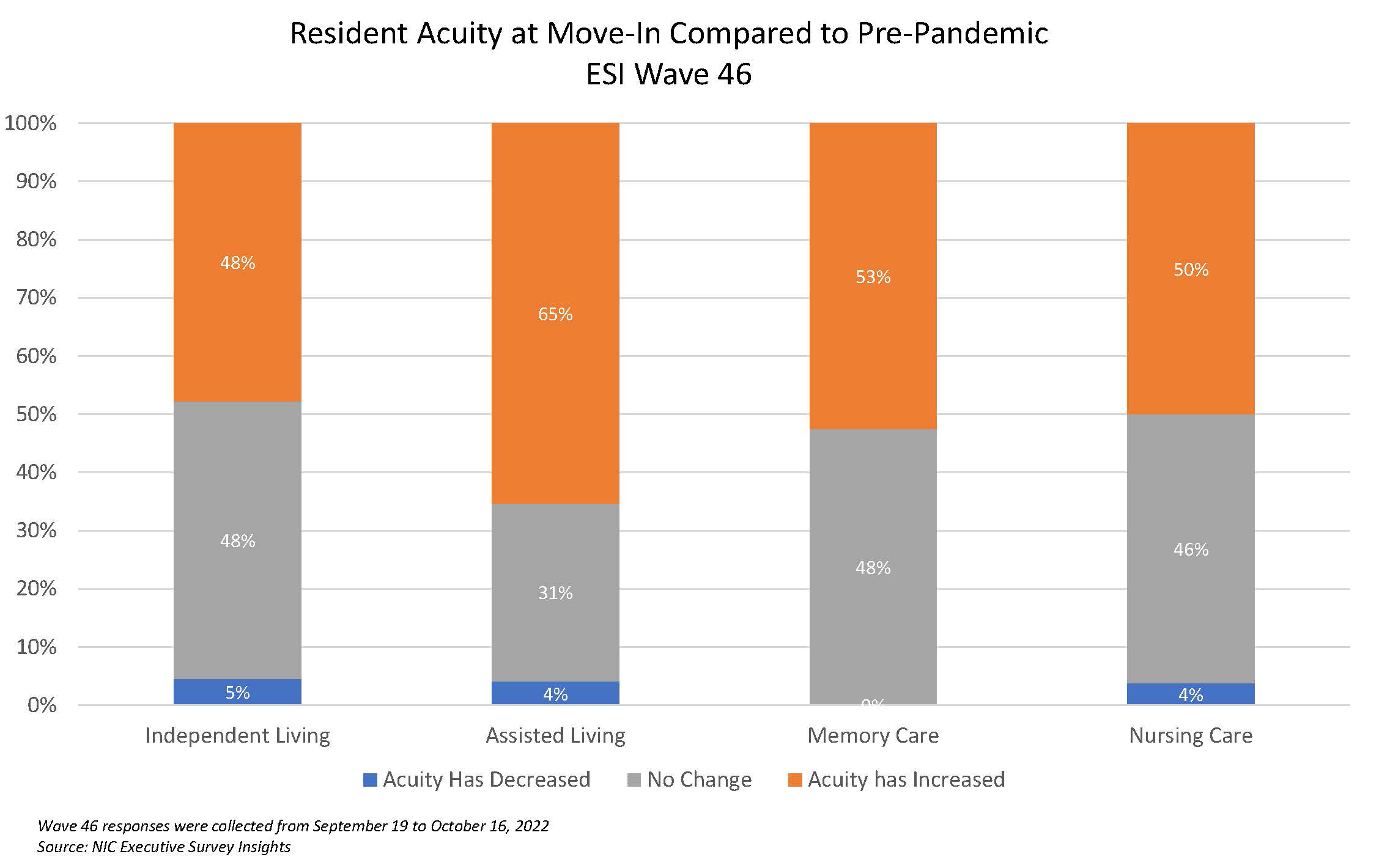

“Increased acuity of residents at move-in is being reported across all care segments, driven by delayed move-ins, but the most cited challenge facing operators – reported by more than 90% of respondents in the Wave 46 survey – is rising operator expenses. Responses to questions on property and professional liability insurance provide additional insight into that sentiment.

