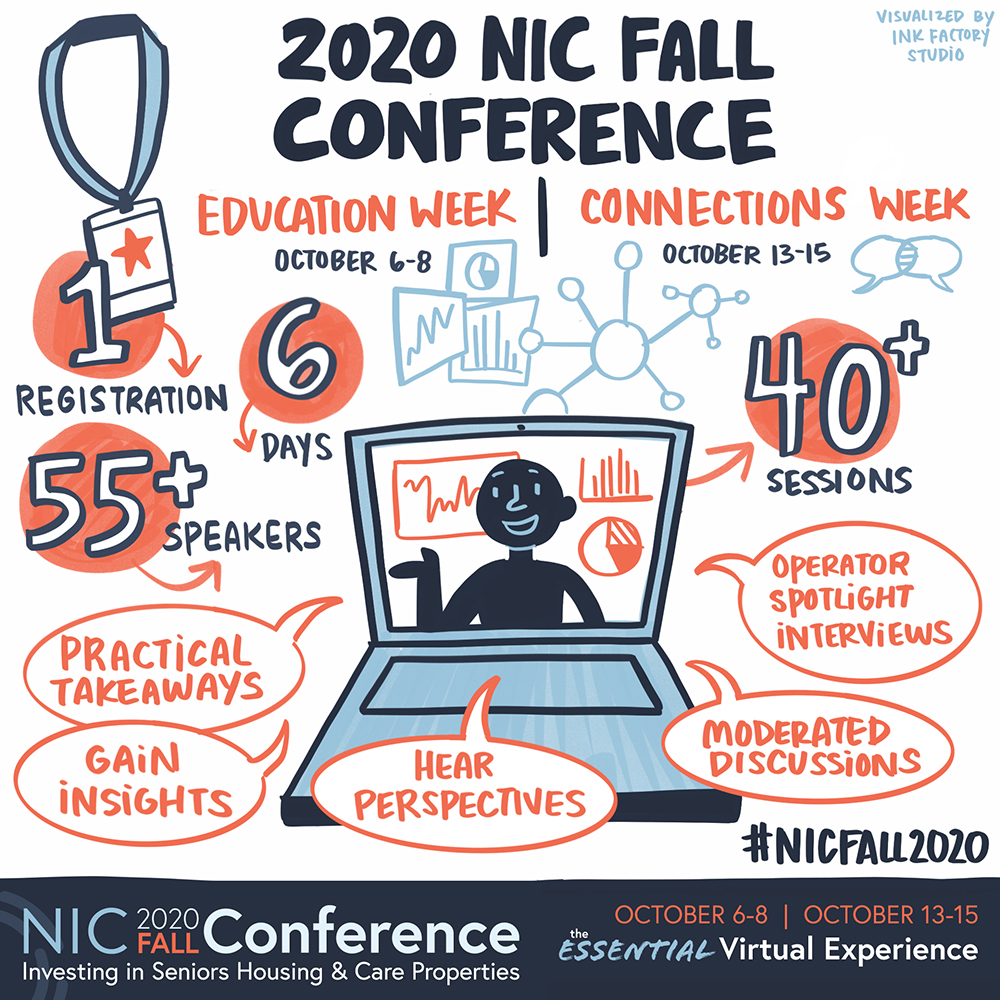

The 2020 NIC Fall Conference, which will be hosted on an advanced virtual technology platform, features many of the attractions of its traditional predecessors, while boasting a host of new advantages, including convenience and lower pricing.

