“The effect of the pandemic’s surge in the Fall is reflected in NIC’s recent ESI survey results. The November surveys (Waves 15 and 16), which provided insights into operator experiences in October, showed new downward trends in the pace of move-ins, move-outs, and occupancy rates across the continuum of care. These trends continued into the holiday season. More survey respondents reported drops in occupancy in the past 30-days than increases. In light of COVID-19 infection positivity rates rising across the country, more organizations in Wave 18 cited self-imposed or government-imposed move-in restrictions as a reason for slowing the pace of settling residents into their communities.”

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change. This Wave 18 survey includes responses collected December 14-December 27, 2020 from owners and executives of 76 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Additionally, the full range of time series data for each wave of the survey by care segment for move-ins, move-outs and occupancy rate changes can be found HERE.

Wave 18 Summary of Insights and Findings

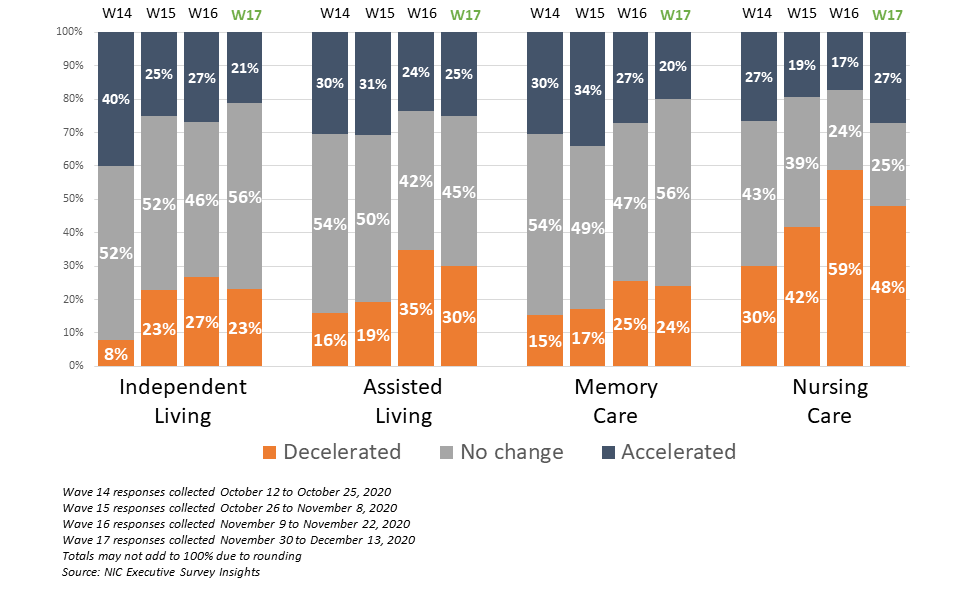

- A slower pace of move-ins was reported by survey respondents in Wave 18 for all care segments, likely reflecting the recent surge in COVID incidence. Conversely, only the independent living and memory care segments experienced faster rates of move-ins, albeit slightly, than in the prior survey period.

- The shares of organizations reporting a deceleration in the pace of move-ins in the past 30-days for the assisted living and memory care segments remained at or around their highest levels since Waves 7 and 8 (surveyed mid-May to early-June). The shares of organizations reporting deceleration in the pace of move-ins in the nursing care segment (60%), was similar to the Wave 16 survey conducted in mid-November, illustrating the beginning of a new slowdown in the nursing care segment due to the Fall resurgence of the virus that began in October (this pattern is evident also for the assisted living and memory care segments, as well.) The full time-series can be viewed HERE.

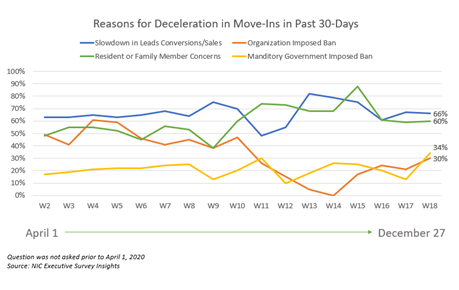

- Roughly two-thirds of organizations cited a slowdown in leads conversions/sales and/or resident or family member concerns as reasons for decelerations in the pace of in move-ins in the past 30-days. However, approximately one-third of organizations in Wave 18 cited a mandatory government-imposed ban (34%, up from 13% in Wave 17) or an organization-imposed ban (30% up from 21% in Wave 17).

