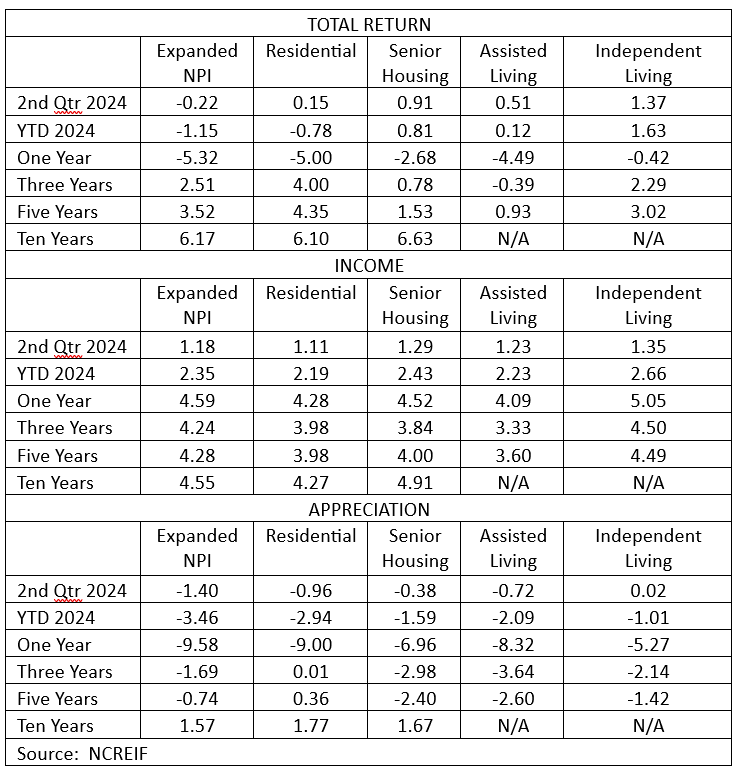

Senior housing posted a positive total return of 0.91% in the second quarter of 2024, outperforming the broader NCREIF Property Index (Expanded NPI), which posted a total return of -0.22% in the second quarter. Positive income returns for senior housing (+1.29) were partially offset by negative appreciation (-0.38%), resulting in overall positive returns for the quarter. Year-to-date , senior housing returned 0.81%, outperforming the Expanded NPI by nearly 200 basis points.

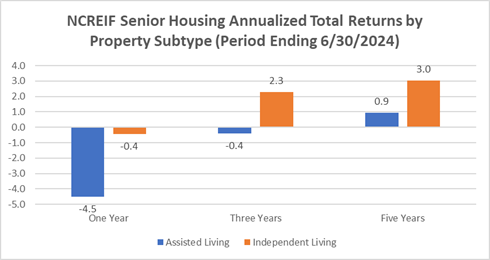

By senior housing property subtype, both independent living (+1.37%) and assisted living (+0.51%) posted positive total returns in the second quarter. Over the longer term, independent living has outperformed assisted living on a total return basis over the one-, three-, and five-year periods. This outperformance may be driven by higher margins typically generated in lower acuity settings such as independent living, which require less staffing and labor expenses than higher acuity settings such as assisted living.

The senior housing income return in the second quarter was 1.29%, in line with the residential sector (+1.11%) and the overall Expanded NPI (+1.18%). The senior housing appreciation (capital/valuation) return was -0.38% in the second quarter but better than the residential sector (-0.96%) and the overall Expanded NPI (-1.40%). The appreciation return is the change in value net of any capital expenditures incurred during the quarter. During the quarter, economic and capital market conditions drove negative appreciation returns in all sectors except for hotel (+0.18%).

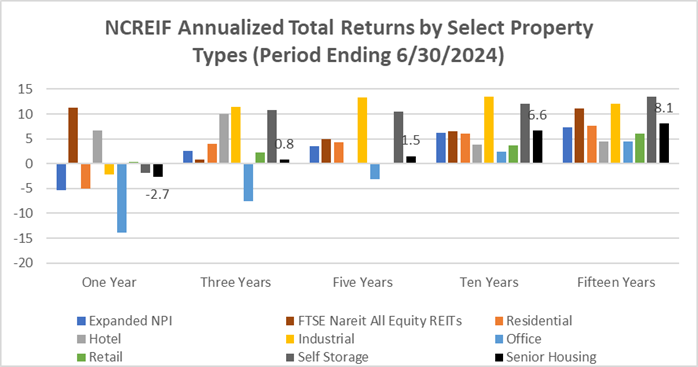

On a longer-term basis, the 6.63% annualized ten-year total return for senior housing was the strongest of the main property types, except for industrial (+13.45%) and self-storage (+12.09%), outperforming the Expanded NPI ten-year annualized total return of 6.17%. Income returns for senior housing (+4.91%) surpassed the Expanded NPI (+4.55%), as did appreciation returns (+1.67% vs +1.57%) over the ten-year annualized period.

The performance measurements cited above for senior housing reflect the returns of 215 senior housing properties valued at $11.39 billion in the second quarter. Overall, the number of senior housing properties tracked within the Expanded NPI has grown significantly from the 56 properties initially tracked beginning in the third quarter of 2003.

Demand for senior housing units continued to outpace new supply, with second quarter 2024 senior housing market fundamentals showing a continued recovery in occupancy rates in the 31 Primary Markets, according to data released by NIC MAP Vision. As a result, the occupancy rate for senior housing stood at 85.9%, up half a percentage point from the prior quarter.

There was a 0.7 percentage point increase in the independent living occupancy rate and a 0.5 percentage point increase in the assisted living occupancy rate, which was a change in pattern from prior quarters which had higher assisted living occupancy growth. Overall, the relatively steady improvement in market fundamentals coupled with a record number of occupied units illustrates that today more older adults than ever before are residents in senior housing properties.

Source: NCREIF

Note: FTSE Nareit All Equity REITs returns as of July 31, 2024.