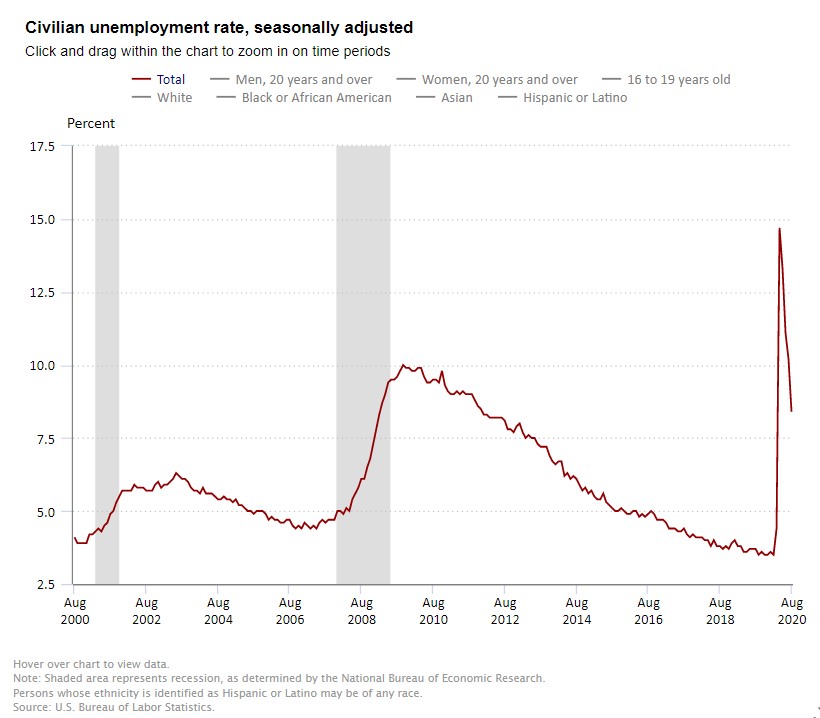

‘The NIC’ comes at a time of immense change, intense public scrutiny, and uncertainty for the future. Amidst a pandemic that impacts frail elders disproportionately, major policy shifts, the rise of new technologies and standards, economic and social turmoil, and with a critically important national election only weeks away, the opportunity to gain the latest data, insights, thought-leadership, and to connect with experts, peers, prospects, and old friends, is more valuable than ever.

Here’s an outline of what you and your team can expect from the ‘essential virtual experience’:

Education Week | Tuesday, October 6-Thursday, October 8

Connections Week | Tuesday, October 13-Thursday, October 15

Unmatched Thought-Leadership

Attendees will gain access to over 40 informative, relevant, and thought-provoking sessions, featuring over 50 experts and business leaders, in a three-track program designed to cater to a variety of roles across the sector. Some sessions will be live, and many will be available for on-demand access, both during and after the event.

Expect many of the sessions to cover areas of traditional interest, such as valuations, insights from the latest NIC data, and the real-world challenges and opportunities facing operators and capital providers in today’s markets. Others will delve into the particular issues posed by the COVID pandemic, uncertainty in financial markets, policy and regulatory change, and more.

Expect many of the sessions to cover areas of traditional interest, such as valuations, insights from the latest NIC data, and the real-world challenges and opportunities facing operators and capital providers in today’s markets. Others will delve into the particular issues posed by the COVID pandemic, uncertainty in financial markets, policy and regulatory change, and more.

Live Main Stage Sessions

Main Stage sessions will, as always, feature figures of national prominence, discussing issues of the highest relevance to the industry. Award-winning journalist Soledad O’Brien, who currently hosts CNN’s “Matter of Fact,” will moderate a discussion with Mark Parkinson, President & CEO, American Health Care Association (AHCA) and National Center for Assisted Living (NCAL), and Andy Slavitt, senior advisor for The Bipartisan Policy Center and former Acting Administrator of the Centers for Medicare and Medicaid Services. From the vantage point of four weeks out from the general election, the panel will help attendees understand the potential policy impacts and what’s at stake for their businesses.

Also likely focusing on the election and associated political realities, household names David Gergen and David Brooks will turn their considerable expertise and experience – and wit – to shed light on the factors to consider as November 5 approaches. This election has the potential to impact the seniors housing and care sector both directly and indirectly, and many attendees will be watching the discussion closely.

NIC Talks

Our popular NIC Talks series returns—featuring another group of uniquely qualified, passionate thought-leaders, including business leaders, academicians, and leading advocates, sharing their perspectives on the question “How will COVID-19 impact the future of aging and aging services?” This year’s speakers include Jo Ann Jenkins, the CEO of AARP, the world’s largest nonprofit, nonpartisan membership organization. She will offer insights from the perspective of 100 million Americans who are 50 and older, who wish to achieve health security, financial resilience and personal fulfillment.

Dr. Louise Aronson, Professor, UCSF Division of Geriatrics, will address “Ageism and COVID-19: Opportunities to Create a Better Future.” Dan Cincelli, Principal, Perkins Eastman, will provide the most recent thinking on architectural and community design innovation, in “How will disruptive forces like COVID-19 impact the design of senior living?” Krista Drobac, Executive Director, Alliance for Connected Care, will bring her audience up-to-date on one of the most widespread innovations to take root during the pandemic, in “Telehealth Beyond COVID-19, A Bigger Leap Ahead.” Another major driver of change in seniors housing and care is in the delivery of healthcare for a population that, due to their frailty and vulnerability, can, in many places, no longer be routinely transported to clinics and hospitals. Dr. Tim Ferris, CEO, Mass General Physicians Organization and Professor, Harvard Medical School, will cover the deep and lasting implications of this development, in “Impact of COVID-19 on Healthcare Delivery.”

