Just two days ahead of the NBA season’s restart in Orlando, Florida, NIC hosted it’s ninth “Leadership Huddle” webinar to discuss the professional sports league’s efforts to contain the virus, and gain insight on the latest developments in testing, wearables, and protocols. Titled “From Pro Sports to Senior Care: Innovations in Testing, Tech, and Protection,” the event was intended to share lessons and experiences earned fighting COVID-19 in other industries with seniors housing and care providers and investors.

While very different in terms of scope, demographics, access to resources, and scale, the NBA has been faced with some of the same challenges that senior living operators face today. Working with experts across the country, including Testing for America, a “nonprofit established by leading scientists, academics, and entrepreneurs,” the NBA is showing significant improvements in curtailing the spread of the virus amongst its players and staff, despite putting them in close proximity to train and play together in a ‘bubble’ located in Orlando, Florida.

As NIC CEO Brian Jurutka explained in his opening remarks, “We are now approaching the fifth month since the coronavirus was declared a pandemic. The country has moved from the crisis response phase, where we pulled back from business as usual, to trying to resume activities that were shut down as we await developments in vaccines and treatments for the virus.” As different sectors approach reopening, there is the potential to share critical lessons, innovations, and experiences across industries.

Sri Kosaraju, Governing Council, Testing for America, expressed the importance of testing, saying, “all of you are obviously dealing with this every single day, and it’s critically important to what you do, and the intent of this, from our perspective, is for it to be a resource, and to be helpful to you in this hour.” Testing for America is a nonprofit “established by leading academics, engineers, and entrepreneurs to solve the COVID-19 testing crisis.” Their volunteer members include leading experts and industry leaders in the science of testing.

The bubble

Kosaraju, who stepped down as president of global healthcare company Penumbra (NYSE: PEN) to focus his efforts on Testing for America, has been working closely with fellow panelist Robby Sikka and the NBA for months. Robby Sikka, an anesthesiologist by training, is the founder and CEO of Sports Medicine Analytics Research Team (SMART), an organization that has assisted numerous NBA, NFL, MLB and NHL clubs with injury data, return to play planning, and player evaluation and development. He is VP of Basketball Performance for The Minnesota Timberwolves, and has been working more broadly with the NBA to develop protocols to protect players and staff from infection as they plan to reopen their season. He described what he calls the NBA’s “bubble and mini-bubble” approach to preventing the spread of COVID-19, which he said could be used within seniors housing and care communities.

The NBA’s approach is to have each team separated into its own mini-bubble within a larger bubble, so that they can train and play together, whilst retaining distancing and protocols designed both to protect from outside, and from bubble to bubble. Sikka said it has been well-documented that the league “went from a 10% positivity rate in the first week amongst players to 0% in the last two weeks. And the reason is, they had mini-bubbles.”

Sikka described a number of approaches that have helped achieve that result. Between June 23 and July 7 the NBA tested every other day. “Your testing cadence really matters because you may not have testing every day. You may also have delays.” When test results are delayed, he assumes there are positives and acts accordingly. “We’re seeing anecdotally its not just the games that are putting players at risk, but group activities. We’re seeing it in baseball and soccer… there are too many things where sharing air in small, confined spaces are leading to outbreaks.” He discussed travel on aircraft and busses, and other instances of close confinement causing outbreaks.

The NBA’s system is a phased approach to allowing players to interact, beginning with social distancing protocols, then increasing levels of testing as teams allowed individual workouts, whittling down the pool of uninfected players until there was a high assurance that it was safe to practice and play in groups. With a COVID-free group, the NBA added rapid testing to their protocol. Today, as the teams prepare to play each other, each team’s mini-bubble practices strict protocols, minimizing exposure, and decreasing the chance of spread. Sikka pointed out that in this system, it is not necessary to test all staff, while observing the bubble system protocols, which strictly limits potential exposure and keeps teams isolated.

Even players’ families must abide by the system. They must test every other day for seven days prior to entering the NBA bubble in Orlando. Once in the bubble, they must quarantine for another seven days, before being able to stay with their loved one. Staff are not allowed visits from family. The organization also enforces a test protocol for anyone reentering the bubble after traveling beyond it, requiring negative results on at least two tests over a 72 hour period prior to gaining entry. “We’ve saved a ton of money because we haven’t spent a single penny on cleaning our building at all,” Sikka said, explaining that with the protocols and testing, they only need standard cleaning. According to Sikka, the protocols are preventing infiltration of the virus, despite rising infection rates within the community outside, and even some positive tests amongst family members.

Sikka also emphasized the critical importance of mask compliance to the program’s success. It is strictly adhered to, particularly to keep mini-bubbles from potentially contaminating each other within the larger bubble. “You don’t need to have a perfect test if you have good communication and compliance with masks,” he said.

Saliva testing

The NBA is funding a study with Yale University, which has developed a $1, reagent agnostic saliva test that can be pooled. According to Sikka, the test may be about two weeks away from gaining FDA “Early Use Authorization” approval, which will allow labs to begin using the test more widely. He envisions labs across the country soon being able to provide saliva tests at scale, and suggested, while not every resident may be able to produce saliva, the test could be used for all staff and visitors, and many residents. “This is a cheap, asymptomatic screening test that can be run rapidly,” he said. Without the need for swabs and for more time-consuming lab work, the test would be quick, comfortable, and lower-risk to administer. He claimed the test is “90% sensitive compared to nasal pharyngeal swabs.”