Just under one-tenth of respondents reported the degree of staffing shortages across their organization to be severe, representing the lowest share of respondents reporting severe staffing shortages in the time this question has been asked. Though labor challenges persist, this may represent a glimmer of relief to the longstanding staffing crisis. Further, the survey results indicate that rent concessions are being offered at fewer properties now than was the case in earlier parts of 2022.”

–Ryan Brooks, Senior Principal, NIC

This Wave 46 survey includes responses from September 19 to October 16, 2022, from owners and executives of 58 small, medium, and large senior housing and skilled nursing operators across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

The trend for rent concessions in the last three waves of the survey which this question was asked is that rent concessions are being offered at fewer properties now than was the case in earlier parts of 2022. Organizations offering rent concessions in all of their properties fell to a mere 7%, down from 21% in Wave 41 and 17% in Wave 37. Comparatively, organizations offering rent concessions in up to 25% of their properties rose to 50%, up from 29% in Wave 41 and 20% in Wave 37.

In the Wave 46 survey, 41% of respondents reported offering rent concessions. This is down from 46% in Wave 41 and 47% in Wave 37. Of organizations who are currently offering rent concessions, the most common forms being offered are free rent for a period of time (37%), rent discounts (24%), unit upgrades (18%), rent freezes (no increases for a specific period of time) (8%), and a reduced entrance free (8%).

