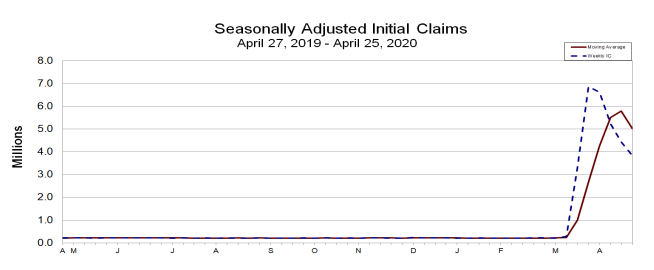

The Department of Labor reported that 3.8 million Americans filed for unemployment insurance benefits in the week ending April 25, 2020 as the COVID-19 pandemic continues to cause businesses to lay off or temporarily furlough workers. This was a decline of 603,000 from the previous week’s upwardly revised level of 4.4 million. The speed and scale of the job losses is unprecedented. In the past six weeks, approximately 30 million people have filed claims. By comparison, 9 million jobs were lost over the course of the 2007-2009 recession.

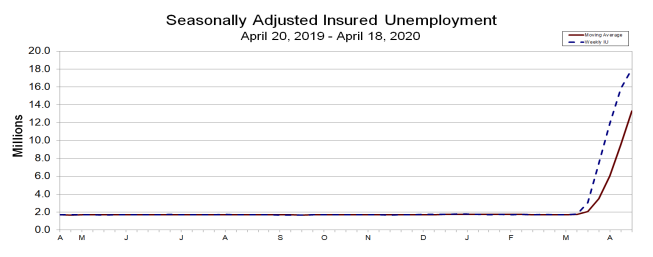

Continuing claims for regular benefits, which are reported with an extra week’s lag, rose 2.2 million to 18 million. This measure, which accounts for people who are continuing to receive benefits, reached a record high. This has also pushed the insured unemployment rate (the share of the labor force that claims unemployment benefits) higher. The insured unemployment rate was 12.4% in the week ending April 18, an increase of 1.5 percentage points from the prior week and up from 1.2% pre-COVID-19. This also marks the highest level of the rate in the history of the data series.

Jobless claims are laid-off workers’ applications for unemployment insurance payments. Gig-economy workers, self-employed people and those seeking part-time work are now eligible to apply for benefits in an expanded unemployment assistance program recently created in response to the pandemic. Further, more than 40 states were paying recipients an additional $600 a week in enhanced unemployment benefits on top of the usual stat payments.

The largest increases in initial claims for the week ending April 18 were in Florida, Connecticut, West Virginia, Louisiana, and Texas.

Separately, the Commerce Department reported yesterday that real GDP growth fell at an annualized rate of 4.8% in the first quarter, down from positive 2.1% growth in the fourth quarter of last year. This was the worst quarterly GDP performance since 2008 and marked the first quarter of the 2020 recession. Second quarter projections range from a decline of 30% to 40% at an annualized rate. Two quarters of negative GDP growth signal an official recession. Consumer spending fell at an annualized pace of 7.6% while business investment plunged 8.6%. Surprisingly, health care spending plummeted by 18% which, given its importance in the economy, was enough on its own to subtract 2.3% points from overall GDP growth. Even though COVID-19 is boosting some hospital and public health activity, non-emergency hospital visits have been postponed and other health care providers, like dentists, have been shut. Helping to offset these declines was residential investment which increased by a whopping 21% as low mortgage rates boosted construction and home sales earlier in the year. This is not likely to continue as the home sales market has also been affected by the pandemic.

In the meantime, the April FOMC meeting took place yesterday. Federal Reserve officials emphasized downside risks to the economy due to the coronavirus and a continued desire and willingness to provide support through monetary policy. Over the next few months, the Fed is expected to continue to expand its balance sheet toward $10 trillion, equivalent to about 50% of GDP. The Fed’s focus will be on establishing and expanding its credit facilities for the private sector. Interest rates are likely to stay low until the jobless rate returns to the “natural rate” of between 4.0% to 5.0%, which is not likely to occur until 2022 or later according to Bloomberg analysts. As recently as February, the unemployment rate was 3.5%, a 50-year low. In March, the rate had already increased to 4.4%. Analysts project a rate as high as 15% to 20% in the coming months as the ranks of the unemployed continue to swell.

The first phase of the Fed’s emergency actions was focused on supplying liquidity to financial institutions and ensuring that key financial markets did not seize up. The second phase being implemented now will see the Fed go further than ever before in buying private sector assets and lending directly to non-financial businesses.