NIC Leadership Huddle

Coping with the Pandemic: Shifting from a Sprint to a Marathon

Aug 13, 2020, 11:00 AM EDT

REGISTER NOW

Wearables and contact tracing

Another innovation in use by the NBA involves wearable devices, such as the Apple watch, Oura ring, and Fitbit – all devices that the NBA has selected to work with. Already hugely popular, millions of Americans are wearing such devices already, and have smart phones that can enhance the devices’ capabilities. The NBA is using wearables as proximity trackers as well as a means to perform contact tracing. Wearables are promising to be able to detect subtle temperature changes, and to thereby detect a COVID-19 infection up to three days prior to other symptoms appearing. Data from these devices can be used to track and screen groups of people, and to identify higher-risk individuals over larger populations. Proximity tracking can warn a wearer that they are too close to other individuals for an extended period of time.

Other considerations that Sikka commented on ranged from activity and social gathering protocols, to having the “guts” as an organization to make tough decisions. The NBA is ensuring disposal of playing cards after they are used, and prohibiting doubles play in ping pong, among other steps to ensure safety while allowing limited social interactions. While the organization is less focused on facility cleaning, they believe ventilation “is probably not appreciated enough,” according to Sikka. He also emphasized the importance of early quarantines and early testing, saying, “I will not let someone in my building if they are not tested.”

Contact tracing, according to Sikka, is also essential. “We have 100% compliance on contact tracing and 100% compliance on wearables, and this is because we’ve forced our folks to really understand, hey, this isn’t just about you. This is about everybody else. It’s not about us trying to control your behavior but it is about you participating in a group that really needs every person to step up. We cannot have weak links” he said.

The importance of testing

Kosaraju provided an overview of where we stand on the development of testing for COVID-19, referring to three phases of development. The initial “shutdown” phase saw development of the first tests, such as PCR (polymerase chain reaction) and Isothermal nucleic acid amplification, which require a significant amount of lab work. As we enter a gradual reopening phase, according to Kosaraju, “Not only do we need more testing, its our view that we need to make smarter decisions about testing.” He described using testing as a screening tool, and incorporating testing into the environment, not only for the sick, but to detect potentially asymptomatic carriers. That will require testing more people, and therefore a development of technological capabilities. Once vaccines are “available and effective,” testing will enter a new phase, in which they will help monitor and protect against future outbreaks.

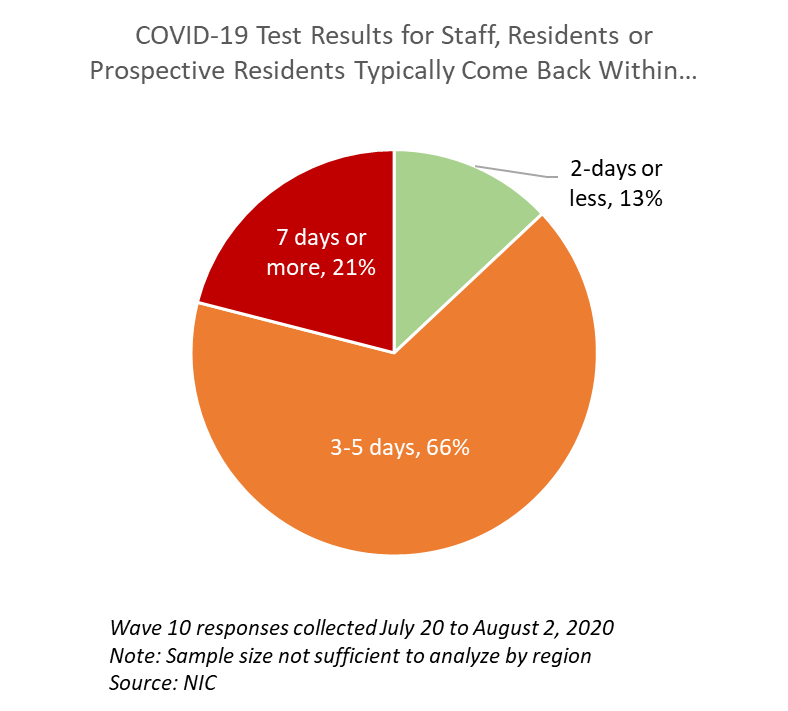

Today we need more testing, and to get tests to the right people, according to Kosaraju. Challenges include mixed messages on the need for testing, and a lack of a centrally coordinated plan that addresses COVID-19 and potential future pandemics. He underlined the importance of providing “accurate, affordable, and rapid” testing, saying, “waiting 7 days for a turnaround time defeats the purpose, if not making it worse.” He then outlined the advantages and disadvantages of today’s testing technologies, as well as new approaches that are being investigated and may soon become more widely available, such as the saliva test in development at Yale. “We’ve come a long way in testing…testing technology is improving. We are making improvements to make it faster, more scalable, rapid, and more cost-effective, ultimately. We are heading down the right path.”

Jurutka posed a few questions submitted by the webinar audience. The first centered on whether and when the saliva test in development at Yale would become approved, and widely available. In response, Sikka pointed out that the protocol for the test is open-source, and publicly available. The test is awaiting the FDA’s Early Use Authorization, which will enable labs to begin using the test, but Sikka expressed hope that a “clear verification” step can be waived. “We’ve seen a negative predictive value that’s equivalent to swabs…we’ve also seen, in a hospitalized population set, 94% sensitivity…so for a screening test its really a perfect test.” While the test will cost $1-2, he suggested a commercial lab will likely mark that up.

Automation, pooling, and more test runs per day will also help scale up testing capacity, on a test that is “much, much more tolerable, and safer” than swab testing. He said, “we’re not going to be swabbing for the rest of the year, we’re going to have alternative tests, and we’re going to have a lot of different tests available by December. But really to get us out of this and to help us get back to whatever the new sense of normalcy is, we’re going to have to have alternatives to swabs.”