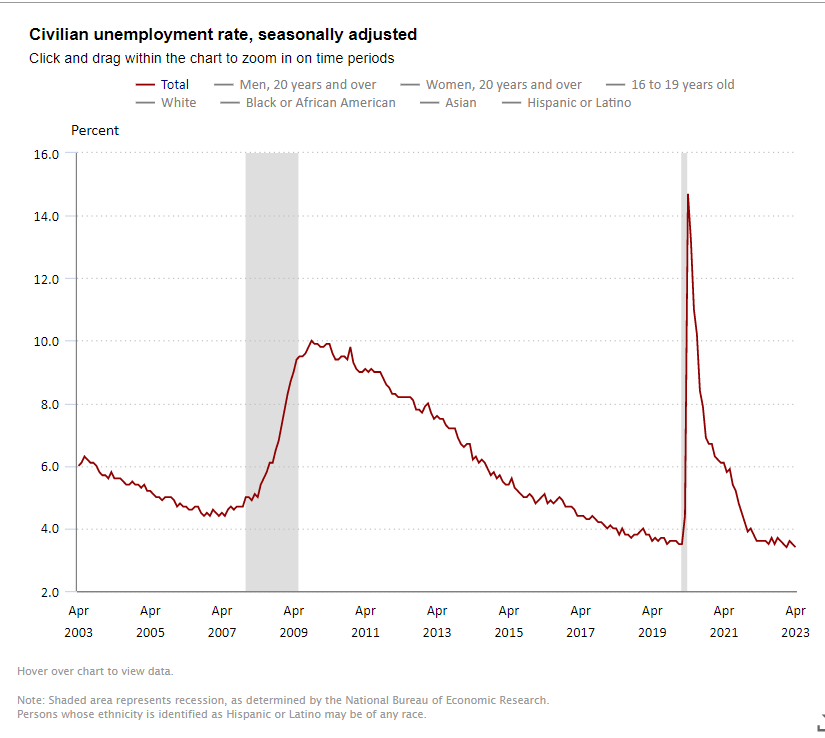

The Bureau of Labor Statistics (BLS) reported that the unemployment rate slipped back to 3.4% in April from 3.5% in March. This places it at the same level as in January at 3.4%, which was its lowest level since 1969. It has been hovering in a narrow range for many months now and underscores the ongoing tightness of the labor market.

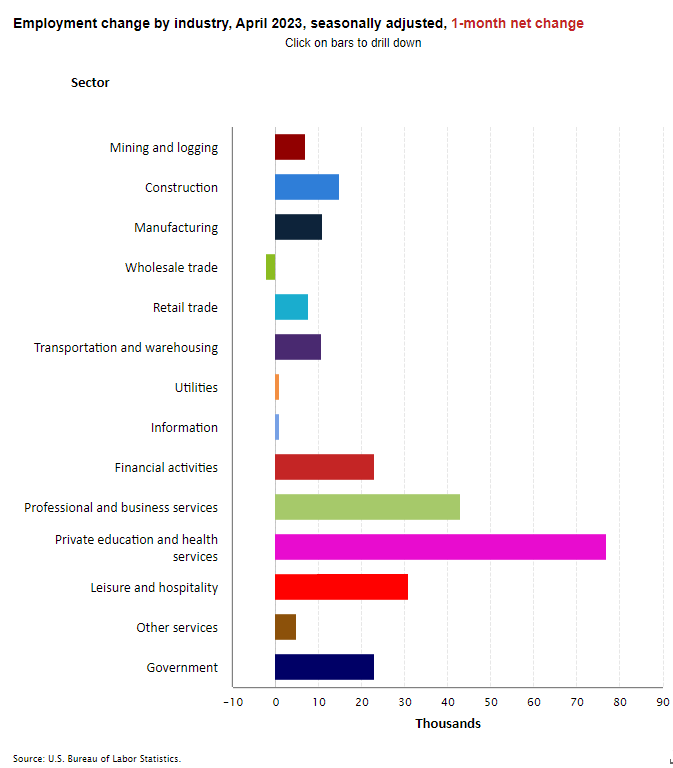

Separately, the BLS also reported that nonfarm payrolls rose by 253,000 in April 2023, below the monthly pace of 290,000 over the prior six months, but still strong. The three-month average gain in nonfarm payrolls was 222,000 as of April, below the 295,000-pace seen in March and the 430,000 pace in February. Market expectations had called for a gain of 185,000 jobs. Of note, revisions subtracted 149,000 positions to total payrolls in the previous two months.

Average hourly earnings for all employees on private nonfarm payrolls rose by $0.16 in April to $33.36 or up 0.5% from the prior month, the largest monthly gain in the past year. This was an increase of 4.4% from year-earlier levels, slightly more than in March at 4.3% (revised from 4.2%). The average hourly earnings data suggest that wage pressures are not easing rapidly. Earlier this week, the BLS released the employment cost index (ECI) which also showed that underlying pressures on inflation remain. Wages and salaries paid to workers rose 5.1% in March from a year earlier.

Today’s report shows the labor market remains tight, with the economy still creating jobs at a solid, albeit slowing pace. Notably, the gain occurred despite the turmoil in the banking sector. In fact, financial sector payrolls rose by 23,000 and professional and business services increased by 43,000. Employment in health care rose by 40,000 in April, compared with the average monthly increase of 47,000 over the past six months. Employment in nursing care facilities grew by 2,600 jobs from last month and 55,100 from year-earlier levels and stood at 1,397,300 positions. Jobs increased by 3,800 positions in CCRC and assisted living facilities and were up by 60,700 from year-earlier levels to 946,500 jobs.

The Fed is not likely to be heartened by the report in terms of observing a slowdown in the economy and inflation pressures. Earlier this week, the Fed raised interest rates another 0.25 percentage points to a range of 5.0-5.25% to its highest fed funds rate in 16 years as it continues to combat inflation. The Fed is looking for evidence of a softer labor market to help ease wage pressures and prevent a wage/price inflationary spiral from occurring.

Other employment data reports are starting to show a slightly slowing labor market, however. Indeed, earlier this week, the Labor Department released the Job Openings and Labor Turnover report (JOLTS) that showed that the demand for labor is starting to cool down a bit. The ratio of job vacancies to unemployed—a measure that Fed Chair Powell frequently references—was 1.64 in March from 1.68 in February. It has trended lower from an all-time high of 2.01 in March 2022 but remains higher than the 1.19 average in 2019, ahead of the pandemic. Total separations, which includes quits, layoffs and discharges rose by 91,000 in March to reach 5.9 million.

In the household survey, the jobless rate slipped 0.1 percentage point to 3.4%, down from 3.5% in March. Both months’ unemployment rates were well below the 14.7% peak seen in April 2020. The drop in the jobless rate reflected a decline in the civilian labor force (43,000) coupled with a relatively small rise in household employment (139,000). The underemployment rate was 6.5% versus 6.7% in March.

Among the major worker groups, the April unemployment rates were 3.1% for adult women, adult men (3.3%), teenagers (9.2%), Whites (3.1%), Hispanics (4.4%), Blacks (4.7%), and Asians (2.8%).

The labor force participation rate inched up to 62.6% in April, unchanged from March and up from 62.5% in February, which followed three prior monthly increases in the rate. It was below the February 2020 level of 63.3%, however. The number of long-term unemployed (those jobless for 27 weeks or more) was 1.2 million in April. These individuals accounted for 20.6% of all unemployed people.