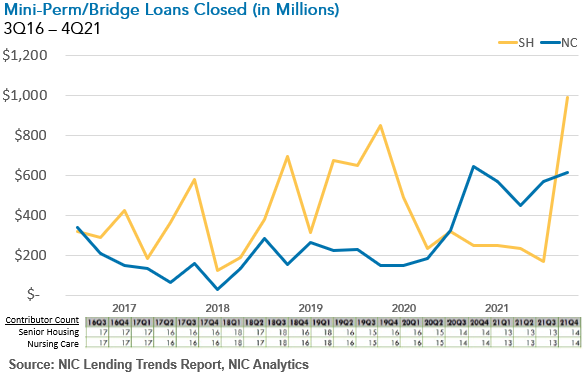

The recently released 4Q2021 NIC Lending Trends Report report shows issuance of new mini-perm/bridge loans for senior housing hit a recorded high in the time series in fourth quarter 2021, while the issuance of permanent senior housing loans moderated. This may suggest that some lenders are more comfortable with the lower-risk shorter-term nature of mini-perm/bridge loans as some senior housing operators build occupancy and demonstrate a longer performance track record.

Other trends from this new NIC Analytics report are highlighted below. The quarterly NIC Lending Trends Report, available complimentary to NIC constituents, currently tracks $86.7 billion in senior housing and nursing care loans. The report includes trends for five years of sector construction loans, mini-perm/bridge loans, and permanent loans from 3Q2016 through 4Q2021.

Takeaways From 4Q21 Report

- Mini-perm/bridge loans have amortization periods generally between 3 and 5 years and tend to function as an intermediary loan following a construction loan and prior to a borrower securing a longer-term mortgage loan. New mini-perm/bridge loan issuance was extremely strong for senior housing in 4Q21. On a same-store basis, mini-perm/bridge loan volume was up nearly five-fold for senior housing from the prior quarter. This marked the largest recorded quarter-over-quarter increase in the time series (since 3Q16) for senior housing mini-perm/bridge loan issuance. A large amount of new mini-perm/bridge nursing care loans also closed in 4Q21. The quarter-over-quarter increase was 7.8% for nursing care.

- Delinquencies edged slightly higher in fourth quarter 2021 from the third quarter for both senior housing and nursing care, although delinquencies remain down notably from the pandemic-related highs in 3Q2020 and are still below 1.5% of total loans. Note that delinquency data includes loans in forbearance for some lenders.

- Total loan balances for senior housing slipped modestly for the second consecutive quarter, while total loans for nursing care edged higher for the third quarter in a row. On a same store basis, total loans for nursing care increased by 2.1% from the prior quarter. Total loans for senior housing declined by 1.4% in 4Q21. The decline for senior housing includes maturing loans coming off the books for some lenders.

These data are not to be interpreted as a census of all senior housing and skilled nursing lending activity in the U.S., but rather reflect lending activity from participants included in the survey sample only.

The 1Q2022 NIC Lending Trends Report is scheduled be released in mid-August 2022.

Interested in participating? The NIC Lending Trends Report helps NIC Analytics to deliver on NIC’s mission to enable access and choice by further enhancing transparency of capital market trends in the senior housing and care sectors. We very much appreciate our data contributors. This report would not be possible without them.

If you would like to participate and contribute your data, please contact us at analytics@nic.org. As a courtesy for providing data, data contributors receive this report early before publication on the website. The information provided as part of the survey will be kept strictly confidential. Individual answers will be combined with the answers of all other respondents. Data acquired from this survey will only be reported in the aggregate, and therefore, the resulting aggregated data will not be attributed to you or your company upon distribution.