On March 10, the House passed the American Rescue Plan, the $1.9 trillion economic relief bill aimed at helping the country recover from the ongoing coronavirus pandemic. On March 11, President Biden signed the bill into law.

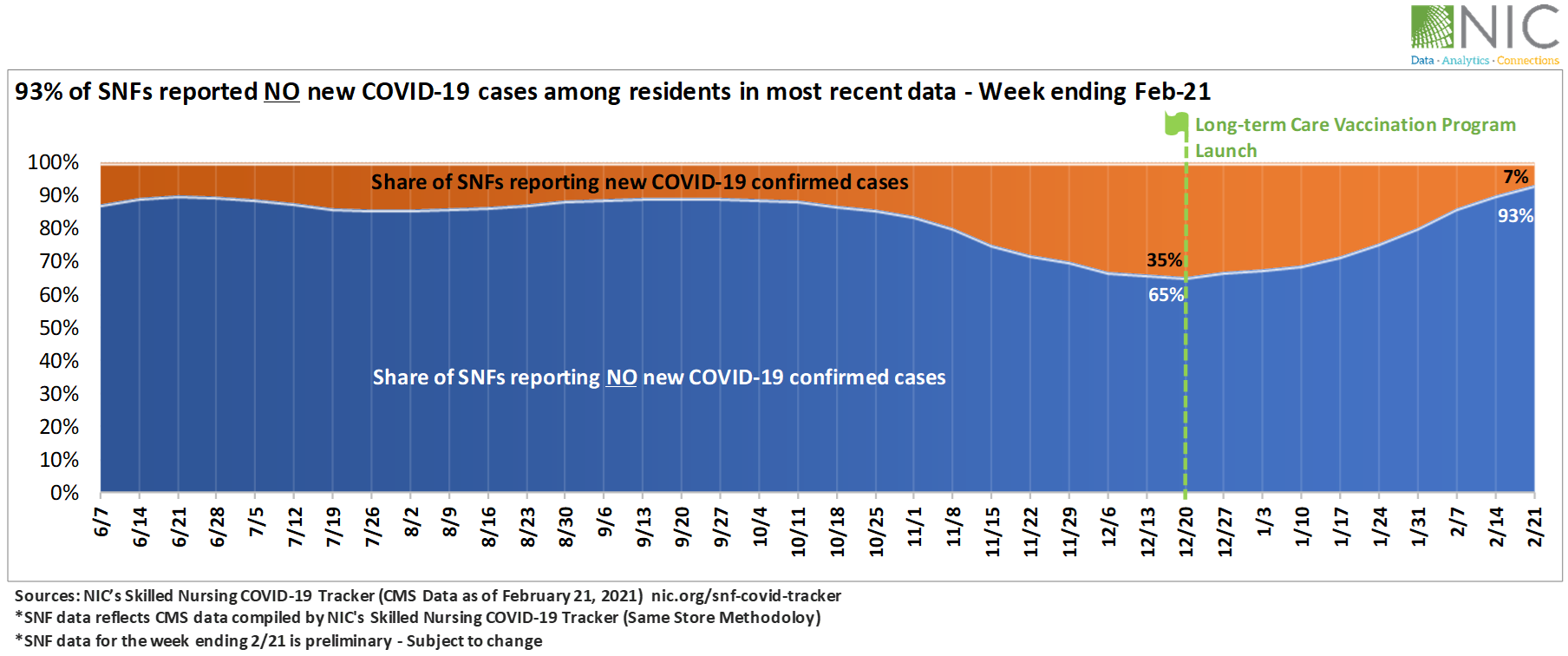

The legislation provides $250 million to states for strike teams for nursing care properties with COVID-19 outbreaks, to assist with clinical care, infection control, or staffing for up to a year after the public health emergency ends. The state strike teams will be deployed to respond to skilled nursing properties that are diagnosed to have, or are suspected of having, COVID-19 cases among residents or staff.

An additional $200 million is allocated to HHS for infection-control efforts within skilled nursing properties. The efforts will center around developing and disseminating COVID-19 prevention and mitigation strategies.

For seniors housing providers, however, the bill’s likely passage is not being met with resounding optimism, as the final package does not include dedicated relief to senior living communities that have also been on the front lines. In recent back and forth between the Senate and the House, proposed funds to support long-term care providers were stripped from the bill.

Argentum’s James Balda expressed frustration with the COVID relief package, saying “Given the failure of Congress to consider the needs of seniors and caregivers in this package, there remains a need for targeting support in future legislation and most critically through what remains in the Provider Relief Fund.”

With no dedicated funding for senior living, the pressure for Provider Relief funds – allocated through the CARES Act around this time last year – to be distributed promptly is at an all-time high. Senior living providers have been beleaguered over the last year with a slow dispersal of relief funds and frequent denials that don’t offer clear explanations.

The Provider Relief Fund was originally created to reimburse healthcare providers’ eligible expenses and lost revenues because of COVID-19. The current slow-paced delivery of funds may not see improvement as a result of the bill’s passage, either. The bill includes $5 million to the HHS Office of Inspector General (OIG) for oversight with respect to the Relief Fund. This will likely increase OIG’s planned efforts to audit and review the Fund’s spending.

Despite the money going towards oversight, there were no additional dollars allocated to the Provider Relief Fund through the American Rescue Plan. Provisions were developed to include a fund for premium pay to essential employees and grants to their employers, which American Seniors Housing Association President, David Schless, says “may be a source of relief for senior living employers.” This will be welcomed by the sector, as labor costs associated with keeping residents safe and communities open have risen significantly during the pandemic.