The aging of the U.S. population and the growing incidence of dementia make understanding the local prevalence of this disease more important than ever for planning senior housing projects.

Data show that degenerative brain diseases such as Alzheimer’s are more prevalent in certain parts of the country than others and understanding these patterns can make feasibility analyses more precise and reliable as well as allow for a better targeting of supply and demand. This blog presents selected portions of a longer analysis that we’ve published as a white paper. Analysis was conducted using NIC MAP Vision data.

Memory Care – Memory care is a senior housing product type that is specifically designed for residents with dementia. Properties where memory care is offered may have a secured/locked environment, design features that highlight sunlight, staff that has specialized training about dementia, spaces where residents can move about safely, and interactive activity stations for residents, among other features. Memory care in this article uses the segment type designation from NIC MAP, meaning that the inventory used in this analysis are memory care units that can be located at any type of property.

Memory Care Medicare Beneficiary Penetration Rate – For this analysis, the memory care Medicare beneficiary penetration rate is calculated as the sum of the number of memory care units in a market divided by the total number of Medicare beneficiaries with Alzheimer’s or dementia in that market.

Total Medicare Beneficiaries with Alzheimer’s or Dementia – The total Medicare beneficiaries with Alzheimer’s or dementia in a market area. These data are sourced from the Medicare Chronic Conditions Data Warehouse. NIC MAP Vision has access to these data from Medicare, and these data points are tied to the geographic location of the beneficiary. These data are accessible at a local level in the Vision LTC portal and are as of 2019, which is the most recent vintage of data available.

The number of people diagnosed with dementia is projected to grow

The number of people in the United States estimated to have Alzheimer’s disease in 2021 is 6.25 million, which is projected to grow to 7.16 million in 2025 and reach 12.73 million in 2050.2 Barring major medical breakthroughs like finding a cure for dementia, this means that the pool of potential residents for memory care is expected to see major increases in the coming years.

Methodology

NIC MAP Vision provides Vision LTC subscribers with data from Medicare in the Vision LTC portal. These data are provided to NIC MAP Vision by Medicare in a process where the individual beneficiaries are kept anonymous. As discussed in a recent NIC Insider interview with Beth Mace and Arick Morton, CEO of NIC MAP Vision, underwriters no longer have to rely on national or state level data on dementia and can utilize local data when planning a product offering or evaluating a market.

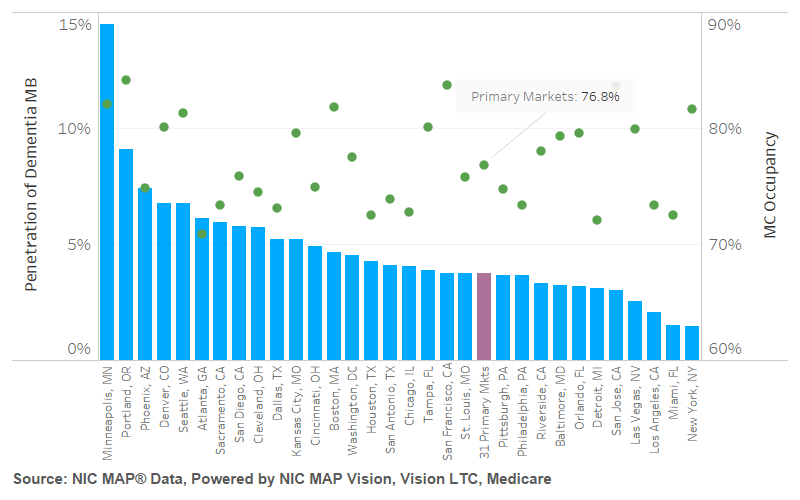

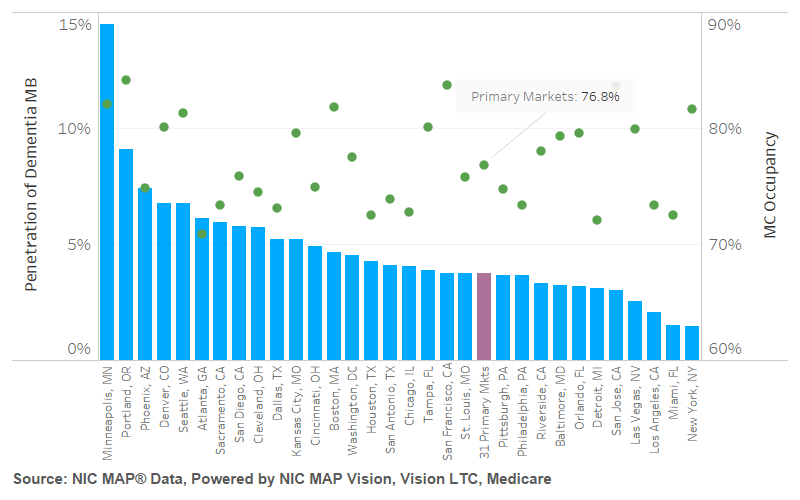

This analysis focuses on the 31 NIC MAP Primary Markets. We looked at the number of dementia Medicare beneficiaries as a share of the population over 65 in each of the metro areas to investigate differing rates of dementia in local geographic population cohorts. Although most senior housing feasibility studies typically use older populations as a measure of potential demand, 65 is the current age at which someone can qualify for Medicare. In order to not overestimate the possible number of dementia or Alzheimer’s Medicare Beneficiaries in relation to the population in the selected metropolitan areas, this analysis uses population 65+.

