With the senior housing and care sector at a crucial inflection point, the 2023 NIC Fall Conference convened a cross section of industry stakeholders to network, learn, and identify strategic opportunities.

The NIC conference theme, “Accelerating Change” provided a timely framework to address the disruptions that continue to be felt throughout the U.S. economy, the healthcare services sector, the labor and capital markets, and the evolving preferences of aging consumers.

“Transformational disruption demands a pivot,” said NIC Board Chair Susan Barlow, co-founder and managing partner at Blue Moon Capital Partners. “With the pain comes great opportunity for the industry.”

The conference was held October 23-25 at the Sheraton Grand Chicago. Highlights included:

- An economic keynote conversation with former Speaker of the U.S. House of Representatives Paul Ryan on the influence of policy and economics in today’s global risk environment.

- The welcome return of “NIC Talks,” the 12-minute Ted-style talks that offer innovative insights and creative solutions to industry challenges from visionary thought leaders.

- A skilled nursing keynote with Phil Fogg, Jr. on the headwinds and tailwinds driving the sector.

- A multi-layered market analysis from CEO’s of the sector’s top REIT investors—Dabra Cafaro and Shankh Mirta.

- Deep dives into the challenges facing the capital markets and what’s ahead.

- An update from executives at the Alzheimer’s Association—Dr. Dr. Joanne Pike and Robert Egge—on encouraging medical breakthroughs that will change the course of memory care.

- Multiple daily, formal and informal, networking opportunities.

The conference drew 2,800 attendees, with 74% comprised of C-suite and executive decisions makers. Operators, developers, and capital providers represented 72% of attendees, a mix that supports conversations to promote housing access and choice for older adults.

Networking Opens Professional Opportunities

Attendees enjoyed multiple occasions to engage in results-oriented meetings with other industry stakeholders including several well-attended receptions, with one for first-time conference attendees. A Women’s Networking Meetup drew several hundred women who exchanged ideas and made connections.

Attendees enjoyed multiple occasions to engage in results-oriented meetings with other industry stakeholders including several well-attended receptions, with one for first-time conference attendees. A Women’s Networking Meetup drew several hundred women who exchanged ideas and made connections.

NIC Board Chair Barlow spoke to the women’s meetup and relayed her own story of how she and Kathryn Sweeney shared a cab ride after an industry meeting and then decided to launch their company, Blue Moon Capital Partners. “This gathering is an actionable event,” said Barlow. “Identify opportunities in your organization and ask yourself what you are doing to move forward. Get involved.” She added that her participation in NIC had prepared her to succeed throughout changing business cycles.

NIC hosted a reception for college scholars who are currently enrolled in senior living programs and attended the conference via conference scholarships sponsored by Welltower. NIC Co-Founder and Strategic Adviser Bob Kramer spoke at the reception. He emphasized that senior living offers excellent career opportunities for those inspired to “do well by doing good.”

Experts Discuss Relevant Topics

The conference offered 10 stand-alone educational sessions. Many of the discussions addressed both the tailwinds and headwinds faced by the industry. (High quality videos of most educational sessions are available to attendees in the conference mobile app for conference attendees. Click here to access the app.)

A standing-room only crowd packed the ballroom for the keynote session with former U.S. House Speaker Ryan. He held a conversation on stage with Bob Hillis, chairman, CEO and founder of Direct Supply/Aptura.

