“Just under one-fifth of respondents noted that the severity of staffing shortages across their organization was severe, while two-thirds indicated the problem was moderate. Regarding tenure of newly hired, full-time employees, on average, just under one-third (29%) of organizations kept more than 80% of new staff on the job after one month, which is down from the Wave 39 survey, conducted in March 2022, when just under one-half (46%) of respondents kept more than 80% on the job after one month.

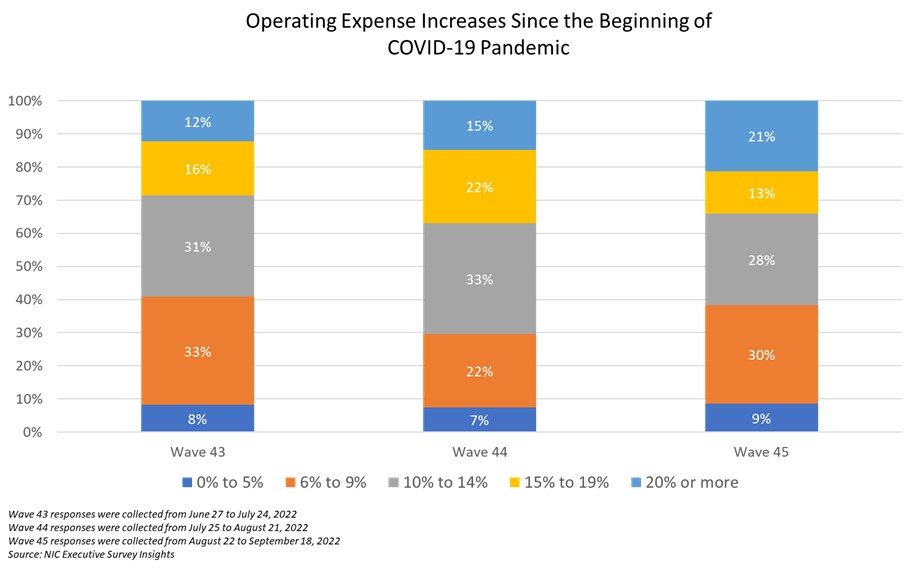

Staffing retention difficulties often lead to increased agency usage, and in turn, both often have a detrimental impact on operating expenses and NOI. Operating expenses continue to rise, with more than one-fifth (21%) of respondents reporting operating expenses that are 20% or more greater than prior to the pandemic. Among the reasons given for the increase in operating expenses are vendor pricing, food costs, overtime and third-party agency usage, utilities, and insurance. Additionally, multiple respondents explicitly underscore industry-specific compensation increases that are above the rate of inflation.”

–Ryan Brooks, Senior Principal, NIC

This Wave 45 survey includes responses from August 22 to September 18, 2022, from owners and executives of 47 small, medium, and large senior housing and skilled nursing operators across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

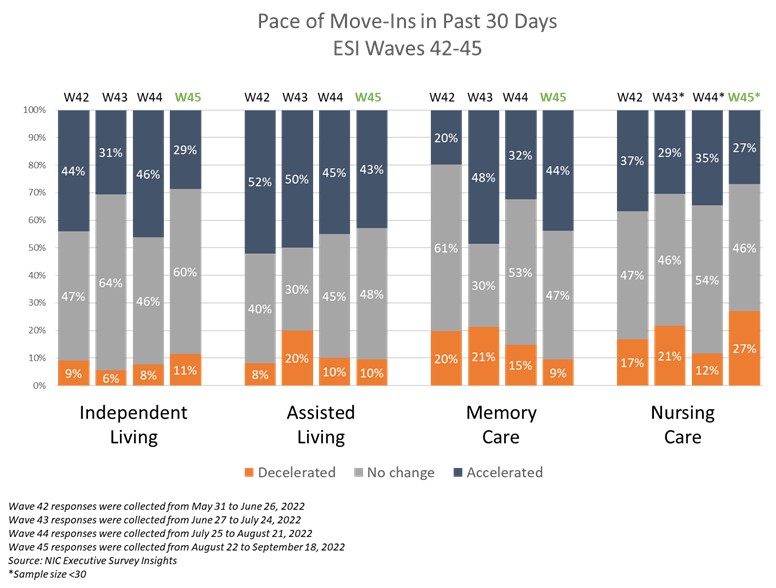

In the Wave 45 survey, reflecting operator experiences in August and September 2022, the rate of operators reporting an increase in the pace of move-ins in the past 30 days fell for independent living properties (29%), assisted living properties (43%), and nursing care properties (27%), but went up for memory care properties (44%). This marks the third consecutive wave with a decline in assisted living properties reporting an increase in the pace of move-ins.

Just under one-fifth of Wave 45 respondents indicated the severity of their staffing shortages across their organizations was severe (19%), while two-thirds (67%) reported it was moderate. Over 20% of respondents report staffing shortages across the entirety of their portfolio. Approximately one-quarter report staffing shortages at up to 25% of their properties, one-third have staffing shortages at up to 50% of their properties, and one-quarter report shortages at between 50%-99% of their properties.

