A NIC report developed to provide timely insights from owners and C-suite operators on the pulse of seniors housing and skilled nursing sectors.

NIC’s weekly Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time where market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

This week’s sample (Wave 4) includes responses collected April 20-26, 2020 from owners and C-suite executives of 94 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Summary of Insights and Findings

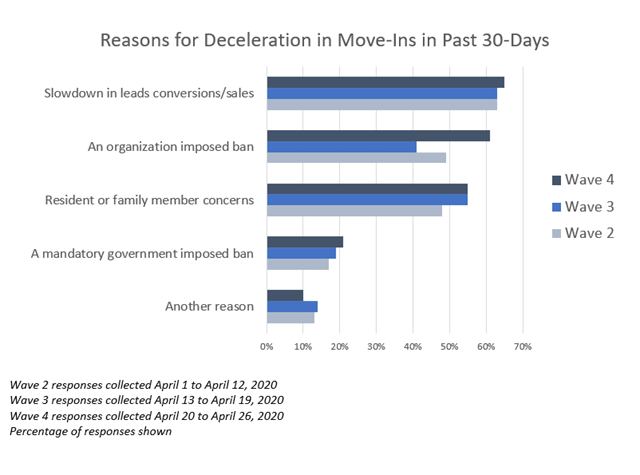

Changes in occupancy rates continued to show declines and move-in rates continued to decelerate for many organizations in Wave 4. The primary reason cited for deceleration in move-ins continues to be slowdowns in leads conversions and sales. However, in Wave 4, more organizations reported an organization-imposed ban on settling residents into their communities than in prior waves of the survey.

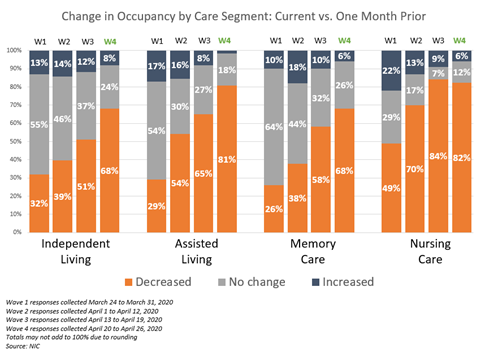

- Organizations with assisted living residences and nursing care beds reported the largest declines in occupancy changes from one-month prior among the four segment types. In Wave 4, approximately 80% of survey respondents reported declines in occupancy from the prior month for assisted living units and nursing care beds. For the assisted living care segment, organizations reporting declines in Wave 4 are up to 81% from 65% in Wave 3. However, the proportion of organizations reporting nursing care segment occupancy declines in Wave 4 was similar to Wave 3 (84%).

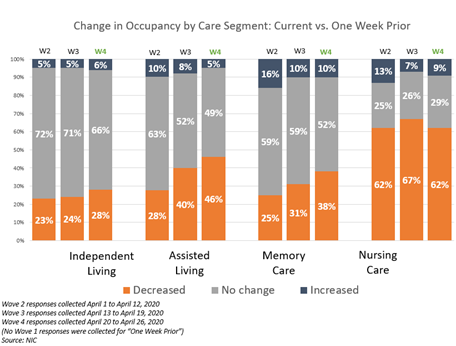

- Compared with one week earlier, higher shares of organizations reported occupancy declines in Wave 4. Consistent with Waves 2 and 3, about two-thirds of organizations reporting on their nursing care segments noted declines in Wave 4.

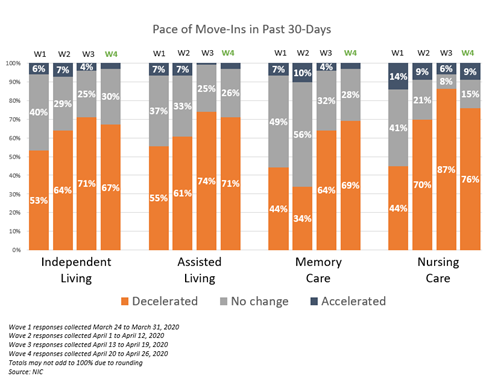

- Around 70% of organizations reported the pace of move-ins decelerated in the past 30 days for their independent living, assisted living and memory care segments in Wave 4. Only about one-third to one-quarter report no change in the pace of move-ins for these care segments. While the majority of organizations reporting on their nursing care segments in Wave 4 note a deceleration in move-ins (76%) the share is lower compared to Wave 3 (87%).

- More respondents in Wave 4 cited an organization-imposed ban on settling new residents into their communities than in the prior two waves of the survey. Some reasons for deceleration in move-ins written into the survey comments included fewer hospital referrals and elective surgery rehab residents, moratoriums on tours, more stringent health screenings, and not wanting to admit residents into a 14-day quarantine.

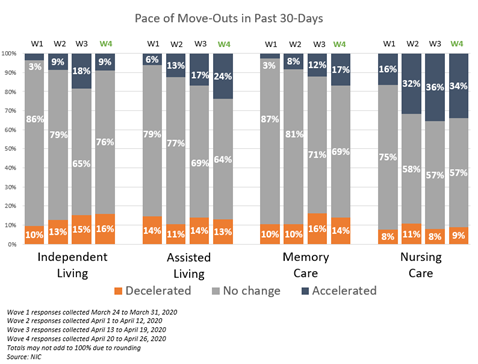

- The majority of respondents continue to report no change in the pace of move-outs in the past 30-days. The independent living segment reported the most stability in Wave 4 with about three-quarters of organizations reporting no change in the pace of move-outs. In contrast, about one-third of organizations with nursing care beds report accelerated move-outs in Waves 2, 3 and 4. Of note, in Wave 4, about one-quarter of organizations with assisted living units report an acceleration in move-outs in the past 30-days (24%), an increasing trend across waves of the survey, and up from 17% in Wave 3.

Wave 4 Survey Demographics

- Responses were collected April 20-26, 2020 from owners and C-suite executives of 94 seniors housing and skilled nursing operators from across the nation.

- Nearly two-thirds of respondents were exclusively for-profit providers (62%), more than one-quarter (28%) were exclusively nonprofit providers, and 10% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 56% of the sample. Operators with 11 to 25 properties make up 17%, while operators with 26 properties or more make up 27% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 80% of the organizations operate seniors housing properties (IL, AL, MC), 36% operate nursing care properties, and 34% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

- About two-thirds (68%) of organizations reporting on their independent living and memory care units in Wave 4—across their respective portfolios of properties—experienced a decrease in occupancy from the prior month. Roughly one-third of respondents with independent living and memory care segment units (32%, respectively) saw no change or an increase in occupancy rates from the time they responded April 20-April 26, 2020 to one month prior, down from 49% and 42% in Wave 3.

- In contrast, 81% of respondents with assisted living units and 82% of respondents with nursing care beds reported a decline in occupancy from the month prior. For the assisted living care segment, organizations reporting declines in Wave 4 are up from 65% in Wave 3 to 81%. The proportion of organizations reporting nursing care segment occupancy declines in Wave 4 was similar to Wave 3 (84%).

- Regarding the change in occupancy from one week ago, roughly two-thirds to one-half of organizations with independent living, assisted living and memory care segment units noted no change (between 66% and 49%); however, respondents for all three care segments reported slightly higher shares of occupancy declines. In Wave 4, about two-thirds of the organizations reporting on their nursing care segments noted declines from one week prior (62%), consistent with Waves 2 and 3 (62% and 67%, respectively).

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

- In Wave 4, between 67% and 71% of organizations reporting on their independent living, assisted living and memory care segments noted that the pace of move-ins decelerated. Between 26% and 30% reported no change in the pace of move-ins for these care segments.

- While the majority of organizations reporting on their nursing care segments in Wave 4 note a deceleration in move-ins (76%) the share is lower compared to Wave 3 (87%).

Reasons for Deceleration in Move-Ins

Respondents were asked: “The deceleration in move-ins is due to…”

- In Waves 3 and 4, roughly two-thirds to one-half of respondents attributed the deceleration in move-ins to a slowdown in leads conversions/sales or resident or family member concerns. However, more respondents in Wave 4 cited an organization-imposed ban on settling new residents into their communities than in the prior two waves of the survey (61% vs. 41% and 49%, respectively).

Move-Outs

- Between 76% and 64% of organizations reporting on their independent living, assisted living and memory care units saw no change in move-outs in the past 30-days. Assisted living saw a greater share of accelerated move-outs in Wave 4 than in Wave 3 (24% vs. 17%). Similar to Waves 2 and 3, about one-third of organizations with nursing care beds noted an acceleration in move-outs in Wave 4 (34%).

This weekly survey is designed for operators to capture high level metrics with minimal time lag to market on important trends for operators and investors. While survey questions will evolve over time, primary key metrics will continue to include changes in occupancy, move-ins, and move-outs as well as COVID-19 related data. With increased participation, future reports will provide COVID-19 related incidence data in seniors housing and care properties, including levels of testing being conducted at the property-level and lab-confirmed positive cases across the industry.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. Your support helps provide both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the current Executive Survey, please click here for the current online questionnaire.