- Approximately one-third of respondents (32%) indicated that their organizations had a backlog of residents waiting to move-in. This is similar to the high point (34%) reached in the Wave 16 survey conducted in mid-November and higher than Wave 17 (26%).

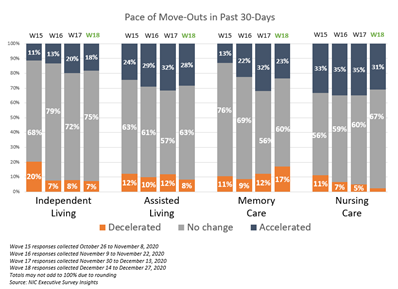

- Most of the organizations that responded to the Wave 18 Survey reported no change in the pace of move-outs for each of the care segments. However, the share of organizations that reported an acceleration in the pace of move-outs in recent surveys is similar to levels seen earlier in the pandemic. The full time-series can be viewed HERE.

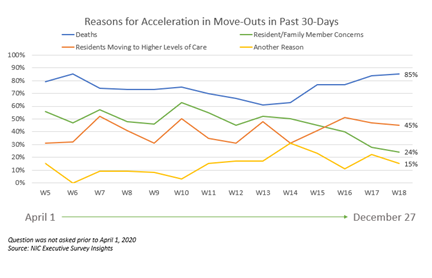

- As shown in the chart below, resident deaths (unspecified reason) continued to be the most frequently cited reason for the acceleration in the pace of move-outs in the last 30-days (85%). This is up from 61% in Wave 13 and equal to the peak of 85% reached in the Wave 6 survey conducted in early-May.

- Roughly 15% of survey respondents cited “another reason” for an acceleration in move-outs. This included COVID-19 outbreaks in higher levels of care segments, staffing limitations/shortages (some due to COVID-19 infection), the Thanksgiving holiday, and adult children waiting for the virus to decline before moving a parent in.

- Presumably, as a result of better and safer visitation protocols and more acceptance, resident or family member concerns cited as a reason for the acceleration in the pace of move-outs (24%) was down from 63% in Wave 10 surveyed in late-July and is currently at the lowest level in the survey time series.

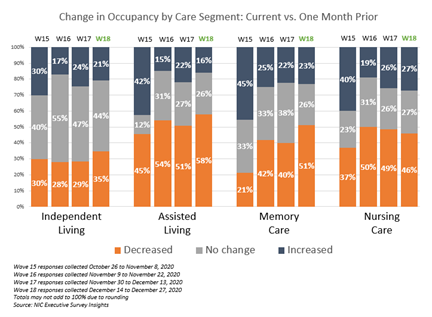

- For each of the care segments, the shares of organizations reporting downward changes in occupancy in the past 30-days continued to outpace those reporting upward changes. Considering recent survey data, this trend began in the Wave 16 survey conducted in early November (reflecting experiences that occurred during October). Compared to Wave 17, the percentage of organizations with independent living, assisted living and memory care segments reporting month-over-month declines in occupancy rates increased. Between 46% and 58% of organizations with assisted living units, memory care units and/or nursing care beds, and 35% with independent living units, reported downward changes in occupancy in the past 30-days. The full time-series can be viewed HERE.

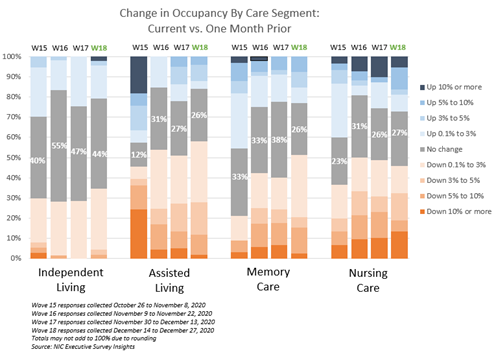

- The chart below describes the degree of those occupancy rate changes. The blue and orange-hued stacked bars correspond to the solid bars in the chart above indicating the degree of change by the saturation of color.

