NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change. This Wave 14 survey includes responses collected October 12 – 25, 2020 from owners and executives of 70 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 14 Summary of Insights and Findings

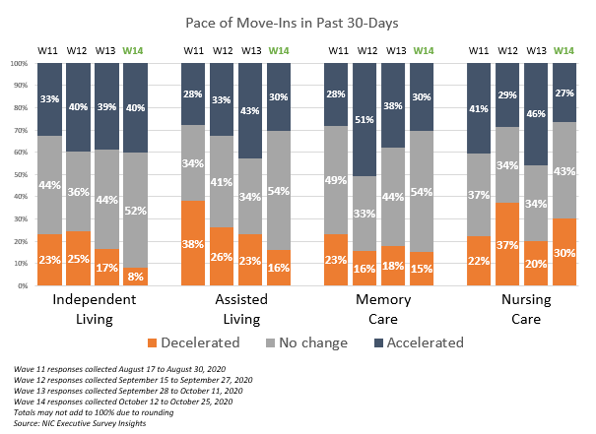

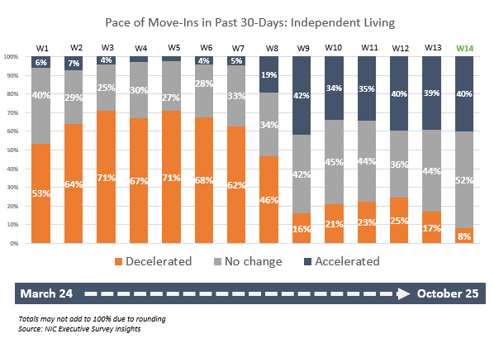

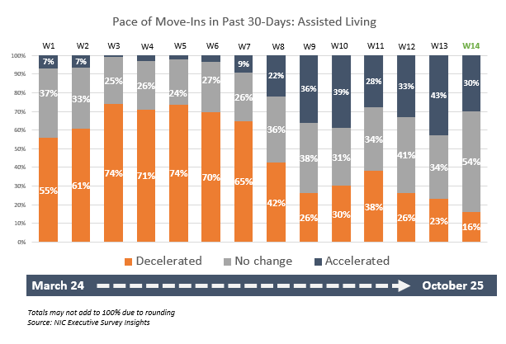

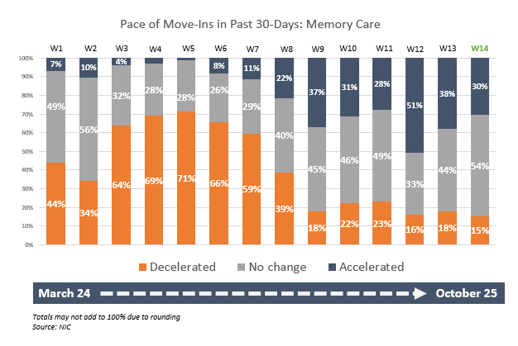

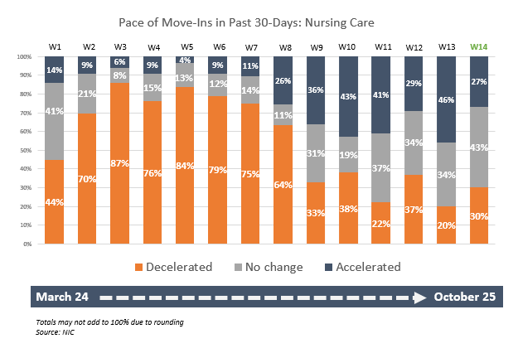

- The shares of organizations reporting no change in the pace of move-ins in the past 30 days is the highest since the survey began for each of the four care segments (between 43% and 54%). That said, shares of organizations with independent living, assisted living and/or memory care reporting decelerations in the pace of move-ins are currently at their lowest levels in the entire 14 waves of the survey time series.

