Seniors housing isn’t quite like other commercial real estate investments. Returns and valuations can be significantly influenced by operational performance which makes acquisition and investment decisions complex. Professionals new to the industry can find underwriting a deal difficult and challenging.

To help these newcomers get a leg up, NIC is hosting the 2019 NIC Seniors Housing Boot Camp: The Art of Assessing the Deal, on Wednesday, April 10 from 10 a.m. to 4:30 p.m. at the AC Hotel Charlotte City Center.

Designed for professionals with 1-3 years of seniors housing experience, Seniors Housing Boot Camp is an interactive workshop for professionals looking to familiarize themselves with the unique aspects of investing in seniors housing.

Individuals with deal-making experience in other sectors will quickly gain practical knowledge by analyzing a “real” seniors housing acquisition opportunity with the input of talented industry veterans.

Sponsored by NIC’s Future Leaders Council, the event is structured around a case study which includes all the details from a deal that was negotiated in the “real world”. Participants will learn how to evaluate a seniors housing opportunity from experts and then formulate a bid on a property. The actual outcome of the case study will be revealed at the end of the program.

Prior to boot camp, participants will receive the case study outlining the key characteristics of a potential acquisition opportunity. Throughout the morning, experts will provide detailed descriptions on how to analyze the deal. Topics include:

- Supply and demand market dynamics

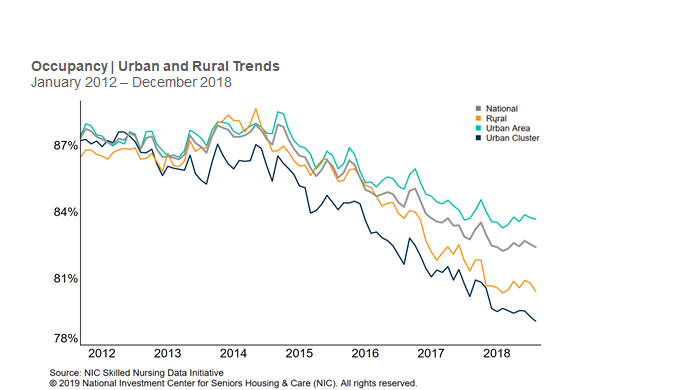

- Occupancy

- Operational performance

- Net income

- Rents

- Cost of care

- Staffing

Participants will learn how to use tools such as the NIC MAP® Data Service, gaining skills which will help them better navigate the opportunities and challenges of the sector. They will then apply what they learn in small teams as they develop a bid for the property. Each group is guided by a table captain, a member of NIC’s Future Leaders Council.

This year’s boot camp, co-chaired by council members Brandi Healey, Ryan Chase, Fritz Kieckhefer and Richard Wang, features several notable programming changes. It will feature a joint networking reception bringing together boot camp attendees and members of the Future Leaders Council. The reception is a unique networking opportunity for Boot Camp attendees and Future Leaders Council members alike.

Industry icon John Moore, the Chairman and Chief Executive Officer of Atria Senior Living, will be the keynote luncheon speaker. Moore will provide his insights into the trends impacting the industry and the major drivers shaping the future of seniors housing real estate.

At the end of the day, teams will present their property bids along with the rationale for their offers. The results of the actual deal will be discussed so that participants can judge their work against the actual outcome. This aspect of the workshop provides attendees a chance to walk through a deal from start to finish. It’s also a great opportunity to network and get to know the future leaders of the industry.

The 2019 Seniors Housing Boot Camp is fully booked. Learn more about future workshops here.