After nearly five years of uncertainty and headwinds in the seniors housing space, capital markets going into 2025 seem to come with the headline “Cautiously Optimistic”.

Over the past 18-24 months, in particular, unprecedented interest rate and cap rate pressure sidelined sponsors and capital providers, leading many in the industry to adopt a “wait-and-see” approach. Additionally, regulatory pressures on federally regulated financial institutions caused permanent financing refinance options to essentially vanish and banks to reduce new loan originations and adopt a more rigid approach to existing loan modifications and maturities, likely requiring additional cash collateral, loan curtailments, recourse, and increased loan pricing. All these factors created additional stress on senior housing assets, regardless of performance and cash-flow at the asset level.

However, as 2025 begins, the tides seem to be turning (albeit, more slowly than desired). The fourth quarter of 2024 saw declining interest rates for the first time in years, and asset values have been rebounding, providing some much-needed marginal relief – and hope – across the industry.

2025 will be interesting on many levels, with particular attention paid to inflation and interest rates. From an interest rate perspective, with the presidential election behind us, and so much policy uncertainty as we enter 2025, it is possible – and even likely – that the Fed will pause rate cuts at the January Federal Open Market Committee (FOMC) meeting, with the expectation there will be fewer cuts than previously thought in 2025. Despite this, interest rate stability is a welcomed change from the rising rate environment we have all been living in.

With stable interest rates and asset values, coupled with the increasingly strong fundamentals of the industry, capital markets seem to be slowly and selectively reentering the space. From banks who have been able to recognize payoffs and are now able to deploy new loan dollars, to new equity groups and debt funds entering the space (or even reentering after sitting out the past few years), liquidity for new and existing inventory appears to be rising.

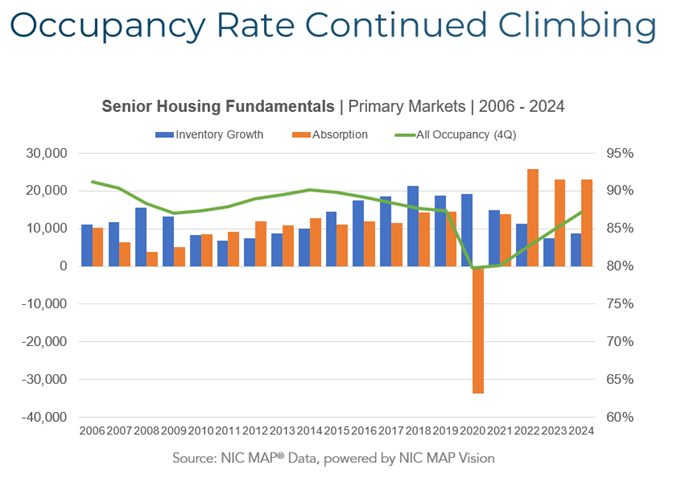

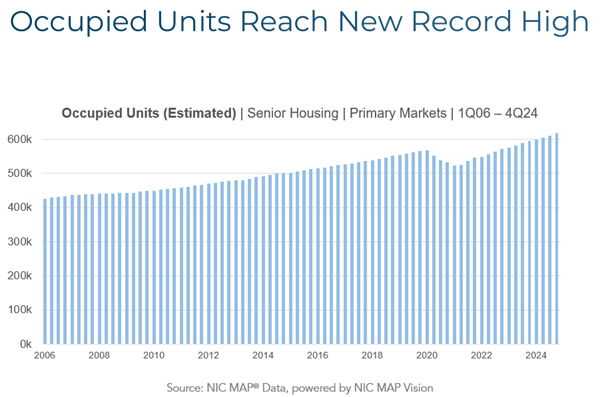

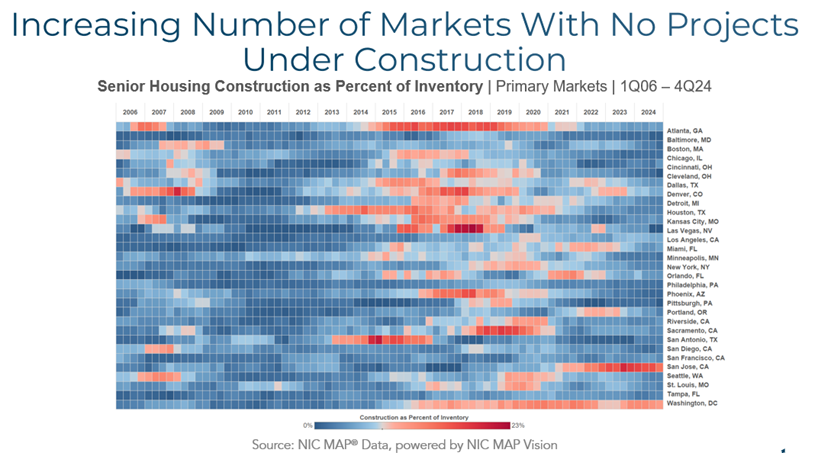

With that, an additional consideration is how new and existing inventory will continue to be capitalized throughout 2025. For existing inventory, traditional bank debt is increasingly available for assets with positive leasing momentum that need some additional time, while a rising number of debt funds are showing interest and available capital for assets with a different story wherein recapitalization or repositioning is needed. On the other side of the coin, new inventory is a rarity as annual inventory growth has been declining since 2019, and currently sits at approximately 1% as of 3Q24 NIC Map Data. However, for sponsors with patient and recurrent equity, along with efficiencies of development, banks are interested and willing to extend new loan dollars after experiencing payoffs throughout the latter half of 2024.

Regardless of what is to come in 2025, the ability to rely on patient and flexible partnerships between sponsors and capital providers continues to be a vital resource.