INTRODUCTION

Many factors play a role in determining the performance of an individual senior housing property. One of these considerations is unit mix, i.e., the share of studios, one-bedroom, or two-bedroom units within a single property. The unit mix of a senior housing property is a critical aspect of a property that must be carefully planned, managed, and executed upon. Senior housing constituents, both upstream and downstream, understand that the proper unit mix of a property is a vitally important component of maximizing occupancy and minimizing resident turnover as a resident moves through the continuum of care.

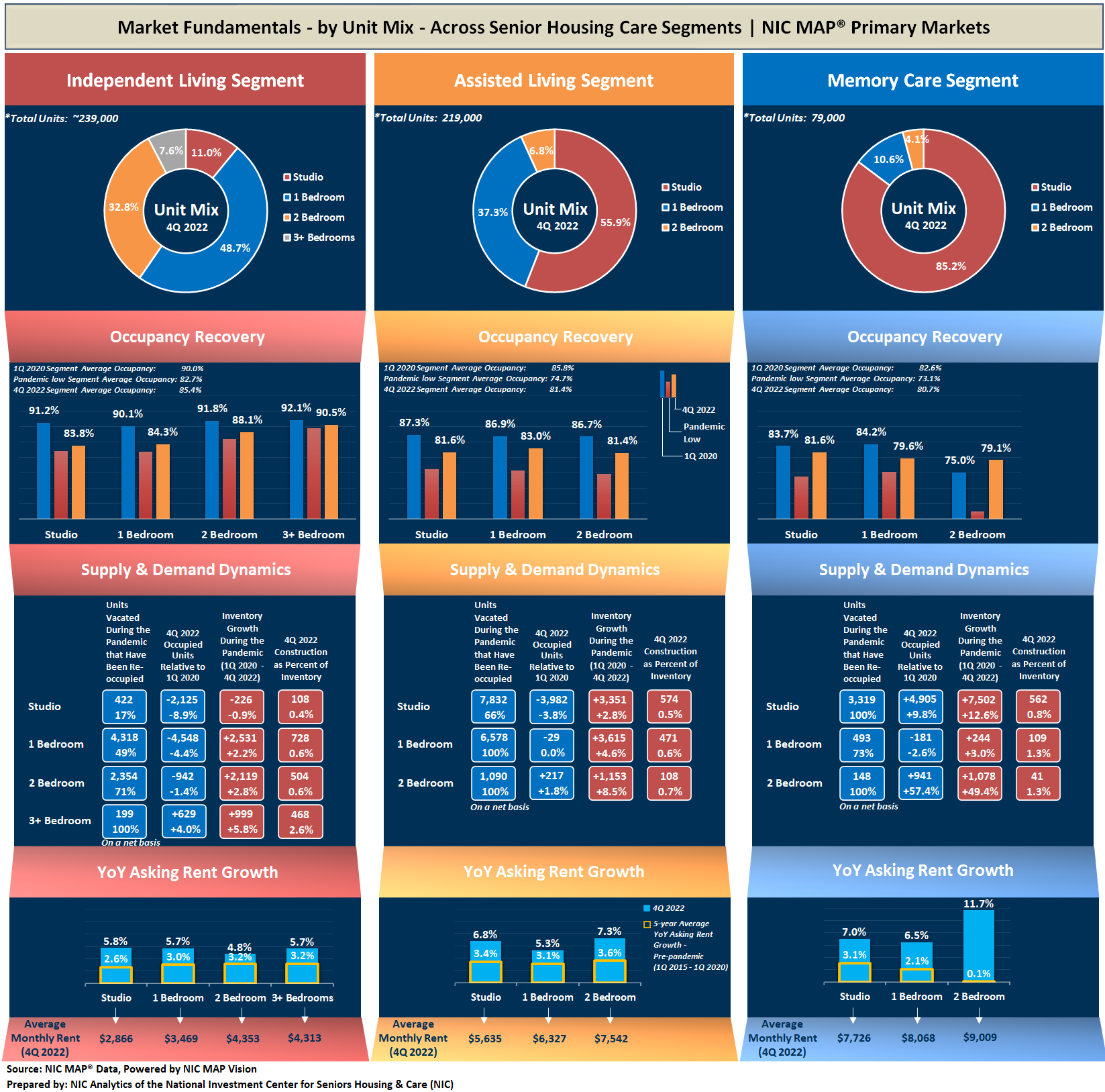

In this article, NIC Analytics examines market fundamentals by unit mix across the senior housing care segments (i.e., independent living, assisted living, and memory care segments) in the 31 NIC MAP® Primary Markets. The exhibit below provides a detailed view of the unit mix distribution, occupancy recovery, supply and demand dynamics, as well asking rate growth across different unit types and care segments.1

ACTIONABLE INSIGHT

When planning the unit mix for a senior housing property, it is important to conduct a market analysis to understand the demand and supply factors in the area. Also, it’s a good idea to keep in mind that trends and preferences can change over time. Ultimately, the unit mix should be designed to meet the current and future needs of the aging residents as well as the personal preferences and lifestyle of the target population, while also considering the local market conditions and trends. The unit mix of a property also depends on how large it sizes each care segment, and partly on the sizing of the units within each care segment.

KEY FINDINGS

Unit Mix

The exhibit below shows that unit mixes vary significantly among senior housing care segments and tend to skew toward smaller-sized units (i.e., units with fewer rooms) as acuity increases and residents move through the continuum of care. This trend of older adults in senior housing downsizing from larger units to smaller units is driven by a number of factors, including a desire for less maintenance and upkeep, an opportunity to increase efficiency for residents with mobility impairments, and the affordability aspect associated with meeting higher care expenses.

Studios are most prevalent among assisted living and memory care segments. Within the NIC MAP Primary Markets, studios account for about 56% of total units within the assisted living segments and 85% for the memory care segments. Studios are typically the most affordable unit type in senior housing, making them a popular choice for single-person households.