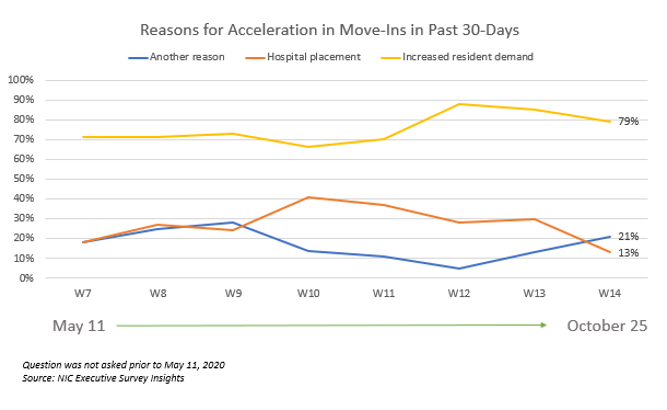

- Between 30% and 40% of organizations with independent living, assisted living and/or memory care units in their portfolios of properties reported that the pace of move-ins increased over the past 30 days. Acceleration in move-ins was most frequently attributed to increased resident demand, with one-quarter of respondents indicating that their organizations had a backlog of residents waiting to move into their communities.

- Fewer organizations with nursing care beds in Wave 14 reported acceleration in the pace of move-ins, with the fewest respondents citing hospital placement since Wave 7 surveyed mid-May—presumably due to anecdotal reports of hospitals sending patients straight home to recuperate from surgeries or illnesses with in-home health care.

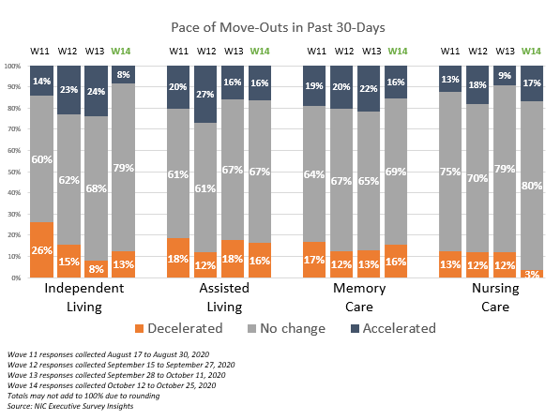

- The shares of organizations reporting no change or a deceleration in the pace of move-outs increased or remained similar compared to prior recent waves of the survey. Shares of organizations reporting a deceleration in the pace of move-outs was lowest for the nursing care segment (3%).

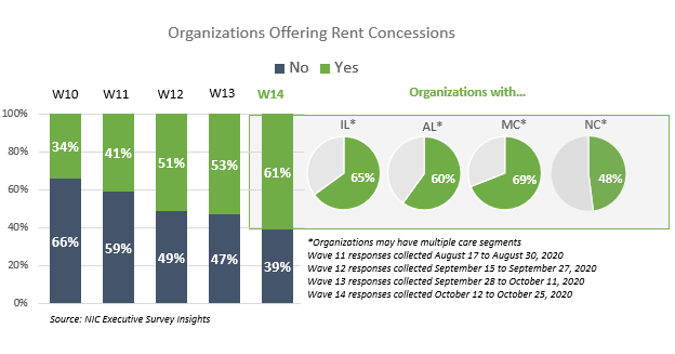

- Higher staff wages for some operators are likely putting strain on NOI. Nearly two-thirds (61%) of organizations in Wave 14 were offering rent concessions—a steady increase from one-third reported in Wave 10 (34%). In addition to more organizations offering discounts to attract new residents, nine out of ten of respondents report offering overtime hours (91%), and roughly two-thirds of (63%) were tapping agency or temp staff to mitigate labor shortages (up from 76% and 55%, respectively, in Wave 13).

- Of the organizations that operate any memory care and/or independent living units (including a combination of other seniors housing and care segments), two-thirds (69% and 65%, respectively) indicated they were currently offering rent concessions, followed by 60% of organizations with any assisted living units, and half (48%) of organizations with any nursing care beds. Among organizations with at least four properties in their portfolios, more than half (57%) were offering rent concessions in greater than 50% or all of their properties, and about one-quarter (27%) were offering rent concessions in all of their properties.