Still the best networking opportunity in the sector

Although nothing can replace in-person networking, the 2020 NIC Fall Conference offers the most connectivity available in today’s environment.

The NIC Community Connector™

Attendees who complete a registration form gain exclusive, complimentary access to NIC’s powerful new networking platform, the NIC Community Connector. The innovative online platform provides a means to search for potential new contacts, and to communicate directly with decision-makers across the industry. It was custom designed to suit the needs of capital providers, owners, operators, service providers, and other stakeholders across the seniors housing and care sector.

It was custom designed to suit the needs of capital providers, owners, operators, service providers, and other stakeholders across the seniors housing and care sector.

Braindate

The braindate™ platform, which NIC rolled out for the 2020 NIC Spring Conference, facilitates focused, issue-specific discussions 1-on-1 or in small groups. Braindate offers both the intimacy of a small group discussion on a pre-determined topic of shared interest (which can be defined by participants), and the efficiency and convenience of scheduled online meeting times.

Live Zoom Meetings

Throughout the event, attendees will be presented with numerous opportunities to participate in live Zoom meetings with experts and peers. Some live meetings will be focused on social networking, with happy hours, and even live entertainment (exclusive Hamilton performances, anyone?) on tap. Other Zoom meetings will be oriented to discussions on the most important and relevant issues, as leaders and experts address the challenges and opportunities of today’s marketplace, and help attendees, as they plan for the future. Throughout the event, NIC will facilitate ‘breakout rooms’ via Zoom, designed to allow for more intimate, focused discussions.

A Personal Touch

As with all NIC events, attendee experiences will include opportunities for some personal and professional development, or to take a break to enjoy live entertainment with their peers. ‘The NIC’ will continue to offer a LinkedIn help desk, helping attendees update their profiles and learn the latest tips and techniques for staying connected and visible in the leading social networking platform for professionals. Videos and presentations, primarily available on-demand, will be available for attendees who wish to take a break with a selection of personal development and wellness programming.

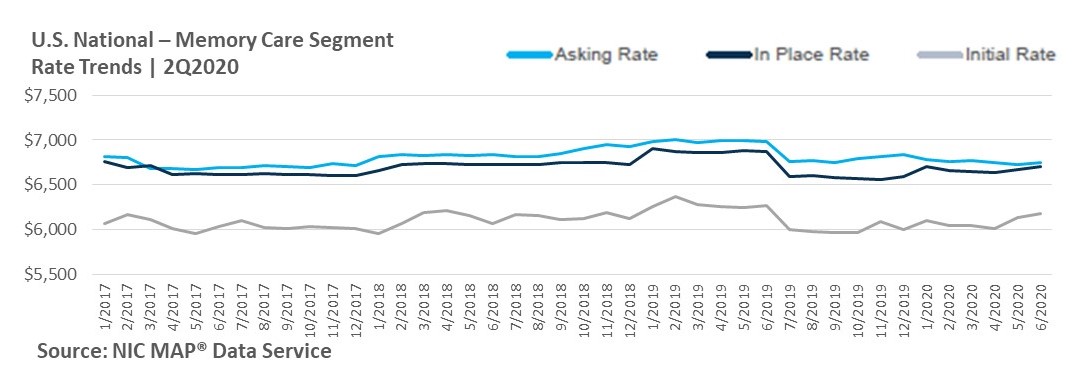

Many attendees are NIC MAP® Data Service subscribers, or may wish to learn how the leading provider of data and analysis for seniors housing and care can help their businesses. NIC will offer a number of opportunities for existing users and those interested in learning more to access NIC MAP staff expertise. Through the Braindate platform, NIC MAP experts will be available to discuss the platform’s potential business impact in 1-1’s and small groups of prospective new subscribers. In other sessions, existing ‘power users’ can dive a little deeper into how the platform works, what it’s latest updates have to offer, and how to get the most out of the many available tools at their disposal.

The Most Accessible NIC Conference, Ever

Aside from the obvious cost-savings that come with a virtual platform, such as the elimination of travel and hotel costs, this year’s attendees will enjoy a time-savings by staying at home or in the office, while participating over two convenient weeks and, for many sessions, by accessing content on-demand, both during and after the event. The online platform introduces the possibility that many more team members within a given organization can participate without heavily impacting operations and productivity.

To learn more about the 2020 NIC Fall Conference, view a ‘what to expect’ video here, or visit fallconference.nic.org today.

{{cta(‘4cb31bcf-c67d-47ae-b40c-8d0c879c20e4′,’justifycenter’)}}