In the years ahead, millions of aging middle-income Americans will need a reasonably priced housing and care option. But innovative ideas are vital to solve the issue of affordability.

Cutting-edge strategies for the senior housing middle market will be shared by the industry’s top leaders and stakeholders at a session during the 2022 NIC Spring Conference in Dallas (March 23-25.)

“The middle market represents a huge opportunity” said NIC Senior Principal Ryan Brooks. He will be a co-speaker at the session, “The Forgotten Middle Market: Vision to Execution.”

A presentation by Brooks during a panel discussion with industry experts will be followed by attendees participating in facilitated breakout group discussions— to take a deep dive into topics addressed by the panel, and strategies to apply these ideas to their business models.

To preview what attendees can expect to learn at the session, Brooks recently spoke with session moderator Diane Burfeindt, managing partner at Trilogy Connect; and co-facilitator Jim Thompson, senior vice president and director of senior housing investments, BOK Financial.

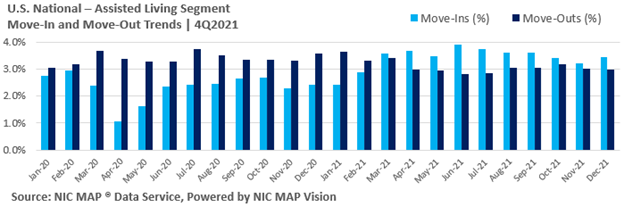

The theme of opportunity will be explored at the session. The need is growing for the product, first identified by NIC in its study “The Forgotten Middle.” It shows that millions of seniors will not be able to afford most of today’s private-pay senior housing communities. These seniors don’t qualify for Medicaid or other government assistance either. So, what’s the best approach?

Repurposing properties is emerging as a key strategy and will be discussed at the session. The high cost of new construction makes it difficult to provide an affordable middle-market property, according to Thompson. However, the pandemic may have provided a “window of opportunity” for developers and investors to acquire older properties at a discounted price. “Repurposing properties can provide an affordable real estate component,” said Thompson.

Other creative real estate strategies will be explored. These include partnering with affordable housing developers or designing new types of developments that combine affordable senior living with retail or multi-generational apartment properties.

“Affordable care is a big issue,” said Burfeindt. She added that it depends on how “care” is defined. Is it medical care? Service coordination? “What should a middle-market product provide?” she asked. Instead of a community that offers everything for the resident, the middle-market product could create an environment where residents can do things for themselves or link them to outside services.

Panelists will discuss creative care solutions, such as partnering with Medicare Advantage programs to help defray assisted living costs. Residents could be tapped as volunteers for some duties along with volunteers from the wider community. Funding may also be available from local social service groups. “What we’re finding is that organizations are developing strategies that are not one-size-fits-all. They are identifying the targeted income in their community and working towards partnerships and solutions that bring existing tools together in a new way that is ultimately less resource-intensive,” Burfeindt remarked.

Session attendees will hear how investors view the middle market. The sheer size of the market is of interest to investors, according to Thompson. A high, stable census and dependable cash flow will be a characteristic of the middle market for years to come, he said. He added that though returns could be lower than traditional private-pay senior housing, multifamily investors may see a middle market senior living product as a way to diversify their portfolio’s cash flow.

Middle-market staffing strategies will also be addressed during the session. Attendees will learn how technology and other innovations will help improve affordability and ease staffing pressures. “Staffing in the middle-market will look very different than we’re accustomed to seeing in other senior housing and care settings,” said Thompson.

Mark your calendar for this can’t-miss session at the 2022 NIC Spring Conference:

“The Forgotten Middle Market: Vision to Execution”

Thursday, March 24, 1:30-3:15, Level 3, Trinity Ballroom