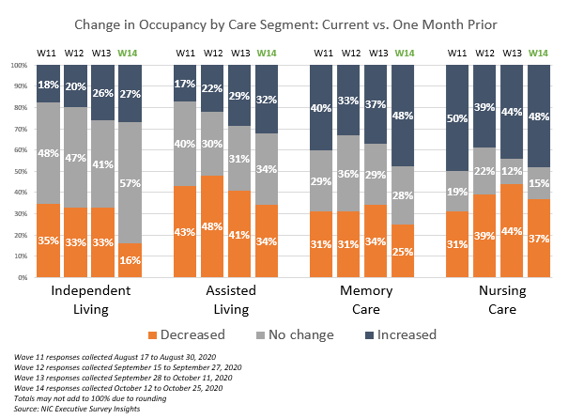

- The growing use of rent concessions may be providing some support to occupancy rates as month-over-month occupancy trends for each of the care segments over the recent waves of the survey are starting to rise. In Wave 14, about one-quarter of organizations with independent living units (27%), about one-third with assisted living units (32%), and roughly one-half with memory care units and/or nursing care beds (48%) noted upward changes in occupancy rates in the past 30-days.

- Organizations reporting month-over-month upward changes in occupancy with assisted living and/or memory care units is the highest in the survey time series, and the fewest organizations with independent living and/or assisted living units reported downward changes in occupancy since the survey began.

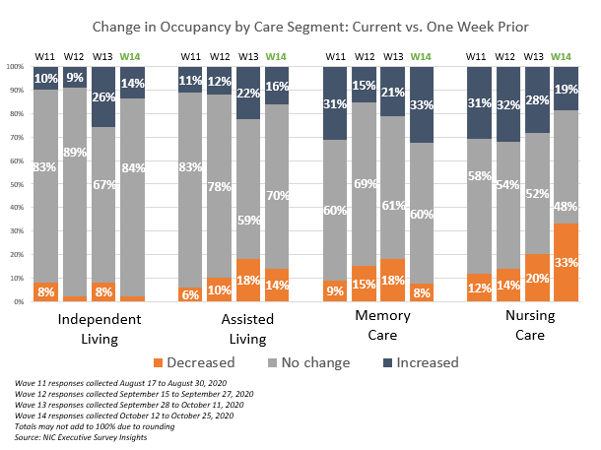

- Greater shares of organizations with memory care units in Wave 14 than in Wave 13 reported week-over-week increases in occupancy than in the prior two waves of the survey. Organizations with nursing care beds reported the highest shares of week-over-week occupancy decreases (33%).

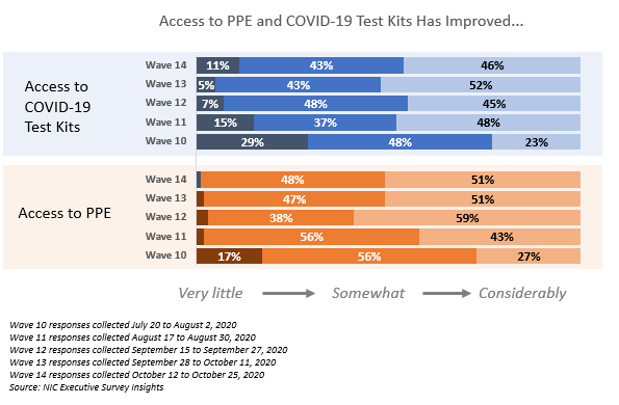

- Accurate and timely testing (within 48 hours) and access to PPE is crucial to operators’ ability to keep residents safe from contagion and grow occupancy. In Wave 14, only one-half of respondents in received their COVID-19 test results within 2 days, up from just over one-third in Wave 13, and only about half of respondents find it easy to obtain PPE.

Wave 14 Survey Demographics

- Responses were collected October 12 – 25, 2020 from owners and executives of 70 seniors housing and skilled nursing operators from across the nation. Nearly two-thirds of respondents are exclusively for-profit providers (63%), about one-quarter (28%) are exclusively nonprofit providers, and 9% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 57% of the sample. Operators with 11 to 25 properties make up 30% of the sample, while operators with 26 properties or more make up 13% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 78% of the organizations operate seniors housing properties (IL, AL, MC), 25% operate nursing care properties, and 22% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30 days has…”

