NIC MAP Vision released its latest Skilled Nursing Monthly Report on June 29, 2023. The report includes key monthly data points from January 2012 through April 2023.

Here are some key takeaways from the report.

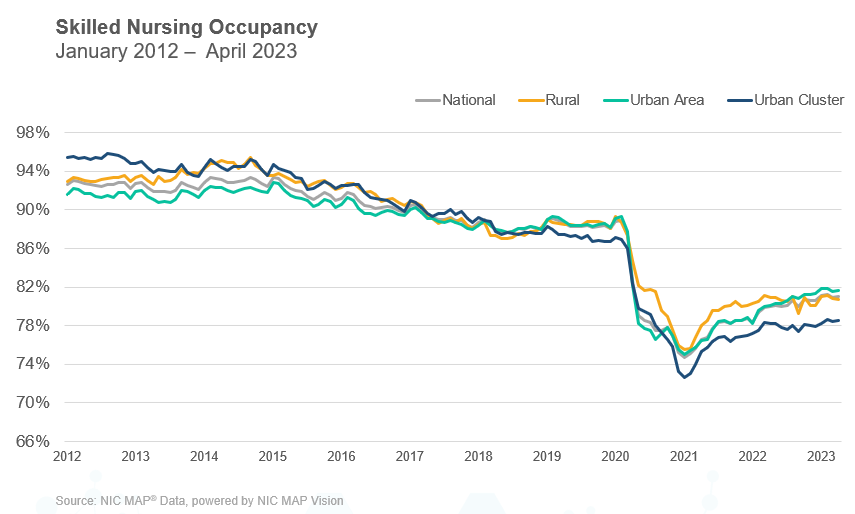

Occupancy

Skilled nursing occupancy increased in April after declining in March. It increased 9 basis points from March to end the month at 81.0%. However, occupancy has been down slightly since the beginning of the year (2023) in January. There was positive momentum in occupancy throughout 2022 and it is up 632 basis points since the low point (74.7%) reached in January 2021. Although occupancy was relatively flat from May 2022 through September 2022, it did increase 277 basis points from January 2022 to January 2023. The staffing crisis in the sector is still a significant burden on skilled nursing operators, especially as the acuity level of patients has increased along with the demand for nurses. As staffing, wage growth, and general inflation pressures persist, operations for many operators will be under pressure but the long-term demand for skilled nursing services is expected to grow over time.

Medicaid

Medicaid revenue mix increased, ending April at 50.4%. However, it is down 127 basis points from one year ago when it was 51.6% in April 2022. One element of the Medicaid revenue share of a property’s revenue is revenue per patient day (RPPD) and that was up slightly from March. It is up 3.0% since last year in April 2022 and is now at $270. Medicaid reimbursement has increased more than usual as many states embraced measures to increase reimbursement related to the number of COVID-19 cases throughout the pandemic, but many states have continued to increase reimbursement. Medicaid has increased 6.3% since February 2020. On the other hand, covering the cost of care for Medicaid patients is still a major concern as reimbursement does not cover the cost of care in many states. In addition, nursing home wage growth is elevated along with overall inflation, and staffing shortages are still a significant challenge in many areas of the country.

Medicare

Medicare revenue per patient day (RPPD) decreased slightly from March to end April at $587. This was a 0.69% decrease from its recent high of $591 in December 2022, which was its highest level since June 2020 when the federal government began implementing many initiatives to aid operators of properties for cases of COVID-19, including increases in Medicare fee-for-service reimbursements to help care for COVID-19 positive patients requiring additional care. Medicare RPPD is up 1.77% from one year ago in April 2022 and some of that increase can be attributed to the fiscal increase for 2022-2023. Meanwhile, Medicare revenue mix trended down in the month of April, decreasing 41 basis points from 22.0% to end the month at 21.6%. It is up 102 basis points compared to one year ago in April 2022. However, it is down 306 basis points from February 2022 which was when the country had an elevated number of COVID-19 cases, and the data suggests there was a significant uptick in the utilization of the 3-Day Rule waiver as COVID-19 cases increased last year. The 3-Day Rule waiver was implemented by Centers for Medicare and Medicaid Services (CMS) to eliminate the need to transfer positive COVID-19 patients back to the hospital to qualify for a Medicare paid skilled nursing stay, hence increasing the Medicare census at properties. As the cases decline, the Medicare revenue share declines, all else equal.

Managed Care

Managed Medicare revenue mix decreased 9 basis points from March to end April at 11.2%. This is up 202 basis points from the pandemic low set in May 2020 of 9.2%, which was a time when elective surgeries were suspended and created less referrals from hospital to skilled nursing properties. Meanwhile, Managed Medicare revenue per patient day (RPPD) decreased from $482 to $481 in April. Compared to its year-earlier value of $484, it is down 0.7% and it is down $121 (20.1%) from January 2012. It continues to create pressure on operators’ revenue as managed Medicare enrollment continues to expand its reach and coverage around the country. However, some operators see an opportunity to capture patient volume with the growth of managed care. The persistent decline in managed Medicare revenue per patient day continues to result in an expanded reimbursement differential between Medicare fee-for-service and managed Medicare. Medicare fee-for-service RPPD ended April 2023 at $587, representing a $107 difference. For context, the differential one year ago was $93 and two years ago it was $85.

Get more trends from the latest data by downloading the Skilled Nursing Monthly Report. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form on our website. NIC and NIC MAP Vision maintain strict confidentiality of all data received.