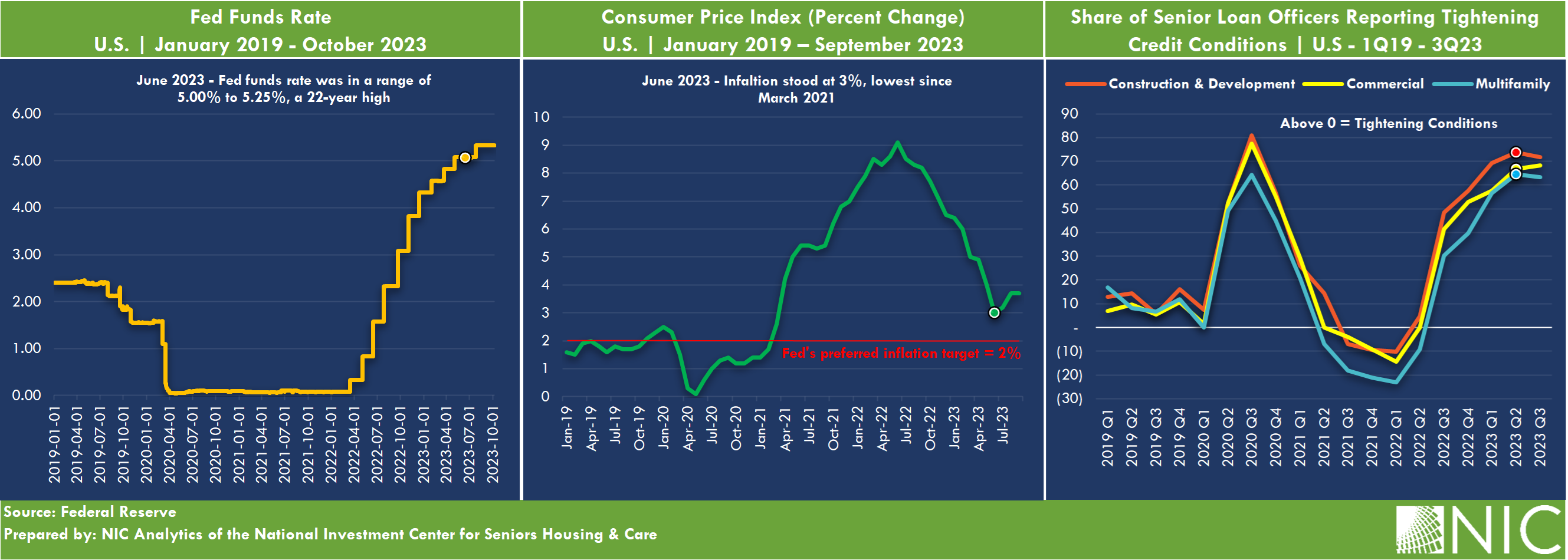

Known for his policy expertise, Ryan expects capital to be more expensive for a longer period of time. He said that the massive amount of U.S. Treasury debt offerings coming due will need to be refinanced at attractive yields which will keep interest rates high.

Known for his policy expertise, Ryan expects capital to be more expensive for a longer period of time. He said that the massive amount of U.S. Treasury debt offerings coming due will need to be refinanced at attractive yields which will keep interest rates high.

Ryan also pointed to positive tailwinds for the industry, including a healthy jobs market and an aging population. The discussion also covered the regulatory environment, technology, immigration, and the current political landscape. Ryan noted that it was never a good idea to bet against free enterprise.

NIC Talks featured four main-stage speakers. The session was curated by NIC’s Kramer. “These speakers inspire us to think differently about senior housing and care,” he said.

Caroline Pearson, executive director of the Peterson Center on Healthcare challenged the audience to embrace the integration of healthcare and senior housing. “Think about ways to locate healthcare services in your community,” she said, explaining that healthcare is both a need and a want of residents.

Former Apple executive Dhaval Patel provided a roadmap on how to sort through various technology offerings and select the right ones. His advice: Ask yourself if the technology is solving the right problem.

Other provocative topics presented by NIC Talks speakers Hanh Brown, Founder and CEO of ThinkA16, and Gerard van Grinsven, CEO of Van Grinsven Hospitality Group, included the impact of artificial intelligence on senior living and how to delight and surprise consumers.

