“An investment in knowledge pays the best interest.”

So said Benjamin Franklin, who had good experience creating, building, and partnering with others to build some significant and (lasting!) things.

We are strong believers in the power of education and have been a valued source for several educational opportunities in senior housing and care investment over the years with our sold-out boot camps and curated insightful sessions at our NIC Spring and NIC Fall conferences. We saw that the industry lacked a true provider of comprehensive professional education for investment and finance professionals in the senior housing and care space, which is why we are excited to announce the launch of NIC Academy.

Fundamentals of Underwriting Senior Housing & Care Certificate Program — A first-of-its-kind professional certification program dedicated solely to senior housing and care investment.

Upon completion of the program, graduates receive a certificate from NIC Academy in Fundamentals of Underwriting Seniors Housing & Care Certificate Program and a professional designation of Certified Senior Housing Investment Professional (CSHIP). This prestigious designation can be applied on LinkedIn profiles, and email signatures and will signal to industry leaders that this candidate has learned directly from industry experts and is different from the rest.

This new Certification for Underwriting in Senior Housing and Care program is an invaluable resource that focuses on the six pivotal topics critical for underwriting success. In just 90 days, students acquire the essential skills to kickstart their careers and fortify their organizations. This innovative program not only equips individuals with expertise but also offers a substantial benefit to employers. With this Certificate, employers can save both time and money, all while fostering the professional development tool for existing employees in need of upskilling or reskilling. The courses within the certification program are led by industry experts who draw from decades of experience in the sector, providing unparalleled insights and knowledge.

Candidates will gain insights and skills that would typically require years of on-the-job training. The curriculum has been meticulously crafted and course offerings range from comprehensive discussions to deep case studies on real-world issues.

The following six courses are designed to take about eight hours each:

- Introduction to Senior Housing and Care Industry

- Fundamentals of Operations

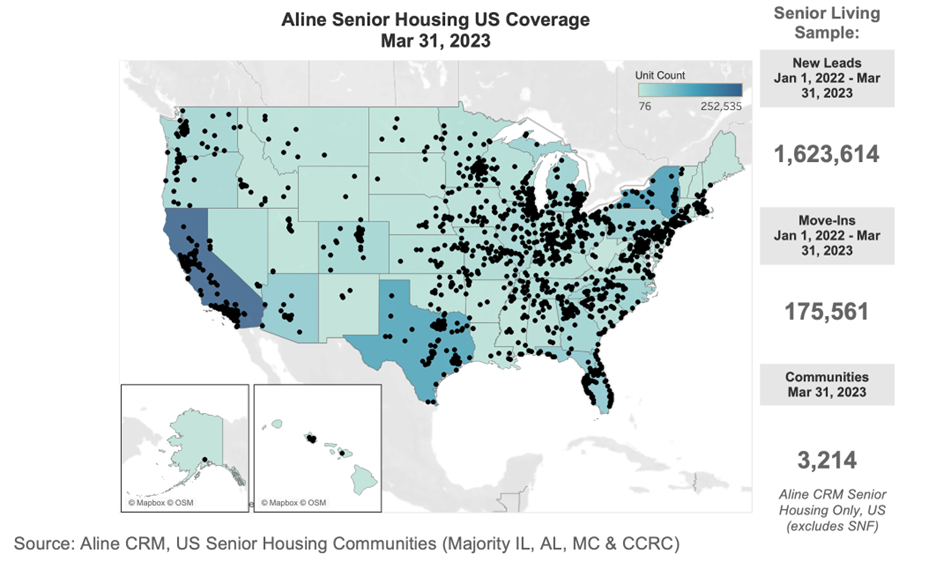

- Market Analysis

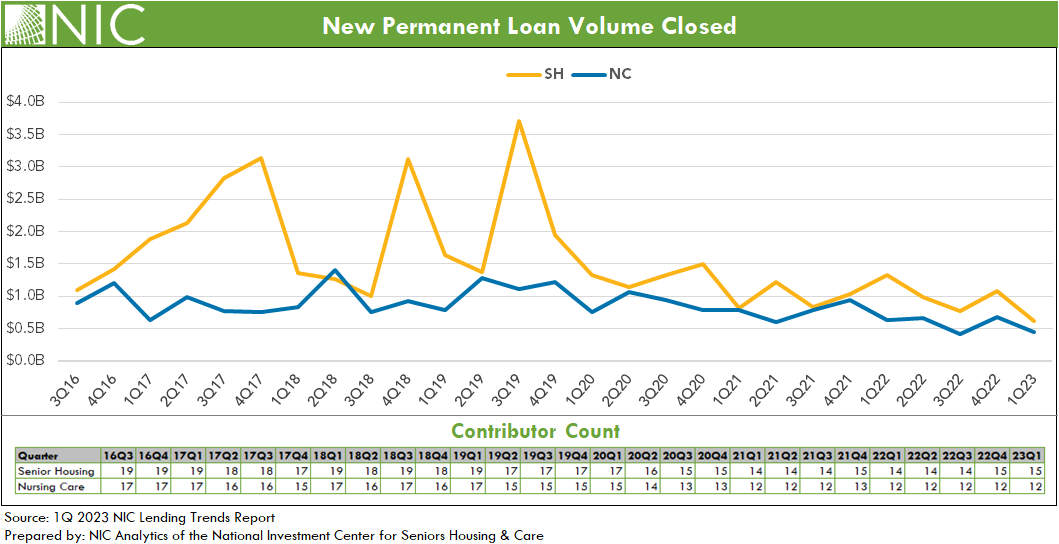

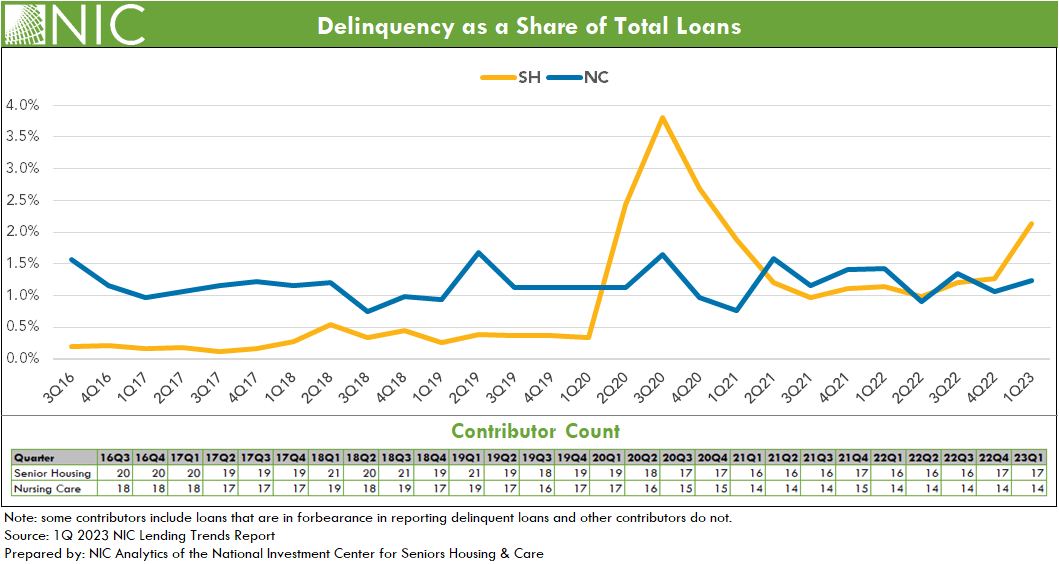

- Capital Markets

- Transactions

- Capstone Experience

Thanks to NIC’s extensive resources, thoughtfully designed curriculum, accomplished faculty, and effective teaching methodologies, students can promptly apply their acquired knowledge to create meaningful contributions within their organizations. This empowers them to delve into pertinent topics such as property valuation in senior housing and care, ensuring their learning translates into actionable insights.

Learning at your convenience

All NIC Academy program courses are offered online, multiple times per year, or on-demand. Online discussion rooms are seamlessly integrated with the courses to help answer questions, expand perspectives, and strengthen the community.

The NIC Academy is dedicated to consistently providing high-quality educational opportunities and we’re proud to offer this new certification program.

Learn more about our certificate program as well as other NIC Academy offerings.

“NIC Academy’s Fundamentals of Underwriting Senior Housing and Care Certificate Program fills the void for comprehensive training of financial and investment professionals in our industry. As we ramp up hiring to meet demand growth, this gold standard Certificate Program will be our go-to resource to quickly get our team up to speed.”

-John Rijos, Co-founder and Operating Partner, Chicago Pacific Founders