Summary. The highest performing senior housing properties in 2Q20, as measured by occupancy, generally remained highly occupied a year later, while properties with the lowest occupancies in 2Q20 tended to remain in the bottom.

Properties in the middle of the pack in 2Q20 saw large drops

in occupancy over the one-year course of the pandemic studied in this analysis and had not shown signs of recovery as of 2Q21.

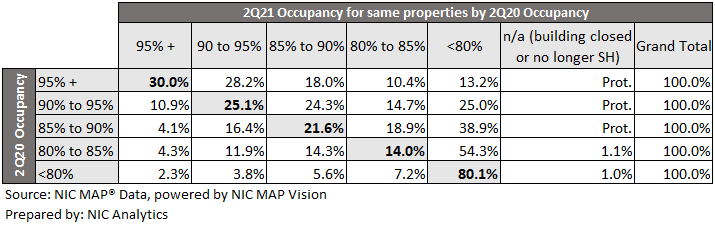

Methodology. We categorized seniors housing properties in the NIC MAP® Primary Markets that were open in 2Q20 and 2Q21 into occupancy cohorts to investigate how properties in different categories performed over the last year. The property count for this analysis totaled 5,072 properties. Notably, some properties closed since 2Q20, some are no longer seniors housing, or were temporarily under renovation in 2Q21. Those properties are captured in the n/a column in the table below. Rows in the table below represent the occupancy band of the corresponding properties in 2Q20 and the columns represent their 2Q21 band.

Highly occupied properties in 2Q20 tended to be highly occupied in 2Q21. Of the group that were 95%+ occupied in 2Q20, 30.0% were in that same occupancy band for 2Q21 and 28.2% were in the 90% to 95% category. This suggests that the high property level performers in 2Q20 tended to be fairly resilient (or did take occupancy hits but still were able to recover). However, even for that 95%+ cohort in 2Q20, 41.6% dropped to below 90% in 2Q21, so that group of properties wasn’t completely protected from pandemic-related occupancy declines with 13.2% slipping into the under 80% occupancy group.

Of the 340 properties that were at or above 95% occupancy in 2Q20 and 2Q21, two thirds of this group were majority assisted living properties, with the remaining one third being majority independent living. The average age of these properties was 26.4 years in 2Q21. The average size of these properties was 126 units, which is nearly the same as the average property size of seniors housing in the NIC MAP Primary Markets (128 units). The top 5 metros in which these 340 properties were located included New York (26 properties, 8.2% of open properties in the New York metro in 2Q20), Portland (23, 12.1%), Los Angeles (22, 6.9%), Minneapolis (22, 8.1%), and San Francisco (21, 13.5%).

Of the 320 properties that were at or above 95% occupied in 2Q20 but dropped to between 90% and 95% in 2Q21, the average property age was 25.1 years old, and the average unit count was 162 units in 2Q21. Of this group 57% were majority assisted living and 43% were majority independent living. The top 8 metros these properties were located in included New York (24), Detroit (22), Minneapolis (20), Chicago (20), and San Francisco, Seattle, and Washington (17 each).

Of the 149 properties in that were in the 95%+ group in 2Q20 but declined to below 80% in 2Q21, the majority were majority assisted living (87%) with only 13% being majority independent living. The average property size was smaller at 91 units and the average age of property was 23 years old. Los Angeles was the metro area that had the most properties that dropped from the 95%+ group to the <80% group at 18 properties. The other four metros in the top five were Chicago (15 properties), Dallas (11), Miami (10) and San Francisco (7).

The middle of the pack in 2Q20 took some hits and haven’t quite recovered yet. For both the 85% to 90% and the 80% to 85% groups in 2Q20, the biggest shifts were into the < 80% category in 2Q21. The average age of property for the 313 properties in the 85% to 90% cohort that dropped into the < 80% group was 24.1 years in 2Q21 and the average property size was 116 units. For the 341 properties in the 80% to 85% cohort that dropped into the < 80% group the average age was 23 years old and the average unit count was 132 units. The 80% to 85% cohort that dropped to < 80% only had a 1% increase in inventory from 2Q20 to 2Q21 and the 85% to 90% cohort had less than 1%, so the declines in occupancy were due to negative absorption as a result from the pandemic rather than inventory growth from expansions.

Properties with low occupancy in 2Q20 tended to continue to have low occupancy in 2Q21. Of the <80% cohort in 2Q20, 80.1% of those properties remained in the under 80% cohort in 2Q21, continuing to struggle. Only a mere 2.3% of the <80% in 2Q20 cohort managed to grow occupancy to 95%+.

Of the 1,145 properties that were in the <80% group in 2Q20 that stayed in the <80% group in 2Q21 had an average age of 18 years, partially reflecting that properties that were still in lease up in 2Q20 most likely fell into this category. The average property size of this group was 115 units. They were also primary majority assisted living (80% of the properties) with only 20% being majority independent living. This group only had a mere 0.3% of inventory growth so inventory growth was not a contributing factor to these properties remaining low.

Removing the group of properties in the <80% group in both 2Q20 and 2Q21 that were under 2 years old in 2Q20 and looking only at the subgroup of properties that would meet NIC’s definition of stabilized in both 2Q20 and 2Q21, the occupancy of those properties dropped from 68.6% in 2Q20 to 64.6% in 2Q21. This shows that this group of properties is continuing to struggle in 2021.

Conclusions. Many of the highly occupied properties in 2Q20 were still highly occupied in 2Q21 and many of the lower occupied properties in 2Q20 still had low occupancy in 2Q21. Many properties in the middle bands for occupancy suffered occupancy declines and have not yet begun to recover.