Capital Markets Under Strain

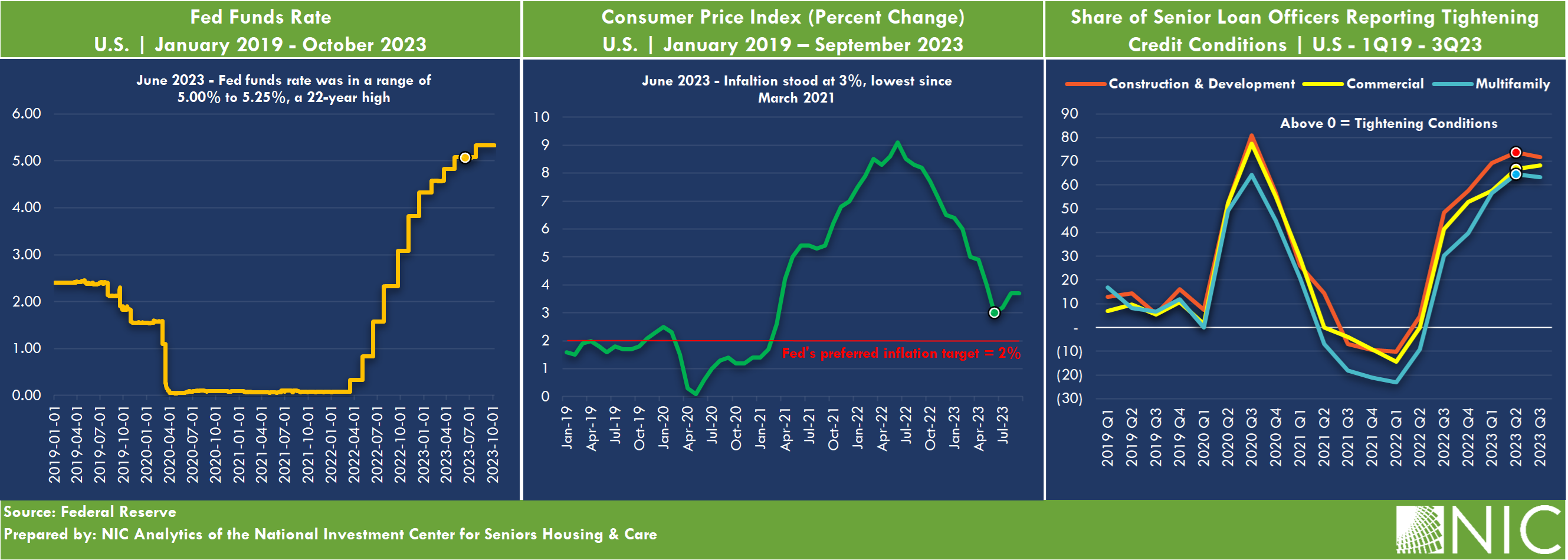

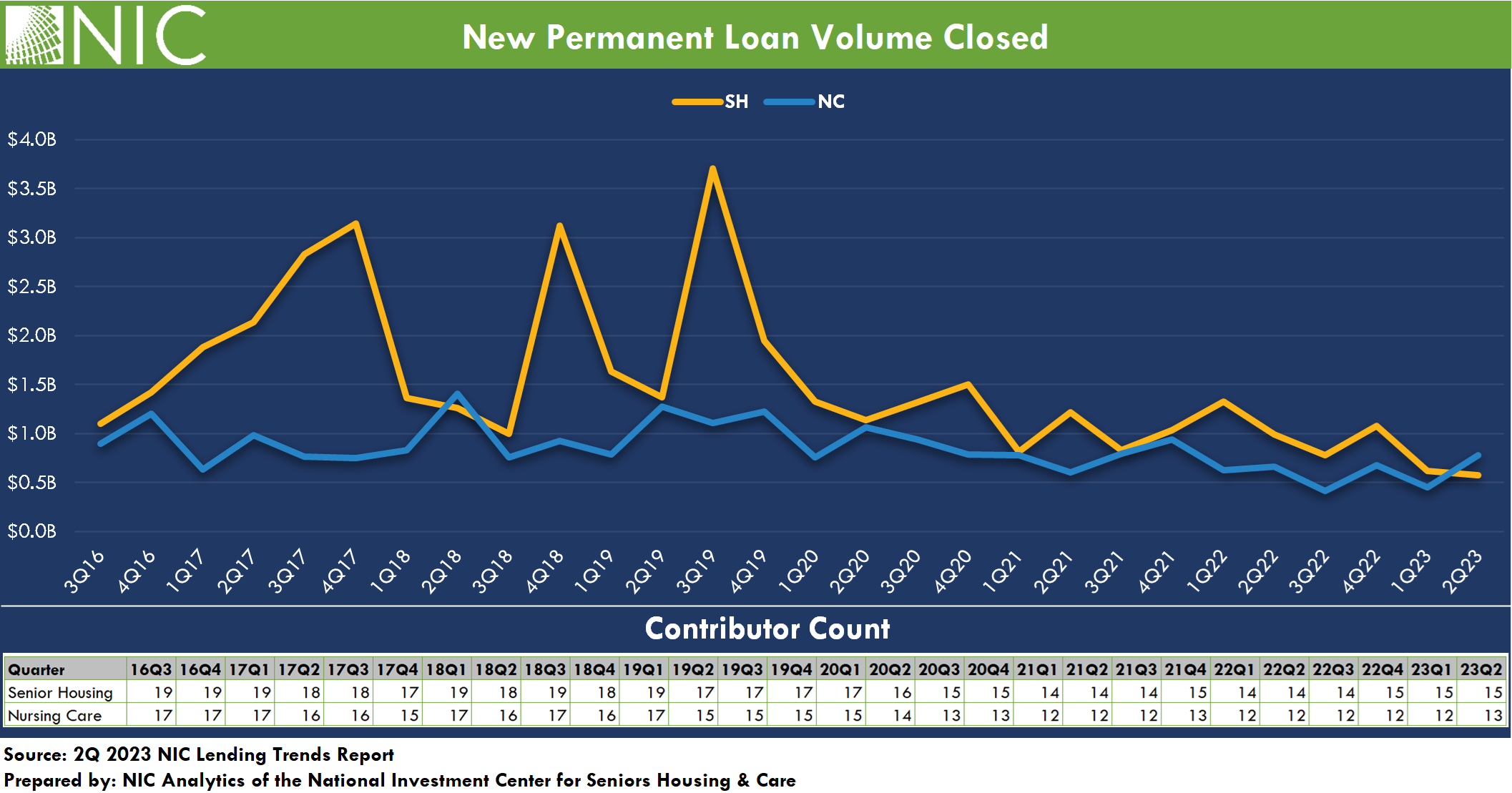

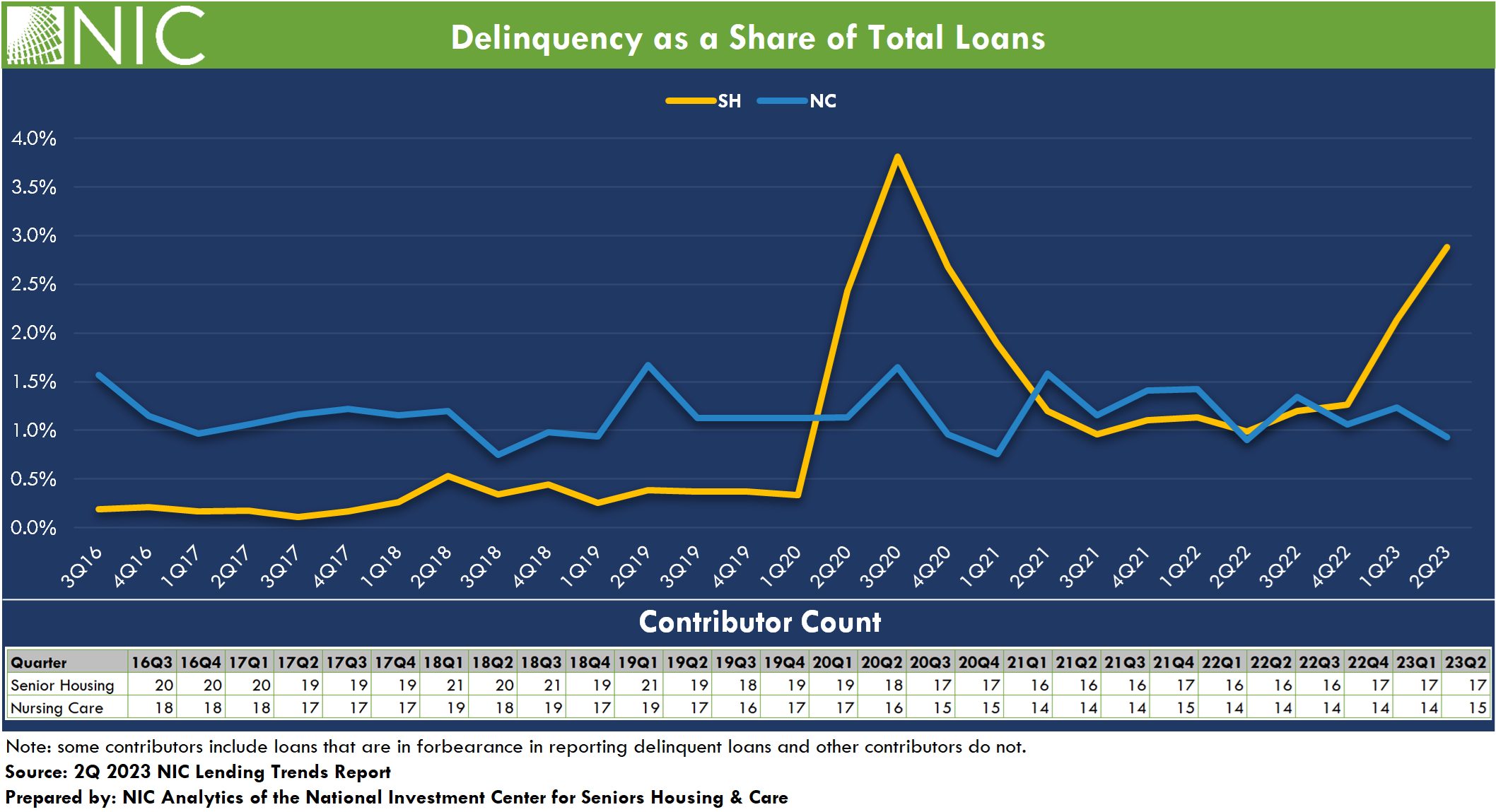

Several sessions addressed the state of the capital markets and financing challenges. However, the panelists agreed that a huge wave of new demand from aging baby boomers will change market dynamics.

The opening panel discussion paired Ventas Chairman and CEO Debra Cafaro and Welltower CEO Shankh Mitra. The session was moderated by Randy Richardson, former CEO, president and strategic advisor at Vi Living.

The opening panel discussion paired Ventas Chairman and CEO Debra Cafaro and Welltower CEO Shankh Mitra. The session was moderated by Randy Richardson, former CEO, president and strategic advisor at Vi Living.

Out of control construction prices and the dramatic spike in the cost of capital will continue to dampen new development, according to Mitra. Cafaro said that a big company with staying power helps to ride out commercial real estate cycles.