The independent living segment—frequently more of a lifestyle choice than need-driven—generally offers more one- and two-bedroom units but fewer studio units than assisted living and memory care segments. Notably, independent living segments in the NIC MAP Primary Markets have the most diverse mix: 49% are one-bedroom units, 33% are two-bedroom units, and 11% are studios, with an occasional three-bedroom unit or cottage.

Occupancy Recovery

In the last decade, independent living segments have generally experienced stronger occupancy rates compared with assisted living and memory care segments. This is mainly due to more restrained supply and development pipelines, more affordable monthly rates, as well as longer length of stay as residents of independent living generally prefer to age self-sufficiently for as long as possible.

At 85.4%, occupancy for the independent living segment continued to be relatively higher than other segment types in the fourth quarter of 2022 but has the most room left to fully recover and return to its pre-pandemic level (90.0%). By comparison, occupancy for assisted living segments was lower at 81.4%, while occupancy for memory care segments was lowest at 80.7% but has the least room left to fully recover to its pre-pandemic level of 82.6%.

The exhibit shows that in independent living, as unit room count increases, occupancy rates tend to be higher. However, in assisted living and memory care segments, smaller units tend to have relatively higher occupancy rates compared with larger units.

In the fourth quarter of 2022, three-bedroom and two-bedroom units in independent living segments had the highest occupancy rates (90.5% and 88.1%, respectively), followed by one-bedroom units (84.3%), and then studios (83.8%). By contrast, in assisted living and memory care segments, one-bedroom and studio units had relatively higher occupancy rates compared with two-bedrooms. At 83.0%, one-bedroom occupancy was the highest in assisted living segments, while occupancy for studio units in memory care segments ranked first at 81.6%.

These most occupied unit types – larger units in independent living and smaller units in assisted living and memory care segments – experienced relatively smaller occupancy declines during the height of the pandemic, have maintained higher occupancy rates compared with average occupancy for each respective care segment, and now are closest to full recovery and a return to pre-pandemic first quarter 2020 levels; except for the memory care segment where two-bedroom occupancy is well-above pre-pandemic levels. (As background, occupancy for two-bedroom units in memory care segments has generally been more volatile due the relatively small number of units, but it’s worth nothing that since the pandemic began, supply and demand dynamics showed increasing interest in this type of memory care unit.)

