Part II—Debt Providers Offer Possible Solutions

Innovative ideas of how to provide housing for the growing number of middle-income seniors were discussed by industry stakeholders at a recent investor summit in New York City. Convened by NIC, the summit also spotlighted new research on middle–market seniors.

Results of the research were initially detailed at an April policy forum in Washington, D.C. (link to research results). The ground-breaking study, “The Forgotten Middle,” forecasts a shortage of affordable seniors housing and care options for middle–income seniors in the next decade.

The investor summit included three separate panels of industry participants: equity investors, debt providers, and property operators already piloting middle-market options. Each panel discussed what is needed to make middle–market solutions work from their perspectives.

What follows is an edited transcript of the second panel discussion which focused on debt providers. (A link to the other discussions is here.)

The debt panel was moderated by NIC Chief Economist and Director of Outreach Beth Mace. Participants included: Robert M. White, Jr., founder and president, Real Capital Analytics; Michael Patterson, vice president, Underwriting and Credit, Freddie Mac; Christopher Callaghan, group vice president, head of healthcare banking, M&T Bank; and Heidi Brunet, managing director, Newmark Knight Frank.

Mace: I’d like to introduce Bob White, founder and president of Real Capital Analytics, who will set the discussion in context by providing a profile of debt providers to the seniors housing market.

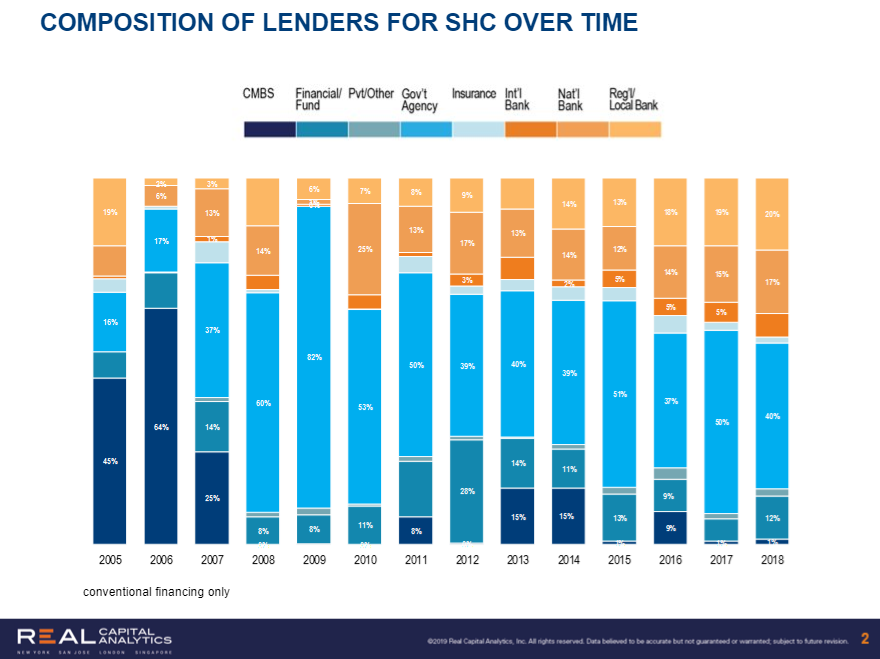

White: A transition in the composition of lenders for seniors housing has occurred since mid–2005 through today. Before the financial crisis of 2007-08, the sector relied on the CMBS marketplace; in contrast CMBS is not a source of financing for seniors housing today. The government agencies have carried lending for the multifamily and seniors housing markets since the crash. At its peak in 2009, the government agencies were 82% of conventional acquisitions and refinancings for seniors housing. The agencies were half of originations in 2011 and 40% in 2018. The highest proportion of bank lending took place in 2018. Regional banks accounted for 20% of the loans and national banks made 17% of the loans. Financial funds accounted for another 12%. Institutional debt funds will be an interesting component of the capital stack going forward.