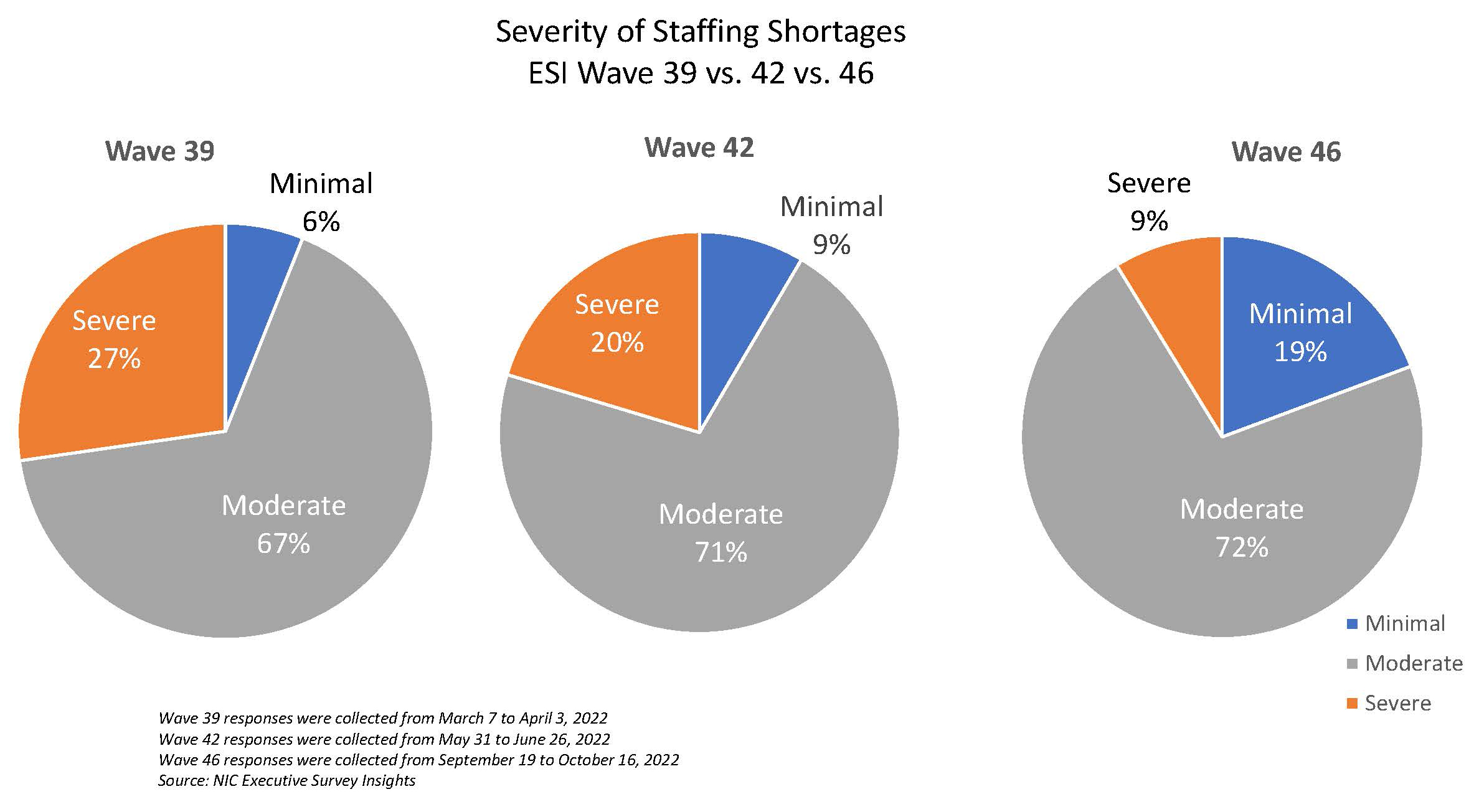

In the Wave 46 survey, one-tenth of respondents (9%) report staffing shortages at their organizations to be severe. This is down from one-fifth of respondents in the Wave 42 survey conducted in June 2022 and one-quarter of respondents in the Wave 39 survey conducted in March 2022. Conversely, one-fifth of respondents (19%) report the staffing shortages at their organizations to be minimal, which is up from 9% in Wave 42 and 6% in Wave 39. This represents both the highest share of respondents reporting minimal staffing shortages and the lowest share of respondents reporting severe staffing shortages since March 2022, which marked the beginning of the time frame in which this question has been asked.

While this may represent a promising sign of relief, staffing and labor challenges do persist. Despite fewer reports of severe staffing shortages, attracting community and caregiving staff is the second most cited challenge operators are facing (79%) followed by staff turnover (67%). Having to limit admissions due to staffing shortages was also reported by 24% of operators.

When asked what the staffing shortages at their organization are due to, the most common response was competition from other industries (25%), followed by an inability to hire nurses (21%), competition from staffing agencies (17%), and an inability to fill nurse aide positions (15%).

