“Are we beginning to see signs of an upward inflection point in occupancy? The market fundamentals data continue trending positively as seen in the most recent ESI results. Between 40% and 57% of organizations reported upward changes in occupancy depending on care segment. This is especially the case for nursing care. The survey shows a clear trend of 50% or more organizations with nursing care beds reporting occupancy rate increases for six consecutive waves of survey data (collected between February 8 and May 2), without notable increases in the pace of move-outs. Moreover, data compiled in NIC’s Skilled Nursing COVID-19 Tracker clearly shows that COVID-19 cases in skilled nursing communities have fallen dramatically and at a faster pace than the broader population since the launch dates of the Pfizer and Moderna vaccines in long-term care settings in late December. These results are further substantiated by an increase, albeit modest, in February skilled nursing occupancy statistics as reported in NIC’s May Skilled Nursing Data Report.”

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 27 survey includes responses collected April 19 to May 2, 2021 from owners and executives of 77 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 27 Summary of Insights and Findings

- As in the Wave 23 survey (conducted in late February) respondents to the Wave 27 survey were asked to list one of the things that their organization plans to keep doing, stop doing, bring back and further develop. Necessity bred innovation during the worst days of the pandemic. Now, due to widespread penetration of the COVID-19 vaccine among seniors housing and care residents, many organizations are restoring the value proposition of living in seniors housing. With visitation and social distancing restrictions cautiously abating, parties and social gatherings, communal dining, group activities and events, off campus outings—and safely hosting visitors in-house—are starting anew.

- In the Wave 27 survey, organizations remain dedicated to continuing ongoing infection mitigation, health screenings of residents and visitors, and many respondents say their organizations are committed to further developing their use of technology including platforms for facilitating resident/family communications, remote work and employee training, comprehensive company-wide reporting, digital marketing including search engine optimization (SEO) lead generation, and telehealth/telemedicine. Others will continue developing niche services and healthcare partnerships. Some plan to cut back on COVID-19-related staff wages, and the cohorting of staff, meal delivery/take-out only dining, but continue to limit especially large or crowded group gatherings. Buffet-style dining may well be a relic of the pre-pandemic era.

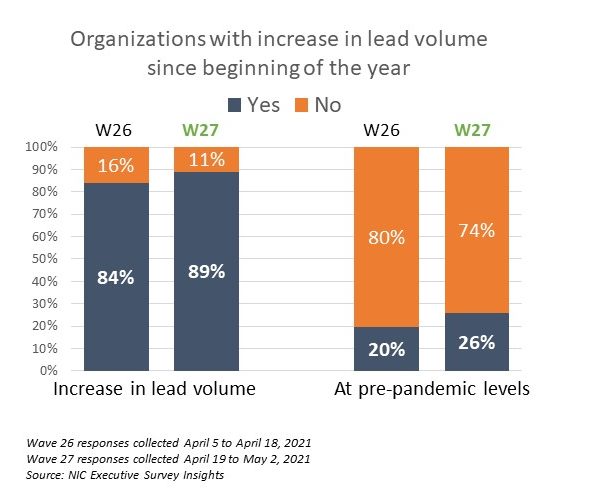

- In the current and prior waves of the survey, respondents were asked if their organizations had seen an increase in resident lead volume since the beginning of the year—and if they had—is lead volume above pre-pandemic levels? As shown in the chart below, roughly nine out of ten organizations reported an increase in lead volume (89%); one-quarter reported lead volume currently above pre-pandemic levels (26%).

- Between two-thirds and one-half of respondents note that the pace of move-ins accelerated in the past 30-days. The shares of organizations reporting acceleration in the pace of move-ins remained at or above 50% with the highest share noted for the assisted living care segment (64%) and the lowest for the nursing care segment (50%). The independent living care segment saw the largest share of organizations reporting acceleration in move-ins (57%) since the beginning of the survey in March 2020.

- The Wave 27 survey data continue to show a trend in the shares of organizations reporting higher occupancy for the independent living, assisted living and memory care segments, and each of the care segments (except nursing care) set new peaks in the time series. Between 40% and 57% of organizations reported upward changes in occupancy depending on care segment.

- Given that the survey shows a clear trend of 50% or more organizations with nursing care beds have reported occupancy rate increases for six consecutive waves of survey data (collected between February 8 and May 2), without notable increases in the pace of move outs—and further supported by an increase in occupancy reported in NIC’s May Skilled Nursing Data Report—nursing care occupancy may have reached an inflection point.

- The degrees of occupancy change vary. As referenced and shown in the chart above, occupancy increases in organizations with memory care residences peaked in the Wave 27 survey. As shown in the chart below, about one-quarter with memory care units reported no change in occupancy (27%), but about one-third reported increases of five percentage points or more (30%).

- In the face of historically low occupancy rates according to NIC MAP® data, powered by NIC MAP Vision, in the first quarter of 2021 (all-time low of 78.8% seniors housing occupancy rate), on average, about 50% of respondents to the survey since July 20 indicated their organization was offering rent concessions. As of Wave 27, two thirds (65%) of organizations with three or more properties in their portfolios are offering rent concessions to more than half (54%) or all of their properties (11%).

- Three-quarters of respondent organizations are offering discounts on rent (78%), like the Wave 26 survey, but one-half (53%) are offering free rent for a specified time (down from 65% in Wave 26). Non-monetary benefits and “something else” include community fee discounts, waiving second person fees, moving allowances, and locking in rent freezes.

- Fifteen months into the pandemic, the share of organizations that report staffing shortages has grown to nine out of ten (90%)—up from two out of three (68%) in the Wave 25 survey conducted in late-March to early-April. One-third (34%) of organizations with more than three properties in their portfolios are experiencing staffing shortages in all their properties—up from one-quarter (24%) in the prior survey.

- To attract community staff, 83% of respondent organizations are increasing wages, 79% are offering referral bonuses, 65% are offering hiring/sign-on bonuses and/or flexible schedules. Roughly 35% are doing student outreach, 33% enhancing benefits, and 20% are offering apprenticeship programs.

- According to Wave 27 seniors housing and care survey respondents, on average, nine out of ten residents (92%) of their respective properties—including all care segments across their portfolios—have been fully vaccinated for COVID-19. Having residents vaccinated has made a significant impact in opening communities. Staff uptake of the vaccine, however, leveled off between Waves 25 and 27 (63% to 66%, respectively).

- In the past five waves of the survey (Waves 23 through 27), there has been consistency in the share of organizations that definitely/probably will mandate the vaccine for staff, ranging from 20% in Wave 24 to 27% in Wave 25. Currently, one-quarter of respondent organizations indicate they will likely mandate a vaccine policy for employment.

Wave 27 Survey Demographics

- Responses were collected between April 19 and May 2, 2021, from owners and executives of 77 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise 57% of the sample. Operators with 11 to 25, and 26 properties or more, make up 43% of the sample (22% and 21%, respectively).

- Roughly one-half of respondents are exclusively for-profit providers (55%), 33% are nonprofit providers, and 12% operate both for-profit and nonprofit seniors housing and care organizations.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 71% of the organizations operate seniors housing properties (IL, AL, MC), 24% operate nursing care properties, and 35% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. Now, more than ever, we need your response so that we can track firsthand the inflection point on occupancy. This will be a turning point and we want all of our industry stakeholders to know when this important moment occurs.

The current survey is available and takes 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link, which will take you there.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and create a comprehensive and honest narrative in the seniors housing and care space at a time when trends are continuing to change in our sector.