NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time where market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

This report is a subset of the findings from NIC’s Executive Survey. Highlights of the responses from owner/operators of CCRC organizations are compared to responses from non-CCRC owner/operator organizations collected near the beginning of the COVID-19 pandemic through the end of May. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Key Findings

- The COVID-19 pandemic has caused the pace of move-ins for all seniors housing and care communities to slow. However, CCRC properties have experienced less disruption on move-in rates and have seen greater stability in occupancy rates than non-CCRC properties.

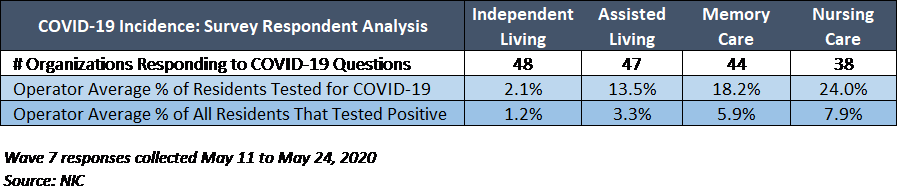

- The impact of the virus among non-CCRC seniors housing and care properties has been swifter and more significant than for CCRCs.

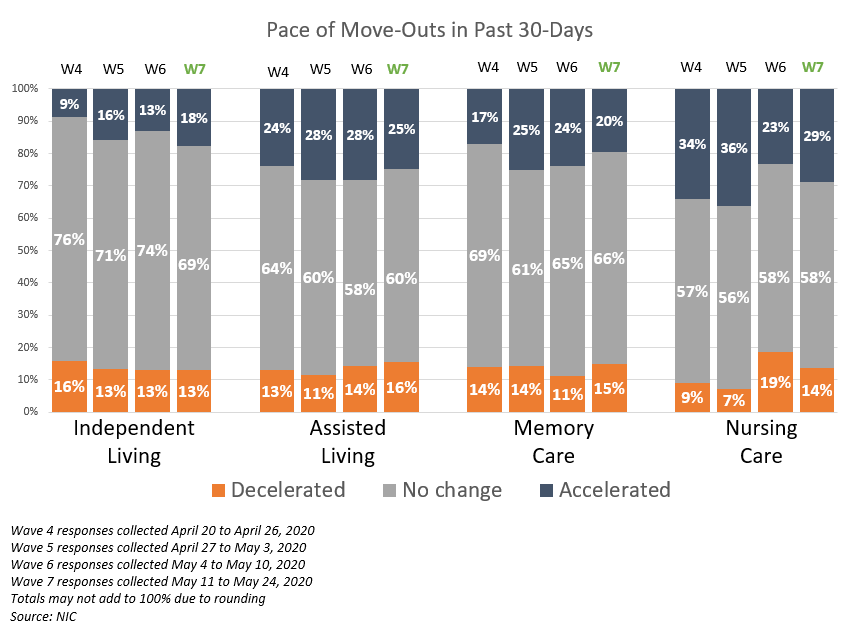

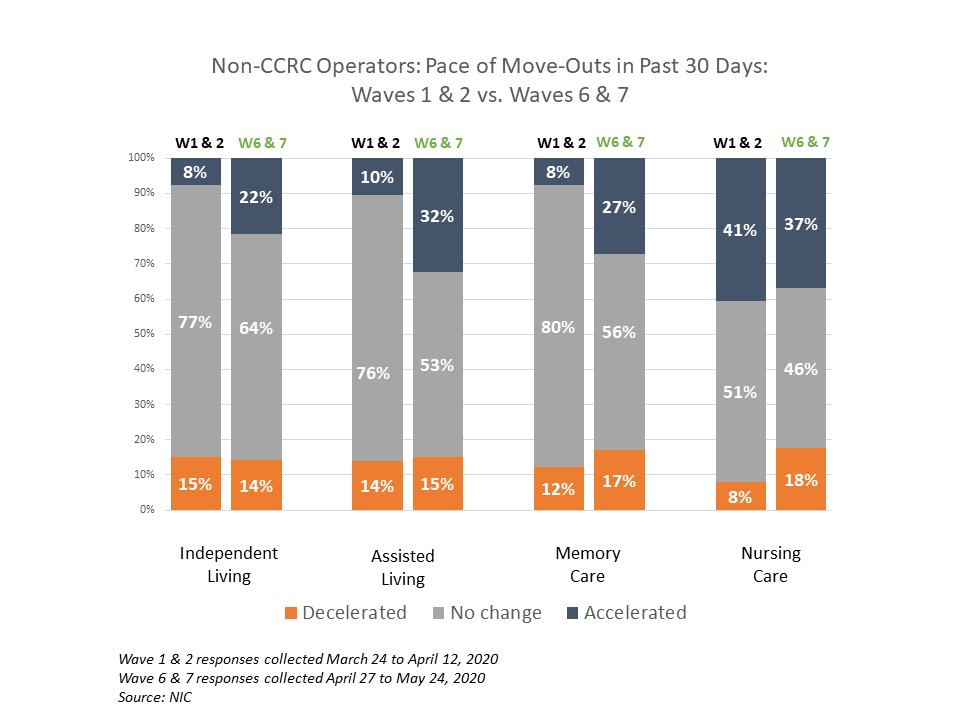

- The pace of move-outs for CCRC properties has been less effected than for non-CCRC properties over the course of the pandemic to date. More non-CCRC organizations have reported growing shares of acceleration in move-outs by care segment than CCRCs.

