The COVID-19 pandemic has been devastating for older adults in the U.S., particularly those with existing chronic medical conditions and complex health care needs. Many of the individuals most impacted by COVID-19 reside in nursing homes, a setting that accounted for at least 25% of all COVID-19 deaths. This setting is often conflated with senior housing, even though they are distinct care settings and serve different, although at times overlapping, populations.

To maintain the health and safety of residents, improve infection control procedures, and navigate potential future pandemics, it is imperative that there be an understanding of the impact that seniors’ housing type had on excess mortality — the difference in mortality rates during the pandemic relative to deaths before the pandemic. In order to garner this improved understanding, NORC at the University of Chicago, on behalf of NIC, conducted a landmark study comparing excess death rates for older adults living in senior housing, long-stay nursing homes, and non-congregate residential settings in the community at large.

The study measured excess death rates for older adults by housing and care setting across two distinct time periods – one prior to vaccine availability and another post-vaccine availability. The study also took into consideration the health status, demographic characteristics, health care usage, and geographic location of older adults to allow comparisons of comparable older adults regardless of where they lived.

Prior to vaccine distribution, older adults living in congregate senior living and nursing care settings did have greater excess mortality than those living in residential non-congregate settings in the community at large. Given what we now know about COVID-19 transmission, the inherent risk for those with underlying health conditions, and the elevated risk for persons who require close contact caregiving, this is an expected finding.

Study results for the post-vaccine implementation period, however, highlight how excess mortality in senior housing settings fell to similar rates as the non-congregate settings.

When comparing similarly frail older adults after COVID-19 vaccines had become available, the study concluded that continuing care retirement communities (CCRCs, also referred to as life plan communities) were significantly safer than being in the community at large. Additionally, independent living (IL), assisted living (AL), and memory care (MC) settings were determined to be as safe or nearly as safe as compared to being in the community at large once vaccines became available.

A possible explanation for these findings is that vaccine availability, distribution, and uptake among residents in congregate settings led to earlier vaccination and ultimately improved outcomes. Senior housing and nursing home settings were among the first to receive vaccines and conduct on-site vaccine clinics for residents and staff. Earlier vaccine rollout may have led to a return to socializing for the independent living cohort or stress reduction amongst those receiving vaccines. Thus, earlier vaccine administration may have had a protective impact on certain risk factors, such as isolation and loneliness.

One of the study’s key conclusions emphasizes how long-stay nursing care differs from senior housing regardless of vaccine availability. In both the pre-vaccine and post-vaccine study periods, long-stay nursing homes had a greater rate of excess mortality than senior housing. Study findings related to the number of chronic conditions residents have by property type underscore a key contributing factor: residents in a skilled nursing setting average more than 16 chronic conditions.

While residents in other senior housing settings also have a significant number of chronic conditions, it is residents of skilled nursing who are at the top. This conclusion is consistent with findings from Phase I of study that show COVID-19 mortality rates across senior housing settings increase as the health and caregiving complexity of residents increase.

The study introduced a new way to use Medicare claims data to assess the health and outcomes of older adults in senior housing and nursing care settings compared with the community at large. The methodology for the study utilizes an academically-designed data linkage approach which combines property information from NIC MAP® Data Service, powered by NIC MAP Vision, with Medicare claims and administrative data. The analysis allows for comparisons of comparable seniors across disparate living settings and is among the first to utilize an accurate, extensive list of senior housing properties matched to Medicare administrative data to identify residents of seniors housing, nursing homes and non-congregate settings.

The connection between housing and health is a critical one; importantly, this study demonstrates the feasibility of utilizing administrative claims data and property data to advance the understanding of the health and outcomes of older adults residing in senior housing settings.

View the complete white paper and associated slide deck of findings, including methodology, inclusion criteria, results, and conclusions on our website.

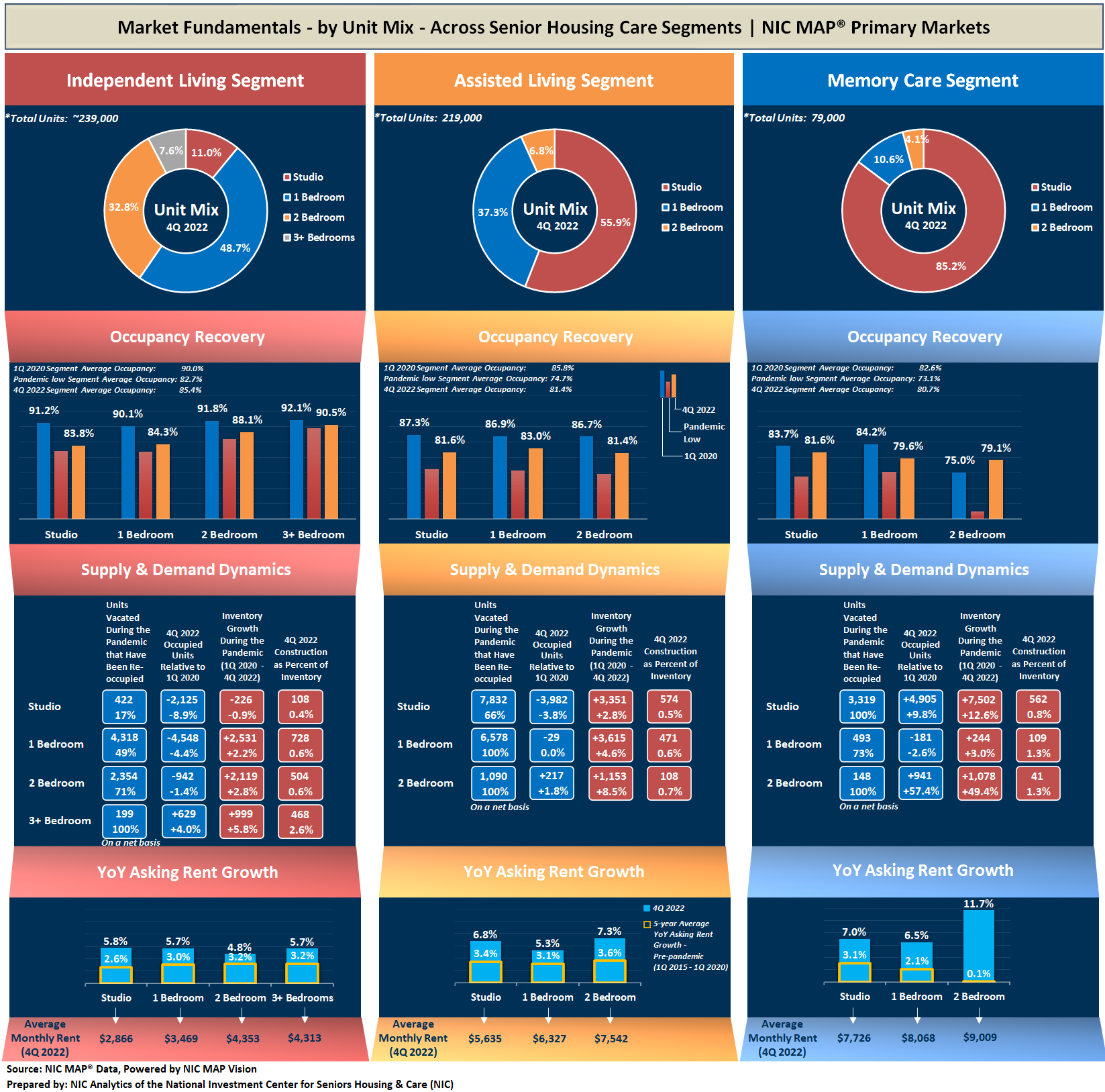

It’s a tale of two markets and many influencing factors as we move further into 2023. The capital markets remain hostage to the Federal Reserve which continues its course of tighter monetary policy and higher interest rates. Most pundits believe this will continue through mid-year 2023 until tangible evidence emerges of decelerating inflation, and in particular service inflation. Meanwhile, market fundamentals continue to improve for senior housing, with rising occupancy rates, strong demand patterns, and limited, albeit on-going, inventory growth.

It’s a tale of two markets and many influencing factors as we move further into 2023. The capital markets remain hostage to the Federal Reserve which continues its course of tighter monetary policy and higher interest rates. Most pundits believe this will continue through mid-year 2023 until tangible evidence emerges of decelerating inflation, and in particular service inflation. Meanwhile, market fundamentals continue to improve for senior housing, with rising occupancy rates, strong demand patterns, and limited, albeit on-going, inventory growth.