Seniors housing relies on national and regional banks for new construction loans. There are 6,000 banks, but relatively few are active in seniors housing. We need to educate the regional banks about seniors housing. The government agencies and local and regional authorities are generally not active in construction financing which should change if we’re talking about increasing middle–market seniors housing availability It’s an important factor to meet the upcoming middle–market demand.

There are differences by market. The major metros—Boston, New York, Chicago, San Francisco, Los Angeles—have the greatest competition among capital providers. The agencies are more active in smaller markets but there are fewer options for financing.

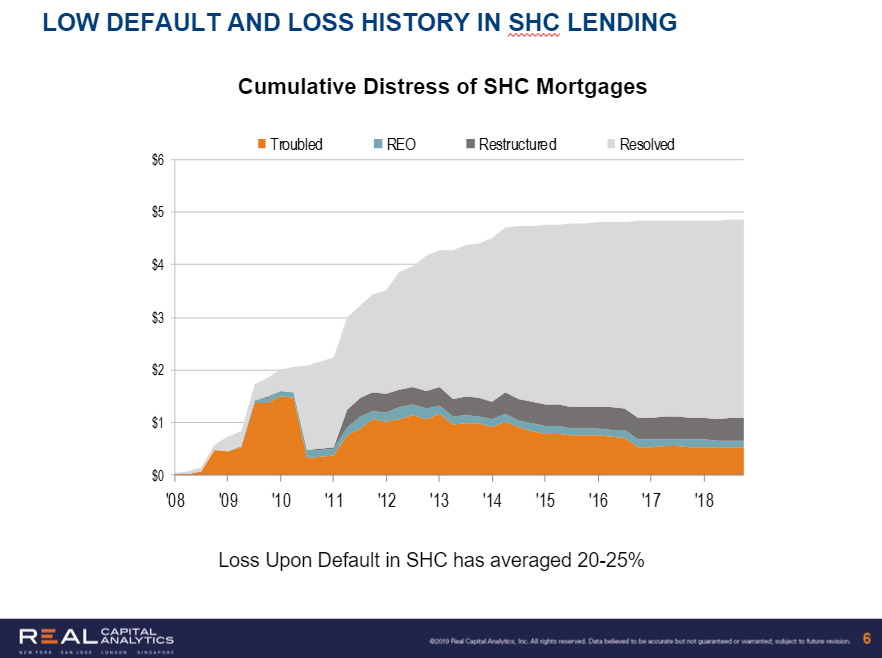

The seniors housing market has low default rates. By 2011, we had tracked about $300 billion of distressed commercial mortgages nationwide. Seniors housing was less than $3 billion of that. Default rates in seniors housing were minimal. Losses upon default have averaged 20-25%, comparable to multifamily losses but lower than other property types, especially compared to hotels which had the highest default and loss rates. Some people attribute that to the operating component. It’s important to track default and loss rates because of new regulations around capital withholding requirements for banking organizations. We could get cheaper debt for seniors housing if we show default and loss rates are lower than industry standards.

Mace: What is your viewpoint of lending to the seniors housing sector?

Patterson: Freddie Mac purchases seniors housing mortgages for independent living, assisted living, memory care and apartments. We purchased over 200 mortgages last year which were sold to investors as securities. Seniors housing is a good business line for Freddie Mac. The industry is growing, profitable and stable, and it provides a durable income stream.

Brunet: At Newmark Knight Frank, we originate the loans and service them on behalf of our clients. Freddie Mac has financed $20 billion of seniors housing with us and the losses are insignificant.

Mace: Can that same model work for middle–income seniors housing?

Patterson: Yes, we make mortgages on durable cash flow and that would continue as long as the properties are stable and have a steady cash flow. We have been able to securitize mortgages and we think that will continue. I have been lending for 35 years and the best thing about securitization is that we can see how the mortgages perform on a monthly basis which informs investors. Education is a big part of what we bring to the process.

Brunet: We have green investors and a middle-market product might attract a certain type of investor with a social mission.