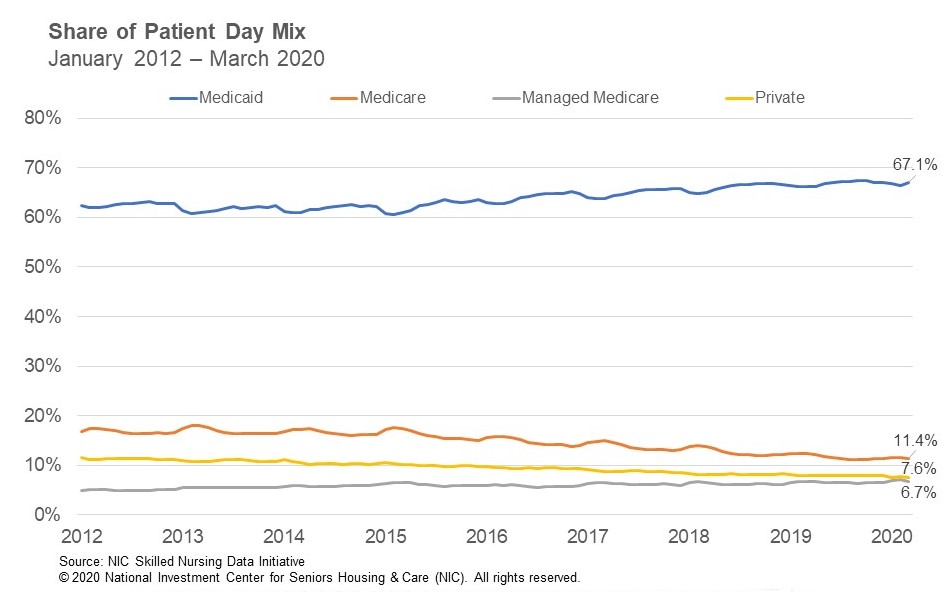

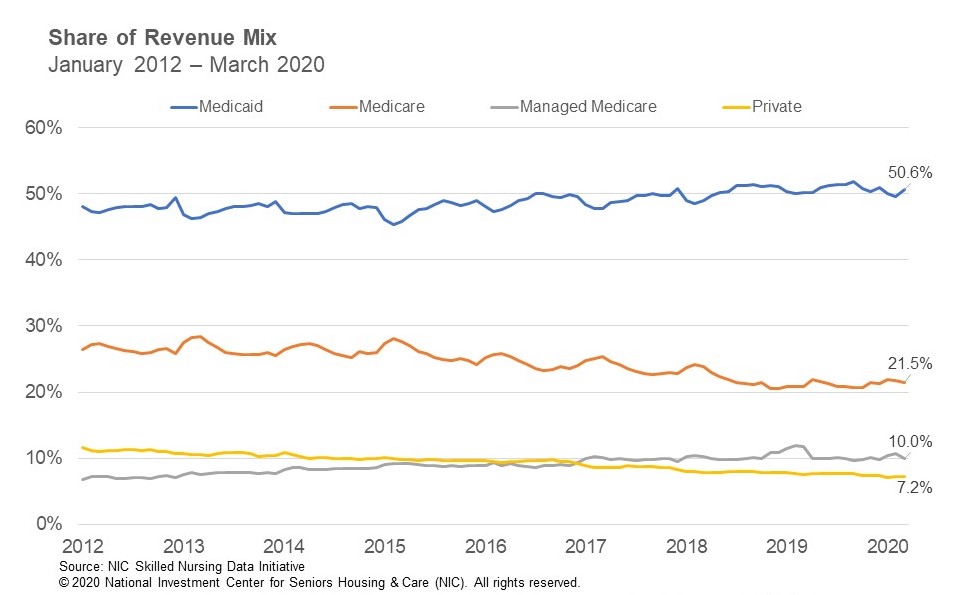

- The largest impact on move-ins and move-outs among care segments has been on nursing care. As the highest acuity care segment, nursing care has experienced the most negative impact of the COVID-19 pandemic on occupancy levels and this has grown over time.

