Your Essential Resource for Seniors Housing & Care Investing

NIC is proud to unveil the highly anticipated Seventh Edition of the NIC Investment Guide: Investing in Seniors Housing & Care Properties. This comprehensive publication serves as the definitive resource for anyone involved in or looking to enter the seniors housing and care sector.

During this period of growth and change in the sector, the NIC Investment Guide provides a senior housing and care primer that investors can use to investigate opportunities, challenges, and potential risks. Those new to the sector will appreciate the introduction to senior housing’s investment characteristics, performance, leading players, and key trends.

What’s New in the Seventh Edition

The latest edition of the NIC Investment Guide offers:

- Fully updated data and insights through 2023 and early 2024

- An enhanced Active Adult rental section featuring key industry metrics

- In-depth analysis of current market trends and emerging topics

Comprehensive Content for Operators and Investors

For Operators, the guide provides detailed information on different community types, including:

- Independent living

- Assisted living

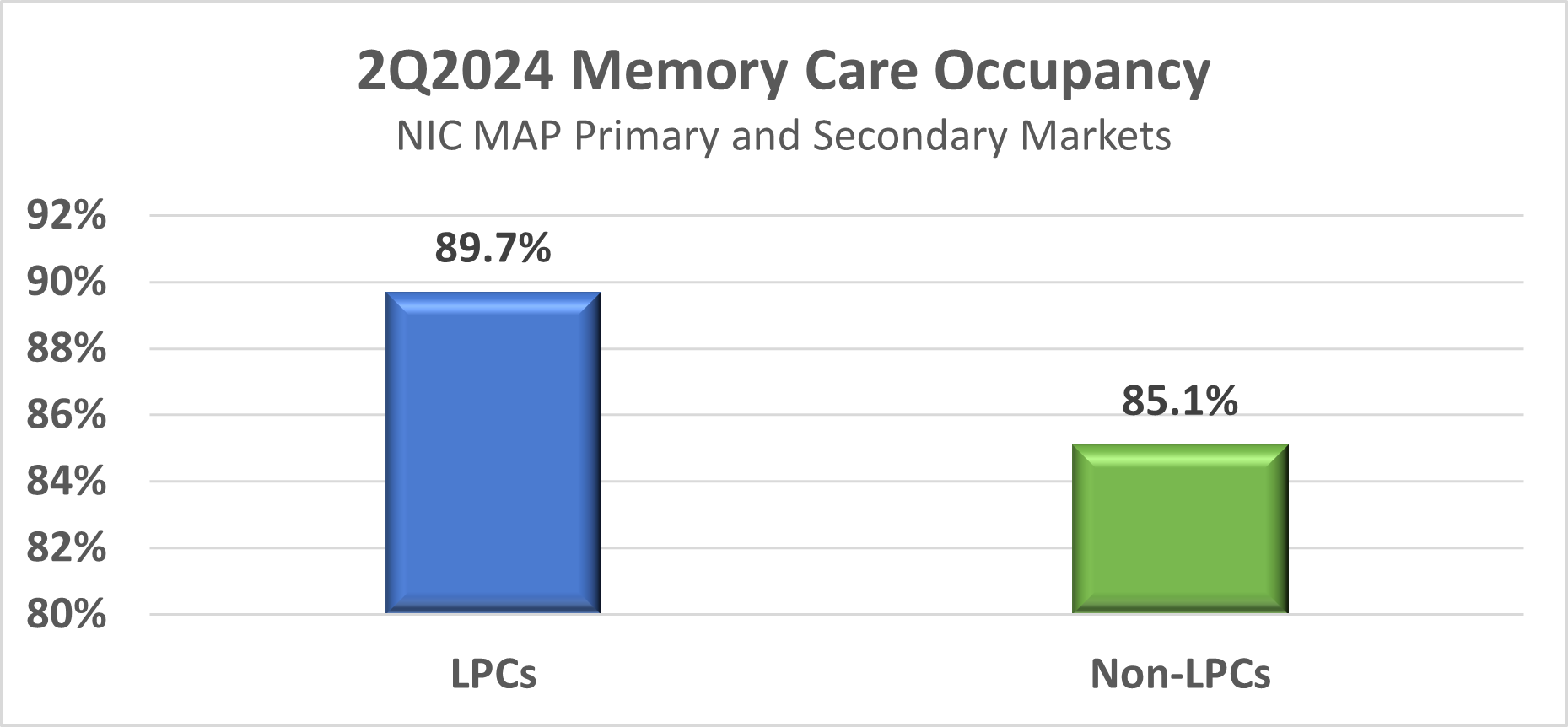

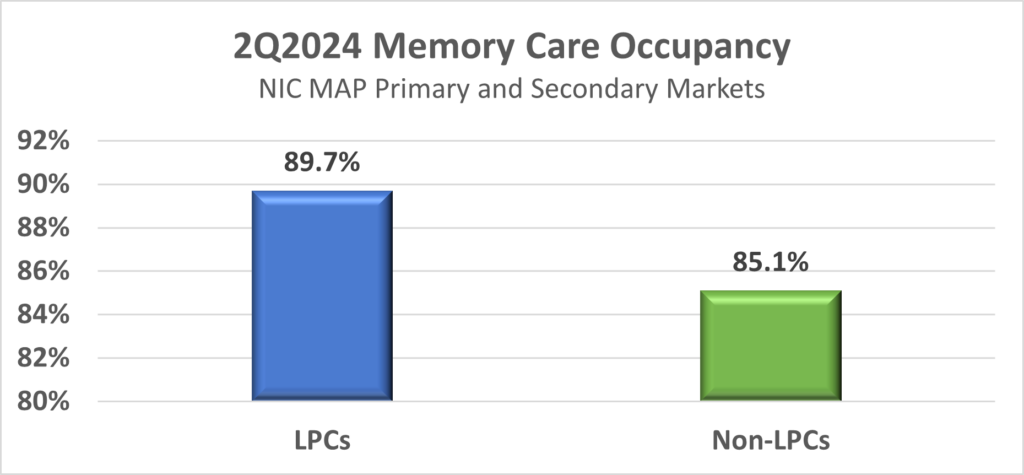

- Memory care

- Nursing care

- Continuing Care Retirement Communities (CCRCs)

- Active Adult Communities

Key data points cover resident characteristics, market size, supply, occupancy rates, rental rates, operating structures, and economic metrics.

For Investors, sections to help inform investment decisions include:

- Emerging trends and observations

- Development and capital spending trends

- Overview of debt and equity sources

- Valuations, returns, and loan performance metrics

Additional Market Insights

The Seventh Edition also includes:

- Comparison of seniors housing property investment characteristics to other commercial real estate types

- Detailed appendices on middle market seniors housing, technology trends, and healthcare collaboration

- Expanded coverage of demographic trends and alternative housing options

Access Your Copy Today

The NIC Investment Guide, Seventh Edition is available for purchase now in a downloadable PDF format. Order your copy today and position yourself at the forefront of this dynamic sector, armed with the most comprehensive and up-to-date industry resource available.