Over the past couple years skilled nursing properties have continued to see strong interest from investors in the sector. This has contributed to skilled nursing valuations becoming what some deem as elevated. However, others might argue differently. Regarding the overall skilled nursing market, many continue to see steady demand trends as the industry passes the inflection point where the growth of the senior population accelerates, and more people with higher acuity levels need care. There are headwinds as we are all aware, including the risk of Medicare reimbursement cuts, low occupancy rates, chronic underfunding of Medicaid reimbursement in many states, a staffing crisis, and ongoing elevated inflation including wage rate growth. Given the challenges that are present, why has skilled nursing property price per bed increased?

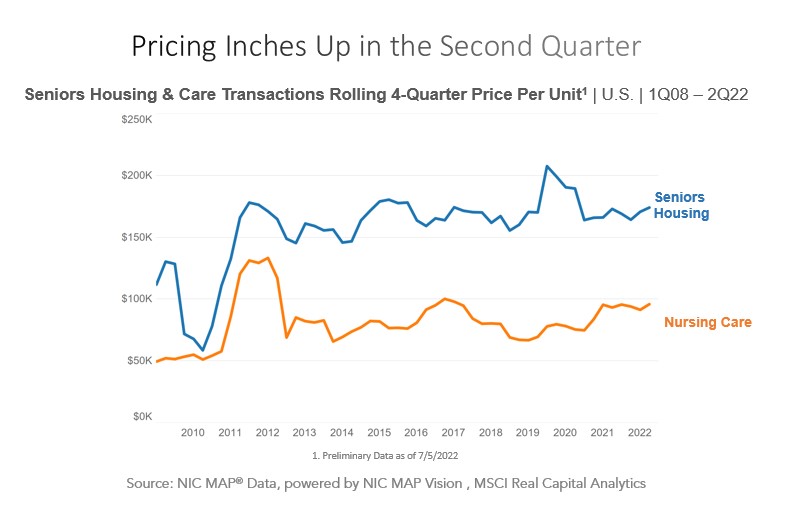

Before answering that question, let’s look at the pricing trends. Below is a chart that shows private pay seniors housing price per unit and nursing care (a.k.a. skilled nursing) price per bed. For this article, pay attention to the nursing care price per bed trendline. In late 2019, specifically the fourth quarter of 2019, nursing care price per bed was $80,000 and in the first quarter of 2020 it was at $78,550. It then proceeded to decline to $74,900 in the third quarter of 2020, its pandemic low. The decline made sense as many assets were struggling during the pandemic. However, the price per bed remarkably increased to $95,600 by the first quarter of 2021 during a period of very low occupancy levels. Occupancy is still challenged as of the second quarter 2022 but price per bed remained in the $95,000 range. Specifically, it was at $95,800 as of the preliminary data for the second quarter, which is 19.6% above the level in the fourth quarter of 2019 before the beginning of the pandemic.

There is not simply one answer as to the reasoning behind why skilled nursing price per bed is relatively high, given the challenging operating fundamentals. There are likely many factors involved.

First, both monetary and fiscal policy created a tremendous amount of liquidity and as a result most asset prices, e.g., real estate and public equities, increased significantly during the pandemic. Furthermore, the government made a commitment to help the skilled nursing industry during the pandemic. This was evident by many Paycheck Protection Program (PPP) loans, Medicare prepayments, Medicaid rate increases, and other forms of aid at the state levels. Second, the Patient Driven Payment Model, implemented before the pandemic, can compensate for higher care levels unlike the previous model but operators need to be able to code their systems accordingly to get paid. Hence, buyers can justify paying higher prices per bed if they are estimating higher cash flow.

In addition, owners with more properties can benefit from scale in certain geographies and potentially have other benefits like staffing flexibility. Therefore, some owners have planned to grow by acquisition and can justify higher prices paid if they own more properties in a certain area. Another reason is the opportunity for growth in other ancillary businesses. These businesses can include in-house dialysis, contract therapy, wound care, pharmacy services or an on-site diagnostic lab, among other businesses. Also, there is the dynamic that the number of skilled nursing property buyers seemingly were outnumbering the seller supply, at least for now.

Lastly, there is the yield spread vs. other real estate asset types. If skilled nursing properties are selling for cap rates at, say, 11%, investors still have significant cushion if they have debt cost of capital in the 5% range and a loan-to-value in the 90% range. In addition, from an overall real estate investment perspective when measuring against other real estate asset types, 11% cap rates look very attractive.

In conclusion, skilled nursing property pricing has been stronger than many would have expected during a pandemic for various reasons. However, the risk of higher rates and labor market challenges could give more reasons for sellers to come to market, which would increase the number of properties on the market. In addition, if the cost of capital continues to increase as well, the price per bed increases may be limited in the near-term.