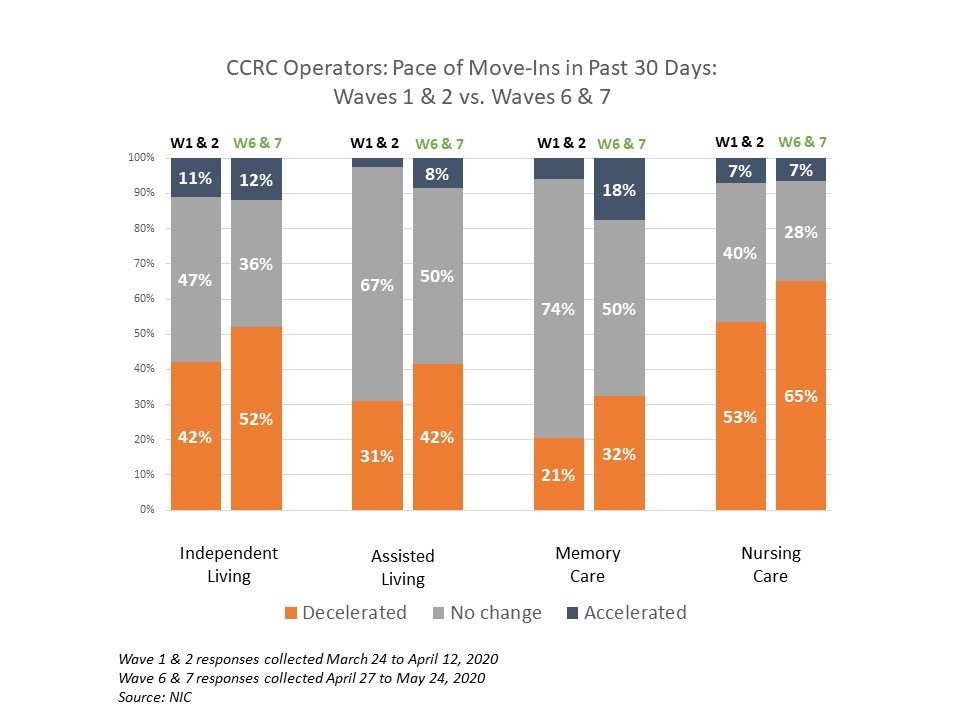

Pace of Move-Ins and Move-Outs

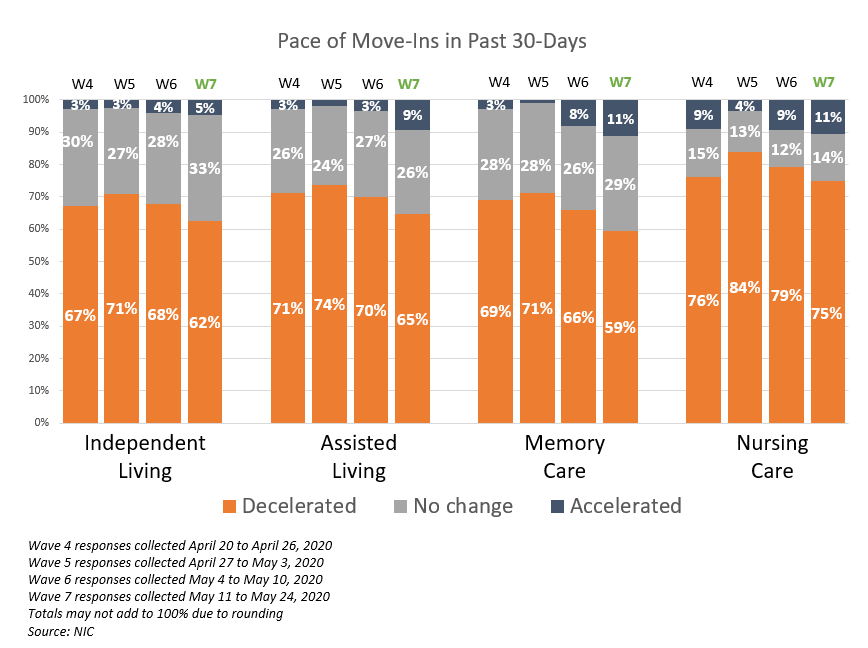

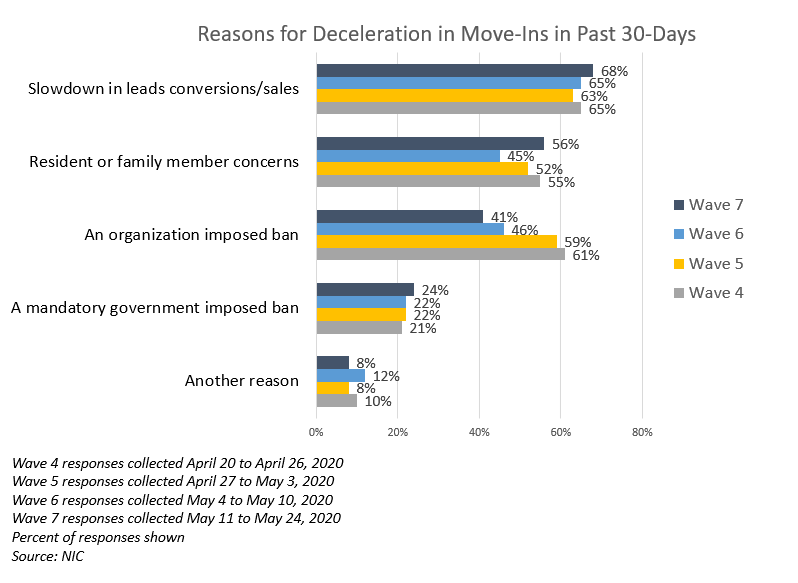

- Approximately one-third to one half of CCRC organizations reporting on their independent living, assisted living, and memory care units in Waves 6 and 7, across their respective portfolios of properties, saw a deceleration in move-ins from the prior month (52%, 42% and 32%, respectively). This compares to 42%, 31% and 21% in Waves 1 and 2—amounting to roughly a ten-percentage point difference—highlighting the growing influence of the COVID-19 pandemic on move-ins as time has passed.

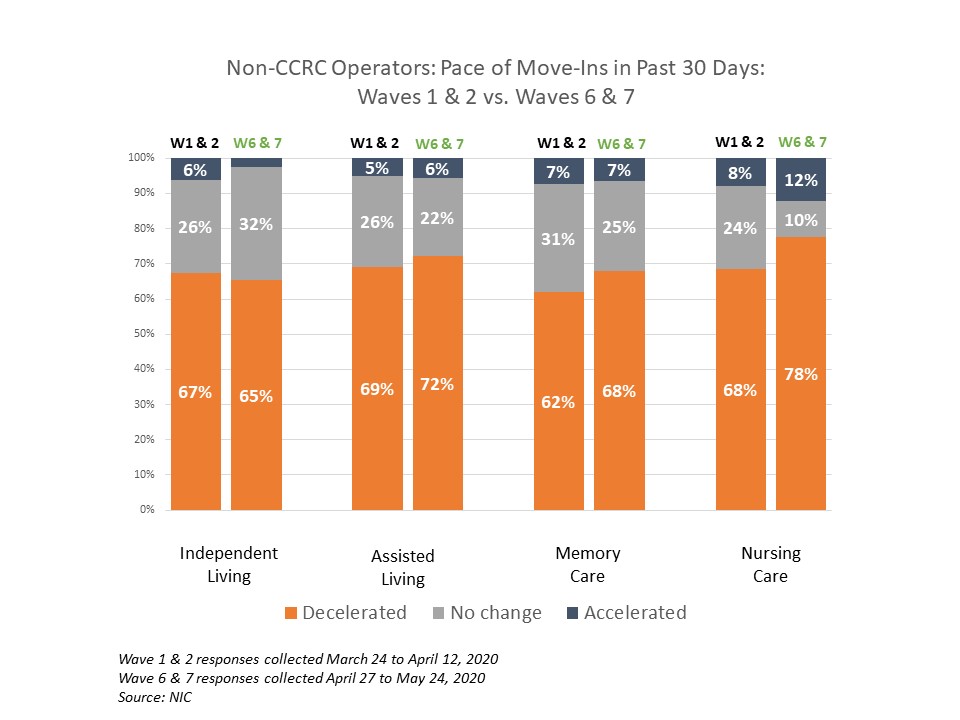

- In contrast, the virus’s effect on move-in patterns among non-CCRC seniors housing and care segments was more significant. Approximately two-thirds to three-quarters of non-CCRC organizations reporting on their independent living, assisted living, and memory care units in Waves 6 and 7 saw a deceleration in move-ins from the prior month (65%, 72% and 68%, respectively). This compares to 67%, 69% and 62% in Waves 1 and 2.

- The CCRC memory care and assisted living segments reported the least change in the pace of move-ins in both timeframes, and the CCRC memory care segment saw a greater share of acceleration in move-ins in across the board in Waves 6 and 7.

- The largest impact among care segments has been on nursing care. Nearly two-thirds of the sample’s CCRC organizations with nursing care beds (65%) saw decelerations in the pace of move-ins in Waves 6 and 7, compared to just over half in Waves 1 and 2 (53%). However, more non-CCRC organizations with nursing care beds noted declines in the pace of-move-ins. Nearly three-quarters of the survey sample’s non-CCRC organizations with nursing care beds (73%) noted decelerations in the pace of move-ins more recently than in the earlier days of the COVID-19 crisis (68%).