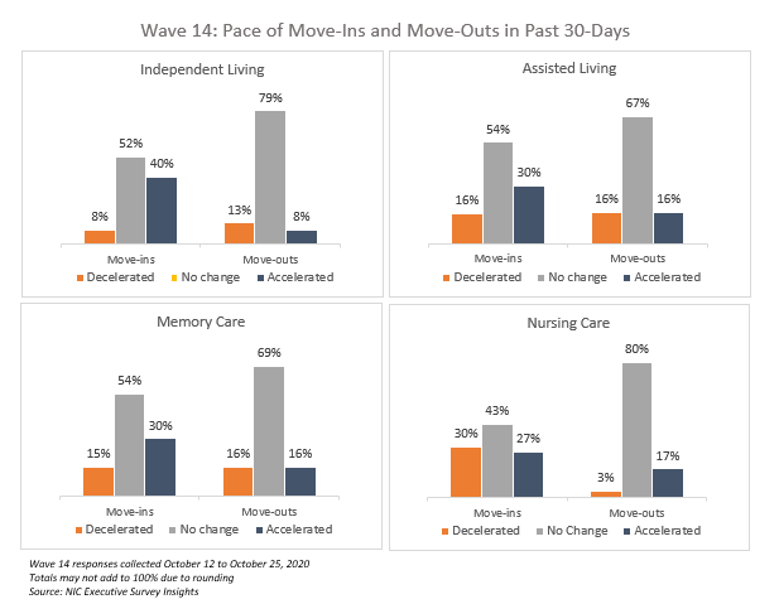

- The chart below offers a side-by-side view of the pace of move-ins and move-outs by care segment. In Wave 14, about half of organizations with independent living, assisted living, and/or memory care units reported no change in the pace of move-ins and more accelerations than decelerations. Furthermore, the majority of organizations saw no change in the pace of move-outs.

- Showing the last four waves of survey data in the chart below, the shares of organizations reporting no change in the pace of move-ins in the past 30 days is the highest across the entire survey time series for each of the care segments.

- That said, shares of organizations with independent living, assisted living and/or memory care units reporting decelerations in the pace of move-ins are currently at their lowest levels in the entire 14 waves of the survey time series.

- The shares of organizations with independent living units reporting acceleration in the pace of move-ins in has been the most stable and oscillating near its time series high of 42% reached in Wave 9 surveyed in mid-June.

- Organizations with nursing care beds have reported the most variability in the pace of move-ins in recent waves, with 30% noting recent deceleration.

Reasons for Acceleration in Move-Ins

Respondents were asked: “The acceleration in move-ins is due to…”

- The share of organizations citing increased resident demand as a reason for acceleration in move-ins in Wave 14 remained high (79%) but declined from a peak of 88% in Wave 12. Organizations citing hospital placement in Wave 14 (13%) is at the lowest level recorded since Wave 7 surveyed mid-May.

- Other reasons for acceleration in move-ins cited by respondents included move-in and visitation restrictions being lifted, pent up demand from a slow second quarter, and adult children expressing less reluctance to more a parent into seniors housing.

- The majority of organizations in Wave 14 continue to note no change in the pace of move-outs in the past 30-days. The shares of organizations reporting a deceleration in the pace of move-outs was lowest for the nursing care segment (3%).

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

- In Wave 14, about one-quarter of organizations with independent living units (27%), about one-third with assisted living units (32%), and roughly one-half with memory care units and/or nursing care beds (48%) noted upward changes in occupancy rates in the past 30-days. The shares of organizations reporting increased occupancy with assisted living and/or memory care units is the highest in the survey time series.

- The fewest shares of organizations with independent living and/or assisted living units reported downward changes in occupancy since the survey began.

- Regarding the change in occupancy from one week ago, greater shares of organizations with memory care units reported week-over-week increases in occupancy than in the prior two waves of the survey.

- Fewer shares of organizations with independent living and assisted living units in Wave 14 than in Wave 13 reported upward changes in week-over-week occupancy (more noted no change). Organizations with nursing care beds reported the highest shares of week-over-week occupancy decreases (33%).

Organizations Currently Offering Rent Concessions to Attract New Residents and Organizations Experiencing a Backlog of Residents Waiting to Move-In

Respondents were asked: “My organization is currently offering rent concessions to attract new residents,” and “My organization is experiencing a backlog of residents waiting to move-in”

- More organizations in Wave 14 (61%) were offering rent concessions to attract new residents—a steady increase from one-third in Wave 10 (34%).

- Of the organizations that operate any memory care and/or independent living units (including a combination of other seniors housing and care segments), two-thirds (69% and 65%, respectively) indicated they were currently offering rent concessions, followed by 60% of organizations with any assisted living units, and half of organizations with any nursing care beds (48%).