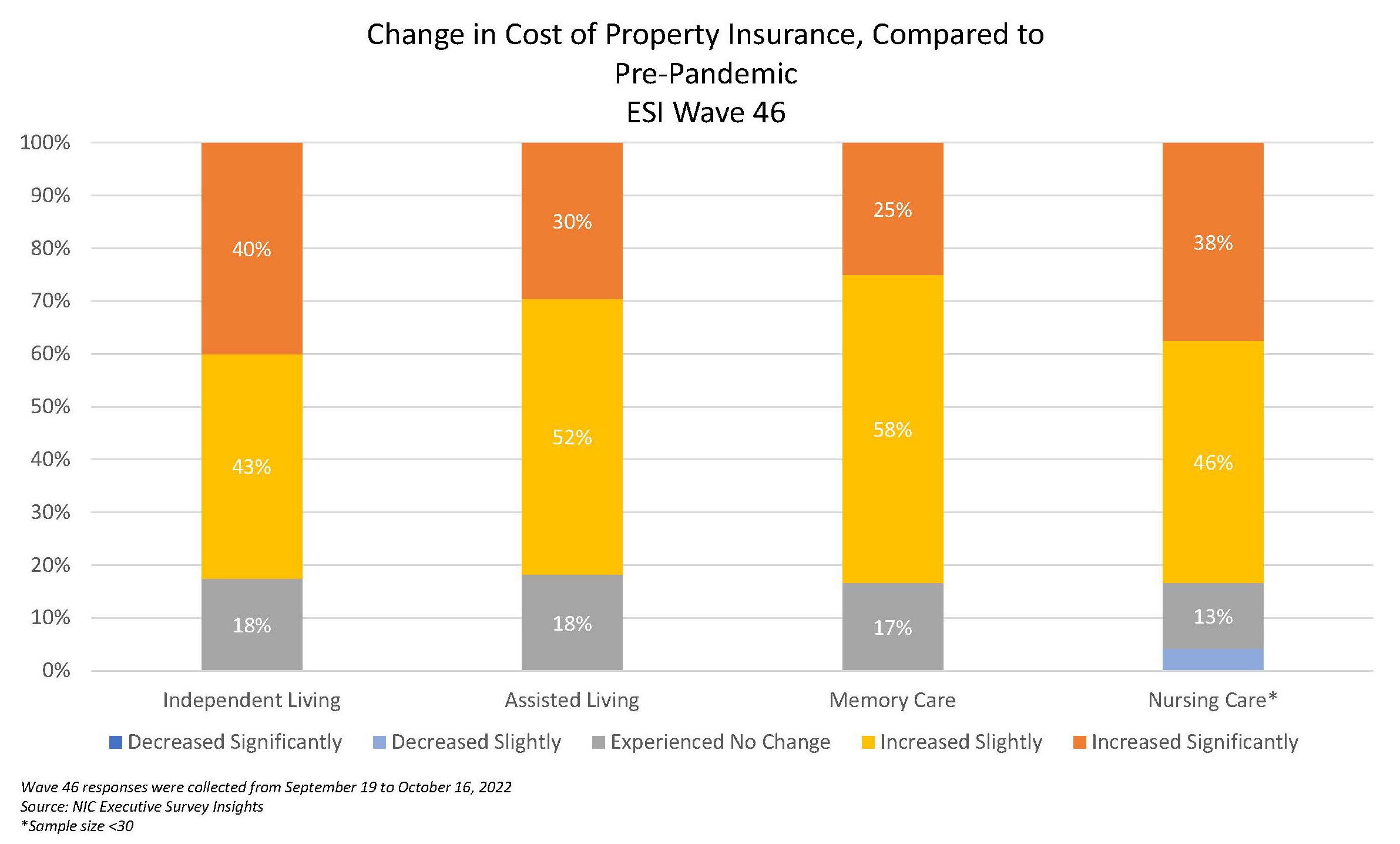

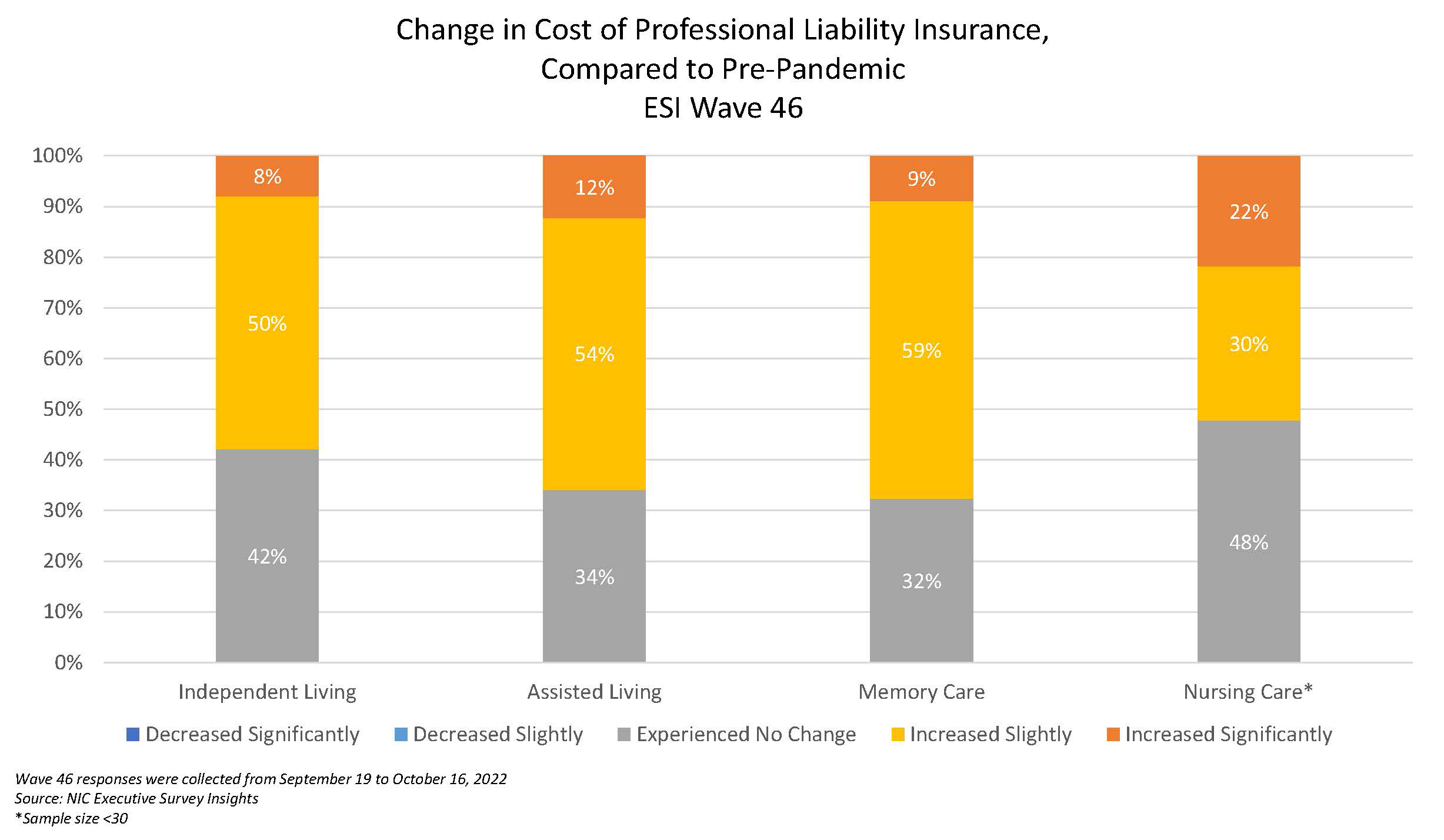

The most cited challenge facing operators – reported by more than 90% of respondents in the Wave 46 survey – is rising operator expenses and responses to questions on property and professional liability insurance emphasize the sentiment.

When asked to compare the cost of their property insurance currently to pre-pandemic, between 82% and 84% of operators across all care segments – independent living, assisted living, memory care, and nursing care – reported it to have increased (either significantly or slightly). Two-fifths of independent living operators report the change in the cost of their property insurance to have increased significantly, followed by nursing care (38%), assisted living (30%), and memory care (25%).

Professional liability insurance has also increased compared to pre-pandemic. When asked to compare the cost of their professional liability insurance to pre-pandemic, two-thirds (68%) of memory care and assisted living (66%) operators report the change in cost to have either increased significantly or increased slightly, followed by 58% of independent living operators, and one-half (52%) of nursing care operators. No owners or operators reported a decrease in the cost of professional liability insurance.

Market conditions, overall macroeconomic environment, inflation, COVID-19, and insurers dropping out of the market resulting in less competition are all among the reasons cited by respondents for the increase in property and professional liability insurance.

The Wave 46 survey asked respondents whether they found the acuity of new resident move-ins to have increased, decreased, or stayed the same as compared to before the pandemic started. Increased move-in acuity was reported by two-thirds (65%) of assisted living operators, 53% in memory care, 50% in nursing care, and 48% in independent living.

