A NIC report to provide insight into COVID-19 among current residents and to more clearly understand existing conditions by care setting.

NIC’s monthly Executive Survey Insights: COVID-19 of seniors housing and skilled nursing operators is designed to bring awareness to the operators, their capital providers and business partners, and the general public, on the current COVID-19 penetration rates by care segment. Providing data on current penetration rates gives perspective on how the sector has adapted in the four months since COVID-19 was declared a pandemic. Providing data by care segment enables insights into how COVID-19 has impacted the different populations in each segment, which vary substantially in levels of health.

Wave 2 of the survey includes responses collected July 6-July 19, 2020 from owners and executives of 52 seniors housing and skilled nursing operators from across the nation. Detailed reports for this wave, along with past survey findings can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Summary of Findings of Staff and Residents in Place on June 30, 2020

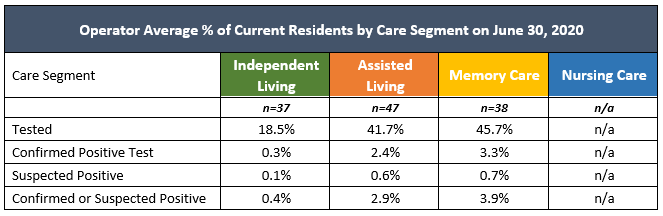

Data collected in a survey of seniors housing and care operators by the National Investment Center for Seniors Housing & Care (NIC), shows operator average COVID-19 penetration varies by care setting among current residents, ranging from 0.4% in independent living, 2.9% in assisted living, and 3.9% in memory care. As was the case with Wave 1, operator average COVID-19 penetration rates were lowest in the least acute care setting of independent living and increased with acuity. Due to sample size limitations, operator averages for nursing care have not been included.

Wave 2 data shows higher COVID-19 testing across all care segments, with an operator average ranging from 18.5% in independent living up to 45.7% in memory care. Survey findings also show an operator average of 78.5% of community staff in place on June 30, 2020, regardless of care setting, had been tested for COVID-19.

Key Findings

Testing and Current Penetration of COVID-19 by Care Segment

Respondents were asked: “Distributed into the following categories, the total number of my organization’s (independent living, assisted living, memory care, nursing care) residents were: 1) Tested for COVID-19 with a PCR test, 2) Laboratory confirmed positive PCR test, and 3) Suspected COVID-19”

- In Wave 2, the operator average percent of residents tested for COVID-19 (of residents in place on June 30, 2020) for independent living is 18.5%. For assisted living the operator average percent residents tested is 41.7%, and for memory care is 45.7%.

- The operator average percent of confirmed or suspected COVID-19 in independent living is 0.4%. For assisted living the operator average percent is 2.9%, and for memory care is 3.9%. Due to sample size limitations, operator averages for nursing care have not been included.

- In Wave 2, operator average testing penetration for independent living was 18.5%, for assisted living was 41.7%, and for memory care was 45.7%. In both Waves 1 and 2, operator average testing penetration increased as care setting acuity increased.

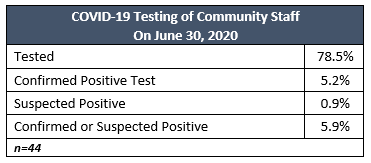

Testing and Current Penetration of COVID-19 Among Community Staff

Respondents were asked: “Distributed into the following categories, the total number of my organization’s staff were: 1) Tested for COVID-19 with a PCR test, 2) Laboratory confirmed positive PCR test, and 3) Suspected COVID-19”

- The operator average percent of community staff tested for COVID-19 (of staff in place on June 30, 2020) regardless of care setting is 78.5%. Of total staff, an operator average of 5.2% tested positive and another 0.9% suspected positive, for a community staff operator average penetration rate of 5.9%.

Demographics

- Responses were collected July 6-July 19, 2020 from owners and executives of 52 seniors housing and skilled nursing operators from across the nation.

- More than one half of respondents were exclusively for-profit providers (56%), 33% of respondents were exclusively nonprofit providers, and 11% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 50% of the sample. Operators with 11 to 25 properties make up 28% while operators with 26 properties or more make up 22% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 51% of the organizations operate seniors housing properties (IL, AL, MC), 22% operate nursing care properties, and 27% operate CCRCs (aka Life Plan Communities).

Methodology

Answering on behalf of their organizations, seniors housing and care owners and executives provided the COVID-19 incidence data shown above. The data is self-reported, non-validated, and based on a convenience sample.

Data is reported as operator averages to prevent the skewing of data that can be caused by larger-sized operators. Operator averages are obtained by first calculating rates for each operator survey response and then taking an average of those rates across the sample.

Definitions

The following definitions were included with the survey instructions to ascertain specific responses from operators:

- Lab Tested Positive: Includes only residents who have been tested for active infection with PCR test. Serology antibody tests should not be included. Includes residents who have tested positive for COVID-19 at a CDC, state or local laboratory.

- Suspected Cases: means the resident is managed as if they have COVID-19 with signs and symptoms suggestive of COVID-19, but do not have a laboratory positive COVID-19 test result or those with pending test results.

- Recovered: For residents in a hospital or rehab setting, “recovered” is defined as having had two consecutive negative tests at least 24-hours apart; for residents in-house, 1) 72-hours symptom-free with no medication, and 2) at least ten days from onset of symptoms.

- Active Cases: Those who are laboratory-tested positive, suspected positive, or diagnosed by a physician, and are still in place but not deceased and do not meet the criteria for “recovered.”

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into the seniors housing and care space.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the current Executive Survey, please click here for the current online questionnaire.