- The assisted living care segment saw the largest share of organizations reporting a decline in occupancy rates in the past 30-days. in Wave 18, 58% of respondents with assisted living units in their portfolios of properties noted declines in occupancy rates to varying degrees. The chart below shows that 30% of the survey respondents reported occupancy declines in the 0.1 to three percentage point range, while another one in four (28%) reported occupancy declines of more than three percentage points.

- About one-half of organizations with memory care and/or nursing care (51% and 46%, respectively) reported a decline in occupancy in Wave 18. The degrees of decline were higher for the nursing care segment than the memory care segment: about one in five organizations with nursing care beds (19%) noted downward occupancy changes between five and ten percentage points or more, whereas about one in five organizations with memory care units (18%) noted downward occupancy changes between three and ten percentage points.

.

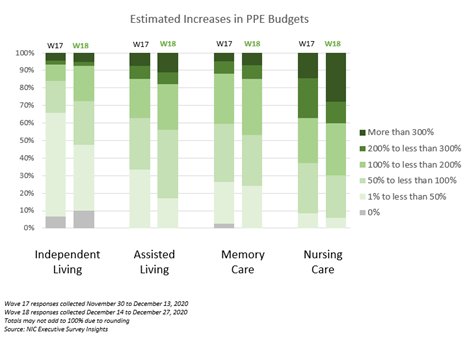

- NOI is likely being pressured as most of the organizations in the Wave 18 survey sample were paying staff overtime hours and using agency or temp staff to backfill staffing shortages (89% and 70%, respectively). Additionally, about two-thirds of respondents (68%) noted they are experiencing challenges obtaining PPE due to high budgetary constraints (34%) or high demand/competition (34%). Fewer respondents in Wave 18 reported challenges obtaining PPE due to restrictions on allocation (18% vs. 29%). However, about two in five respondents reported having experienced none of these challenges (39%).

- The higher levels of care segments (assisted living, memory care and nursing care) reported increases in PPE budgets commensurate with growing levels of care. Additionally, organizations with the largest portfolios of properties were more likely to report significantly higher PPE budget increases than single-site operators. As shown in the chart below comparing Waves 17 and 18, each of the care segments saw growing increases in PPE budgets, but the nursing care segment saw the most growth with roughly one-quarter (28%) estimating an increase of more than 300%.

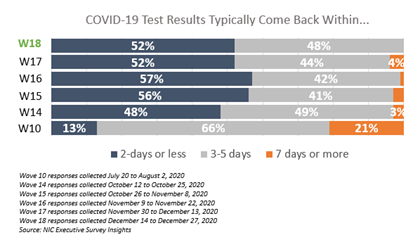

- In Wave 18, one-half of respondents (52%) received their COVID-19 test results within 2-days, however it is taking 3 to 5 days to receive test results for the other half of respondents (48%). No respondents reported having to wait more than 5-days. These findings were relatively unchanged since Wave 14 surveyed mid-October.

- Four in five respondents (82%) indicated their organizations have increased the use of telehealth/virtual appointments since the beginning of the pandemic (similar to 87% in Wave 17).

Wave 18 Survey Demographics

- Responses were collected December 14-December 28, 2020 from owners and executives of 76 seniors housing and skilled nursing operators from across the nation. Approximately half of respondents are exclusively for-profit providers (52%), more than one-third are nonprofit providers (37%), and 11% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise just over half of the sample (56%). Operators with 11 to 25 properties make up about one-quarter of the sample (24%), while operators with 26 properties or more make up 20% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 73% of the organizations operate seniors housing properties (IL, AL, MC), 40% operate nursing care properties, and 35% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By providing real-time insights to the longest running pulse of the industry survey you can help ensure the narrative on the seniors housing and care sector is accurate. By demonstrating transparency, you can help build trust.

“…a closely watched Covid-19-related weekly survey of [ ] operators

conducted by the National Investment Center for Seniors Housing & Care…”

Wall Street Journal | June 30, 2020

The Wave 19 survey is available and takes just 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.