The total investment return for the seniors housing sector was a positive 0.54% in the second quarter of 2021. This marked the fourth consecutive quarterly gain after one quarter of negative returns in the second quarter of 2020 when total returns were negative 1.00%; that marked the first negative total return since 2012 and prior to that in 2009.

The income return in the second quarter was the same as in the first quarter, but at 0.78% it was the smallest quarterly gain on record as far back as 2003. The valuation (capital/appreciation) return fell 0.24%, the seventh consecutive quarterly decline. This contrasts with the NPI and apartments, where the valuation return turned positive in the fourth quarter and saw gains of 2.54% and 2.71%, respectively, in the second quarter of 2021. Many investors have reduced their appreciation expectations for seniors housing as the impact of the coronavirus has weighed heavily on their view of the sector. The valuation return is the change in value net of any capital expenditures incurred during the quarter.

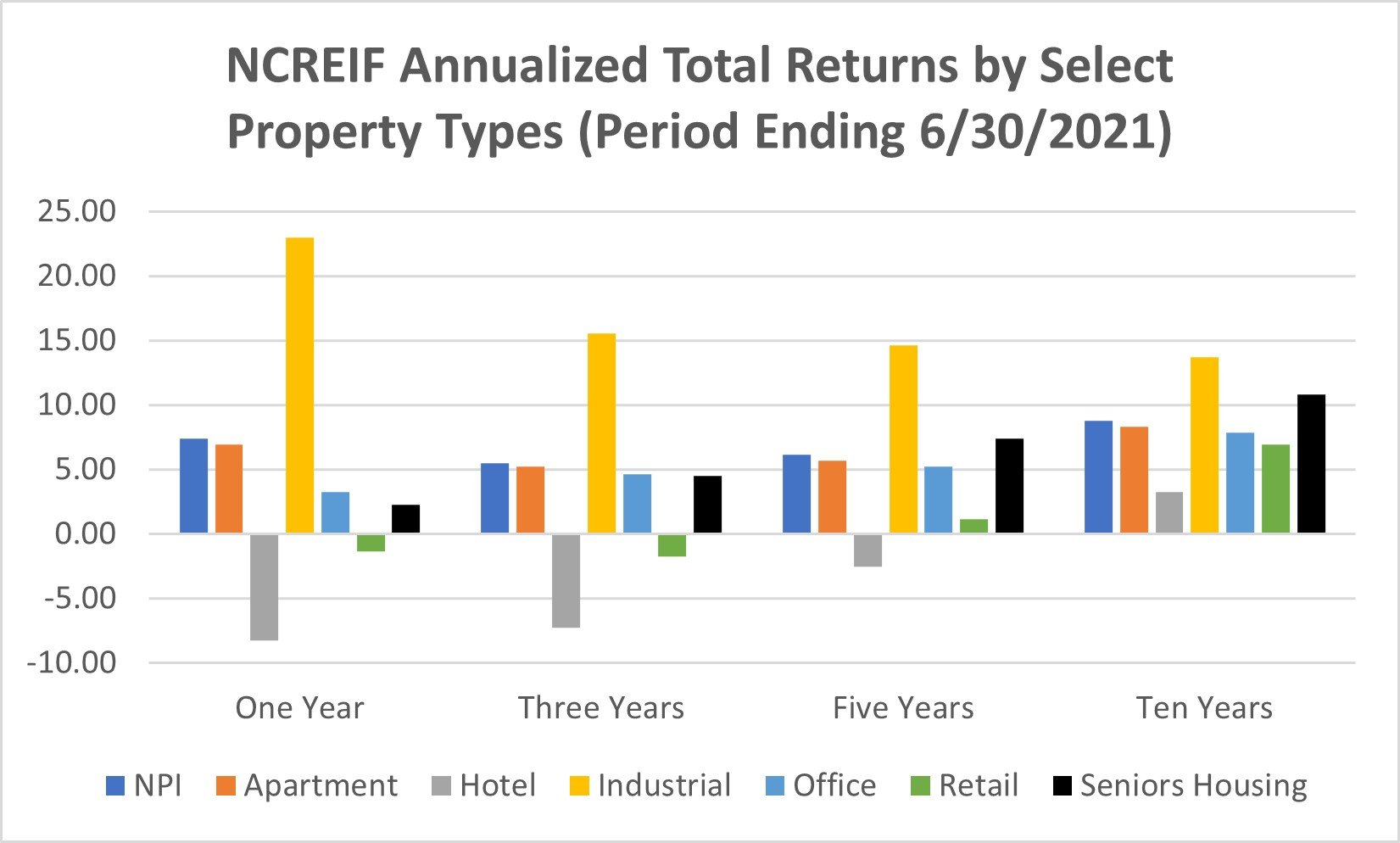

The one-year valuation return for seniors housing was a positive 2.26%, the strongest annual return since the onset of the pandemic in the second quarter of 2020. The 2.26% total return compared favorably to retail (-1.32%) and hotel (-8.27%), but was smaller than the other major property types, including the overall NPI (7.37%). Meanwhile, the industrial sector enjoyed an eye-popping 22.98% appreciation return on a one-year basis.

Note that the performance measurement cited above for seniors housing reflects the returns of 149 seniors housing properties valued at $7.9 billion in the second quarter. This represents the highest property count and market value in the NCREIF time series for seniors housing.

For more details, download the full article here.