- Among organizations with at least four properties in their portfolios, more than half (57%) were offering rent concessions in greater than 50% or all of their properties, and about one-quarter (27%) were offering rent concessions in all of their properties.

- Approximately one-quarter of respondents in Waves 12-14 indicate that their organizations have a backlog of residents waiting to move in.

Improvement in Access to PPE and COVID-19 Testing Kits

Respondents were asked: “Considering access to PPE (personal protective equipment) and COVID-19 testing kits, my organization has experienced that access has improved… Very little, it is still difficult to obtain enough PPE/testing kits in most markets/Somewhat, in some markets it is easier to obtain PPE/testing kits than in others/Considerably, we typically have no difficulty obtaining PPE/testing kits, regardless of market”

- While there’s been some improvement in recent waves of the survey, still only about half of respondents find it easy to obtain PPE and COVID-19 test kits.

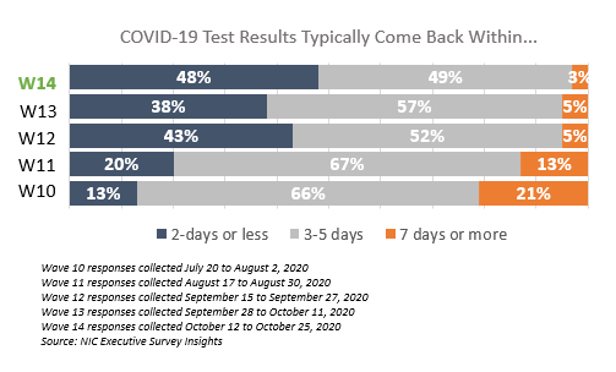

Time Frames for Receiving Back COVID-19 Test Results

Respondents were asked: “Regarding COVID-19 test results (either for staff, residents or prospective residents) results typically come back within…”

- Roughly one-half of respondents (48%) received their COVID-19 test results within 2-days, up from 38% in Wave 13. Half of the sample (52%) reported that it takes 3 or more days to receive test results—however, this is down from 62% in Wave 13 and 87% in Wave 10.

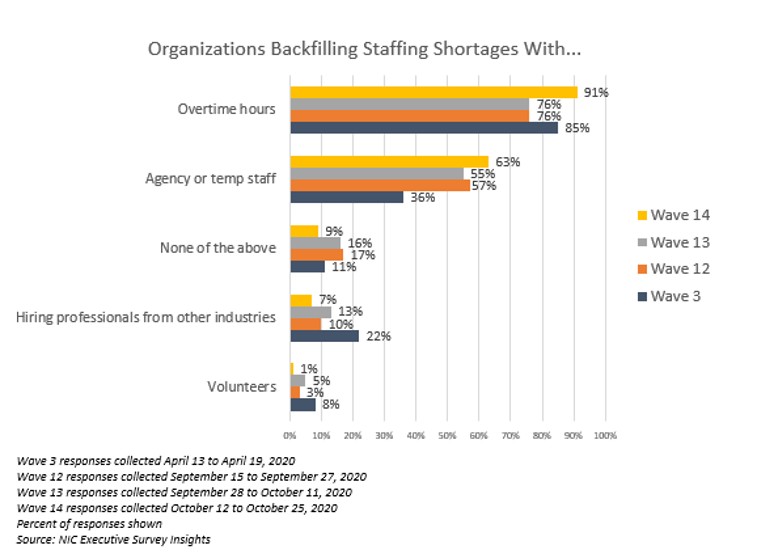

Labor and Staffing

Respondents were asked: “My organization is backfilling property staffing shortages by utilizing … (Choose all that apply).” Note: this question was asked in Wave 3, and then again in Waves 10-14.

- Nine out of ten organizations (91%) are offering staff overtime hours in Wave 14 (a survey high), and nearly two out of three (63%) are using agency or temp staff to fill staffing vacancies—up from 36% in the Wave 3 benchmark.

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By providing real-time insights to the longest running pulse of the industry survey you can help ensure the narrative on the seniors housing and care sector is accurate. By demonstrating transparency, you can help build trust.

“…a closely watched Covid-19-related weekly survey of [ ] operators conducted by the National Investment Center for Seniors Housing & Care…”

The Wall Street Journal | June 30, 2020

The Wave 15 survey is available until Sunday, November 8, and takes just 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.