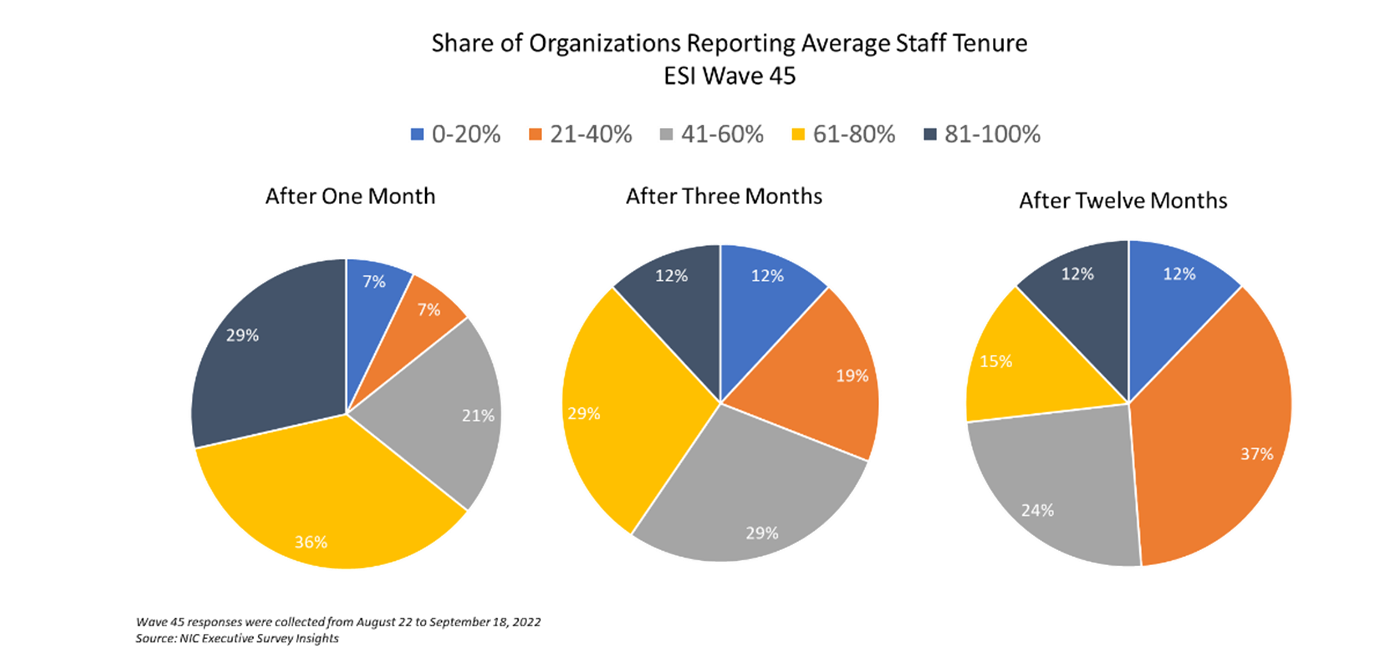

Regarding tenure of newly hired, full-time employees, on average, just under one-third (29%) of organizations kept more than 80% of new staff on the job after one month. This is down from the Wave 39 survey, conducted in March 2022, when just under one-half (46%) of organizations kept more than 80% on the job after one month. Looking at longer-term retention, on average, just over one-tenth (12%) of organizations retained more than 80% of new staff after one year. This metric is also down from the Wave 39 survey, conducted in March 2022, when just under one-sixth (16%) of organizations retained more than 80% of new staff at the one-year mark.

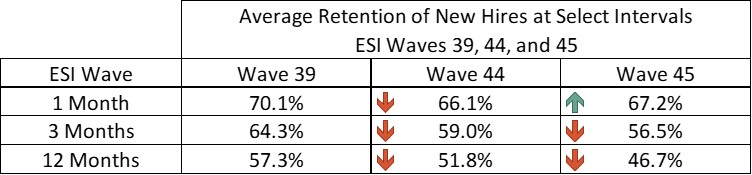

As indicated in the table below, the average share of newly hired employees that remain on staff after three months and after one year has decreased over each of the last three ESI surveys that included this question (Waves 39, 44, and 45). While the average share of newly hired employees that remain on staff after one month has remained relatively stable, long-term employee retention has become even more challenging.