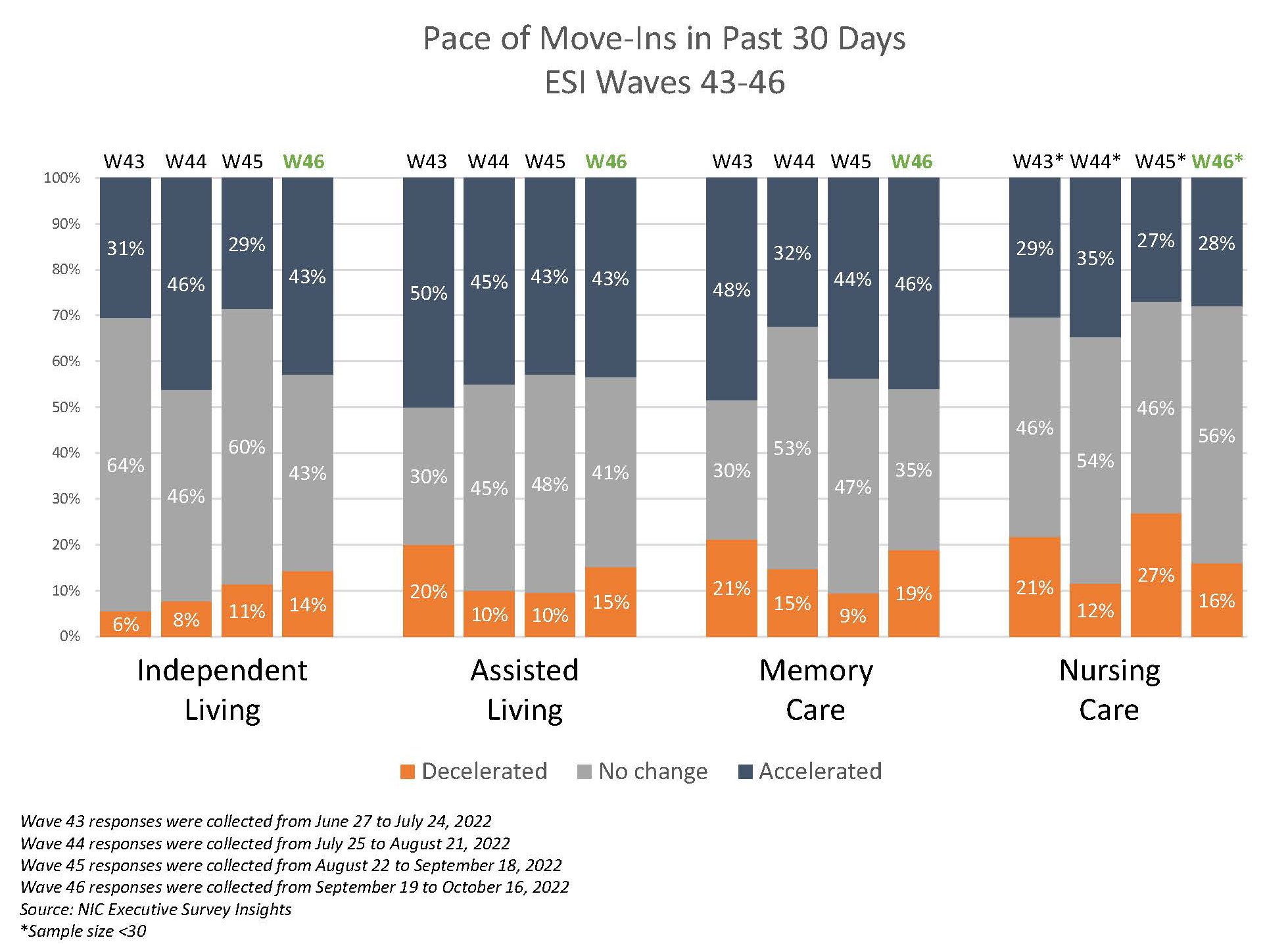

In the Wave 46 survey, reflecting operator experiences in September and the first half of October 2022, the rate of operators reporting an increase in the pace of move-ins in the past 30 days held steady for assisted living properties (43%), memory care properties (46%), and nursing care properties (28%). The rate of independent living operators reporting an increase in the pace of move-ins in the last 30 days rebounded to 43%, compared to 29% in Wave 45.