Callaghan: We can underwrite to a lower margin for permanent debt and get comfortable with the sustainable cash flows. The challenge is finding the equity for construction. How do you develop a brand new facility? Or find the equity to convert a building into seniors housing? If you look at the ability to take cash out at low margins, it’s a challenge for the institutional markets to get their returns over a five year period.

Mace: Would you provide debt for a middle-market product?

Callaghan: Yes, we’ve done low–income properties and high–end properties in tax exempt scenarios where 20% of the units are for those below the area’s median income. There are a lot of ways to finance a middle-income project.

Mace: We talked about the number of units needed going forward to house the growing numbers of middle-income seniors. Is there a vehicle that would provide that kind of scale?

Brunet: If it’s a good sponsor and good operator, the capital will be there though it might be different than the capital we have today. We’re lucky that there’s more liquidity in this space—both debt and equity—and it’s better than it has ever been and it will continue to get better.

Mace: You sound optimistic. So what is the biggest challenge?

Brunet: The industry’s biggest challenge is labor and staffing. As a lender, if you have good operators and good product, whether it’s a new building or repurposing of an older one, the debt piece will be easy.

Mace: Freddie Mac does affordable multifamily lending, any lessons learned there?

Patterson: We do affordable and workforce housing and we spent time to learn and understand those markets. We would like to have the opportunity to learn what works whether it’s the shared units we’ve talked about or other ways to operate properties. We need to understand the property to provide financing.

Mace: Do you think the alignment of interests will change in terms of debt service coverage ratios or loan-to-value ratios?

Brunet: It’s important to partner with sponsors or operators who are experienced in the space and have good track records. As a lender, I am not interested in working with a multifamily developer without experience in seniors housing. But if they are experienced seniors housing folks committed to the space, then that’s a different conversation.

Callaghan: Lenders will be there as long as cash flow looks strong and sustainable. We may assign a higher cap rate to that kind of project so the loan–to–value ratio is appropriate. But we should think about leveraging community– based services such as Meals on Wheels or tapping into Medicare-funded services.

Patterson: When reviewing a deal, we look at the potential tenant pool in the area that can fill the building. One thing this study has shown is that the tenant pool is going to be huge at a certain price point. The ability to understand that allows us and our lending partners to get comfortable with those properties.

Mace: Why does seniors housing have low default rates? And do you think that would be the case for the middle–market as well?

Patterson: Our book of business has a good collection of people who understand the business and run their businesses well.

Callaghan: Risk models differ geographically. We see strong performance in downtown areas and in places like Massachusetts, New Jersey and northern Virginia. They have the demographics that work to keep those markets strong and losses minimal.

Mace: What are some innovative or practical ideas about how to spur more options for middle-market seniors today?

White: NIC has been great educating investors and making it a major property type on the institutional side. Debt markets are farther behind. The more they hear about the experiences of the banks and lending platforms, the better it will be. Only a few of the 6,000 banks are in seniors housing. Banking specialty groups could be formed to meet the coming demand.

Brunet: New purpose–built properties with shared units and repurposing vacant office or malls are two ideas. The debt will be specific to the project but it will be there. Fannie Mae and Freddie Mac have pre-stabilized programs that allow the borrower to lock in low permanent rates prior to full lease-up.

Callaghan: Maybe some of the care can be reimbursed. How do we manage reimbursement avenues to bring in more revenue? The real innovation is on employee and staffing side because costs are going up and the labor pool is tight. Maybe regional training initiatives among multiple providers could help fill the void in workers.

Audience Q: Could we bring down the cost of development and the unit price by using modular construction?

Callaghan: My biggest worry is the cost of land in urban areas. It’s a tough challenge.

Audience Q: Could we look at the hotel industry and its debt sources as a model?

White: The CMBS market is interesting. It’s bigger in the hotel market. Collateralized loan obligations are growing. Lenders need to be educated about the difference between hotels and seniors housing since hotels have higher default rates. Foreign capital—debt and equity—is promising. They like any kind of multifamily development. Aging economies like Japan, Korea and even China are interested in seniors housing in the U.S. as an investment and to get experience to bring the model home.

###

May 27, 2019

janekadler@gmail.com