A deep dive into the debt market and a separate session on valuations illustrated the challenges faced by investors. Arick Morton, CEO at NIC MAP Vision provided some perspective on market fundamentals. Occupancy is recovering and rent growth has caught up with wage growth. Demand is strong.

The final day of the conference kicked off with a keynote discussion titled, “Navigating the Current Skilled Nursing Environment.” Phil Fogg Jr., CEO at Marquis Companies, was interviewed by Steve Monroe, editor at large at Irving Levin Associates.

As immediate past Board Chair of the American Health Care Association, Fogg gave a thorough analysis of the skilled nursing sector. He is concerned about proposed regulations that mandate new staffing minimums. But Fogg expects providers to have more negotiating power with payers in the next 3-5 years.

Attendees also heard from experts on promising Alzheimer’s research, the alignment of management companies and owners, and how to establish inclusive labor practices.

During a session on how to appeal to the new consumer, moderator Helen Foster, principal at Foster Strategy, challenged attendees to experiment. “Baby boomers will change our industry,” she said. “So many solutions are needed. True innovators are looking to outside sources for inspiration. We have to take risks.”

During a session on how to appeal to the new consumer, moderator Helen Foster, principal at Foster Strategy, challenged attendees to experiment. “Baby boomers will change our industry,” she said. “So many solutions are needed. True innovators are looking to outside sources for inspiration. We have to take risks.”

###

Mark your calendar! Join us March 5-7 at the 2024 NIC Spring Conference in Dallas. Registration opens November 29th!!