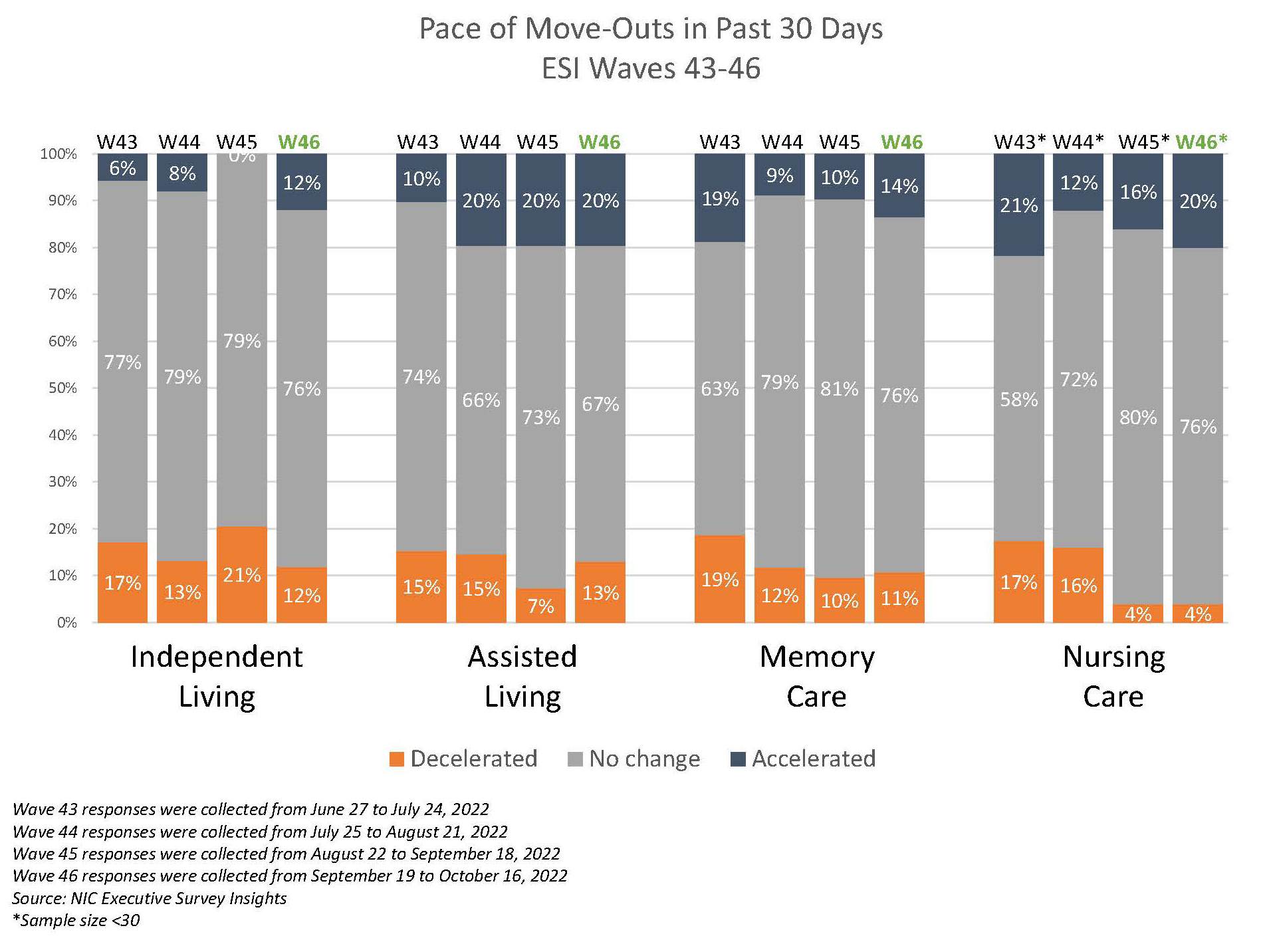

Most survey respondents reported no change in the pace of move-outs across all care segments within the past 30 days, a consistent theme for the most recent four ESI Waves. In Wave 46, 76% of independent living operators, 67% of assisted living, 76% of memory care, and 76% of nursing care operators reported no change in the pace of their move-outs.

Wave 46 Survey Demographics

- Responses were collected between September 19 and October 16, 2022, from owners and executives of 58 senior housing and skilled nursing operators across the nation.

- Owners/operators with 1 to 10 properties comprise roughly two-thirds (64%) of the sample. Operators with 11 to 25 properties account for 19%, and operators with 26 properties or more make up the rest of the sample with 17%.

- More than half of respondents are exclusively for-profit providers (57%), just over one-third operate not-for-profit seniors housing and care properties (34%), and 5% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 79% of the organizations operate seniors housing properties (IL, AL, MC), one-fifth (22%) operate nursing care properties, and two-thirds (34%) operate CCRCs – also known as life plan communities.

This is your survey! Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. While some standard questions will remain for tracking purposes, in each new survey wave, new questions can be added based on respondents’ suggestions. Please let us know what you think.

Wave 47 of the ESI is now live. The current survey is available and takes ten minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Ryan Brooks at rbrooks@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic.