A NIC report developed to provide timely insights from owners and C-suite operators on the pulse of seniors housing and skilled nursing sectors.

This is the first in a series of findings from NIC’s weekly Executive Survey of operators in seniors housing and skilled nursing. This week’s sample includes responses collected March 24-31, 2020 from owners and C-suite executives of 180 seniors housing and skilled nursing operators from across the nation.

Key Findings

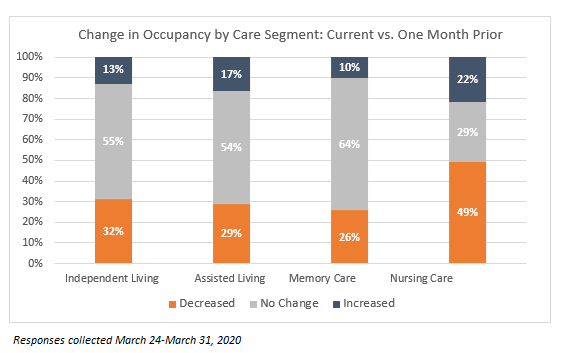

- Roughly half to two-thirds of organizations reporting on their care segment units—across their respective portfolios of properties—saw no change in occupancy rates from one month prior to the time they responded. The exception was nursing care where about half saw declines.

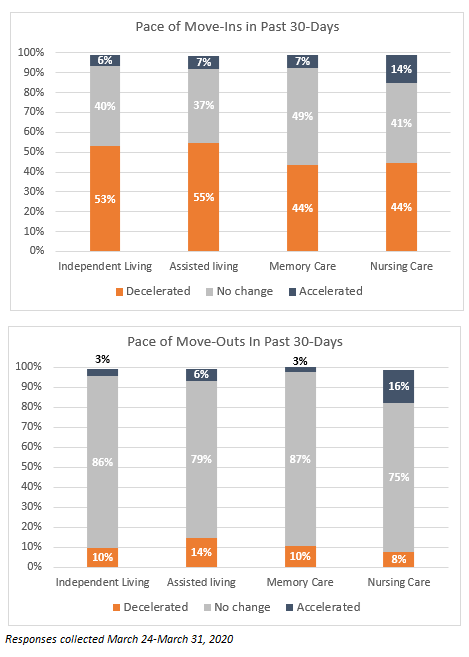

- Most organizations also reported no change in the pace of move-outs; 40%-50% reported decelerations in the pace of move-ins.

- The majority of organizations indicate that their properties are back-filling staffing shortages by increasing overtime hours, and they are supporting property staff by providing flexible work hours.

- About 40% of organizations expect no change in their development pipeline going forward.

Survey Demographics

- Slightly more respondents in the sample exclusively operate for-profit properties (49%) than exclusively operate nonprofit properties (45%), and 7% operate both for-profit and nonprofit properties.

- Owner/operators with 1 to 10 properties comprise 63% of the sample. Operators with 11 to 25 properties make up 23% while operators with 26 properties or more make up 14% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 73% of the organizations operate seniors housing properties (IL, AL, MC), 42% operate CCRCs (Life Plan Communities), and 25% operate nursing care properties.

Summary of Results

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Percent 0-100)”

- Roughly half to three-quarters of organizations reporting on their care segment units—across their respective portfolios of properties—saw no change or an increase in occupancy rates from the time they responded to one month prior, the beginning of the COVID-19 pandemic. Conversely, anywhere from one-quarter to one-half of organizations reported decreases in occupancy by care segment.

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

- Most respondents report that the pace of move-in rates decelerated over the past 30-days. The largest percentage of slowing move-ins was reported for assisted living and independent living (55% and 53%).

- The majority of respondents noted no change in move-outs.

- Nursing care beds had a higher pace of accelerated move-ins and move-outs compared to other care segments.

Mitigation Strategies for Labor Shortages

Respondents were asked: “My organization is back-filling property staffing shortages by utilizing… (Choose all that apply)”

- In response to back-filling staffing shortages, respondents indicated the following:

- 84% are increasing overtime hours

- 45% are hiring agency or temp staff

- 32% are hiring professionals from other industries

- 10% are using volunteers

Supporting Property Staff

Respondents were asked: “My organization is supporting property staff who may be experiencing challenges by providing… (Choose all that apply)”

- To support property staff who may be experiencing challenges, answers with the highest number of responses included the following:

- 76% are providing flexible work hours

- 63% are providing remote work

- 47% are offering additional paid sick leave

- 33% are providing to-go meals for families

- 22% are reimbursing childcare

- 11% are providing on-site childcare

- Answers with lower response rates included increased wages and retention bonuses, hazard pay and additional shift fulfillment, staff meals, more flexible use of PTO, and providing basic home essential supplies.

Development Pipeline Considerations

Respondents were asked: “My organization’s projected development pipeline going forward is expected to… (Choose all that apply)”

- When asked to describe expectations about their organization’s development pipeline going forward:

- 41% expected no change

- 25% expected it to decrease

- 18% expected it to increase

- Uncertainty is the main reason for expected decrease in the development pipeline (88%). Nearly one out of five (18%) cite supply chain disruptions, and 3% cite lack of construction labor. Other reasons include COVID-19, capital markets/debt availability, conserving cash, economic stress during the pandemic, and concerns about consumer buying strength.

- For those who expected their organization’s development pipeline to increase, some cite lower interest rates as a reason (25%). Others anticipate greater future demand or already have development planning underway.

If you’d like to participate in the current Executive Survey, please click here for the online questionnaire.