Using memory care segment supply data from NIC MAP and dementia Medicare beneficiaries data from Vision LTC, we also calculate how many memory care units there are per dementia Medicare beneficiaries in each of the metropolitan markets.

Selected findings from the white paper

There are differing levels of dementia incidence by metro area and differing levels of inventory, meaning there may be imbalances in some markets and not in others, and individual markets may have varying levels of need as well as utilization of memory care units (as measured by occupancy rates). This finding may also extend to more granular areas than at the metro level.

Dementia Medicare beneficiaries by metro area

Dementia Medicare beneficiaries are not evenly distributed across the U.S. Some markets have notably higher proportions of dementia Medicare beneficiaries than others. The Miami, FL metro area has the largest share of dementia Medicare beneficiaries as a share of the population 65+ at 16.6%. Detroit has the second highest level of dementia Medicare beneficiaries as a share of the total population 65+ at 13.4%. At the other end of the spectrum are Portland Oregon, Phoenix and Seattle, all less than 8.0%. The white paper provides further information for this portion of the analysis.

Memory care units per Medicare beneficiary

Juxtaposing the need for dementia care by metropolitan market against the supply of memory care units shows that there are supply/demand gaps. For example, while Miami has the highest need for dementia care as measured by its large share of beneficiaries with dementia, it has the second lowest number of memory care units per dementia Medicare beneficiary at 1.52%. Detroit also ranks low in the number of memory care units per dementia Medicare beneficiary at 3.1%, the sixth lowest of the 31 Primary Markets.

Both Miami (72.5% occupancy) and Detroit (72.1% occupancy) face pressured memory care occupancy in the third quarter of 2021. Atlanta has the lowest memory care occupancy of the 31 Primary Markets at 70.9%. Portland has the highest memory care occupancy of the Primary Markets at 84.1%. While occupancy is likely still recovering from pandemic lows, San Francisco (83.7%), San Jose (83.6%), and Minneapolis (82.1%) also have relatively high memory care occupancies among the Primary Markets. The Primary Markets has a memory care segment occupancy of 76.8%, with 16 metros of the 31 metros below the average and 15 metros above.

Additional metros are explored in more detail and additional graphs are reported in the white paper analysis. We encourage NIC Notes readers to download the full paper.

Conclusions

Understanding local incidences of dementia can help inform plans for new projects or expansions. This analysis demonstrates that there are local variations in both the availability of memory care supply and of the dementia Medicare beneficiaries in the Primary Markets.

This analysis also demonstrates that there are metros where there are higher levels of memory care units available to serve dementia Medicare beneficiaries, and there are other metros where there are many dementia Medicare beneficiaries and proportionately lower levels of supply available. This analysis is at the metropolitan market level, and deeper dives into smaller geographic regions in these metro areas could show more detailed information of local dynamics.

VisionLTC subscribers can use the VisionLTC platform to conduct a more localized analysis, drilling down into smaller market areas.

Selected caveats and limitations

This section provides some of the caveats and limitations of the analysis that the whitepaper explains in further detail. For full description of the limitations, please see the full publication. This analysis does not account for utilization rates of home care services, which may also have differing levels of popularity and utilization between markets. The analysis also does not factor in income assumptions for the dementia Medicare beneficiaries or their children (although the Vision LTC portal does have some income data available to subscribers as well for evaluating local income levels). The analysis also does not account for potential regional differences in availability and involvement of family caregivers.

There is also the possibility that some of the totals of dementia Medicare beneficiaries could have notable declines due to loss of life from the pandemic when the data are updated with 2020 figures, as we know many older people with dementia have been severely impacted by the virus. As a result, some of the penetration rates of memory care units per dementia Medicare beneficiaries may be understated here compared to what the 2020 numbers may be due to declines from loss of life from COVID-19.

The NIC MAP Metro areas and the Vision LTC metro areas may not have the exact same geographic boundaries for all metro areas, though they should generally be the same or very similar. This is because the two services use different years of the Census’ boundaries for metros. Visual inspection of the boundaries for each of the Primary Markets did not illustrate notable differences at time of writing, but this difference may be important for any future analysis on a smaller market outside of the Primary Markets.

Sources

1 Alzheimer’s Association

2 Rajan KB, Weuve J, Barnes LL, McAninch EA, Wilson RS, Evans DA. Population estimate of people with clinical AD and mild cognitive impairment in the United States (2020-2060). Alzheimer’s Dement. 2021; 1-10.

VisionLTC, powered by NIC MAP Vision

NIC MAP, powered by NIC MAP Vision

data?

data?