Demand Dynamics

In the fourth quarter of 2022, the difference between the occupied stock for independent living segment and that of assisted living segment was the smallest in the timeseries. In other words, the occupied stock for the assisted living segment has been growing at a relatively faster pace than for independent living segment. The same high acuity trend applies when comparing occupied stock for memory care segment with assisted living or independent living segments.

In independent living, occupied stock across larger units has recovered most of the units placed back in the market. Three-plus bedroom units have recovered 100% of the units vacated during the height of the pandemic, and in fact, exceeded first quarter 2020 occupied stock by 4.0%, followed by 2-bedroom units (71% of units have been reoccupied but occupied stock remained negative 1.4% relative to pre-pandemic levels). Across assisted living, one-bedroom and two-bedroom units have recovered 100% of the units vacated during the pandemic and surpassed pre-pandemic level. This was also the case for studios and two-bedroom units in the memory care segment.

Supply Dynamics

Over the period from first quarter 2020 through fourth quarter 2022, the stock of units within the independent living segment increased in all unit types but studios. Three+ bedroom units had the highest pace of inventory growth at 5.8% or 999 units, but one- and two-bedroom units added the largest number of units on a net basis (2,531 and 2,119 units, respectively). Similarly, across assisted living segments and memory care segments, larger units had the highest percentage increase, but on a net basis, smaller units had the largest number of units added to the market.

Largely due to impact of higher interest rates and capital market dynamics, a slowdown in the growth in senior housing inventory and development activity is helping to bring supply and demand into better balance. In the fourth quarter of 2022, all unit types across senior housing care segments showed a slowdown in construction as percent of inventory, in many cases below 1% and in all cases far below pre-pandemic first quarter 2020 levels.

While new inventory compounded the downward pressure on occupancy during the height of the pandemic, this trend of construction starts slowing down will serve as a tailwind for the occupancy recovery. In fact, occupancy across the three senior housing care segments recorded six quarters of positive momentum and consistency, suggesting that senior housing is now on a trajectory of rising occupancy rates and better supply/demand patterns broadly. Notably, this is not the case, however, in all geographic markets.

Year-over-year Asking Rent Growth

The effects of inflation and rising costs are reflecting on asking rate growth across all senior housing care segments and unit types. From year-earlier levels, asking rates rose to the highest levels in the timeseries across all care segments and unit types in the fourth quarter of 2022. Memory care segments recorded the largest year-over-year increases, ranging from 6.5% for one-bedroom units to 11.7% for two-bedroom units, followed by assisted living segments (ranging from 5.3% for one-bedroom units to 7.3% for two-bedroom units). Growth in asking rates was less for independent living but was still high compared with pre-pandemic year-over-year increases across all unit types. Note these figures are for asking rates and do not consider any discounting that may be occurring.

In conclusion, the layout and unit mix of a property is an important consideration in occupancy patterns and should be considered in developing or evaluating a senior housing property. The unit mix in turn is driven by market dynamics, including location, demographics, and resident income profile, as well as the vision of the senior housing property owner. While smaller units are currently more prevalent among assisted living and memory care segments, larger units may appeal to a different resident profile in the foreseeable future i.e., middle income residents seeking to share with other residents a larger unit with multiple bedrooms to reduce monthly rates and increase efficiency and socialization. In fact, larger units are relatively affordable (even when compared with studio units) if they house more than one resident, despite the relatively large increases in monthly rates across all care segments.

—

1 Note this analysis only includes properties reporting the unit mixes within the senior housing care segments. This means that properties and segments with unknown unit mixes were excluded from the analysis. This article also uses the segment type designation from NIC MAP, meaning that the data used in this analysis are units that can be located at any type of senior housing property, with respect to segment type.