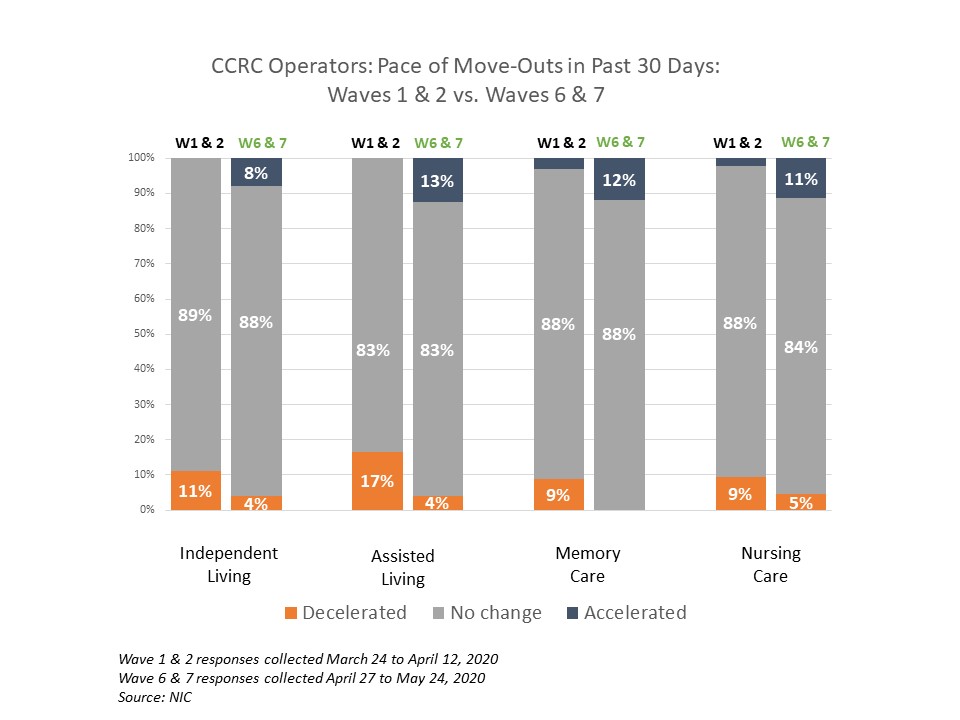

- There is greater stability in the pace of move-outs reported by CCRC organizations compared to non-CCRC organizations. A potential reason for this survey finding could be that CCRCs offer multiple care segments (at a minimum, independent living and nursing care) typically by a single provider on one campus, and this full range of services allows residents to remain within the community as their care needs change.

- The majority of both CCRC and non-CCRC respondents noted no change in the pace of move-outs across the duration of the pandemic to date, apart from the non-CCRC nursing care segment. However, for non-CCRC properties, each care segment showed larger shares of organizations reporting an acceleration in move-outs as the COVID-19 pandemic progressed.

- Some possible explanations for the relatively better performance of CCRCs during the pandemic may include the following considerations:

- While many CCRCs accept nursing care residents from outside of the community, the majority guarantee access to current residents. Furthermore, non-CCRC organizations with nursing care beds may have seen a greater effect on move-ins as the virus caused hospitals to curtail elective surgeries, reducing the amount of short-term, rehabilitation residents.

- Non-CCRC residents tend to move in older and have more care needs, especially in the higher acuity settings. CCRC residents, on the other hand, tend to enter the independent living care segment of the community at younger ages and in better health both physically and cognitively, having planned to live on a campus that can meet any care needs they may have in the future without having to make a move from the community.

- Multiple levels of care often spread out across a large footprint may make it easier for CCRC operators to distance vulnerable residents from others augmenting protection from contagion that is harder to do in properties that are home to residents with more diversity of care needs under one roof.

Changes in Occupancy Rates

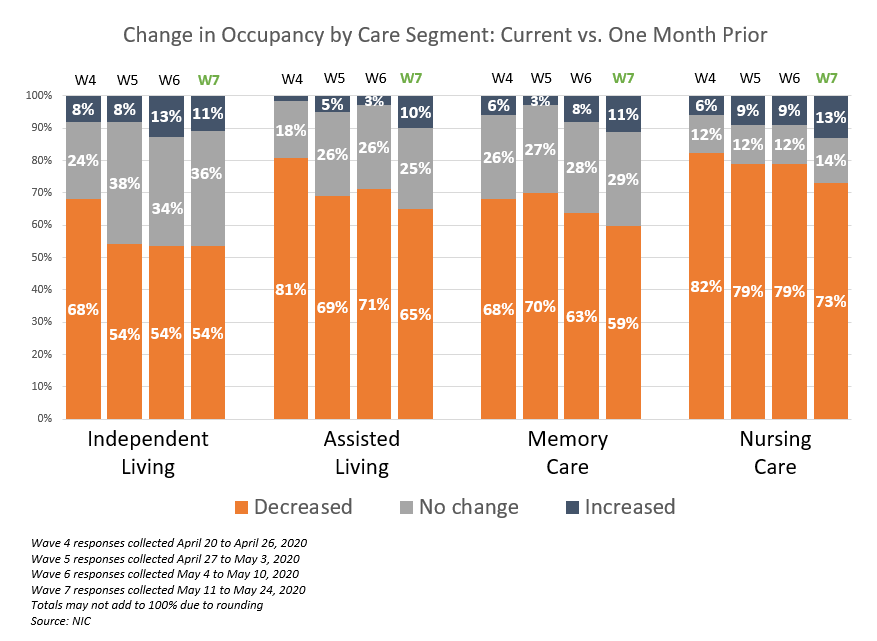

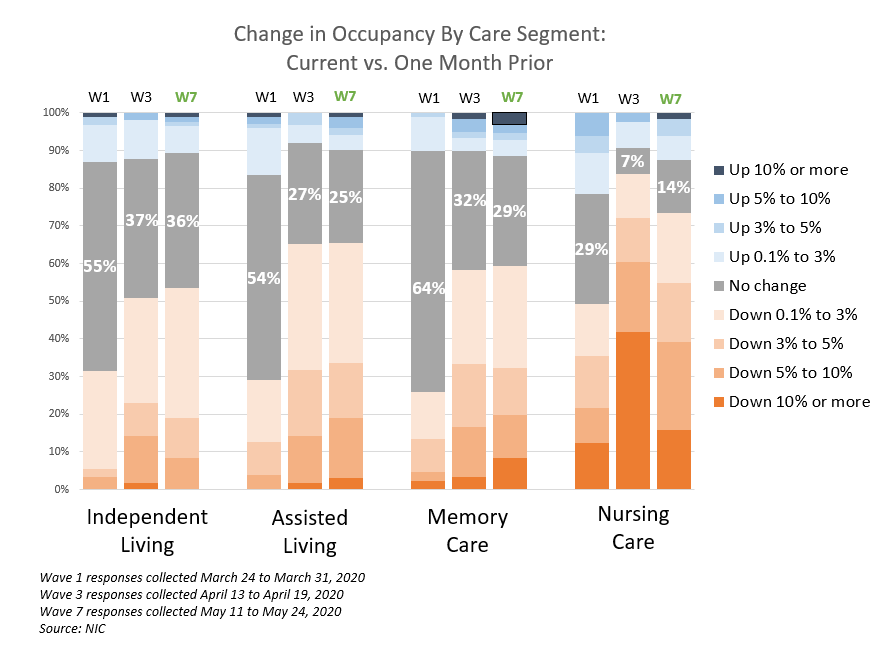

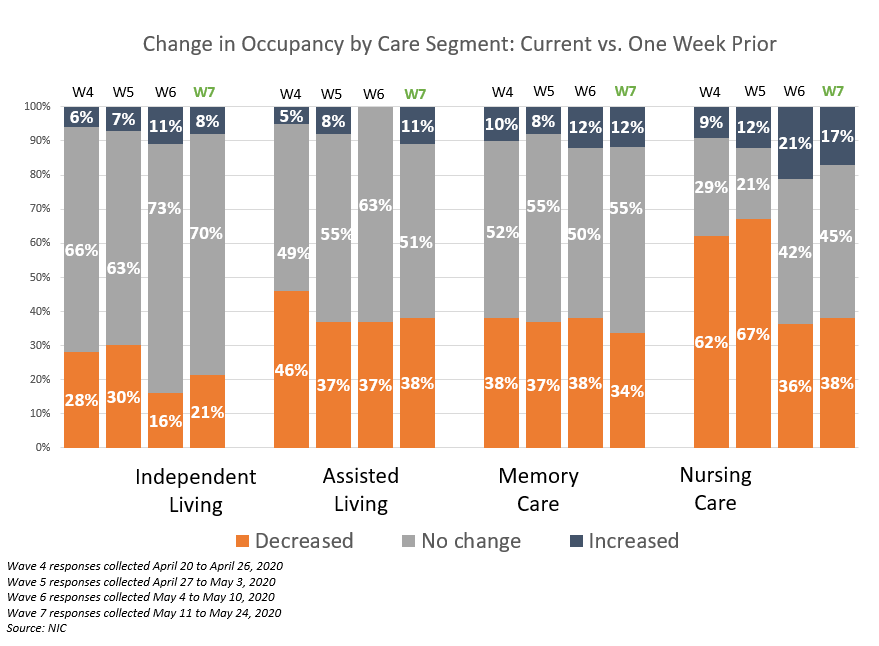

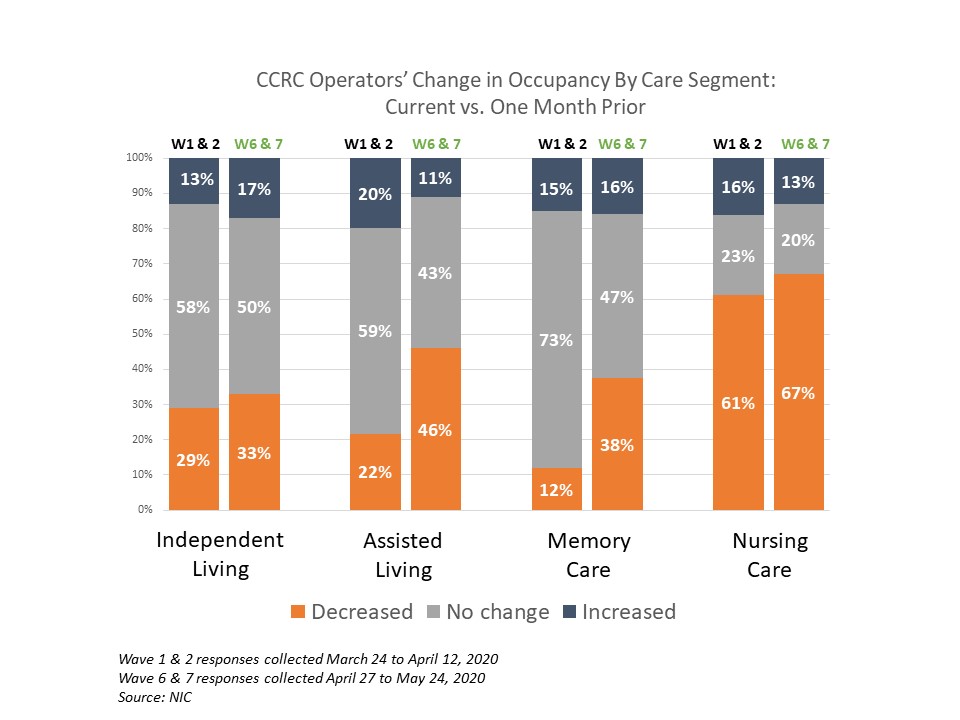

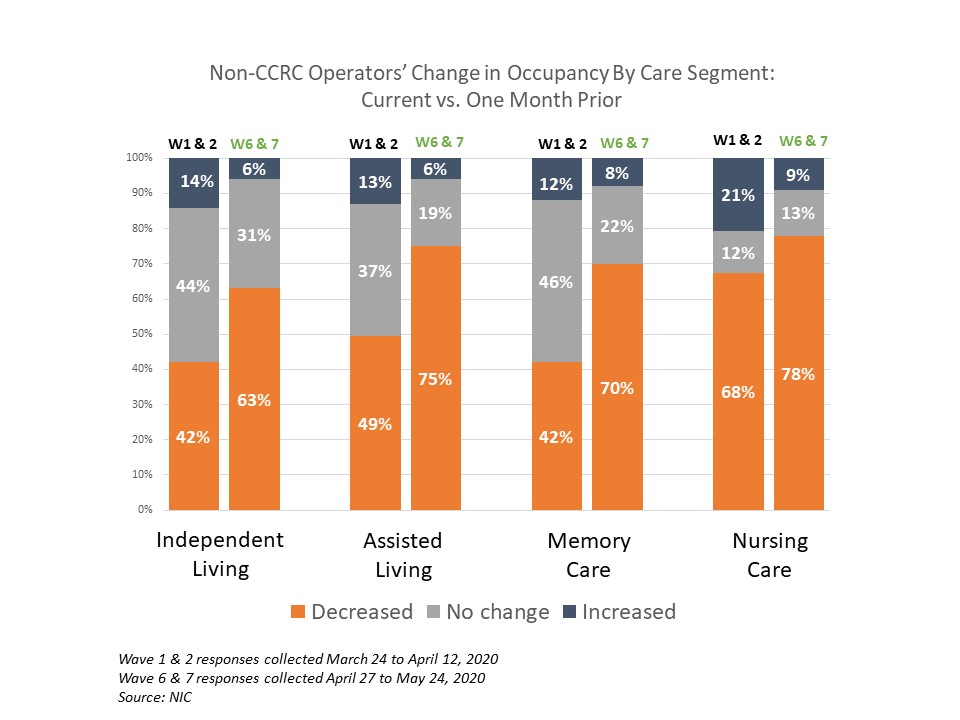

- The highest acuity segments have experienced the most negative impact of the coronavirus on occupancy levels and this has grown over time. Shares of CCRC and non-CCRC organizations reporting a decrease in occupancy in the past 30-days are higher in Waves 6 and 7 than in Waves 1 and 2.

- The nursing care segment for both CCRCs and non-CCRCs reported the highest shares of organizations with occupancy declines over time (from 61% to 67% for CCRCs and from 68% to 78% for non-CCRCs).

- The memory care and assisted living care segments have seen the most change in occupancy from earlier in the pandemic to recently. Roughly three-quarters of CCRC organizations with memory care segment units (73%) and more than half with assisted living (59%) reported no change in occupancy from the month prior in Waves 1 and 2 compared to 43% and 47%, respectively, in Waves 6 and 7.

- Conversely, among the same non-CCRC care segments, there were more organizations reporting a deceleration in occupancy which widened over time—from 49% to 75% in assisted living—and from 42% to 70% for memory care.

- The independent living care segment has seen less downward pressure on occupancy compared to the assisted living, memory care and nursing care segments. Only about one-third of CCRC organizations reported occupancy declines in independent living between when the survey began to recent times (29% and 33%, respectively). However, more non-CCRC organizations with independent living reported occupancy declines in both timeframes (42% and 63%, respectively).

In conclusion, while the pace of move-ins has decelerated with the progression of the COVID-19 pandemic across all types of seniors housing and care communities, CCRCs have experienced less disruption, translating into more occupancy stability than non-CCRCs.

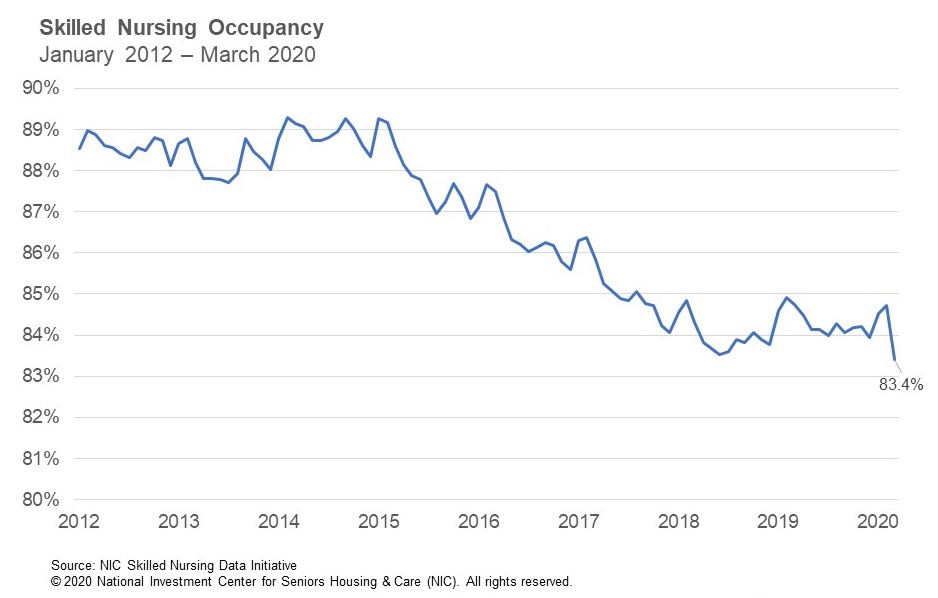

These survey results are consistent with what has been reported in the NIC MAP® data analysis of the performance of CCRC care segments compared to non-CCRC care segments in the past. As detailed in a recent blog post breaking down the market fundamentals at the care segment-level, CCRCs have reported stronger occupancy rates than freestanding and combined non-CCRC care segments.

During the great recession, CCRCs struggled with declining occupancy due to a strong development pipeline that delivered inventory during a devastated housing market, which made it difficult for residents to sell their homes to move into CCRCs. Additionally, adverse and uncertain economic conditions raised barriers to moving into choice-based, lifestyle-focused CCRCs. However, CCRC occupancy rebounded during the recovery period following the great recession, and since then, CCRC inventory growth has been muted compared to other seniors housing property types. For the past several years, CCRC occupancy rates have outpaced their non-CCRC counterparts.

Going forward, CCRCs entered the COVID-19 pandemic from a position of relative occupancy strength and have performed better than non-CCRCs in terms of move-ins, move-outs and changes in occupancy rates. Time will tell how well CCRCs will weather the current COVID-19 crisis and potential economic consequences to come.

Survey Demographics

- Waves 1 and 2 responses combined, collected between March 24 and April 12, 2020, included 48 responses from owners and executives of CCRC operators. Single-site CCRC operators made up 60% of the sample, and 96% of the organizations responding were exclusively nonprofit owner/operators.

- Non-CCRC operators included 148 responses from owners and executives. The Waves 1 & 2 combined sample was comprised of 75% multi-site operators (5 or more properties). The majority (82%) were exclusively for-profit providers.

- Waves 6 and 7 responses combined, collected between April 27 and May 24, 2020, included 51 responses from owners and executives of CCRC operators. Single-site CCRC operators made up 75% of the sample, and 94% of the organizations responding were exclusively nonprofit owner/operators.

- Non-CCRC operators included 218 responses from owners and executives. The Waves 6 & 7 combined sample was comprised of 74% multi-site operators (5 or more properties). The majority (78%) were exclusively for-profit providers.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. Your support helps provide both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the Executive Survey, please click here for the current online questionnaire.