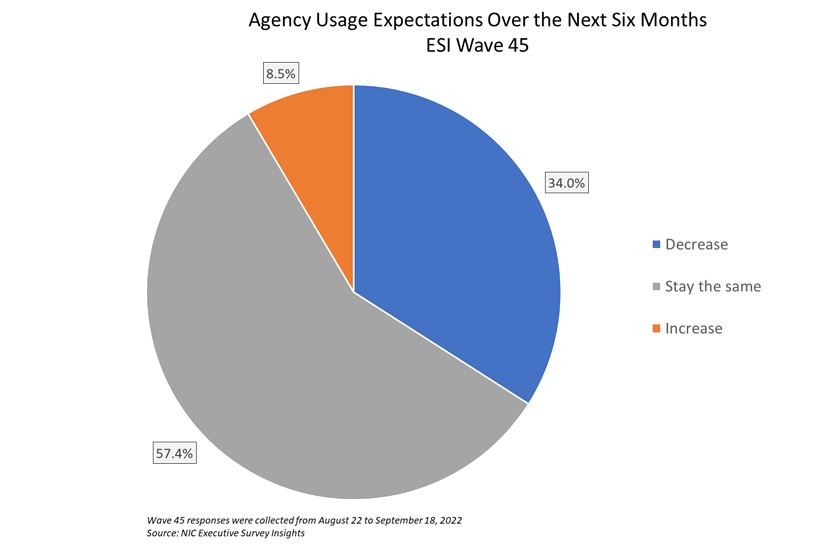

With employee retention remaining a challenge to operations, agency labor utilization is often turned to as a stopgap measure. When asked about their organizations’ expectations of agency usage in the next six months, 8.5% of Wave 45 respondents anticipate an increased reliance on agency staff, while two-thirds of respondents anticipate reliance on agency staff to decrease. Most respondents – 57% – anticipate their organizations’ agency usage to remain the same as it is currently.

Staffing retention challenges and a heavy reliance on agency usage can have a substantial impact on operating expenses and in turn NOI. When asked about the change in operating expenses since the beginning of 2022, 87% reported operating expenses to be higher and 13% reported operating expenses to have remained the same. No respondents had reduced operating expenses since the beginning of this year. When asked about the change in operating expenses since before the pandemic started, one-fifth of respondents have seen operating expenses increase by 20% or more.

Reasons given for the increase in operating expenses include vendor pricing, food costs, overtime and third-party agency usage, utilities, and insurance. Multiple respondents explicitly underscore industry-specific compensation increases that are above the rate of inflation. One respondent indicated that frontline staff at their organization received an average increase of 24% in compensation.

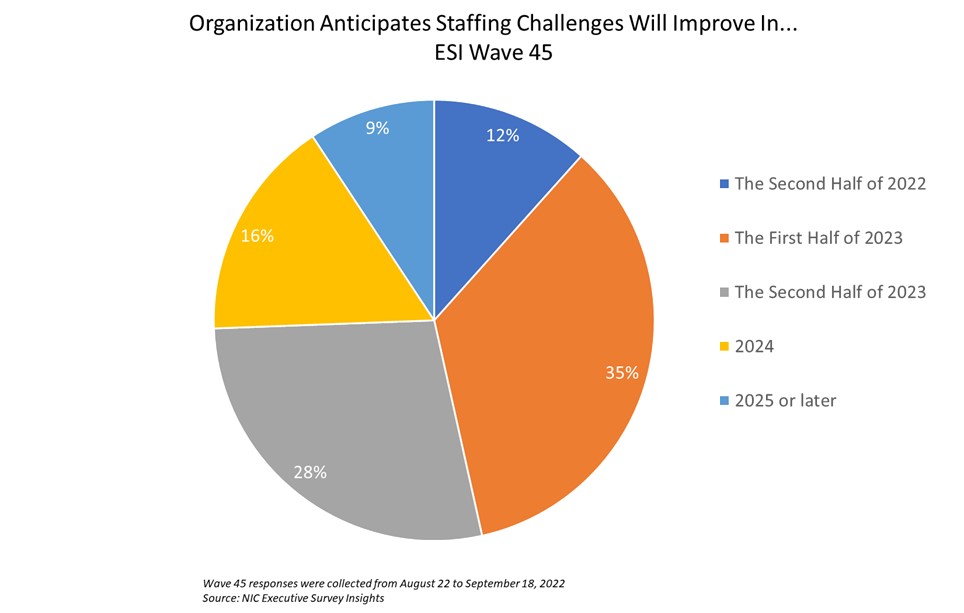

However, a promising sign of relief to the long-standing labor market issues may be that 12% expect staffing challenges to improve in the second half of this year. One-third believe labor markets will ease in the first half of 2023, approximately one-third believe staffing challenges will improve in the second half of 2023, and one in four anticipate it will take until 2024 or beyond before staffing challenges ease.

Wave 45 Survey Demographics

- Responses were collected between August 22 and September 18, 2022, from owners and executives of 47 senior housing and skilled nursing operators across the nation. Owners/operators with 1 to 10 properties comprise roughly two-thirds (66%) of the sample. Operators with 11 to 25 properties account for 21%, and operators with 26 properties or more make up the rest of the sample with 13%.

- One-half of respondents are exclusively for-profit providers (49%), just under one-half operate not-for-profit seniors housing and care properties (45%), and 6% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 66% of the organizations operate seniors housing properties (IL, AL, MC), 21% operate nursing care properties, and 45% operate CCRCs – also known as life plan communities.

This is your survey! Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. The ESI 2022 questionnaire has been shortened from prior surveys. While some standard questions will remain for tracking purposes, in each new survey wave, new questions can be added based on respondents’ suggestions.

Wave 46 of the ESI is now live. The current survey is available and takes ten minutes to complete. If you are an owner or C-suite executive of senior housing and care and have not received an email invitation to take the survey, please contact Ryan Brooks at rbrooks@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic.