NIC provided a grant to NORC at the University of Chicago (NORC) to study the disparate effects of the pandemic on different seniors housing and care settings. The study results have just been released.

The analysis examines mortality rates by property level of care – independent living, assisted living, memory care, and skilled nursing – and provides a comparison to seniors aged 75 and older living in non-congregate settings (single family homes and apartments).

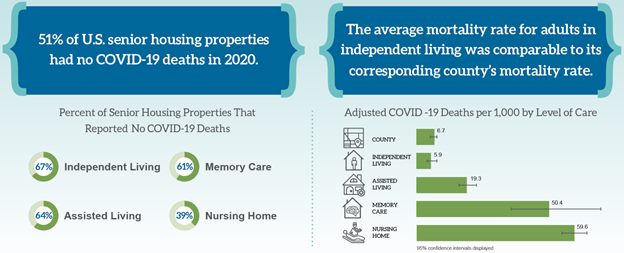

The study focused on data from 3,817 seniors housing properties across 113 counties in five states – Colorado, Connecticut, Florida, Georgia, and Pennsylvania. About two-thirds of independent living properties (67%), assisted living properties (64%), and memory care properties (61%) experienced no COVID-19-related deaths. Thirty-nine percent (39%) of skilled nursing facilities (also known as nursing homes) experienced no COVID-19-related deaths during the same period.

Also, among the study’s key findings is that COVID-19 mortality rates across seniors housing increased as the health and caregiving complexity of residents increased, with the highest percentages occurring in memory care settings and skilled nursing properties. By including a comparison to seniors aged 75 and older living in non-congregate settings in the broader geographical areas, study findings suggest that residents who live in independent living properties were not at higher risk by virtue of their congregate care setting.

Throughout 2020, average adjusted mortality rates from COVID-19 in skilled nursing were 59.6 per 1,000, likely driven by the advanced age, frailty, and comorbidities of the residents. By contrast to skilled nursing, assisted living mortality rates were two-thirds lower at 19.3 deaths per 1,000 residents. Resident deaths in independent living settings were statistically comparable to the experience of older adults living in non-congregate settings in the broader county.

Adjusted mortality rates in memory care were 50.4 per 1,000 residents, which is statistically comparable to skilled nursing. Memory care units faced particular challenges with infection control, since seniors who have cognitive impairments are more likely to require additional care and support for basic needs.

In a secondary analysis that looked specifically at continuing care retirement communities (CCRCs) residents, CCRCs were associated with a significantly lower expected mortality rate when compared to non-CCRCs. The mean expected mortality rates for CCRCs across all care segments was 10.0 per 1,000 as compared to 19.9 per 1,000 in non-CCRCs.

The study also included a dozen interviews with seniors housing operators and eight state affiliates of LeadingAge and Argentum, organizations that serve non-profit and for-profit aging services, to understand the context of the COVID-19 case and death data, and the challenges they faced during the pandemic. These qualitative interviews helped place the study’s quantitative results in context and help readers understand some of the challenges faced in managing COVID-19 in these settings, including PPE shortages, delayed testing results, and a rapidly changing regulatory environment across all levels of government.

A second phase of the study is being planned to build upon these findings by comparing death rates across levels of care while risk-adjusting for age, health status, and demographic characteristics, as well as understanding the impact of COVID-19 on all-cause mortality by care setting. These data findings will be critical to improving the public’s understanding of the safety levels within the various seniors housing care segments. Phase 2 of the COVID-19 research study is expected to be completed by November 2021.

To view the study’s complete findings and conclusions, please see the Final Report and detailed Technical Report by visiting NIC’s COVID-19 study landing page.