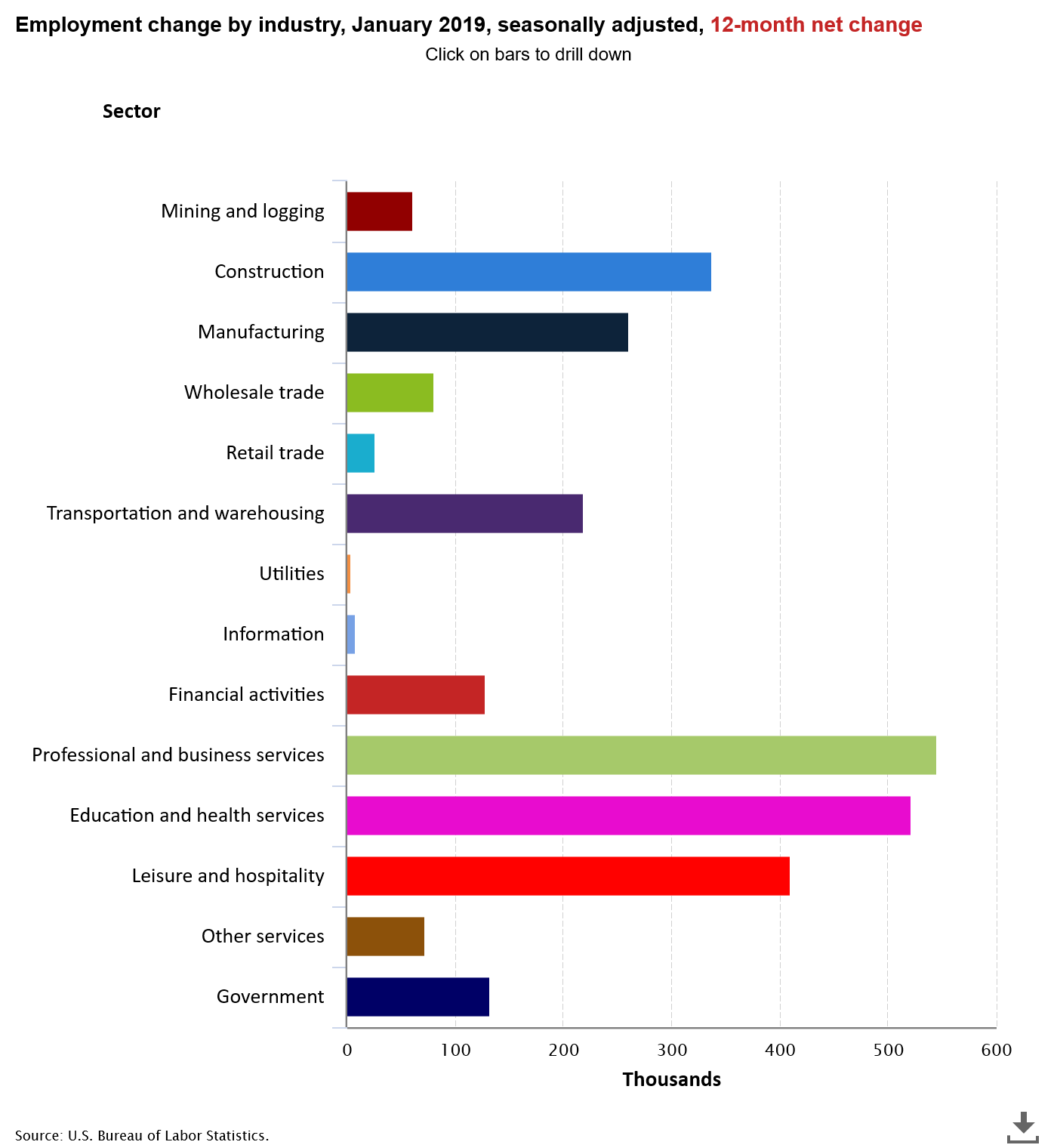

In January, employment in health care rose by 42,000. In the past year, health care has added 368,000 jobs.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work rose 0.1 percentage point to 63.2% in January, still very low but up from its cyclical low of 62.3% in 2015. The low rate at least partially reflecting the effects of an aging population.

Adding further evidence to the strong job market are unemployment insurance claims which recently reached a near 50 year.

In an announcement by Federal Reserve Chairman Powell this week, the Fed indicated that they would not be raising interest rates in the immediate future due to concerns about global economic growth and limited inflation. That said, the jobs report shows that the labor market remains robust. Further indications of strength in the economy could cause the Fed to raise rates sooner. In December, the Federal Reserve raised the fed funds rate by 25 basis points to a range of 2.25% to 2.50%. That marked the fourth increase in 2018. The Fed has now raised rates by a quarter percentage point nine times since late 2015, after keeping them near zero for seven years.